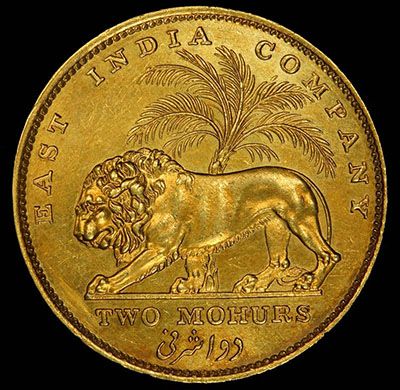

Imagine you’re a British entrepreneur in the 1600s. It’s wildly lucrative to send sailing expeditions to the East Indies, bringing back rare and exotic goods from Asia and selling them at a massive profit. But the journey is risky: your crew might be drowned at sea, captured by pirates, or decide to never come back.

To mitigate your risk, you form a group of investors, pool your money together, and fund multiple expeditions. This way, if one of the sailing expeditions doesn’t make it, others will: all the investors share in both the risk and the reward.

This was a milestone in the history of finance: rather than risking it all on a single ship, you could buy a piece of an “East India company,” which would sponsor multiple voyages, and pay dividends to all the investors. It was an early example of diversifying risk, of not putting all your eggs in one battleship.

But when you bought a piece of an East India company, what were you really buying? A piece of paper.

This piece of paper was proof of your investment. But you can almost hear the early skeptics. “You’re buying a piece of paper? But it has no real value, like gold or silver. Why are you buying paper?”

Those pieces of paper were the first company “shares,” so named because investors shared the risk. They entitled you to a share of the reward … and there was plenty of reward. Before long, these shares in the companies – these pieces of paper – could be sold for huge fortunes. It was the birth of our modern stock market.

Tokens are the New Shares

Now imagine you are a modern-day investor who wants to invest in high-tech startups. Like the early East Indies sailing voyages, sponsoring any single company is risky: your team may never produce a working product, they may be attacked by corporate pirates, or they may simply run out of money.

You could combine your funds with other investors, and spread your risk among various startups, taking an ownership stake in each new company. This, of course, is the traditional venture capital model. But what if you don’t have VC money? What if you only want to invest $10,000? Or $1,000?

One word: tokens.

Tokens are the financial innovation that is transforming the world economy. Built using blockchain technology, tokens allow investors around the world to own a small piece of any asset, just like those early investors bought “shares” of East India companies.

Imagine that a top VC firm now offers tokens to the public. These tokens represent a “share” in the firm that can be bought and sold like stock. Hundreds of these tokens have already been issued for startup companies, and are currently trading on massive global exchanges like Poloniex.

These early tokens, however, are only the tip of the iceberg. Tokens are revolutionizing the world economy.

A Tidal Wave of Tokens

In 2011, Marc Andreessen famously said, “Software is eating the world.” It’s now time to say, “Tokens are eating the economy.”

This is because tokens allow ordinary investors to “share” in any asset: not just startups and VC firms, but even physical assets like gold or fine art.

Imagine that you’re an investor in Dubai who wants to get into New York real estate. The owner of a skyscraper on Fifth Avenue issues tokens. From Dubai, you can buy those tokens, then hold them as an asset backed by the physical real estate in New York. If the value of New York real estate skyrockets, so do your tokens—and vice versa.

Or, imagine that you are a museum with a valuable Rembrandt painting. You can’t sell the painting, as it is crucial to your museum’s success, but you can issue tokens backed by that painting. Art lovers can now own a piece of the painting, generating funds for you to further invest in your collection.

In the early days of the stock market, stocks were bought and sold in British coffee shops. But with the advent of blockchain technology, tokens can be bought and sold anywhere in the world, by anyone with a computer. Tokens are the great democratizer.

How to Invest in Tokens

At Bitcoin Market Journal, we created a complete list of upcoming Initial Coin Offerings, which has since become the most successful section of our site. We rate each new token offering on a scale of 1 to 5, so you can invest in the most promising new tokens.

We’d love your feedback on how our rating system works for you. Does it help?

Health, wealth, and happiness.

Bitcoin Market Journal

Welcome to Steem!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is the new wealth investment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I laughed so hard at the meme. Like I actually LOL'd.

I really appreciate this explanation. I'm just really starting to understand these concepts for the first time and so everyone who uses any kind of analogy on here is my immediate BFF. I do have a question for you, though -- say I do sell tokens, (shares, essentially?) of the famous painting hanging in my museum. If the price skyrockets and I never sell it, what value does that give my token holders? Or are they making money based on museum ticket sales? Sorry, that may have turned into a philosophy question somewhere along the way.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a great question. While it's unclear how we will value rare assets (like a one-of-a-kind painting) with tokens, ultimately the market will decide the value.

Since you like analogies, here's an analogy using the stock market. If investors buy a stock in a company, and never hear anything from the company again, they'll lose faith in the company, everyone will sell, and the value of the stock -- and thus the company -- will go down.

It's likely the same thing will happen with tokens: if someone buys a token backed by a Warhol painting, but Warhol starts to go out of style, the value will likely go down. If there's a Warhol renaissance, or MOMA puts on a huge Warhol retrospective, the value will go up.

Thus, tokens will motivate the owners of the underlying asset to always be ADDING VALUE, just as the stock market motivates corporate managers to constantly ADD VALUE with their companies. Hope that helps!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A very interesting article, I look forward to your articles

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Incredible explanation, simple and funny at the same time, I´m following up close ICO´s for about 3 month and I have to say the good projects are so rewarding!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks to the post .. follow me @neljoe

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Saya telah membaca tentang artikel Anda dan Anda menjelaskan lebih banyak rincian yang sangat saya sukai tentang menceritakan kronologi kejadian di masa lalu, sangat mudah dimengerti oleh semua orang.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

well

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

liked the introduction and how you compared between old times and now. sharing in risk and reward is what crypto currency folks doing now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sangat baik jika kita memiliki itu pasti senang hidup kita

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steem! I just joined today myself, so I'm still learning the ropes, but you seem like a perfect choice to be my first "follow"!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you guys do any kind of code review as part of your in-depth ICO assessment, e.g. to validate whether the token is inflationary (i.e. has a hard-coded cap on the maximum token supply)?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I will follow you and check out your site for tips on ICOs.

However, I hesitate to compare tokens with shares, as many tokens don't offer a piece of ownership of the company, but rather - sometimes more, sometimes less - obscure user benefits once a product is finished. This is an important difference imho.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit