Are interest rates about to break out?

And is this the time to hedge your interest rate risk?

The last time I wrote about one of the biggest bubbles out there (record low interest rates), it was June 30, 2017, and I mentioned that I invest part of my assets in ETF's that increase in value when interest rates (US 10y, EU 10/20y) increase. In my view, now is the time, (if you haven't done already) to lock in your interest rates for the long term or hedge your interest rate risk. For example, if you have a variable interest rate mortgage (why at record lows, only way is up??) it could be wise to lock the rates in for the next 15 years.

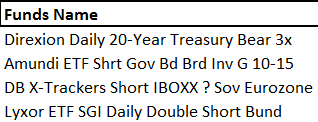

One year from now, max 2 years, I will be buying a new house. To hedge some of the risk that I have if interest rates increase between now and Q2 2019, I invest some of my money in the following funds:

Here's the Monthly Chart of US 10 year interest rates.

June 2016 marked the High of this Bull Market in Bonds, so far, with a record low yield of 1.34%. A break and close above 2.6% and then a successful retest of 2.6% is considered bullish for rates, bearish for bonds.

I will add to my ETF's when the retest is successful > 2.6%.

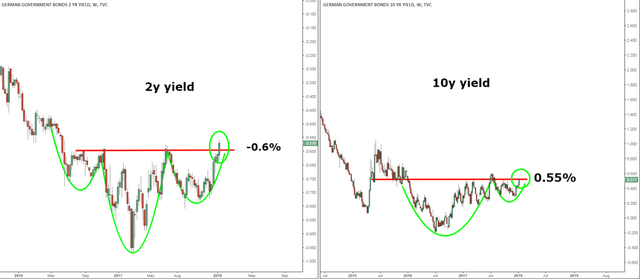

German 2Y and 10Y Rates - Ready To Break Out?

2y yield is at minus 0.6%, so in my view, if you have time and patience: the only way is up.

Short Sovereign Bonds / Long Interest Rates

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://tripstrading.com/2018/01/12/real-bubble-trade-us-eu-interest-rates/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's my own blog, thanks for the reminder :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit