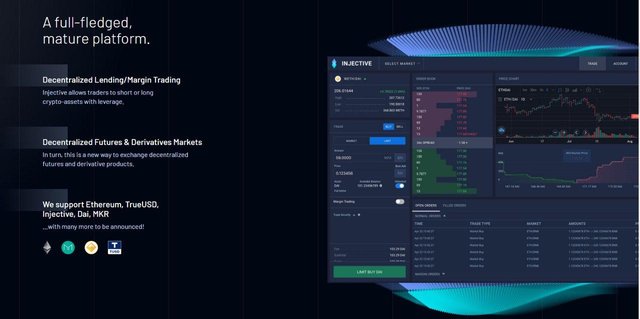

We are excited to announce Injective Protocol — the first layer-2 fully decentralized exchange protocol that unlocks the full potential of decentralized derivatives and borderless DeFi.

What wil be the future of Injectve Protocol

The Injective Futures convention is a decentralized distributed prospects convention which at present backings decentralized interminable trades, contracts for distinction (CFDs), and numerous different subsidiaries! Our convention permits people to make and exchange on subjective subordinate markets with only a value feed.

Enormous holler to the skilled UMA group for spearheading the precious development and for their profound mastery in helping us structure our fates conventio.

Share With Injective Protocol

Injective chain is based on the Cosmos zone and is a decentralized protocol built on Layer-2, providing a high-speed Ethereum decentralized trading experience. It will use the Cosmos IBC protocol to achieve cross-chain transactions, VDF (Verifiable Delay Function) to simulate real time through Proof of Elapsed Time, and standardize order sequencing to eliminate early tradings. In addition, the Injective chain supports token staking and provides technical support for creating more services such as staking in the future. Based on the Injective chain, Injective's trading platform has also achieved a fully open source design, which allows it to be a completely decentralized network. It also provides a market-maker friendly API interface, which is close to the current mainstream exchange interface, allowing the user experience to be similar to that of a centralized exchange.

Security of Injective Protocol

For programmers, it is as simple as pie getting through the firewalls of a great deal of trades, as their protections are not strengthened and, best case scenario permeable. This is clear as a few reports in the past have certified these cases. A few trades including Binance have at one point been focused for malware assaults and hack endeavors.

To decline the entire issue, the greater part of these trades are brought together, making it open to harm and control by the framework itself.

Luckily, the Injective Protocol stage is intended to be better than these trades, impervious to various types of assaults, as a method of guaranteeing that the clients are secured and reserves/resources ensured consistently and no matter what.

All these are only a couple of the highlights that venture the Injective convention to be better than BitMEX, FXT and a mess of different trades out there.

Additionally, in the management system, the Injective trading platform has borrowed the design from the auditing systems of centralized exchanges, modularized design, and the audited listing system, but it is based on community management, not just one people. In addition, Injective has introduced liquidity support for DEX from a considerable number of top global market makers, including QCP, CMS, Bitlink, Altonomy, etc. Together with a powerful incentive mechanism, Injective can ensure the liquidity of the trading platform.

About the Exchange

Unlike traditional exchanges which serve as the gatekeepers of the crypto industry, Injective makes exchange a decentralized public utility. What genuinely separates Injective is that we decentralize and open source each part of decentralized trade. Everything — from the front-end trade interface, back-end framework, savvy contracts, to orderbook liquidity — is given straightforwardly and to free.

This turns the traditional business model of exchange on its head, as we eliminate the technical barrier of entry for one to permissionlessly run a highly performant exchange.Injective's model rather remunerates relayers in the Injective system for sourcing liquidity. Thusly, trade suppliers are boosted to more readily serve clients, contending among one another to give better client experience, in this manner widening access to DeFi for clients all around the globe.

Upcomming

The development of exchanges based on blockchain technology

With the application of blockchain technology in asset tokenization and the trading of it, many digital asset exchanges have emerged, such as Binance, Coinbase, Bitmex etc. These well-known exchanges are also classified as centralized exchanges in the blockchain and digital asset industry.

Centralized exchanges can be used to conduct trades from fiat-to-cryptocurrency. They can also be used to conduct trades between two different cryptocurrencies. While this may seem to cover all of the potential transaction types, there is still a market for another type of cryptocurrency exchange as well.

Centralized exchanges, as the name suggests, means that the assets deposited by the users are stored in the hands of the exchange owners, and matching of trades and even prices of products are subject to centralized controls operated on centralized servers. In other words, we, as users, do everything on the platform based on our trust in the team and institution running it.

In comparison, the essence of decentralized exchanges (DEXes) is to allow users' assets to be under decentralized custody (assets are stored on the blockchain), with every transaction record stored on the blockchain giving transparency and traceability. Simply put, this whole decentralization is meant to prevent malicious human behaviors and to facilitate users to trust in codes and technology instead of other human beings.

Decentralized trades are another option; they cut out the center man, producing what is regularly thought of as a "trustless" domain. These sorts of trades work as shared trades. Resources are never held by an escrow administration, and exchanges are done completely dependent on keen agreements and nuclear trades.

With the advancement of blockchain technology and the emergence of more public blockchains, there are now a variety of decentralized exchanges. DEXes are different because of the diverse public blockchains they are based on and their respective concepts and technologies. Here we only discuss the decentralized exchanges pertaining the general traits.

DEXes can be further divided into two focuses: spot and derivative markets. Most of the DEXes in existence focuses on the spot markets, and are not many derivatives DEXes given the complexity of financial designs development workloads. However it has become palpably clear that derivatives markets have grown exponentially in digital asset domain, and we are already seeing the next boom coming from derivatives trading. Few strong contenders that have emerged in 2020 include Injective Protocol, DerivaDEX and Serum. Here let's explore Injective Protocol, which will be launched in August.

The future is coming, and the exchange, as the infrastructure of the digital age, is undergoing rapid and unprecedented development. In 2020, we will witness this change

Contacu us on

Official Website: https://injectiveprotocol.com

Bounty Link : https://bitcointalk.org/index.php?topic=5256993

Telegram: https://t.me/joininjective

Whitepaper Link: https://docsend.com/view/zdj4n2d

Github: github.com/InjectiveLabs

Twitter: https://www.twitter.com/@InjectiveLabs

Reddit: https://www.reddit.com/r/injective