I want to clear up a common misunderstanding.

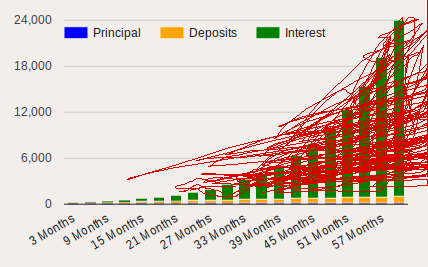

Some people believe that the interest gained on SP balances is compound interest. That leads to over-the-top claims, such as the one we see here:

https://steemit.com/steemit/@anonymint/it-s-so-easy-to-become-a-millionaire-with-steem

Starting with just a $400 initial investment and generating only a meager $2 (½ STEEM) in daily blogging rewards, the total value of your STEEM POWER could be worth more than $1 million within 5 years!

This is the power of compound interest, as exemplified by the following chart.

But that's simply FALSE.

The fact is, SP growth is NOT compound interest. The principal never changes, unless you add to it through participation in the site. I've said this in various comments, so I'm just going to copy a few of those to save time...

There is no such thing as Steem Power (SP) in the back end. When you power up, your STEEM is converted to VESTs. When you power down, your VESTs are converted back into STEEM. The conversion rate changes over time, though... so that balance appears to be growing. It's showing you how much STEEM your VESTs are worth.

The Steem Power in your wallet is called VESTs behind the scenes. That number doesn't change unless you receive rewards from posting, commenting, voting, or powering up/down. The change in number that you see is a reflection of the change in the conversion rate between VESTs and STEEM.

Steem Power doesn't really exist. It's just an abstraction. The amount of VESTs that are represented by the Steem Power figure stays constant aside from increases due to participation and interaction with the community. The difference is subtle, but it basically means that the growth doesn't resemble compound interest so much as inflation.

There is a big difference between what is happening to your Steem Power balance and what would happen to your credit card balance if you missed a few payments. There will not be exponential growth of the money supply and the attendant hyper-inflation that would bring. It's not going to happen!

To clarify a bit for those that are new to STEEM I will add this detail.

When STEEM pays out 1$ worth of rewards (whether from posting, commenting or upvoting) it simply creates the new units "out of thin air". This has the effect of diluting everyone's STEEM holdings since the supply has increased but your personal wallet's balance has not.

The way to protect yourself from this dilution is to Power Up.

What does this do you might be axkin'?

Well, for every 1$ worth of STEEM created to pay for content & curation there are 9$ worth of STEEM created to send to those that have powered up.

So you should only hold STEEM if you are planning on selling it, or sending it to someone. Don't hold it for a long time since it is being diluted little by little by everyday's payouts.

Power it up and you will lock in your value.

Hope this helps complement the main post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

But this means that SP also gets diluted. So at constant price, if you're inactive, you'll be down after a year. (correct?)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

... of course 1 Steem stays 1 Steem, but it gets devalued against any stable currency. That's what I meant in my original comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

STEEM is just a short-term, highly liquid part of the puzzle. I hope people realise it's not designed to be held. In the short term, we may see the exchange market value STEEM highly against the Dollar. But long term, once the 100% inflation kicks in, I expect STEEM to start devaluing.

Steem Power is the best long term investment - but of course not everyone will be OK with waiting 2 years for powering down. It only works if you are invested and believe in the long term success of Steemit. If that comes to pass, powering up now will pay off massively later - no crazy compound interest required.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

SP itself does not create a compound interes, but dont you get more curating rewards if you have more SP? That alone creates a compounding effect doesnt it?

Basically anything that earns more money as time goes on and then that increased amount is what makes the money, compounds.

I believe SP has other compounding properties, but all that is needed for a counterexample to disprove an assertion is one instance, which I believe I have done.

tl:dr SP compounds over time

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Incorrect.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I mean in the literal sense of you get SP due to simply having SP. the SP is stored as vests which (ignoring any external inputs) stays the same, but the conversion rate from vests to SP keeps going up due to the 9:1 effect. So the fact that SP is actually the current conversion rate of vests using an ever increasing factor could be interpreted as vests dont compound, ie. are static. However, the issue here is that it is discussing SP and not the internal vests and the SP caculated from an ever increasing conversion rate sure looks like compounding, acts like compounding, because it is compounding.

Add to this the effect of SP*log(SP) being your allocation for curating and by any sense of the word SP is compounding, even if the underlying vests would remain static if you never did anything at all.

So, the OP should really correct the misinformation at the risk of getting downvoted should it not be corrected

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The internal accounting of VESTS is irrelevant, because it is STEEM that we base the external exchange and market capitalization on. I explained this in my comment.

The point about VESTS is also irrelevant because the value of VESTS are effectively taken from STEEM holders and given to STEEM POWER holders. That is the compounded interest payment.

It is absolutely compounding. The value VESTS represent are taken from one party and given to another. An interest payment is taken from someone and given to another.

WTF ??? Is wrong with people who upvoted this blog!

I downvoted it because not only did he spread lies about me, he also downvoted my blog post.

You are welcome to provide cogent rebuttal. I haven't seen one from you yet.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm sorry dude, but you either do not have any idea what VESTs are and what Steem Power is... or you are blatantly lying to people trying to mislead them...

I'm am trying to be as nice as I can here, but what you're doing is just wrong.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Im kind of confused here about the "taken from one party and given to another" thing. Thats not what makes interest compound. Bacchist could have stated it better, but tbh im not sure we're working on the same definition of compounding either

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I know when I read "You are welcome to provide cogent rebuttal. I haven't seen one from you yet." I know I need a TLDR

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

But the conversion rate is increasing linearly, no? That is to say, if i have X amount in steem power, and I don't add any more, the increase in the conversion rate will yield a fixed increase in SP every month, not a linear one. Am i missing something.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, the conversion rate increases quasi-linearly as a function of time, very unlike compounding which is a geometric series that grows super-linearly. The principal, denominated in VESTS, is static. It doesn't move at all unless you are earning additional VESTS by curating or blogging, but that has nothing to do with interests.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

recursive... see my other reply... the conversion rate doubles every year.... thats is compounding and thats not a linear increase... ie, the 1m vests is worth 200 now, 400 after one year, 800 after 2 years, etc... thats 100% APR compounded yearly

That is not linear. Anonymint is off on how much were going to make (i think because hes trying to calculate it compounding monthly)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sounds logical

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'll make this super simple for the standard person that wasn't amazing at math.

Creating the numbers and gains out of air.

You start with 10 sp, at 10% interest a month you have 11 sp.

You start with 11 sp, at 10% interest a month you have 12.1 sp.

You start with 12.1 sp, at 10% interest a month you have 13.31 sp.

Now over time steem may go up in value or may crash and burn and become the value of rdd, diem etc.

That being said today's price does not represent a price seen 104 weeks from now. So while 10 steem may be worth .05 btc currently, your 50 steem in 2 years might be worth .05 or .000005 btc.

https://steemit.com/steemit/@rogue91/steem-power-and-proper-calculations-of-gains

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you! That was really helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for pointing this out :)

I feel like many people have the wrong idea about what this is all about!

I feel like people need to focus more on writing quality content, Rather than the financial factor. If we focus too heavily on the money end of it, We may bring in more spammers.

https://steemit.com/life/@kaylinart/why-do-people-choose-to-fail

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This blog is incorrect.

And it is highly insulting for such erroneous misinformation to be highly upvoted while ridiculing me.

I wrote the blog post which bacchist is quoting and criticizing with this post.

Let's begin with the Investopedia defintion:

The Steem white paper says that for every 1 STEEM created for a block, 9 additional STEEM POWER are created and distributed proportionally to STEEM POWER holders. In other words, for every 10 new units of money supply created, 9 of them are STEEM POWER and earned as interest for STEEM POWER holders, regardless how you account for them as a ratio to VESTS.

The interest paid to STEEM POWER holders is taken from STEEM holders, as a percentage of the market capitalization.

The reason you guys are fooled is you are not accounting for the fact that the interest payments are taken from STEEM holders and given to STEEM POWER holders.

I am sorry for those who lack math skills and upvoted this incorrect blog post. Please note your names are listed on the list of upvoters.

There is exponential growth of the Steem money supply. Even if you keep the VESTS constant and account for tokens divisibility as separate parameter, the external unit of exchange are STEEM and the supply of STEEM is growing exponentially with a compounding on newly minted STEEM on every block.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Did you happen to notice that a certain @dan is among that list? You know, the guy who invented this system in the first place? Are you claiming his math skills are lacking, and he doesn't understand what he created? A little humility might be in order here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just to be fair, Dan also upvotes plagiarist. So I'm not sure he is actually reading what he upvotes. It's more like he glances at it and calculates, "will normal people upvote this?" and then clicks accordingly. It's like on Twitter when they say, "Retweets are not endorsements". Upvotes are not endorsements, but more a game of whether or not you think other people will blindly upvote a post without thoroughly assessing it's content. ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/steem/@jl777/truth-and-fairness-vs-popularity-what-to-do-when-a-post-that-says-another-post-is-wrong-and-gets-more-reward-than-the-original

As a community do we care more about accuracy or popularity?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

from the "voting is popularity contest" by smooth: "Downvotes are widely discouraged except for reporting abuse, which means every non-abuse post with at least one upvote should have an upvote percentage of 100%"

@tuck-fheman would you consider what bacchist did to anonymint's post as non-abusive?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/steem/@smooth/voting-is-a-popularity-contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't agree with a lot of the upvoting and downvoting on Steemit. People are downvoting for others using what they consider to be a wrong tag on their post or because they posted in a different language and didn't tag it with that language.

Any sort of consensus has been lost in recent weeks due to the influx of new users happy to make up their own set of rules. I'm sure over time it will work itself out just like it did when the 2nd wave of new users hit the beaches of Steemit island.

After people have been here for a month or two they realize what the whales approve and don't approve of, and if they want to make money they will "pander to the whale" or perhaps persuade a few whales to change their minds.

When people's rewards begin to dwindle, they realize they need to change their ways. It's generally only those who have been given a free whale ride for a while that feel like they can do whatever they want without retribution. But once their post start earning $1.28 each, they'll come around usually. ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not speaking for Dan, but I think he's said in the past that he upvotes anything that will bring about an open discussion. He many not agree with the post, but thinks it's a topic that should be discussed and in this case it appears he is correct, assuming that is his reasoning behind his upvote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, that's a good point, but this (I'd imagine) is a slightly different type of article. It only takes a quick scan to see what the content is about.

As far as I understand, VESTS don't change over time unless you curate or post. Steem Power is just a reflection of your VEST holdings given the current ratio of 1MV to Steem Power (234 right now) . To me, it seems like share dilution, not compounding interest. That said, I understand how easy it is to get this confused because I wrote two posts myself on the Steem Power "interest" before better understanding things.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If the money supply of the dollar remains constant, yet we use an accounting ledger which moves dollars from one person to another when an interest payment is made, is that not an interest payment because the total supply of dollars didn't change.

Just because you invent some orthogonal ratio token that remains constant doesn't mean value wasn't transferred. Duh!

Come on guys, I don't have time for middle school math tards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@lukestokes:

If you call analysis trolling, then yes I am doing analysis at Bitcointalk.org. Some of it is postive for Steem and some of it is critical. Otherwise it wouldn't be analysis.

@bacchist wants me to be 100% loyal. He doesn't want the fact that Steem is an exponential compounding system to be exposed. Which may explain why @dan upvoted his (or may not if @dan didn't even read it).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes I am claiming @dantheman can come here and debate me if he feels he is correct. I already explained the math. Let's wait to read a cogent rebuttal.

See also my explanation that this is not simple interest.

Edit: tie-warutho you are wrong. Please stop downvoting my posts!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So if I understand this correctly, interest is generated on the Steem power, just not compound interest?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is actually quite dated. That was the case at the time, but now interest on Steem Power balances is quite limited. Participation and engagement are the main ways to accumulate SP and SBD. Posting, commenting, and voting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for your reply. So does that mean that interest is no longer generated on Steem power? I'm trying to steer clear of interest or at least know how interest is being added on (religious reasons).

Edit: misread. So it is generated, but just at a lower rate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is generated, but it is less than 2% a year.

It is considered "dilution protection" more than what we typically refer to as interest. Since the STEEM supply is increasing, a bit less than 20% of the new STEEM created goes to existing Steem Power balances, to protect them against inflation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am upvoting this because people need to understand. The less 'get rich quick' dreamers there are in the network the better. Lol. I am in this for the long haul and plan to slowly accumulate steem through blogging and commenting and generally being a positive Steemerian. Oh, and also buying as much Steem under 5$ as i can! Anyway great explination @bacchist thank you for your service. 😉

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If that was your intent, you should have not been upvoting this blog post.

If you don't want people to invest in exponential compounding systems, then why do you upvote some claim that Steem is not an exponential compounding system, when in fact Steem is an exponential compounding system.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice!

You know a lot about the charts. ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Looks like a 5 year old scribbling which is about level of his illogical analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Let me explain this another way, which will hopefully end all the confusion.

The debasement of STEEM units is 9/10ths to pre-existing STEEM POWER holders. The other 1/10th goes to new STEEM holders, not the pre-existing STEEM holders.

So if the ratio of STEEM POWER to STEEM is 9 (i.e. SP is 9/10ths of the money supply), then STEEM POWER holders have no gain in terms of the percentage of the money supply due to aforementioned debasement. If that ratio is less than 9, then STEEM POWER holders do have a gain; and if that ratio is greater than 9, then STEEM POWER holders do have a loss in terms of the percentage of the money supply due to aforementioned debasement.

It is a variable interest rate, which can even be 0% or negative, depending on the market conditions.

And that does not factor in the change in market price (and thus market capitalization) due to the debasement.

None of that changes the fact that when the interest rate is not 0%, there is a positive or negative interest rate compounding.

What is a fair criticism of my blog post, is that the effective gains in terms of percentage of the money supply, is much less than 90% APR because the ratio is probably normally closer to 9 than to 1 (or an infinitesimal).

The ~90% APR is always the case comparing the effect of the debasement on pre-existing STEEM POWER versus pre-existing STEEM holders w.r.t. to percentage of the money. However, that is rather meaningless effect, since new STEEM holders are created with 1/10th of the said debasement. Thus the constant 90% assumption of my blog post was an error. Yet also the claim of the OP of this blog that there is no compounding due to VESTS is also in error.

There is a compound interest rate, it is just variable and can even be 0% or negative at times.

Edit: and note afaics that 50% of 1/4th of the STEEM created is converted automatically to STEEM POWER as 50% of the blogging rewards. Thus this will tend to force the ratio to greater than 9 (a negative interest rate), which would mean that much of the debasement is being paid by the STEEM POWER holders.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@anonymint im pretty sure that the dilution caused by steem power rewards to bloggers is supposed to be offset somehow by part of it being paid in SBD, though im not really sure of the mechinism for that yet.

that said, im not trying to be a dick, but you really suck at making your case here, which is easy as hell to explain without bringing in the creation of steem and steem power. I have an MBA and your explanation was so bad you confused me into thinking you were wrong, when you were actually mostly correct. You could have won this argument 20 hours ago if you weren't making it needlessly complex. (see my post above for why its compound, and not simple interest)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post ! That's the one I was looking for to clear my mind about the nature of Steem Power Interest's rate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post, @bacchist! I feel I'm partly to blame for this misconception because I understood it as "interest" as well, and wrote a couple posts about what I was trying to understand. I know see it more accurately as share dilution over time which holding VESTS protects you from. You and I have had a number of conversations about this and I really appreciate you working it through with me. I'm glad to see you're getting a nice reward for those efforts! $1k+, baby! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We're kind of conditioned to think of interest as compound interest, because our financial system relies so heavily on it. I thought of it in those terms until I spent quite a lot of time with it. The economics of Steem are not what any of us are used to!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

For the 9 STEEM POWER paid as interest (for each 1 STEEM created) to not be compounding, then it would require that all STEEM balances were forward stock split by the same proportion. But the STEEM balances are not given any new STEEM.

You should apologize to me and remove your downvote from my blog post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice clear post. Not being subject to the large inflation rate is definitely a pro for SP.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The most powerful force in the universe- compound interest @bacchist

Glad you pointed this out, i was having trouble coming to terms with the exponentiality of it all- glad to see you have a sense of humour- upvoted

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you bro for sharing this information , i think i was wrong like most of people on steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have been seeing this misconception going around as well! Glad to see it cleared up.

All that said, SP is still pretty lucrative with simple interest. It's just not the magic bullet some people have misunderstood it to be.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Simple interest is a term that normally applies to loan payments and it refers to paying the interest payment in full before the amount of the unpaid interest payment is added to the principle to accrue more interest in a compounded manner.

Simple interest does not at all apply to the interest paid to SP holders, which is added to their balances and accrues interest in a compounded manner.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is not added to balances and compounded. Please do your research and stop misinforming people.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

does having SP give you more SP for curating, all else being the same.

If yes, how is that not compounding?

If no, then there is a more serious misunderstanding by one of us

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In my book if I get more rewards and that in turn gives me even greater awards, I call that compounding. You can call it whatever you want, that doesnt change the fact that anybody that engages with the community in anyway will get compounding.

Now if you want to talk about vests and how they dont compound for anybody that is totally inactive in the community, I could see how that case doesnt compound, but who cares about that special case for something that cant be exchanged?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is not a fixed interest rate compounding. It is compounding due to saving your excess production and using it to invest in more production.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It does, but that's not compound interest. That's an increase in the rewards you get for participating.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If we contemplate the value of VESTS measured in STEEM units, then clearly we can see that when 9 new STEEM POWER are created for every 1 new STEEM (and given that STEEM POWER are 1:1 convertible to STEEM and the new STEEM POWER are distributed to existing SP holders), then clearly we can see that (the value that) VESTS (represents) have been transferred from STEEM holders to STEEM POWER holders. And that interest payment compounds the next time this done.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What is not added to balances and compounded? The 9 STEEM POWER is added to STEEM POWER balances each time 1 STEEM is created.

Go to my long comment and make a cogent rebuttal. I am waiting. You are misinforming everyone!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

OK, i figured it out, you're both wrong.

https://steemit.com/interest/@sigmajin/how-anonymint-and-bacchist-both-got-it-wrong

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

more info on interest and why its not really interest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for making it so clear. Tried a few articles before this glad I found your post. Cheers!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome article bacchist, i wish you all the best with steem!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very nice article .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Up and up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for clearing this up. I kept reading the interest section in the white paper as referring to SP, not SBD/SMD.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank for sharing tthis info.what it mean is that you have to be continuing blogging posting for your atem to grow

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I could be wrong, but iiuc Steem interest is not compounding. (authors note, i was wrong. See https://steemit.com/interest/@sigmajin/how-anonymint-and-bacchist-both-got-it-wrong)

First, let me describe what non-compounding interest is like. Assume I have 1000 dollars on deposit, at an interest rate of 10 percent monthly.

If my interest is not compounding, I would have 1100 after 1 month, 1200 after 2 months, 1300 after 3 months. That is to say, my interest would be calculated

Based upon my initial deposit, and would be a fixed amount unchanging amount every single month. My balance would increase linearly.

If my interest is compounding, I would have 1100 after 1 month, 1210 after two months 1331 after 3 months etc. In this case, my balance would increase exponentially.

NOw, lets assume I have 1M vest. Right now, that equals 224 steem.

Because of the increased conversion rate, the value of my 1M vest will increase LINEARLY from month to month.

Im not sure wher the taken from one party and given to another thing comes from. The only thing that differentiates compounding interest from non compounding interest is if the intrest is added back into the principal.

If you go to steemstats.com, its pretty clear that the interest youre earning is linear... that is to say, your week interest is 7x your day interest and your month interest is 4x (or so) your week interest and your year interest is 12x your month interest. If it were compounding your year interest would be much more than 12x your month interest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ALso just as a side note, @Anonymint doesnt take into account the 10-1 reverse split after 3.5 years.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for clarifying - now makes more sense. Sometimes I need to read an article like this a few times to let it sink in. Bookmarking -

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Solid post. I was about to start a similair discussion. It's surprising how much uneducated investors the crypto space has. You still see people invest in this shady and scammy coins. I was researching a way to do better investment analysis on the current cryptos. Besides coinmarketcap.com there is: https://www.coincheckup.com I'm really enthusiastic about this site, they let you analyze every single coin out there. Check: https://www.coincheckup.com/coins/Steem#analysis To see the: Steem Report

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Need @anonymint input

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good read!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article, Bacchist, I believe I found a site for true compound interest for crypto, check out my blog post and check it out if you're interested. https://steemit.com/bitcoin/@oakheartgames/compounding-bitcoin-interest-for-people-not-banks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There should be some sort of explaination on how this system works. Augmenting the monetary supply will indeed make the value of the coin here weaker but at the same time, trust and the growing user base make it more valuable. It'd be nice to have a note from the devs about so we can actually understand what they're planning to do. If there already is such a comment or explanation, please link it here. Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/interest/@sigmajin/understanding-the-steem-economic-system-vests-sbd-steem-dilution-interest-and-all-those-crazy-things

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So even if our steem power goes up our Vests never will without additional investment? How would we calculate our returns then on Steempower. It doesnt seem like a basic interest rate calculation works.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you need to contribute to the community via curating, posting and commenting. if you just sit on the vests and do nothing, you wont get anymore vests. however when mapped to SP units, it does compound, even if you do nothing. But in that case, you are losing ground to the others that are actively contributing

STEEM is NOT a simple one dimensional passbook account. To try to understand it in those terms will lead to misunderstanding

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The way I see it is:

You get a 1.9x split every year (annualized) if you are powered up.

Inflation goes up at 2x every year (annualized).

Doing nothing on the site, you lose 10%.

Posting and upvoting only get you some % back, but on average you won't break even (because of other payouts like mining and liquidity rewards).

That's if steem stays the same value. The currency value is swinging and is more volatile than the 10%.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What happens to the total dollar money supply is not relevant to your interest payment on the bank's ledger w.r.t. whether there is a transfer and compounding. Just because the money supply debasement is compounding faster than your interest is compounding, is irrelevant to whether the interest is compounding. Duh!

For each 1 STEEM created, 9 STEEM POWER are created and transferred to SP holders. This is a transfer of value from STEEM holders to SP holders, as a percentage of the market capitalization of the money supply.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So soon we'll all be steem millionaires, but steem will be approximately 1 millionth the value (and they'll adjust the units accordingly and employ rounding). Yay!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Maybe we can say the same about the dollar if we had 90% compounding interest investment valued in dollars and the Federal Reserve decides to hyperinflate the supply of dollars.

If there was no transfer of the percentage of the STEEM money supply from STEEM holders to SP holders, then there wouldn't be any compounding, because it would be a wash.

P.S. I don't think the Fed will do that. I am just making a math point.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nonononononononono....

Its not a split. its a dividend. If they werent afraid of getting jumped by SEC agents thtas what they would have called it in the white paper. thats why they were talking about dilution so much.

Its not inflation, for a variety of reasons. (check my blog for my post about inflation)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm going to borrow some of your post, and cite you within the post; just to provide a simpler way of helping people calculate their sp.

https://steemit.com/steemit/@rogue91/steem-power-and-proper-calculations-of-gains

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do not regret Upvote to this article,

it was interesting to read;)

Steem It Up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I need your help to solve this problem with Mr. justin o'connell: https://steemit.com/steemit/@luisucv34/i-would-like-to-publicly-apologize-to-justin-oconnell-from-cryptocoinsnews

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!cheetah ban

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay, I have banned @elargroup.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit