In the crypto market, Bitcoin remains the most valuable digital asset. This is because it is the cryptocurrency with the most visibility, both theoretical and practical. By theoretical I mean most people know about it and associate cryptocurrencies with it. By practical, it is the payment digital asset that is used most frequently. Despite all these facts, in the world of cryptocurrencies, there are other options (altcoins) that can become a good investment.

I believe lots of traders ask themselves “What cryptocurrency should I buy/trust?”. This is not a question with an easy answer. To answer this question you have to take into consideration aspects like price variations, the development of the project, markets, wallets, reviews, gain expectations, and a small analysis of the competition.

And there will be people to say there is no other digital asset but Bitcoin. They can be right, from a safe point of view. On the other hand, there are other options that can bring you good gains in the short and middle term. This article is not a magical solution to get rich, but 7 tips that will help you succeed in choosing good projects to invest in.

Disclaimer. This is not a financial advisor, but my personal opinion and experience. The crypto market is a high risk one. This means you can have huge gains (as I will show next), but also massive loss. You have to assume these risks before investing in digital assets.

What is an Altcoin – Altcoins vs Tokens

Most people believe an altcoin is any other cryptocurrency besides Bitcoin. This is half true. In the crypto market, there are Bitcoin, altcoins, and tokens. An altcoin is any other digital assets besides Bitcoin that has its own native blockchain. Ethereum, Xrp or Litecoin have their own independent blockchain, so they belong to the altcoin category. Actually, most of the top currency for CMC are coins.

On the other hand, in the crypto market, you will also see tokens. A token is a digital asset that runs on the blockchain of a specific cryptocurrency. Tether (USDT) is an OMNI token, Binance Coin (BNB), OmiseGo (OMG), Maker (MKR), 0x (ZRX), Basic Attention Token (BAT), Zilliqa (ZIL), Aeternity (AE), Pundi X (NPXS), Populous (PPL), Aurora (AOA), Chainlink (LINK), and Golem (GNT) are all ETH tokens. As of November 2018, in the top 50 cryptocurrencies, 14 were tokens and 35 were altcoins.

How to choose a good digital asset for investment?

If you are asking this question, then you might be interested in reading all this article. I will not give you specific cryptocurrency names, but 7 things to consider when making an investment. It does not guarantee success, but it is a practical guide that will help you get closer to big gains.

If you already have in mind a cryptocurrency, just make it pass these filters. If you have no idea what digital asset to choose, then here are some guidelines for you.

1// Calculate the gain favor.

2// Take into consideration the active projects only (and verify the development team).

3// Check the available markets.

4// Check for potential wallets.

5// Take a small look at the reviews.

6// Set gain expectations for your investment.

7// Check the competition on related coins.

Some of the steps might be obvious, some challenging. Let’s have a look in depth at each of them and understand how they can actually help you.

1// Calculate the gain favor.

The gain favor is a term I have named for a specific feature of the cryptocurrencies. It represents the ratio between the all-time high price (ATH) for each digital asset and its current price. The obtained number will give you the possible gains of your actual investment.

If this number is 5, then you can gain 5 times more the money you invest. If it is 100, the numbers can look pretty nice. In calculating the gain favor number, I make 2 assumptions.

One first assumption

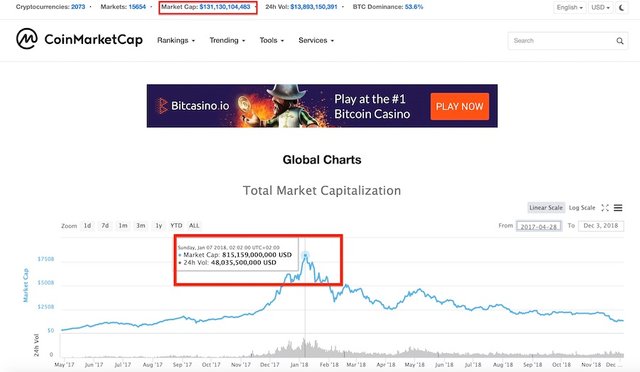

The crypto market will go up again, at least around the last high peak it had. This high peak was in December 2017-January 2018, when the global market capitalization (GMC) was around $800B. At the writing time of this article, the GMC was around $130B, so more than 6 times lower. The global market capitalization depends entirely on the prices of digital assets. If each individual cryptocurrency’s price goes up, the GMC goes up.

In my opinion, the probability of the crypto market to go up again to around $800B is very high. When this thing will happen, I have no idea. But it doesn’t really matter. Today, the market is in a dip and you can speculate that. Then, you might have to wait 1 month or 3 years to see some gains. On the other hand, the crypto market is a high-risk investment. And you are either patient and believe things will turn well or don’t invest at all.

The second assumption

This refers to the growth of the individual digital assets. If the GMC goes to $800B, a cryptocurrency’s price will be around its ATH price. There is something we should take into consideration: the number of digital assets that are available on the market.

Today, there are more than 2000 cryptocurrencies that contribute to the calculation of the global market capitalization. Back in December 2017, there were around 1000 digital assets on the market. I don’t have an exact number for a year ago, but the middle of 2017 and 2018 were the years of the ICOs. This means there were a lot of new projects launched in the market. All these ICOs, now tradable cryptocurrencies, contribute to the GMC. So if the GMC is $800B, the price of each digital asset will be a little lower than its ATH. On the other hand, we can expect the crypto market to go even higher than the last time.

These 2 assumptions are, in my opinion, realistic. This is because I believe the crypto market is making a needed difference in our financial world, in many areas. So the market will go up, as people will invest in a better financial future. And good projects, those that really make the difference, will be part of our everyday life, we will use them. So their value will increase.

The Calculation of the Gain Favor

As mentioned above, the gain favor measures the feature of the price of a digital asset. More specific, it is the ratio between the all-time high price (ATH) and the current price. The obtained number is the possible gains you can have if you invest in that particular cryptocurrency. Let me give you some examples.

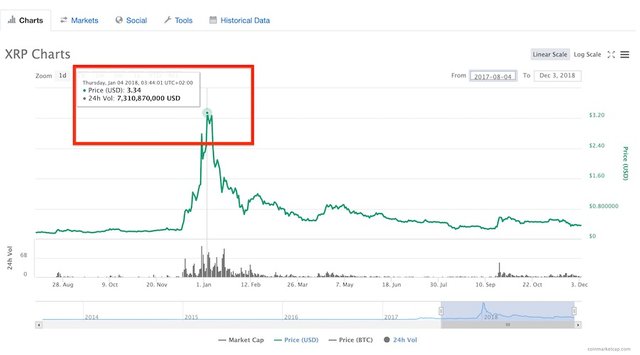

For Xrp, the ATH is $3.34, as you can see from the image below. Today’s price (3rd of December, 2018) for 1 Xrp is $0.361. So the gain favor for Xrp is 3.34/0.361 = 9.25. This basically means that, if you invest now $1,000 in Xrp and its price goes back to its highest value of $3.34, your investment will worth $9,250. But if you invest $10,000, you will make $92,500. And so on.

But Xrp is a low-risk investment in terms of digital assets. There are cryptocurrencies with a bigger gain favor. Some examples with a gain favor of 100 or more are BitDegree (BDG), Experience Points (XP) and Cobinhood (COB). This means that $1,000 invested now can turn into more than $100,000. As mentioned above, high risks bring high gains and vice-versa.

More info. You can check this article for more details about the gain favor number and analysis in depth about investing BitDegree (BDG). And this is NOT an advertisement. It is my personal opinion and investment.

2// Check if the project is still active.

A very important aspect you should take into consideration when investing in a cryptocurrency is the evolution of the project. Maybe this should be the first thing first because it doesn’t matter the gain favor if you invest in a dead or scam project.

So, if you think about a particular cryptocurrency, have a first look at the links provided by the CoinMarketCap website. Each digital asset, on its details page, has links to the website project, social media accounts, and contact information. Check all those links and see where they get you. If the official website of the project is not working, there might be something fishy about the cryptocurrency.

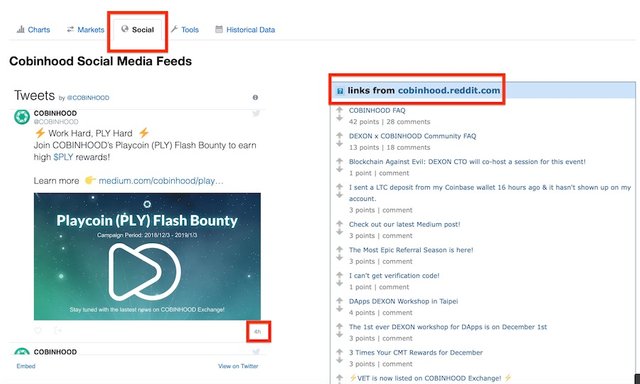

Read about the project, its aims, and the roadmap. Then have a look at the founders, the development team and CEO. Also, check the Social tab from CMC for the specific coin. You will see the last Tweets – check the time. If they don’t have updates in 1 year, you might want to reconsider your options. There are also a few other helpful social links that you should check. You can see below the information for CoinMarketCap for Cobinhood token (COB).

This project seems trustful, as it has launched the exchange platform they have promised in the ICO launch. The trading platform Cobinhood is completely functional and provides good services to its customers.

The same is true for the exchange platform Covesting and COV token associated, and the BitDegree courses platform and the BDG associated token, and many others.

3// Have a look at the available markets.

The subject of available markets has 2 sides: if a certain cryptocurrency is listed on big exchanges, this means you will easily be able to buy and sell it. This is also a sort of guarantee that the community trusts that particular digital asset. But these types of cryptocurrencies don’t have a big gain favor (usually, it is less than 25).

On the other hand, if a specific cryptocurrency is not listed on big exchanges, this comes with an advantage: when (and if) it is listed on big exchanges, more people will find out about it and the price will certainly go up. The negative side of small exchanges is the traded volume. For little-known cryptocurrencies, the volume can be really low. This means that a limit order can be filled in terms of days (maybe weeks) or not at all.

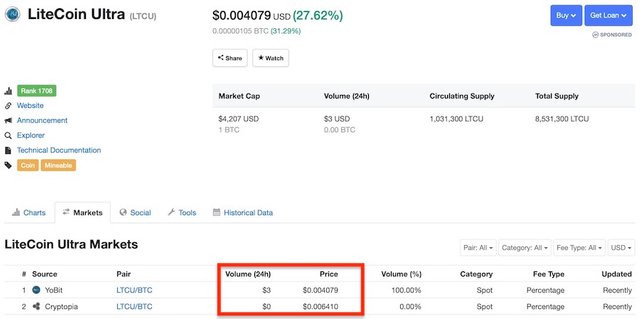

An example you can see in the image below. LiteCoin Ultra (LTCU) has the gain favor 147, but if you want to buy it, there are 2 markets only. And both markets have almost no volume. This means that you either buy at the market price (which can be a lot higher), either assume that it is possible for your order not to fill.

Litecoin Ultra has 2 markets only and a low traded volume.

4// Check for potential wallets.

Actually, the wallet part depends entirely on your investment. If you make a small investment, you can choose to leave your cryptocurrencies on an exchange. It is not the safest thing ever, but it is an option. It comes with risks. A recent example is the Cryptopia exchange.

On the other hand, if you choose to make a bigger investment, check some wallets. There are many multi coins wallets that you can use. Hardware wallets like Nano Ledger S and Trezor support many digital assets and all the ETH tokens. You also have device multi cryptocurrency wallets, like Jaxx, Exodus, Coinomi, Atomic Wallet and many others.

Keeping safe a big or middle investment is important. On the other hand, if a multi-coin wallet supports a particular digital asset, this generates more trust in that cryptocurrency.

If you choose to leave your coins on the exchange don’t forget to turn on the 2-factor authentication on your account. Also, take into consideration some security measures when you log into your exchange account, like keeping your credentials safe or not connecting from a public wifi.

5// Take a small look at the reviews.

Well, the thing with the reviews is a double-edged sword. In my reviews searches over time I could see many stupid things. People usually act emotionally and write things on forums out of scare and insecurity. So you will find many people “yelling” things that are not totally correct.

When documenting my Cobinhood exchange article, I could find a lot of senseless complains, especially for someone that has used the platform. The first example that comes to my mind was the fact that they have ridiculous high withdrawal fees. I mean, seriously? Compared to what? Did you make some calculation before posting that? Cobinhood might not be the best exchange for you, but you either cannot tell me it has high fees.

The example from above was just to show you that, sometimes, people’s opinions have no fundaments. So you have to be picky when you look at the forums.

On the other hand, not seeing any review might not be a great idea. On the forums, you can see the involvement of the development team in the community, which, in my opinion, is important. If the community has questions about a specific cryptocurrency, there should also be official answers. Besides that, if the community has only negative opinions about a digital asset, the probability for it to go up again might be quite small.

The reviews are correlated with the 2nd point from this list. If the project is active, the probability to find balanced reviews is high. Having a look at the forums and the community’s opinion about a certain project will help you see if there are some major flaws or negative sides about a cryptocurrency. All the other is just blah blah.

6// Set expectations for the investment.

This point is extremely important and highly correlated to point number one. Let’s suppose you already have decided to invest your money in a digital asset that has the gain favor 80. The same time, you are confident that it is a good project and the community opinions sustain your decision.

The next very important step is to set your gain expectations. If you don’t know what is the profit you want to make, you risk missing great opportunities. This was a mistake I have once done and I hope you will not do.

Setting expectations means setting some selling thresholds. Setting more selling thresholds might make you feel a little more comfortable, especially if you are a beginner. But, for a digital asset that has the gain favor 80, I would suggest you set the selling point when the cryptocurrency’s price goes 50 times higher. Why is that? Because:

- if you wait too much, you might never sell and wake up in a new market dip (it happened to me in December with some digital assets);

- if you don’t set some thresholds, it will be difficult to approximate a good sell time;

- if you clearly know your profit expectations, you will be less probable to make emotional decisions; emotional decisions are the worst enemy in the world of finances;

- you will know exactly your minimum ROI (return of investment).

Let me give you an example. I have invested in BitDegree token precisely for these 7 reasons, with all the details. The gain favor at the time of my investment was around 150. But I have decided I would sell my tokens when BitDegree will worth 50 times more. My analysis was simple:

- if today I invest $1,000 in BitDegree, I can make $50,000 out of it. Should I invest $10,000, I would make $500,000;

- the probability of 50x gains is higher than the 100x.

When investing, you want to set your mind not to take emotional decisions. Questions like Should I sell? Should I wait? What if the price will continue to go up? What if tomorrow it will go down to less than 10x? bring instability and you should avoid them. You should make an investment having some numbers that you can rely on.

To make thing even simpler, once your cryptocurrency hits your threshold, you can still hold. If it goes back around your threshold price, just sell and make (at least) the expected profit. This has one small inconvenience: you have to keep your eyes on the price variations during that period of time, so you don’t miss your expected gains.

7// Check the competition on related cryptocurrencies.

This is something I didn’t pay much attention in the past. On CoinMarketCap website, you will see a lot of information on the details page of a specific digital asset.

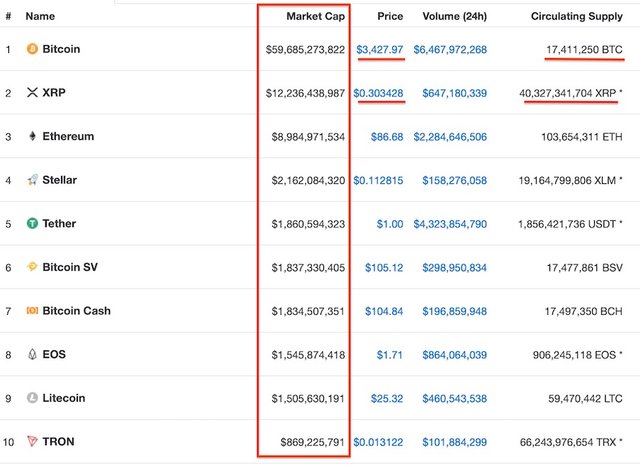

One of those details is the rank, which might not be that relevant. The rank depends on the cryptocurrency’s market capitalization. This market cap is obtained by multiplying the price of a digital asset with the supply. This means that, for a cryptocurrency to be in the top, it either has a big price (like Bitcoin), either a big supply (like Xrp). The price might reflect the trust of the community in the project, but the supply not really.

The rank depends on the Market Cap, which is influenced by the price and the supply of a cryptocurrency.

When you decide on a cryptocurrency, have a look at the related projects (you will find in the bottom of a coin’s details page on CMC). But don’t look in terms of price and supply, but the aim of the project and what problems it solves.

For example, many traders find it useless to invest in cryptocurrencies that make the same thing as Bitcoin. On the other hand, the financial market is widely opened for many projects and many niches, so there might be Bitcoin for some niches and other digital assets for others. Just like Paypal and Visa.

Final Thoughts

Choosing how to make a good investment can be very challenging. You can take a financial advisor (and I am NOT) and he will make this analysis for you. Or you can spend some time in the world of cryptocurrencies and see the potential of your best investment.

I have shared with you 7 things I take into consideration every time I decide on a new cryptocurrency. I can’t pretend these are the only criteria you should take into consideration, as the crypto world is a never-ending story in terms of learning. But these are the things I have learned that work and I really hope you found them really useful.

Disclaimer. This article is also available on the CryptoLand website that I have a collaboration with.

Hello @aninamaev! This is a friendly reminder that you can download Partiko today and start earning Steem easier than ever before!

Partiko is a fast and beautiful mobile app for Steem. You can login using your Steem account, browse, post, comment and upvote easily on your phone!

You can even earn up to 3,000 Partiko Points per day, and easily convert them into Steem token!

Download Partiko now using the link below to receive 1000 Points as bonus right away!

https://partiko.app/referral/partiko

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @aninamaev! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@aninamaev, thank you for supporting @steemitboard as a witness.

Click on the badge to view your Board of Honor.

Once again, thanks for your support!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit