Hi steemian friend..

How is everyone..

Wish you good health always..

Today post,, I want to share about the interest system in the Bank.. Perhaps many steemians friends have all heard a lecturer in trouble with his financial institution, where the remaining debt principal why not diminish. Well, here I want to share about the system of interest commonly used in Indonesian banking.

Borrowing money to banks or financial institutions will always be burdened with interest. Therefore, before a friend wants to borrow money in the bank, then all you need to do is recognize some system of bank interest. What interest system will be used for your credit ..?

There are several types of credit interest calculation that is flat and effective.

Each type of interest has a different way of calculation.

Well,, following explanation and example of the calculation of interest:

Flat system

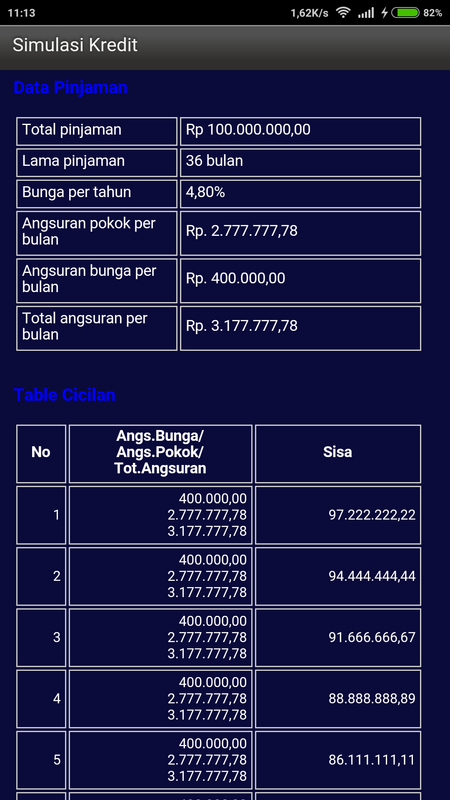

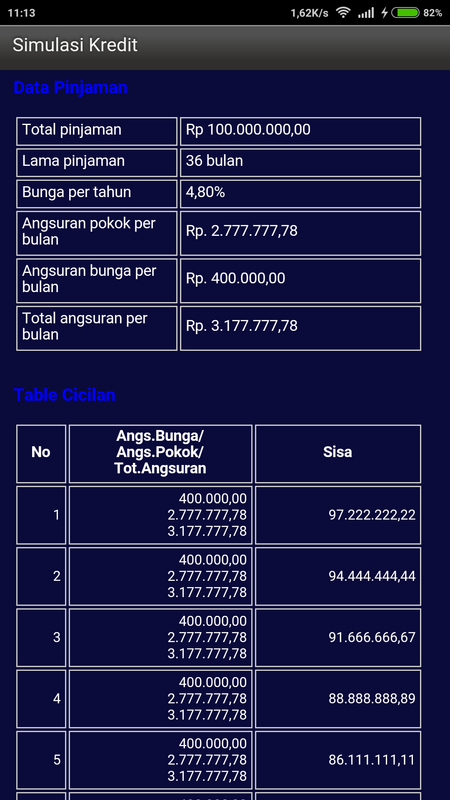

Flat interest is a system of interest rate calculation which amount refers to the principal of initial debt. In this flat rate system the portion and principal in monthly installments will remain the same. For example, you apply for a loan of Rp100 million, a flat rate of 4.8% per annum and a 3 years loan tenor.

The principal amount and interest you pay during the credit period will always remain the same until your credit period expires.

Effective System

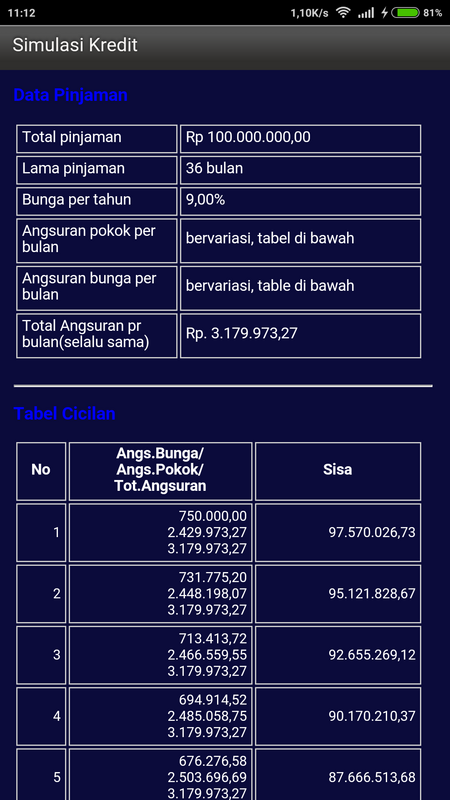

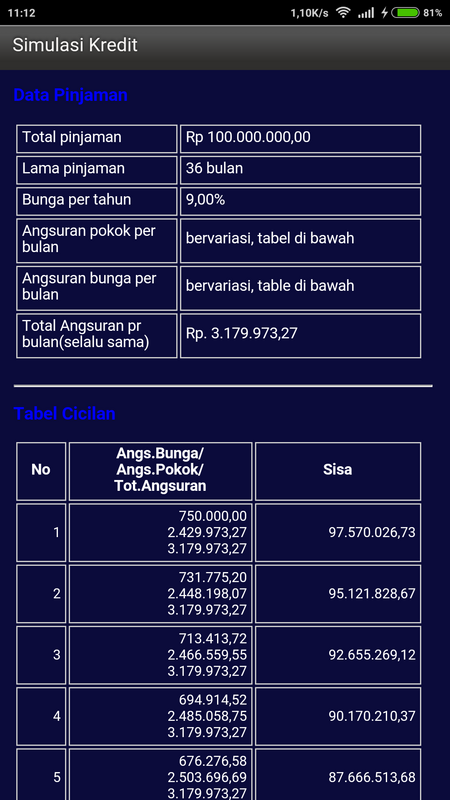

The effective interest system is the opposite of a flat interest system, the interest portion is calculated on the basis of the remaining principal. Thus, the portion of interest and principal in monthly installments will be different, although the monthly installments remain the same.

The interest rate paid by the debtor every month will decrease because the rest of the principal also decreases. The second monthly installment of the paid interest will be less than the first month's installment, so on. As well as the principal credits paid on the second installment will be greater than the first installment, so on.

Now friends all already know about bank credit interest right.. hopefully this can add knowledge about banking. So if you apply for credit, make sure the way credit calculations use what way to not regret later.

Best regrads to all,, steemian friends.. Hope we can go developing together in steemit..

Thank's for reading..

And lastly do not forget to upvote and follow me @alfiadi

Halo sahabat steemian semua..

Apa kabar..

Semoga sehat selalu semuanya..

Postingan hari ini,,saya ingin share tentang sistem bunga di Bank.. Mungkin banyak di kalangan sahabat steemians semua pernah mendengar seorang dosen yang bermasalah dengan lembaga keuangannya, dimana hutang sisa pokoknya kenapa tidak berkurang. Nah, disini saya mau membagi tentang sistem bunga yang biasa dipakai di perbankan Indonesia.

Meminjam uang ke bank atau lembaga keuangan memang akan selalu dibebani bunga. Karena itu, sebelum sahabat mau meminjam uang di bank, maka yang perlu sahabat lakukan adalah mengenali beberapa sistem dari bunga bank. Sistem bunga apa yang akan dipakai untuk kredit Anda..?

Ada beberapa jenis perhitungan bunga kredit yaitu flat dan efektif.

Tiap jenis bunga tersebut mempunyai cara perhitungan yang berbeda-beda.

Nah,,berikut penjelasan dan contoh perhitungannya bunganya :

Sistem bunga flat

Bunga flat merupakan sistem perhitungan suku bunga yang besarannya mengacu pada pokok utang awal. Dalam sistem bunga flat ini porsi dan pokok dalam angsuran bulanan akan tetap sama. Misalnya, Anda mengajukan pinjaman sebesar Rp100 juta, bunga flat 4,8% pertahun dan tenor pinjaman 3 tahun.

Nilai pokok dan bunga yang Anda bayarkan selama jangka waktu kredit akan selalu sama sampai habis masa kredit Anda.

Sistem bunga efektif

Sistem bunga efektif adalah kebalikan dari sistem bunga flat, yaitu porsi bunga dihitung berdasarkan pokok utang tersisa. Maka, porsi bunga dan pokok dalam angsuran tiap bulan akan berbeda, meski besar angsuran per bulan tetap sama.

Nilai bunga yang dibayar debitur setiap bulan akan semakin mengecil atau berkurang dikarenakan sisa pokoknya juga semakin berkurang. Angsuran bulan kedua bunga yang dibayarkan akan lebih kecil daripada angsuran bulan pertama, begitu seterusnya. Serta pokok kredit yang dibayarkan pada angsuran kedua akan lebih besar daripada angsuran pertama, begitu seterusnya.

Sekarang sahabat semua sudah tahu tentang bunga kredit perbankan kan..mudah-mudahan ini bisa menambah ilmu tentang perbankan. Jadi bila anda mengajukan kredit, pastikan cara perhitungan kreditnya memakai cara apa agar tidak menyesal nantinya.

Salam kenal buat semuanya,,sahabat-sahabat steemian.. Semoga kita bisa maju bersama dalam steemit..

Terima kasih sudah membaca..

Dan yang terakhir jangan lupa untuk di upvote dan ikuti @alfiadi

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cekaja.com/info/sistem-bunga-bank-yang-wajib-anda-kenali/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit