Hi, I'm Markus Schmidt. I study Computer Science and business in München and I dont want to talk much about me, I just want to create stuff for the steemit community. I decided to start with an article about the history of traditional financial arrangements and sorry for my german precision in the article, I hope the article is not too dry:)

Now understanding the history of traditional financial arrangements isn't essential to understanding how Steemit,Bitcoin or other cryptocurrency works. However, it would be an interesting subject to look at and I hope everybody will enjoy the informations I provide here. I will use mostly Bitcoin as an example of cryptocurrency. Let’s begin!

Barter --> Credit --> Cash

The path to Bitcoin is littered with many failed attempts at e-cash systems and other credit card payment systems. Here's about a couple schemes.

Some of them are academic proposals that have been well cited, others are actual systems that were deployed and tested. On of the many system is PayPal. It's the only current system that we have from the history of cryptocurrencies that's still bring used today.

Now we'll look at traditional financial arrangements. I’m not going to give you a full history of cash, and the assent of money, and all the things that went into the invention of cash. But I will look at some of the basics just to remind ourselves. They will help us understand the different types of proposals that we'll see. If I rewind in time and go back to a time before there was a government, before there was currency.

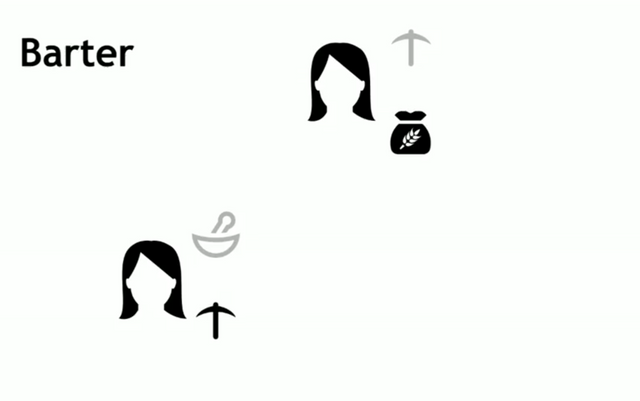

One system that worked for acquiring goods was barter. In a barter arrangement you may have two people. For example, here we have one person who wants to have a tool. And we have another person that needs medicine. Now, if each of these has what the other person needs, then they can do a swap, and they can both satisfy their needs. For example, one person can give medicine to the second person, and the second person can give a tool in return. Now, the problem with barter is, what happens when the two people don't have what the other wants?

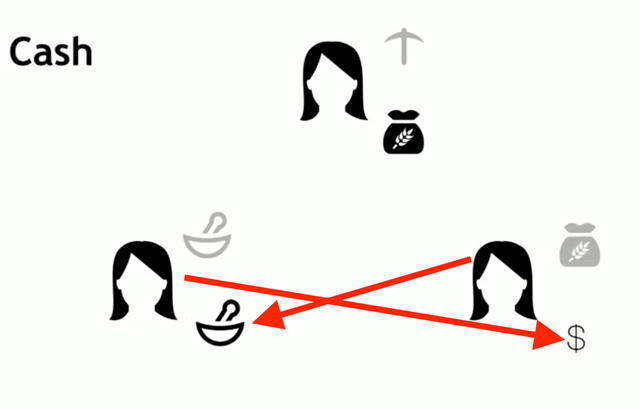

In this case, for example, we might assume that this person has food, which they're willing to trade for a tool that they want. The other person has a tool but they don't have any need for food, they want medicine instead.

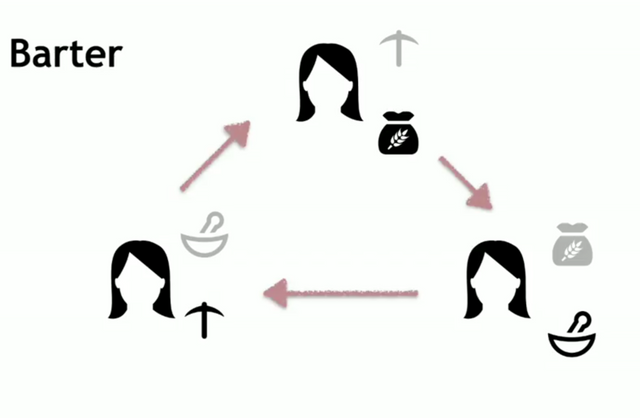

This situation can be resolved with the introduction of new parties. For example, let's assume that there's a third person. This person wants food, and they have medicine available, that they're willing to trade for food. In this case, it's possible to arrange a three way swap where everyone gets what they need.

Now, the drawback of a barter based system is coordination. It's hard to coordinate all three people to have them at the same place, but also to situate them in time, where everyone's needs and wants align in time so that they are able to complete the swap. In order to deal with this draw back of barter, one of these two systems emerged to replace it. One system is credit. One system is cash. It's currently a subject of academic debate which of the two emerged first. For the purpose of this article we don't really care about that debate.

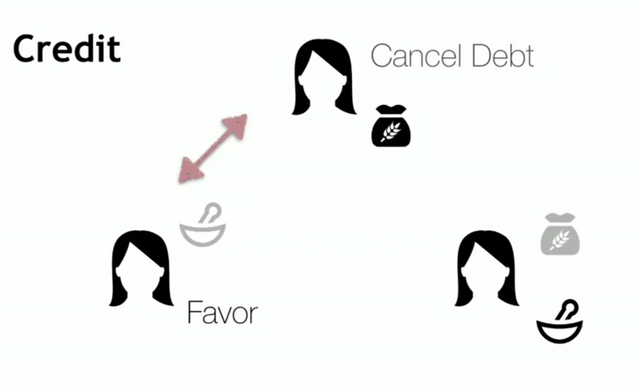

In a credit based system, we can assume that the first person, for example, who needs a tool, they're able to acquire the tool from another person. However, they don't have the medicine that this person wants, all they can offer is food. Since this person doesn't want food, the arrangement could be that they still make the trade, the first person gets the tool. But the second person gets a favor that's owed to them in the future. In other words, this person has a debt that they need to settle with this person in the future sometime. Now, we can say that this person's needs are satisfied. She acquired the tool that she wants. But really she has a new need as a result of this arrangement. She has a debt and she would at some point like to cancel that debt in the future, so that's her new want.

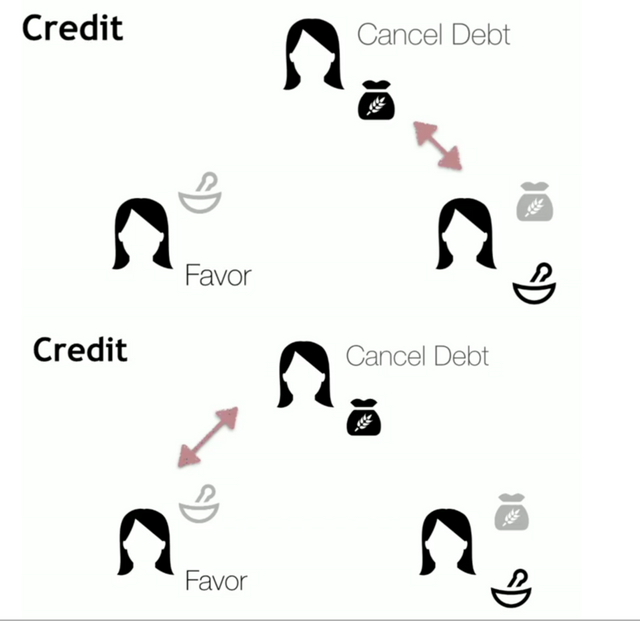

Now, she can at some future time, she may come across a third person. And in this case the third person wants food, which she has.

The third person is offering medicine and if she remembers that medicine is what the person she has a debt with wanted to acquire, then she can trade her food for the medicine. And then when she has the medicine, she can go back to the original person and cancel the debt. As a result, everybody's happy.

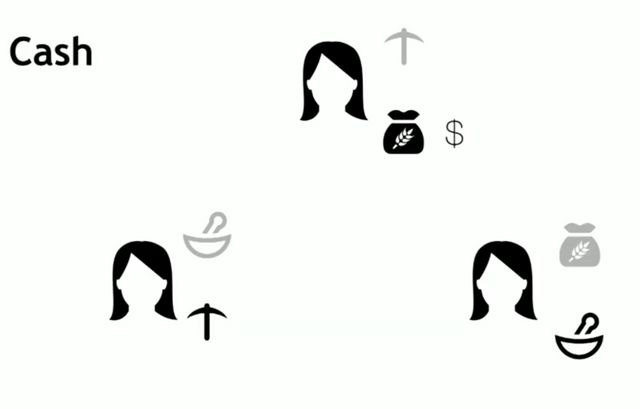

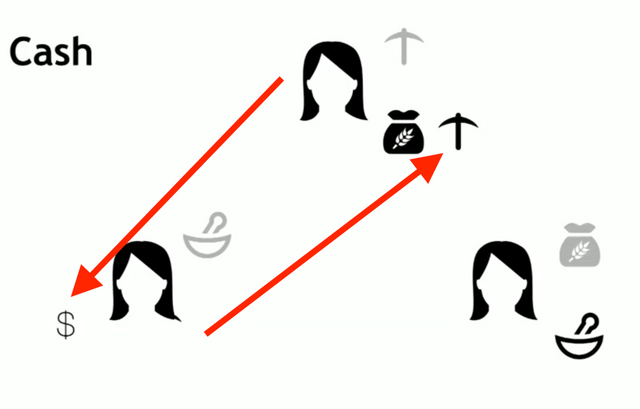

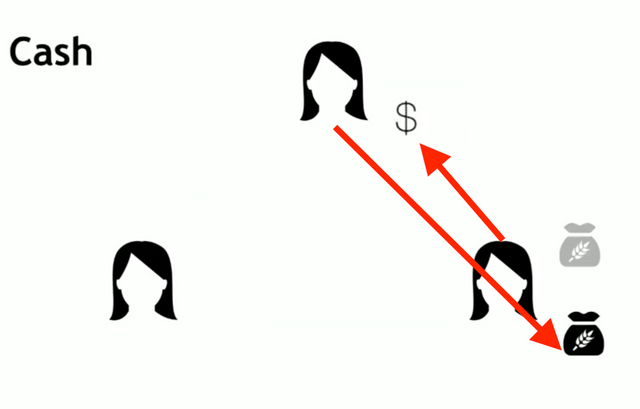

A second alternative we can look at is the cash-based systems. In this case, we'll assume the same scenario, except for in this case we'll assume that this person also has some money, something of monetary value. In this case, when the person above wants to acquire a tool from someone who's offering the tool, they can offer cash instead since they don't want the food that they have. So in this case they do the swap. This person's satisfied, she has acquired her tool and this person has acquired money, which is the value of that tool.

Then later, if this person happens to come across other person, she still wants medicine, this person is offering medicine, she can swap it for the money, okay? Finally, to complete the cycle, the original person has food. This person needs food and has money, they can pay for the food. And the money goes back to the original person who held the money in the first place, and everyone's needs are satisfied.

Now we can contrast and compare cash systems versus credit systems. In a cash based system one requirement to bootstrap the system is you need an initial allocation of cash. The whole trading cycle would not have worked had the one person not originally had some cash on hand.

By contrast, in a credit based system, there's no allocation that's needed. It can work right out of the box. However, the credit based system does have one drawback. And that is the party that gives the tool to the other party in exchange for a debt is taking on some risk. There's a chance that that person never comes back and settles the debt.

Cash also allows for a finer grain precision when you want to say how much something is worth. In barter-base systems, it's hard to say if a tool is worth more than medicine or medicine's worth more than food. With cash, we can apply a mathematical quantity to how much something is worth. For these reasons, this is why we use a blended system today. We used a combined system of cash and credit, where debt are measured in the amount of cash it would take to settle the debt.

Direct application(P2P fire-sharing)

A fairly direct application of this ideas can be seen in some proposals for P2P file-sharing. Two systems that use these idea are Mojo Nation and Karma.

Mojo Nation was a short lived project. It lived about two years, but it's sort of the intellectual ancestor of other protocols that are used today like BitTorrent and Laughs. Karma on the other hand was an academic proposal. In both of these cases, we consider a P2P file-sharing system. Where some people have files, say movies or music, that they're offering to send to other people in the network. And they'll do this in exchange for other files that they want to acquire.

In this case, both of these systems suggested that users, when they enroll in the system, are allocated initially some amount of cash, called Mojo or Karma in the systems respectively. Then the users were able to spend this money to acquire the files that they want, so if you're downloading from someone else. Then you're paying cash to that person. When someone comes to you and they get a file that you have, that you're offering, they pay the cash back to you. And the idea is to try and keep your balance floating around the amount that you were initially allocated.

This also solves the problem of arranging barter between users. If different users have disjoint sets of files that they want to share and files that they want to acquire, then by using currency they don't have to find that perfect person who has exactly what they need and is looking for exactly what they're offering.

Welcome and Thank You for being with us!! Following your Blog now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome and Thank You for being with us!! Following your Blog now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit