Background

In the fourteenth century, revolution began with the birth of the insurance sector in Italy. During this period the goods were at risk with the presence of pirates. Therefore, merchants ensured the safety of their goods. The fifteenth century insurance was a written policy between the company and the insured in contract form. Although in fifteenth century they insured only goods when it comes to 2018 almost all the belongings of humans are insured. Thus, insurance sector is a mature sector in cooperated with bank sector. Even though the object of the insurance does not change the relationship between the company and the insured is changed in 2018. The birth of “Inscoin for Knox project” is related to this. The “Knox insurance’ is valid in American continent, Africa and Europe. Later they will spread their roots to other continents as well.

About Inscoin

Inscoin is the first insurance company to accept crypto and the first to solve the issue of falsification of insurance policies. It will also prevent the forgery of insurance policies. It is recognized as the world’s first insurance company to provide paper form and digital smart contract form. The issuance of insurance is determined by the blockchain. This will have added benefit of transparency towards customers from the company. The Inscoin token is INSC. One INSC is equal to 0.0002 USD. The restricted areas are USA and China. There will be the distribution of 500,000,000 tokens. All unsold tokens will be burned.

The challenge

A recent FBI study revealed that the cost of insurance fraud is nearly 40 billion dollars. The loss is further extended to 500 US dollars. Not only that the companies at losses with costs from the management of IT security and operational losses from attacks. This has led for insurance companies to manage cyber risk using three lines of defense model. The first step taken is with IT and CISO by implementing information security strategy. The second defense step is taken with CRO by assessing the sufficient internal solutions and their alignment with regulatory requirements. The third step is the internal audit. Although three line defenses is set with top level management’s oversight has led to further cyber risks. Another issue is the slowness of international banking transactions.

The solution

The use of blockchain technology merged with the insurance company with the real world makes the Knox project the world’s first digital insurance policy. The aim is to find a solution to certification and anti-forgery problem. The decentralization along with cryptocurrencies have touched every sector in the world. The use of blockchain creates a network that allows participants a valid transaction along with possible certification. A certified document in the blockchain technology can never be falsified. Therefore, the most important application in the blockchain technology is non-falsifiable certification. The Inscoin project aims to use Ethereum technology. The ERC20 technology creates digital private coins of controlled issuance. This will support an entrepreneurial project and the development of this project. The token makes possibilities for new technologies. The goal is to exploit the blockchain and decentralize the whole insurance system. By decentralization, the meaning is to transform traditional insurance policies from paper into smart contracts.

Policy as a smart contract

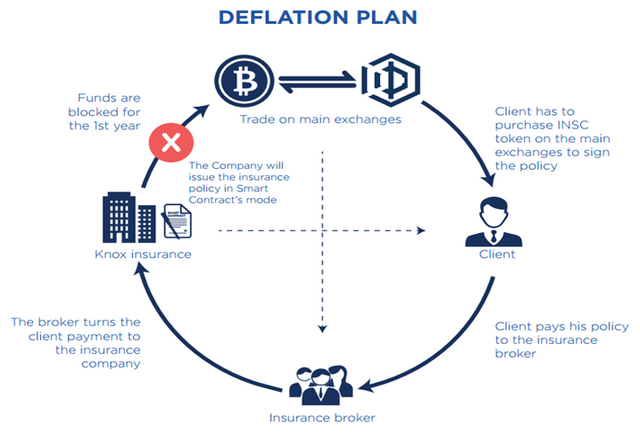

The payment of Inscoin policy will provide customers the authentic and standardized policy. This also provides the code of the policy to the customer that will coincide with the address of the smart contract related to the policy. The customer can verify the policy and the legality of the company throughout the smart contract. Smart contract has added benefits. It prevents false insurance policies. With smart contracts, there will be quick collecting of credits.

Broker

The Inscoin project includes brokers. There are already 300 brokers linked with them. These brokers have added benefits. Those who are willing to invest in pre-ICO and ICO will have personalized bonuses. 15% tokens will be given to brokers on purchased tokens. Besides they will receive a commission from the headquarters too.

Conclusion

Inscoin manages a fair relationship between the company and the customer. With maximum transparency, the customers are certified of genuine insurance policy. Also, name and reputation is important in the insurance sector. Inscoin makes it clear that they have a good name and reputation. The blockchain technology further digitalizes Inscoin and brings the insurance sector to the decentralized world.

website : https://inscoin.co/

whitepaper : https://inscoin.co/#whitepaper

Telegram: https://t.me/inscoinico

Linkedin: https://www.linkedin.com/company/inscoin-holding-ou/

Twitter: https://twitter.com/inscoinforknox

Facebook: https://www.facebook.com/Inscoin-for-Knox-1802470656458272/

Reddit: https://www.reddit.com/r/InsCoin/