I have been building a new short position against WTI Crude Oil for the past two months... my last short position in WTI Crude Oil was closed in Q4 2018.

I expect forex volatility to predicate a large downwards price movement throughout H2 2019. Periodic geopolitical information flow has shrouded the materially significant increase in supply along with a concurrent reduction in demand (present-day and projected).

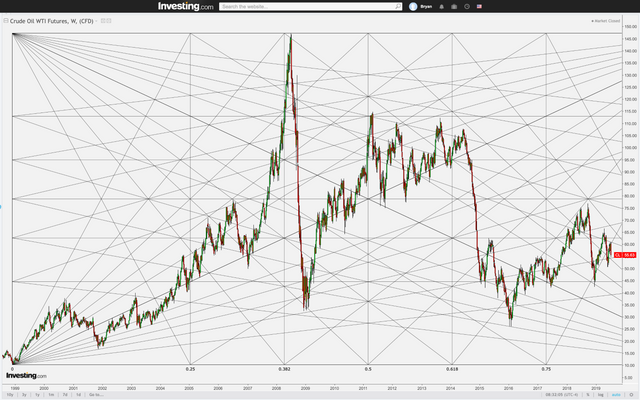

Soft Targets: $34 & $27

Cycle Minimum Target: $12.21

Position:

20Dec '19 $XLF 21puts @ 0.23 average

18Oct '19 $USO 9puts @ 0.11 average

20Sep '19 $KSA 27puts @ 0.24 average

16Aug '19 $DB 6/7puts @ 0.05 average

One minute candlestick chart of $CL_F

Five minute candlestick chart of $CL_F

Weekly candlestick chart of $CL_F

Congratulations @bryanalighieri! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit