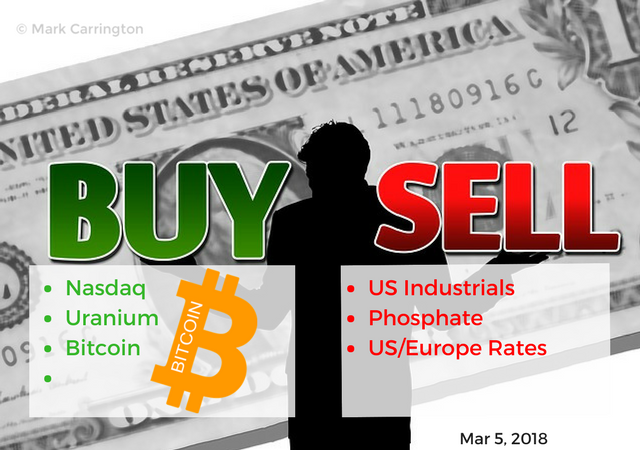

US Markets fight back. US Dollar looks confused as it wrestles trade vs interest rates. I am investing for growth and rates to keep rising. Time to do more bottom fishing in uranium. Reducing sovereign risk in phosphate and industrials profits go into the bank ahead of trade war risk. Bitcoin quietly marches up and holds over $11,000.

Portfolio News

US Dollar One of the talking heads said yesterday that he thought the US Dollar was behaving out of sync with what else was going on in the markets. Everything was up in US markets apart from steel and US Dollar.

These headlines tell a mixed story. There are a lot of moving parts - trade tariffs, rising US interest rates, phased end of stimulus in Europe, etc. I even heard the word "safe haven" used in the context of a possible trade war and money flooding to Japan. It is all kind of confusing as Japan could well be a key casualty in any trade war.

Then Governor Kuroda of the Bank of Japan said that he would consider ending stimulus policies starting in 2019. Well who knows what the data will be doing then.

This chart tells me what the market thinks - the market is actively buying 10 year Japanese Government Bonds. It feels like I am the only seller right now. There are nearly 75 basis points in that chart = 3 rate rises.

Bought

ProShares UltraPro QQQ (TQQQ): US Technology. I am always on the look out for investing ideas especially those that are presented with backing of reported results. The Aggressive ETF headline on a Steemit post caught my eye - basic idea is to use leveraged ETF's and hold them for a week and use relative performance to rebalance every Friday. With markets traded down from the tariff tantrum, Monday seemed to herald a good day to start with the first pick - a leveraged ETF on the Nasdaq Index (QQQ). I bought a small parcel to test the idea out - we shall see what transpires

https://steemit.com/money/@haejin/aggressive-etf-performance-update

Chart gives a quick look at the underlying instruments that the strategy uses. Nasdaq (QQQ - black bars) vs S&P 500 (SPY - red line) vs 20 Year Treasuries (TLT - yellow line) vs Volatility Index (VIX - orange line)

Note: Leveraged ETF's carry disproportionate risk - do not copy this idea until you understand those risks.

Paladin Energy (PDN.AX): Uranium Producer. Paladin operates a uranium mine in Namibia and has interests in a moth-balled producer in Malawi. It has just emerged from a bankruptcy process where the debt was restructured and existing shareholders diluted in the consolidation. I added a small parcel of shares to bring my diluted holding to a marketable size. Uranium has been a story of failed breakouts - maybe this is a cheap way to run the next attempt. Here is a chart going back to Fukushima of the Global X Uranium ETF (URA) - all I have done is add a new breakout arrow from the last time I made the chart

Sold

Industrial Select Sector SPDR ETF (XLI): US Industrials. I continue to look for candidates to sell in one of my accounts to relieve margin pressure. With the steel and aluminium tariffs hitting industrial business hard this was an obvious candidate for a 142% profit since April 2017.

Danakali Limited (DNK.AX): Phospate Mining. This trade idea was identified as a break up by my investing coach and fitted in with my agriculutre theme. I have since found an ETF that invests more widely in agricultural related chemicals - Global X Fertilizers/Potash ETF (SOIL). The ETF provides coverage for the sector and diversifies away company specific risk. Danakali operates a phosphate mining business in Eritrea in East Africa - that carries significant sovereign risk. 14% profit since January 2017.

Shorts

Euribor 3 Month Interest Rate Futures I saw the chart with a high test bar rejecting retracement highs I could not help myself. I added another short position

Eurodollar 3 Month Interest Rate Futures Price action on the Eurodollar charts shows a different type of reversal - we call these train tracks. Basically the market was heading up for a day and then came back down about the same amount the next day. It does need to be a biggish move to qualify. I added another short position on the December 2018 futures.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $305 (2.6% of the high) making the 4th consecutive day where volatility has been lower than normal. In my Bitmex account one trade hit a profit target at $11,187 for a $183 per contract profit (1.6%)

I wrote yesterday that price looked like it wanted to break higher. It did. The one hour chart shows a different pattern to what we have been used to seeing - 3 cycles of 3 higher highs with only small dips between each.

CryptoBots

Outsourced Bot Bot closed a manual STRAT trade I had set up to do dollar cost averaging (DCA) trade for 2.64% profit. Over the weekend trades on DASH and Monero (XMR) were closed both above 2%. Those trades were replaced with a NEO trade which made its way like a stone to the problem child list. Inching ahead a few dollars at a time is the way this bot feels

Problem children (>10% down) list was joined by QTUM and ARK - ETH, ZEC, DASH, ICX, ENG, EOS, GAS, STRAT, NEO, ETC, XLM, ADA, BTG, QTUM, XEM is the current list. There can be no new trades until this list clears (or I clear it)

Profit Trailer Bot For most of the day I kept the bot from adding new positions by only allowing it to hold the number of pairs in DCA. When the first trade came out of DCA for a profit (NANO), the bot added some new pairs and made some profitable choices. Overall there were 7 trades closed for 1.74% average profit bringing overall average up to 1.54%. Of note were the BCD trades coming out of 3 levels of DCA with a 1.95% profit.

DCA list was reduced by 2 with BCD and DGD making it off the list and into profits. Bitcoin Diamond (BCD) went up over 60% in the 24 hour periood - that is when DCA works.

The concerning part of the list is that 4 out of the 8 counters got worse (it was 7 when I first started the write up). This is confirming something one of the people I follow has begun to talk about. Hold your Bitcoin and trade the other coins against something else is what he says. That is the plan - progressively shut this list down and switch to trading against Ethereum. I am waiting for an Ehtereum transfer to be cleared through my mining company.

New Trading Bot New bot closed two BTC trades for 1.92% profit each bringing the overall average up to 1.76% out of 34 trades

The open positions list is almost at capacity - NEO looks somewhat worrying from a trade point of view.

While the average win percentage looks acceptable, the problem list drags the overall profile down. It is time to begin to understand the mechanics of Pump and Dump schemes which are driving these prices like crazy - 64% on BCD in one day saved me BUT why?

Currency Trades

Forex Robot closed 12 trades (0.52% profit) and is trading at a negative equity level of 15.2% (higher than prior day's 12.9%). Currency markets are going through some fundamental change as the US Dollar is being revalued and Japanese Yen looking to come off stimulus in 2019 (says Governor Kuroda of the BoJ). Trading robots tend to do badly when these disruptions occur.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

March 5, 2018

maybe im being dumb here (all i trade is stocks/etfs). How do you "buy" uranium?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buy the Global X Uranium ETF (URA) or simply buy Cameco (CCJ) which is 26% of URA

http://etfdb.com/etf/URA/ has the details

The Van Eck Vectors Nuclear ETF (NLR) gives a play focused more on nuclear energy = energy producers plus a little Cameco plus some equipment makers

Etfdb.com is a great resource. Type any category into the search box to find a lit of ETF's

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you for sharing my friend @carrinm, success always for you my friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am interested to read your post and I will support every action that you will do for the common interest and the progress of buying and selling in the world of steemit. good post @carrinm

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit