Want to jump straight to the answer? You can trade cryptocurrency on eToro, WeBull and Uphold!

Many investors like to trade cryptocurrency because it’s an extremely volatile asset class. If you can time the market right, trading crypto can give you much higher returns than traditional investments.

Cryptocurrency traders often have one of two goals: to accumulate Bitcoin (BTC) and Ethereum (ETH) or make a profit in USD in a shorter time. In a crypto bull market, it’s pretty easy for your portfolio to increase in USD value, but it’s more challenging to build your Bitcoin stake. To track your portfolio’s value in terms of Bitcoin, you can trade altcoins against Bitcoin on exchanges like Crypto.com.

By actively trading your cryptocurrency, you risk losing your crypto to the market. Since cryptocurrency prices are so volatile, it’s not uncommon for traders to lose money quickly trading cryptocurrencies. This is why so many crypto enthusiasts just HODL their Bitcoin and other cryptos

How to Trade Cryptocurrency

Take a look at the 6 steps to trading cryptocurrency.

.

Step 1: Make a cryptocurrency brokerage account.

Before you can learn how to trade cryptocurrency, you need to make an account with a crypto brokerage. eToro, Uphold and WeBull are among the best crypto brokerages on the market. All 3 of these options offer a simple user interface and a variety of altcoins to choose from.

To make an account, you’ll need to provide your crypto brokerage with personal identification information, similar to opening an account with a stock brokerage. Some common information you need to provide when setting up your account includes your Social Security number, address, date of birth and email address.

Step 2: Fund your account.

Once you’ve signed up with a crypto brokerage, you’ll need to connect your bank account. Most crypto brokerages offer bank funding through debit cards and wire transfers. ACH deposit (linked bank account transfer) is typically your cheapest option to fund your account –– it’s free on most platforms.

Step 3: Pick a crypto to invest in.

Most active cryptocurrency traders allocate most of their capital to Bitcoin and Ethereum. These cryptos move more predictably than smaller altcoins, so trading with technical indicators can be easier.

Many crypto traders allocate a portion of their capital to smaller altcoins. Although small mid-market cap cryptos are riskier than large-market cap cryptos, they offer higher upside potential. Many small altcoins have risen over 1,000% in a matter of months, making them attractive investments for risk-tolerant investors.

Step 4: Choose a strategy.

There are a plethora of trading indicators to choose from, and most traders take multiple factors into consideration when buying and selling cryptocurrency. If you’re new to investing, you may want to consider purchasing a cryptocurrency trading course.

Asia Forex Mentor is a popular choice that can teach you how to invest in foreign currency along with other items—including cryptocurrency. The One Core Program has been featured by several financial information sites, and it is a favorite of Benzinga. Check out a review of the platform, consider signing up and change your approach to trading.

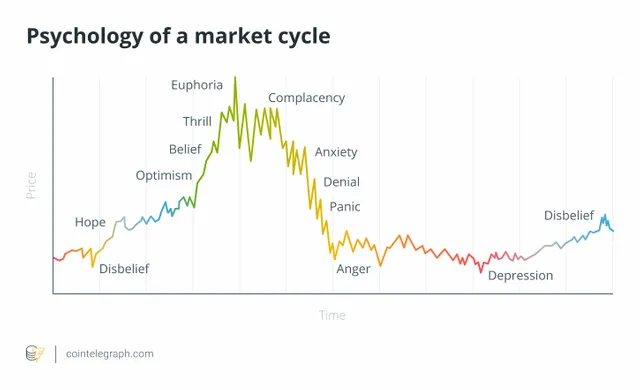

If you’re an experienced trader, you may already have a strategy you use to trade stocks. Stock trading strategies are also commonly used for cryptocurrencies. A personal favorite trading strategy that many traders use is Elliott Wave Theory. Elliott Wave Theory focuses on the psychology behind the market sentiment, so it works particularly well for speculative assets like cryptocurrencies.

Step 5: Consider automated crypto trading.

When you seek out a crypto trading strategy, you might try automated crypto trading with a platform like Coinrule. Trading bots enact a strategy that is intended to give you the best results given your investment goals. Because automated trading can provide you with a conservative, neutral, or aggressive method, you can make money quickly, hold your coins or diversify your portfolio.

You might also consider actively trading cryptocurrency on some platforms while using automated trading with others.

Step 6: Store your cryptocurrency.

If you’re actively trading your cryptocurrency, you’ll have to store your funds on the exchange to have access to them. If you’re buying your cryptocurrency to hold for the mid to long term, then you should get a cryptocurrency wallet.

Cryptocurrency wallets come as software wallets or hardware wallets. Both are secure, but hardware wallets offer the best security, as they store your crypto on a physical device, offline. Ledger is a great hardware wallet brand many investors trust to store their crypto assets on. It supports pretty much all the top cryptos and offers great priced wallets that are all you need to keep your coins safe. If you’re looking for a software wallet, there are several options on iOS, Google Chrome and Android that are free to use.

One of the best software wallets available to cryptocurrency traders is ZenGo. The mobile wallet uses secure 3-factor authentication to protect your digital assets, offering comparable security to other wallets on the market. Plus, ZenGo lets you buy, sell and earn interest on digital assets directly from your wallet.

In addition to top notch security, ZenGo eliminates the vulnerability of having a private key. This makes it a phenomenal choice for novice investors who don’t want the burden of keeping their private key safe and secure.

Compare Cryptocurrency Brokers & Exchanges

There are a ton of options when it comes to cryptocurrency brokerages. For new investors, WeBull is a fantastic option for a few reasons. It offers both stock and crypto trading all on the same platform so you can dip your toe into crypto before diving deep. It also has great paper trading functionality so you can test out trading cryptocurrency without risking a cent.

Other crypto brokerages that are solid options for intermediate traders are eToro, WeBull and Uphold. Robinhood also supports certain cryptos but the platform only supports trading for 5 altcoins

What is Cryptocurrency?

Although there are many different types of cryptocurrencies, they all have one thing in common: they operate on blockchain technology, making them decentralized. Decentralization of financial operations through cryptocurrencies has several efficiencies over the traditional financial system, including:

Cuts out almost all the overhead costs associated with banks

Less expensive transactions that can be sent and received internationally

Inflation or finite supply that’s written into code — no need to trust the Federal Reserve

Financial derivatives like trading strategies and loans can be coded directly onto certain cryptocurrency blockchains, replacing the need for financial intermediaries.

The largest and first cryptocurrency of its kind is Bitcoin. For this reason, all other cryptocurrencies are collectively referred to as 'altcoins'. Bitcoin can be thought of as a super commodity and used as a “digital gold.” Its value proposition comes from it being a perfectly scarce, immutable, portable, and divisible savings technology. Ethereum is the 2nd-largest cryptocurrency with a market cap of $140 billion. Developers can develop smart contracts on Ethereum’s blockchain to create decentralized alternatives to traditional banking functions, like lending and trading.

How to Secure Your Information Trading Crypto

There is no single best cryptocurrency, but there may be the best cryptocurrency for a certain use case. For example, Bitcoin is the best cryptocurrency to use as a store of value asset because it has the most widespread adoption and a finite supply of 21 million coins.

Most of the best cryptocurrency projects are in the top 50 market capitalization of cryptocurrency. Most small market cap cryptocurrencies have questionable use cases or have underdelivered on their promises. Small market cap cryptos are generally riskier than larger market cap coins like Bitcoin and Ethereum. However, high risk isn't necessarily a bad thing. Risk works both ways, meaning that each investment into small-cap altcoins carries the risk of significant failure and benefit of significant success.

It’s important to invest in cryptocurrencies that have a solid team backing the project. To get information about a cryptocurrency, it’s best to read the cryptocurrency’s whitepaper. This will give you an idea of how crypto works and what its intended use is.

Metaverse cryptocurrencies have been a hot asset class leading the start of 2022. Tokens like MANA and SAND are in-game currencies for the blockchain-based metaverses Decentraland and The Sandbox, respectively. Additionally, a key event to look out for this year is Ethereum’s move to proof-of-stake (PoS) in the summer of 2022 as the network shifts away from an environmentally-damaging proof of work consensus mechanism.

The shift to PoS, however, is not expected to reduce the transaction fees on the network which is one of the largest pain points for users. One solution for this to also look out for in 2022 is the continued development of layer 2 scaling solutions like Polygon. Networks like Polygon aim to significantly reduce gas fees and transaction times on the Ethereum blockchain making it more accessible to users.

Ethereum has seen large growth due to the development of DeFi and NFTs with other altcoins also seeing a significant increase in value over the past year. Ethereum continues to gain a lot of interest due to the variety of financial applications being built on its blockchain and the potential for developers to bring blockchain projects to life.

If you found any value in this content leave an upvote and comment down below