HyperQuant is a multifunctional platform for automated crypto trading, asset management and dApps creation that is based on the Fast Order Delivery protocol and blockchain technologies. It is made by professional quant traders who know capital management industry inside-out.

The Need for a new, docentralized financial platforrm

Operating in the financial markets should be not only available for most people but also obligatory. In times of instability and financial turbulence, only wise portfolio management can protect capital from high inflation and secure a safe future.

In the contemporary world. centralized financial systems are particularly common. These systems possess the following disadvantages due to their nature:

- Closed structure and lack of transparency

- Inferior control when transferring funds for management

- Total dependence on the team managing the capital

- A limited range of utilized strategies

The creation of blockchain technology led to the rise of a new market, where the issues of centralised systems were partially solved. However, different concerns appeared. These are as follows :

- Cryptocurrency and altcoin prices are too volatile

- The majority of token holders cannot skilfully manage the risks

- There is an abundance of untrustworthy coins and altcoins

- Dozens of cryptocurrency exclanges have limited liquidity.

To solve this issue, a multilevel program architecture, HyperQuant, was designed HyperQuant is a revolutionary ecosystem for the creation of financial services with the use of blockchain technologies and artificial intelligence. This whitepaper will describe the primary possibilities for the creation of services on this platform as well as the basic services that are part of the system's core.

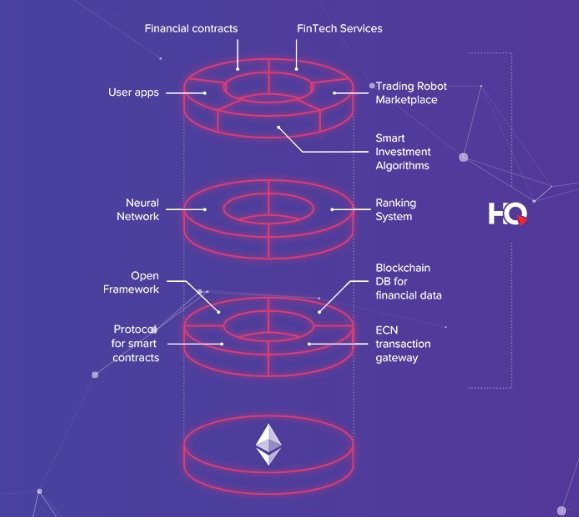

HyperQuant Platform Architecture

The most important modules of the ecosystem are as follows :

- Operation layer- a mechanism of smart contract realisation (for example. Ethereum Blockchain

- Core layer HyperQuant system core that provides the utility for the creation and development of algorithmie trading solutions.

- Al layer a governing layer with the rating system and artificial intelligence that allows different platform elements to be managed.

- Application layer contains the final services and solutions for retail and corporate system users.

The major dangers of and issues with AI- primarily based trading

A wrong education or re-optimization. The marketplace is a completely open machine with the continuously changing quantitative and qualitative membership of its members. The transpiring changes effect the market boom, its fluctuations, its volatility and price adjustments. Developers frequently try to input plenty of unconnected and unformatted entries into the AI, which is a critical mistake. A neural community skilled, for example,to recognize faces on pics, isn't applicable for trade alternate — and vice versa. The trade information suggests that 80% of the money owed tied to the usage of a neural community — are set to zero within the first year after introduction.

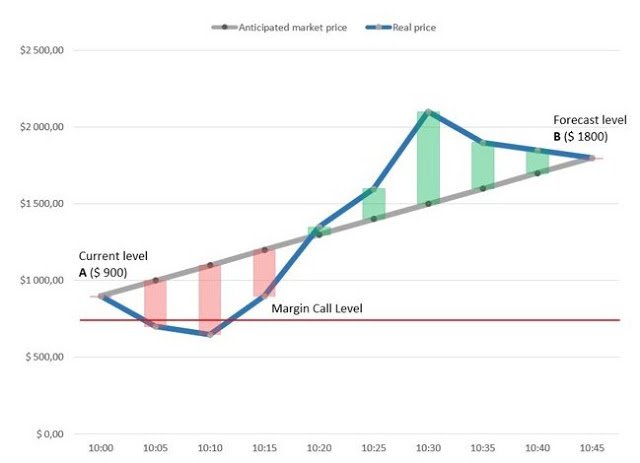

The loss of or wrong chance management. Survival in the marketplace is at once linked to the capability to manipulate dangers. Only professional finance and chance management allows investors to survive the so not unusual turbulence intervals. AI, able to forecasting the marketplace adjustments with 90% accuracy, can create a series of 10 to one hundred loss making deals in collection. Even with the aid of efficiently forecasting the course of the alternate and the future charge degrees (the vital indicators are rate stages, not prices) — it is not possible to appropriately pinpoint how the charge modifications from the antique one (factor A on the graph) to the new one (point B).

BlackBox. Few understand that by means of teaching a neural network — a trader gets a black box. The very last product is a closed production with a selection making set of rules incomprehensible even for the trader. With detrimental environment and the resultant lack of a sizable investment — the dealer won’t be able to appropriately discover the cause for the smash down.

HyperQuant philosophy.

Quantitative hedge finances are much like the personal golf equipment, that require a high monetary stage to go into. There is a large cause for such exclusivity. Contrary to normal budget — quant ones continually try to reach marketplace neutrality with the approach portfolios, thus lessening the effect from market movement dynamics. This lets in the investor now not to worry approximately the black swan and long-time period investment risks.

Our philosophy is shaped around departure from marketplace risks by way of growing a correct threat control shape, balancing techniques and using a extensive diversification. That is why HyperQuant uses AI no longer only for predicting the marketplace but for making the first-class investment alternatives upon thorough type. The middle of our platform is a neural community — a continuously learning score mechanism. The non-stopping development comes with the platform growth and the boom within the factors of the latter ends in the growth in statistics obtained by means of the neural community. This, in turn, makes the neural network re-training extra green. It additionally allows to quick adapt a newly introduced element in the system.

Cutting-edge technology

- Hyper Fast

Fast Order Delivery protocol allows light-speed data transactions between different trading platforms. It works hundreds of times faster than similar solutions, which provides a significant competitive advantage for dApps and the services based on it.

- Hyper Smart

All the components of the platform are managed by HyperQuant Artificial Intelligence and Risk Management system. It constantly evolves through machine learning based on the data accumulated within the protocol.

- Hyper Secure

We use Merkle tree model and proof-of-existence principle to store data of the protocol transactions on Ethereum blockchain. This ensures system transparency and security. The system itself is highly efficient in terms of traffic and computing, so even if it has 1,000,000,000 orders on a daily basis, the proofs will take only 1kb in size and require just 30 hashing operations.

The Economy of HQ Token

Hold Tokens

- To use crypto trading bots

- To use market making and hedging software

Earn tokens

- By developing and placing dApps on the marketplace

- By providing valuable data to the marketplace

Spend tokens

- To create smart contract that store data about your investment portofolio and your personal configuration of trading bots

- To build your own trading dApps or hedge fund software on top of the platform

Token Sale Details

Private sale : May - June, 2018

Public pre-sale : July, 2018

Ticker : HQT

Token type : ERC20

TGE Token Price 1 HQT = 0.00028 ETH 1 ETH = 3500 HQT

Fundraising Goal : 41,143 ETH

Total token supply : 320 000 000 HQT

Available for token sale : 45%

Country : Estonia

Accepting : ETH

Whitelist : Yes

KYC : Yes

Unsold tokens : Frozen for 2 years

Lock-up period

Team - 1 year after the Token Generation Event

Advisors - 6 months after the TGE

Bonus - 3 months after the TGE (each months 1/3 is unlocked)

Bonuses for institutional investors will be locked up to 6 months.

Conclusion

HyperQuant's ecosystem provides solutions to a wide range of problems that blockchain community enthusiasts and blockchain newcomers encounter. HyperQuant's ecosystem is not just today's much needed financial instruments; it is also a new venue intended for global distribution.

Cutting-edge Al-based technologies are rapidly evolving and flourishing these days. It is going to be the next Big Thing" projected to be a new trillion-dollar industry by many experts. But, here at HyperQuant, we are not just developing yet another smart algorithm or a neural network; we are building a huge platform, a future home for thousands of AL-based systems.

HyperQuant's business model is based on an innovative approach that determines what is important and necessary for the user. The concept of this business model relies on identifying high-profit zones, determining the methods of obtaining market share and ensuring its protection from competitors. HyperQuant's ecosystem creates an architecture that allows pioneering technologies to be transformed into actual economic value. Services created in HyperQuant's ecosystem have a huge potential for growth.

Team and Advisors

We are a strong team of hard-working professionals that are obsessed with our mission. The direction of our work is guided by the smartest industry experts. The direction of our work is guided by the smartest industry experts.

Founders

Pavel Pavchenko

CEO

Paul Rogov

Managing Director

FOR MORE, YOU CAN VISIT :

Website : https://hyperquant.net

Whitepaper : https://hyperquant.net/en/wp/

Medium : https://medium.com/hyperquant

Facebook : https://www.facebook.com/hyperquant.net/

YouTube: https://www.youtube.com/channel/UCOgRfmQR-GKJlbnF1tRQPgw

Twitter: https://twitter.com/HyperQuant_net

Telegram: https://t.me/hyperquant

My Profile : https://bitcointalk.org/index.php?action=profile;u=1273236