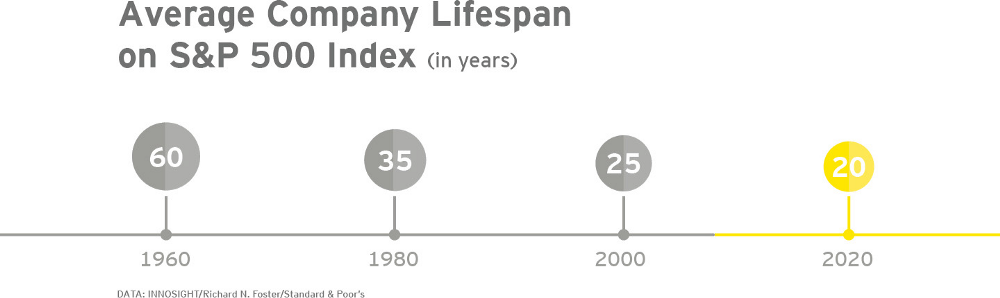

“Most companies today will not live beyond their 50th birthday” — The Innovation Paradox

Most mature multinational enterprises recognize the need to plug into new trends, to look out for weak signals in their ecosystems and to accept new developments.

The challenge is: How to execute on innovation, and how to overcome the risk and reward paradox?

Incumbent market leaders, having the longest presence, have the most to lose, and will be the least likely to change and adapt. Having market leadership, stable profits, a dominant brand is the biggest drag on moving, on shifting key.

Paradoxically, by focusing on what got you to where you are, it may be threatening to your survival.

The innovation paradox is that for a disruptive idea to take hold, to grow into an economic force like a Google or Uber, it has to transition from an invention into an executed reality.

“The maverick is rarely a good corporate citizen, but no innovation takes hold without adoption — and in the end the maverick needs the suit” — Peter Thief

LEADERSHIP

Sitting on a throne is a thousand times harder than winning one.

When Jan Timmer, former CEO of Philips, became the electronics company’s President in 1990, one of his first moves was to dummy up a newspaper, dated a few years into the future. Its bold front page headline read, ‘Philips Goes Bankrupt!’ Timmer built his senior team’s strategy around that headline.

“Create a story about a future that you want to avoid and then make it detailed and graphic.” — John Kao

STRUCTURE

Different roads sometimes lead to the same castle.

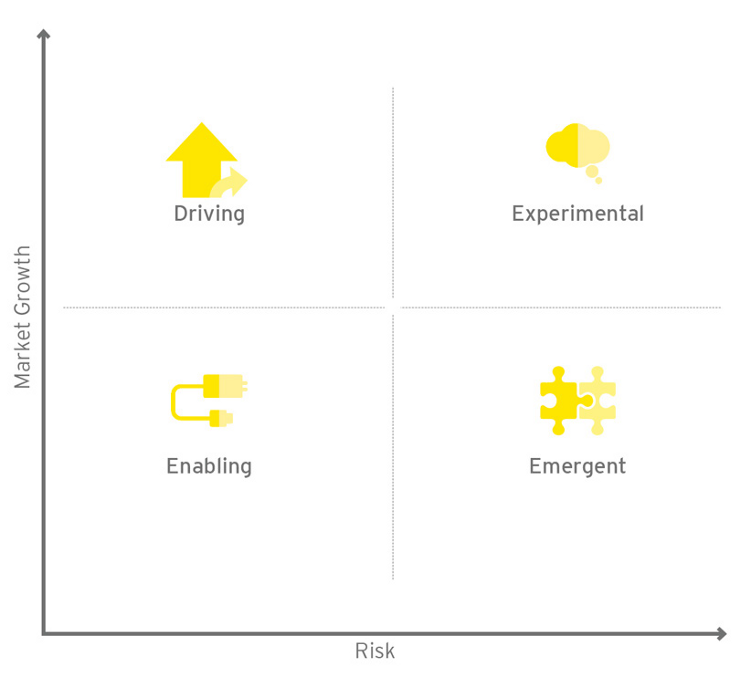

There are many ways in which an established enterprise creates a distinct arm or unit whose focus is to invest in external companies, usually at an early stage.

Enabling investments may include no financial investment at all. A technology company such as IBM or Microsoft allows developers to use the parent protocols, platform or hardware and supports developers with access to clients and its own business units. Enabling investments are focused on popularizing and extending the parent company’s platform, helping embed the

Emergent investments solve an acknowledged customer challenge, apply a new business model to the parent, build in an adjacent sector or subsector to create foreseeable synergies that are nevertheless not part of the current business. Corporates may sponsor companies because they are able to move faster, iterate and create solutions more quickly and cheaply than internal R&D units can. Some corporates invest in emergent solutions outside their own business focus.

Driving categorizes investments that are future focused but meeting strategic needs. A parent enterprise may judge that it can accelerate the speed to market by accessing external innovation.

Experimental investments are very speculative lab-based pilots that test blue sky thinking. Startups tend to be at a very early stage and many corporations invest through an accelerator or incubator, making many small bets in a high failure rate environment.

KEY TAKEAWAYS

Think like a designer. Focus on the consumer.

Think of yourself as a challenger, not a market leader.

Experiential learning trumps data — the shock of the new.

Experiment.

Network.

Balance.

THE END?

Hi !!

Nice to meet you! We are currently trying to create a Steemit community for fellow Singaporeans.

Inspired by what other countries had done (teamaustralia, teammalaysia, etc), a community will help Singapore Steemians to grow together. We can share ideas, collaborate efforts and learn from each other.

If you are interested, feel free to join this newly created Facebook group and unite together! https://www.facebook.com/groups/steemsingapore/

Hope to see you participate in this community! #teamsingapore

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit