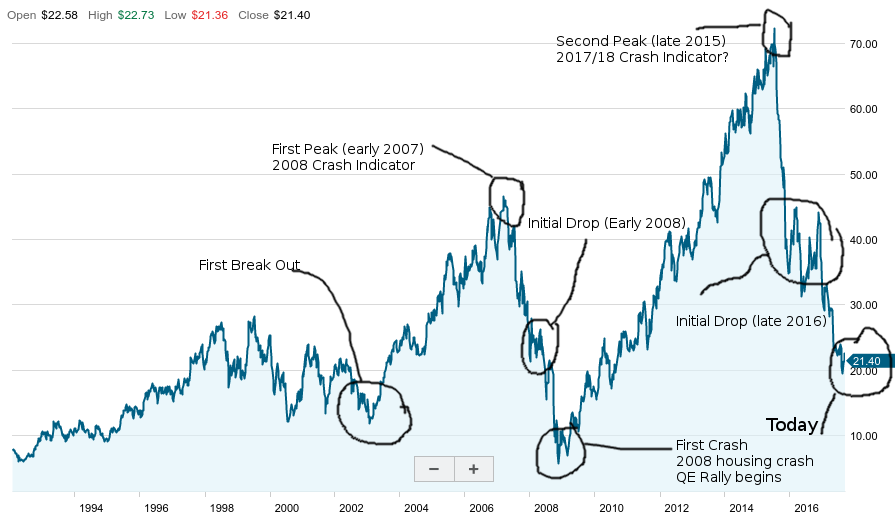

Guys I am thinking about this especially given how I believe Macy's chart predicted the last 08 crash and another is just around the corner.

Buying Macy's (M) stock ~$21 then writing the $25 call (jan 2019 expiration) for a credit of ~$2.20. Then using that credit, buying the $18 put (jan 2019 expiration) for ~$2.20. This allows you to open both sides for basically free.

While you wait, you will be collecting their yield of ~7% currently. The play out is simple. You will either be forced to sell at $25 on a break out to the upside (resulting in a $4 profit per share) or earning huge if they crash again by closing the short call for nothing (under $0.05) and profiting big on the put that will be worth many times more than the amount you loose in the stock value!

Combine this with the fact that e-commerce giants like Amazon are taking away market share and driving down margins for retailers like Macy's it seems like a great time to consider taking on a position similar to this one.

The last conclusive piece to take away is how Macy's was a huge indicator of the 2008 housing bubble, crash, and how QE directly effected the stock market. The strategy above is designed to make money whether the market goes sideways, up OR down, and is heavily profitable during the potential next down swing.

Thanks for information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That drop looks scary! Very good information bigdeej!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The next crisis will be worse than the one in 2009.

After the previous crash the government has tried to save us by keeping the interests rates low, however this can't continue forever.

If we get hit by another crisis, who knowns what will happen...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed 100% and if you notice on Macy's chart there were clear indicators that the markets were about to crash that I believe are showing again, only this time it will be amplified thanks to QE bail outs in 2008+

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey mr... been trying to get hold of you... sent a mail to your gmail.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Will check

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good job

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit