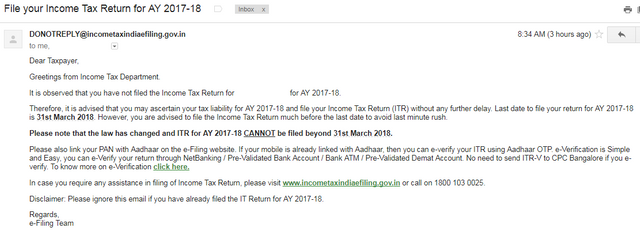

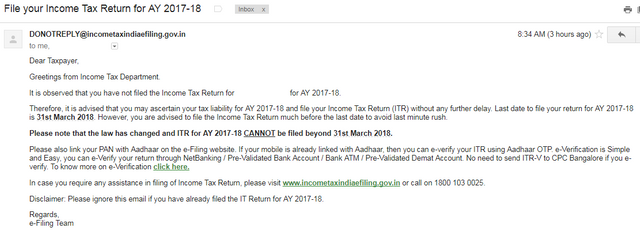

Most important information for the tax payers in India. Kindly file your Income Tax pending Return for A.Y. 2017-2018 as the law has been changed and after this date no one can file the return.

Most important information for the tax payers in India. Kindly file your Income Tax pending Return for A.Y. 2017-2018 as the law has been changed and after this date no one can file the return.

Hi,

last date to file ITR has been extended to 31st august from 31st july.

If you fail to file income tax returns before the due date i.e 31st august you still can file the ITR for assessment year 2018-2019 till 31st march but , penalty for late fee will be levied on you at the time of filing income tax returns.

As per the new law from this year, Individuals will have to pay late fee after last date to file income tax return

Rs 5000 if tax is filed after due date of 31st july but on before 31st december of that assessment year (in this case 31st december 2018)

Rs 10,000 if tax is filed after 31st december but on or before 31st march of the relevant assessment year (in this case from 1st january to 31st march 2019)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit