Davos jawboning makes US Dollar slide more. Bottom fishing takes me to Russia and Mexico and Italy and the oil patch (again). A quieter day in Bitcoin markets makes for a few small profits.

Breaking news

US Dollar US Dollar weakened strongly on the back of jawboning by US Treasury Secretary Steve Mnuchin. It seems that the market has fully priced in the expected rate cuts from the Federal Reserve.

There seems to be a decoupling between US Dollar and Treasury yields. I am positioned for the coupling to go back in place. Jawboning only works for a while. Instinct tells me there is a lot of funds movement selling US Treasuries (hence yields rising) and funds being sent outside US (hence Dollar falling) ahead of ECB and BoJ changes. Support for my feeling is yields on 10 year Japanese Governemnt Bonds (JGB) gave back the gains they made after BoJ announcement on January 23. I am pleased I only protected half my short trade.

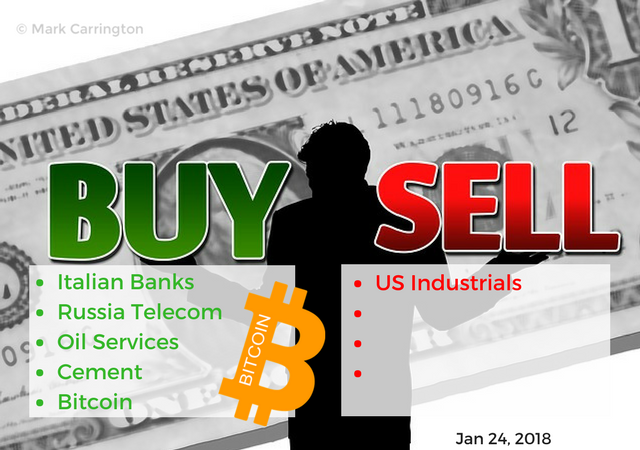

Bought

Banco BPM Società per Azioni (BAMI.MI): Italian Bank. Identified BPM from a Price to Book Valuation screen run on the Milan stock market. BPM is the 3rd largest bank in Italy following the merger of Banco Popolare and Banca Popolare di Milano in January 2017. The long run chart shows a classic roller coaster journey through the GFC (2009), the European Debt crisis (2012) and the Italian Debt crisis (2017). The long term chart tells the story well enough

The shorter term chart that spans the merger dates shows price breaking the weekly downtrend and testing the support and resistance level at €3 (the dotted horizontal line). Price broke above that level overnight and closed above that level. I bought a small parcel of shares and also put in a bid on a bull/call spread. My strategy in Europe has been to sell the overall index and buy into recovering stocks. This is a good example. The orange line is the European Stoxx 600 Banking index (represented by the DB Trackers Banking ETF( XS7R)). BPM is 75 percentage points behind that - close half the gap and I score a handsome profit. Dividend yield is 1.12%

OJSC RosTelecom ADR (RKMD.IL): Russian Telecom. I ran the Price to Book Valuation screen on the UK market and this stock came up. Chart pattern is a classic example of what I am looking for. Price has tried several times to break the weekly downtrend lines and appears to be bottoming out. Over the last 6 months price has been sandwiched between the two support lines and has made another double bottom. My experience is that when price breaks out of range like this, it runs hard.

Rostelecom is Russia's leading long-distance telephony provider. Domestic long distance service provides about 50% of the company's revenue; and international long distance calls provide about 25%. I have been invested in Russia since OPEC and Russia agreed on oil production cuts. (See TIB127 and TIB128 for the rationale on Russia). That was enough for me to add a small position. And I find this morning that the dividend yield is 7.4% = a tidy bonus.

Weatherford International plc (WFT): Oil Services. WFT popped up on a Price to Sales screener for the US markets. This got me excited as oil services has been moving very strongly in recent weeks. I was required to deliver Haliburton (HAL) stock on a covered call trade just last week. This was a way to get back some lost ground. The chart from the 2014 oil price highs shows a beaten up stock that has tried a few times to break up. Maybe this is the one.

I did not need to do the comparative chart to know that WFT is lagging. Here is the chart showing WFT (black bars) lagging by 38 percentage points behind the sector (represented by the Van Eck Oil Services ETF (OIH - red line)) and 66 percentage points behind Haliburton (HAL - orange line). The risk in the investment lies in the debt structure that WFT is carrying. Interest cover is poor - the business is highly leveraged to a rising oil price and it could fail. My holding is small.

CEMEX, S.A.B. de C.V (CX): Mexico Cement. Cemex appeared on Price to Sales and Forward Price Earnings screens. While Cemex is based in Mexico it operates globally with 75% of sales from the Americas and 25% from Asia and Europe. Financials show a solid business with Return on Equity of 9.6% and strong cash flows. The business is also carrying a large debt burden though interest cover is manageable. The screen identified the break up. The chart is stronger than a classic bottoming out. Economies in the region are growing. With a closing price of $8.39 I could afford an option contract in my small portfolio. Now to the chart which shows the bought call (10), and 100% profit as blue rays with the expiry date the dotted green line on the right margin

The challenging part of the trade is the strike price (10) is where the 2017 highs were. Price will need to mimic what it did from the 2012 lows. I have copied across an Elliot Wave (left hand zig zag) to the current cycle. I can see that each leg up to points A and to point C has not been as strong this time around. The blue arrow shows the latest gap. Applying that to point E will have the trade shy of 100% profit. I will explore if I can sell a call option above 10 that will bring the premium down to that possible outcome.

Now there is some risk in this trade from the NAFTA discussions with 28% of Cemex revenues arising in the US.

https://www.cemex.com/investors/key-company-data/worldwide

Sold

Johnson Controls International (JCI): US Industrials. This trade was testing a short term options trading strategy. The rules for the trade are to close out if premium drops to 50% of the paid premium. I set out to put in a stop order at the 50% level. Finger trouble hit the Limit order button and the trade executed for 42% loss in 2 weeks. I am not bothered by the mistake as JCI did appear on two of my screens for long trades. Lesson learned on the strategy - focus on long setups when the market is wanting to go long. There will be plenty of time for short setups.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $1012 (8.8% of the high) making for a much quieter day than we have seen for a few days. In my Bitmex account I added one new position at $10,735 and closed out two for profits of $286 (2.57%) and $447 (4.16%) per contract. I remain exposed to 4 contracts with an average price of $11,839 - a little higher than yesterday

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 8.8% (higher than prior day's 7.7%).

Outsourced MAM account I run an outsourced forex trading account with Actions to Wealth. They closed out 4 trades for 0.27% loss for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and Bloomberg.com. Cemex image is credited. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with Bitcoin for as little as €50 (in Bitcoin) and earn Bitcoin at a rate way better than your bank will offer - think weeks instead of months. Not available in US or Canada http://mymark.mx/Mark

January 24, 2018