1.

MEMX vs Next Exture+ vs 대체거래소에 이어지는 글입니다.

새롭게 정리할 계기가 없었는데 페이스북에서 자본시장연구원 이효섭님의 글을 읽었습니다. 매일경제신문과 함께 "자본시장 혁신 현장을 가다 '라는 기획에 참여하였다고 합니다.

잇단 파격…실리콘밸리에 제2나스닥

美LTSE, 실적공시 1년에 한번만…韓, 임원 세금체납까지 공시

싱가포르 거래소는 공기관 아닌 상장사…능동적 혁신 이어가

주총 없이도 증·감자…자금 블랙홀 뜨는 싱가포르

英 "핀테크 진출 도와달라" 각국과 협약

英 3대 핀테크, 한국行…15조 송금·환전시장 먹잇감

이제야 종이증권 없앤 韓…싱가포르는 증권형 토큰으로 주식거래

글로벌 핀테크, 韓송금·환전시장 노린다

이 중에서 관심을 가졌던 부분은 거래소입니다. 위에서 사례로 등장하는 곳이 LTSE(Long Term Stock Exchange)입니다. 혁신이 어떤 모습으로 일어나는지는 나라별로 같을 수 없습니다. 싱가포르나 미국에서 성공한 모델이 한국에서 성공한다고 보장할 수 없습니다. 그래서 사례로만 기억속에 남겼습니다. 이후 해외에서 다른 글을 읽었습니다.

Exchange Landscape Gearing Up for Expansion in 2020

앞서의 기획이 제도에 집중했다고 하면 위의 기사는 기술의 영역 - 물론 자본시장의 기술은 제도이기도 합니다. 게임의 규칙을 만들고 이를 기술로 구현하기 때문입니다 -에서 다루어 관심을 가졌습니다. 아울러 이전에 다루었던 MEMX도 등장하기때문입니다.

위 기사에 등장하는 부분을 인용합니다. 첫번째는 주문유형입니다. 이전 MEMX를 소개할 때도 인용하였던 부분입니다. 거래소간의 경쟁이 극에 달하면서 극단화하였던 주문유형을 단순화하여 투명성을 높히는 것으로 이해합니다.

Simplifying Order Types두번째는 매매체결과 관련한 부분입니다.While the new venues collectively are going to inject more platforms into the market structure, each one claims its goal is to simplify trading.

“Our game plan is to keep it simple, keep it cheap. Create incentives for the industry to participate,” said Gallagher, who said it was aligning owners with users, following a model like MEMX.

MIH partnered with Hudson Trading and CTC Trading Group to launch a cash equities exchange to supplement is options business under the MIAX Pearl license, reported The Trade in May. MIAX also received investments from existing exchange members IMC, Simplex Trading, Susquehanna Securities, and Two Sigma.

As it did with options, MIAX’s strategy has been to offer liquidity providers an equity stake if they maintain certain volume threshold’s over time. “We will offer six or seven liquidity partners the right to own about 3.5 % of the company over the next 36 months from the launch date if we deliver on what our promise is,” said Gallagher. He expects the equities exchange to launch in the Q2 or Q3 of next year.

Differentiate with Technology인용문중 "simple Market Model"이 무엇인지 LTSE의 홈페이지에서 확인해보았습니다. The Long-Term Stock Exchange unveils its very simple market을 보면 다음과 같이 정의합니다. 미국의 자본시장구조가 어떤지를 알아야 아래 문장의 의미가 명확할 듯 합니다만 여기서 핵심은 Hidden과 Reserved Order로 보입니다.For its part, MEMX also wants to simplify the order types, noting that its member owners are familiar with all the order types that exist.

“The differentiator here is we have a greenfield opportunity to build an exchange from scratch,” said Kellner. “Technology has really improved over the last few years. We’re not looking to innovate via the market structure. We’re looking to innovate via technology,” said Kellner.

Likewise, Long Term Stock Exchange CEO Zoran Perkov said the LTSE will offer a “simple market model” with simple order types. “Our simple market model is a trading platform; it carries a subset of what you find in the broader market where you only have the ability to display an order,” said Perkov, a serial builder of SROs who previously worked at Nasdaq and IEX.

While other new entrants are aligned with broker dealers or market makers, LTSE is the first U.S. national securities exchange primarily designed to support corporate issuers and investors “who measure success in years and decades, not financial quarters,” stated LTSE in a Sept. 18 announcement.

In that release, LTSE said it intends to file a rule proposal with the SEC to change the rules, so that all buying and selling of shares will occur exclusively at prices displayed to all participants.

On LTSE, there won’t be any hidden or reserve liquidity on that market. “There will be simple order types on that market. We feel that is consistent with the idea of what an exchange is — one allowing companies to raise capital and allowing investors to express their interest,” he said.

All orders will be fully displayed There will be no hidden or reserve orders All trading will occur at displayed prices이를 자세히 설명한 자료를 소개합니다. LTSE가 SEC에 제출한 자료중 매매시스템과 관련한 부분입니다.

C.LTSE Trading System[gview file="http://smallake.kr/wp-content/uploads/2020/01/34-85828.pdf"]Users may submit orders with the display instructions of Displayed, Non-Displayed, or Reserve, but orders submitted without display instructions will be fully displayed. Displayed orders will be displayed on an anonymous basis at a specified price. Orders will be classified as a Round Lot, Odd Lot, or Mixed Lot. Users may also choose to designate orders with an Anti-Internalization Group Identifier modifier for anti-internalization purposes to prevent executions against resting opposite side orders originating from the same market participant identifier. All of these order types and parameters are similar to order types and parameters approved by the Commission and currently available on other national securities exchanges.

The LTSE system will continuously and automatically match orders pursuant to price/display/time priority, with displayed orders and displayed portions of orders havingprecedence over non-displayed orders and non-displayed portions of orders at the same price without regard to time.

위 기사중 놀라운 곳은 Intelligent Cross 라는 대체거래소입니다. 로이터의 기사입니다. AI라는 단어가 눈에 들어옵니다.

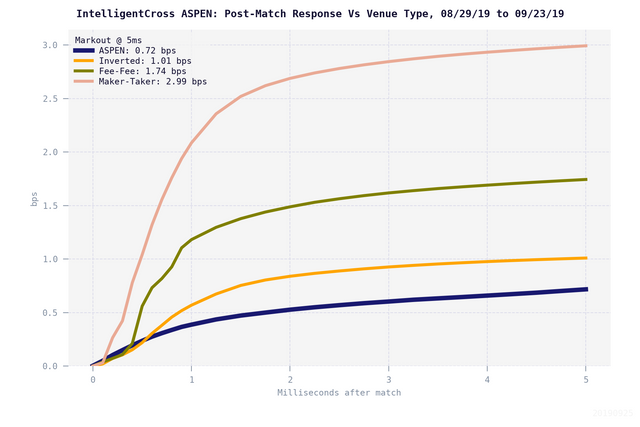

Since its September 2018 launch, IntelligentCross has become the 16th-largest ATS out of 31, trading 52.5 million shares the week of Sept. 9, according to the latest Financial Industry Regulatory Authority data. In March, IntelligentCross launched an order type called the Adverse Selection Protection Engine, or ASPEN. Adverse selection refers to trading against market participants who have more information than you, potentially leaving you on the wrong side of the trade.AI를 적용한 매매체결엔진이 Intelligent Midpoint입니다. 아래는 설명입니다.ASPEN’s AI queues up displayed orders and matches them 150 microseconds to 300 microseconds apart. Not matching them immediately gives automated systems a chance to adjust the quotes if necessary, depending on what the market does in the interim.

Users of ASPEN currently pay a flat fee on either side of the trade. But at the end of October, they will be able to choose one of three pricing systems: a flat fee, a rebate for adding liquidity, or a rebate for taking liquidity, depending on the order.

AI-driven stock-trading venue eyes U.S. exchange status, adds new pricing중에서

Intelligent Midpoint matches orders at discrete times, milliseconds apart. Its AI system measures the price response after each trade and calibrates the match times to keep it as close to zero as possible. Lower market response leads to lower information leakage, which means less slippage for institutional orders.NBBO midpoint orders

Discrete matches, milliseconds apart, calibrated per-name for minimal post-trade price response

Continuous order management—orders can be updated without delays

Only interacts with other midpoint orders

1 billion shares matched since launch

SEC에 제출한 보고서에는 아래와 같이 정리하고 있습니다.

Discrete Match Events The ATS accepts orders in all NMS Stocks eligible for trading (e.g., those that are not subject to a trading halt). The ATS offers two separate matching processes ("Matching Processes") that execute orders using discrete match events ("Match Events") in each security. Subscribers choose which Matching Process to which they send their orders. The Matching Processes are: (1) the "Midpoint Discrete Matching Process," which only include Midpoint Discrete Peg Orders and executes such orders at the midpoint of the prevailing NBBO at the time of the Match Event; and (2) the "Discrete Bid/Offer Matching Process," which includes limit, market, and primary and marketable peg orders that execute at prices that are at or between the prevailing NBBO at the time of the Match Event. The Midpoint Discrete Matching Process is also referred to as Intelligent Midpoint. The Discrete Bid/Offer Matching Process is also referred to as ASPEN (Adverse Selection Protection Engine). Orders in the Midpoint Discrete Matching Process will not be displayed. Orders in the Discrete Bid/Offer Matching Process may be marked by Subscribers as either displayed or non-displayed. Orders eligible to be Displayed Orders are: (1) Limit Orders with a limit price that does not lock or cross the NBBO; and (2) Primary Peg Orders that do not lock or cross the NBBO.

한국에서 거래소는 규제의 틀속에서 갇혔지만 고수익사업입니다. 다만 경쟁자를 허락하지 않는 독점사업이기도 합니다. 물론 법적으로는 경쟁이 가능하지만 시장참여자가 없습니다. 규제의 틀이 여전히 높기때문입니다. 투자자들의 새로운 요구가 없기때문일까요, 이를 발견하고 사업화하지 못하는 기업가 탓일까요, 이도저도 아니면 경쟁을 허락하지 않는 규제탓일까요?

어찌되었든 한국의 거래소산업은 정체중입니다.

Posted from my blog with SteemPress : http://smallake.kr/?p=28255

Congratulations @smallake! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit