Federal Reserve bouys US markets but spooks interest rates. Congress repeals some of Frank-Dodd Act which should be good for small banks. I find a new way to invest across the energy sector. Bitcoin and Ethereum offer falling knives trades.

Portfolio News

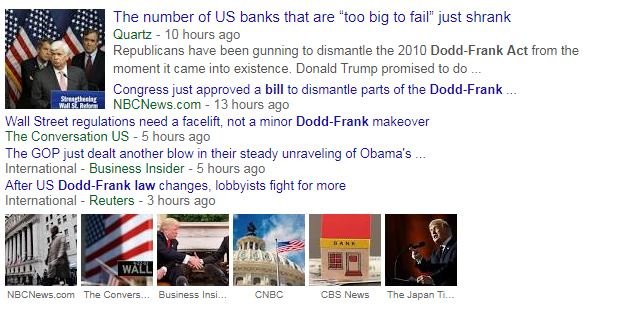

US Bank Regulation Congress took action to repeal parts of (or rollback) Frank-Dodd Act. This unravels a suite of regulations introduced after the GFC to prevent a repeat of the practices that drove the GFC.

The key part of the repeal is it changes the definition of what is "too big too fail". This is particularly helpful for smaller banks. Sen. Mitch McConnell, the majority leader, said the legislation would give “smaller community lenders relief from Obama-era overregulation.”

https://qz.com/1286289/dodd-frank-act-explained-the-number-of-too-big-to-fail-banks-just-shrank/ has a good overview of the changes

US Interest Rates. The minutes of the last Federal Reserve meeting were released.

The key messages were that the Fed would allow inflation to overshoot the 2% target temporarily and that they would continue with gentle rate hikes. The market reaction was instant - US stocks went up and US interest rate yields went down (about one third of a rate hike). The down of interest rates made my portfolio worse off as I am levered up to rising rates.

Bought

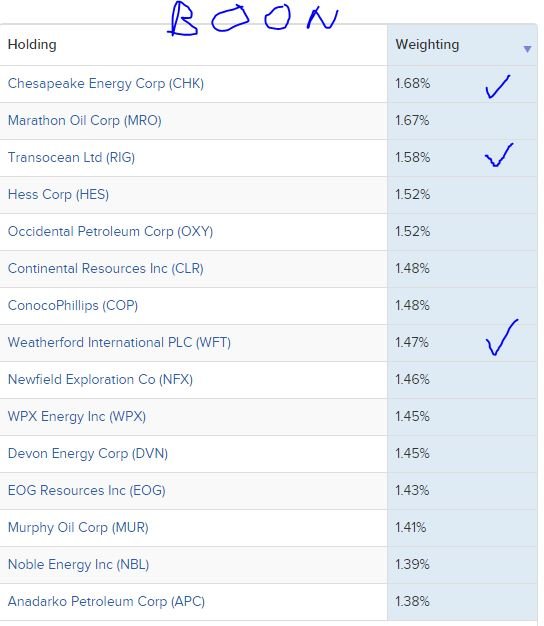

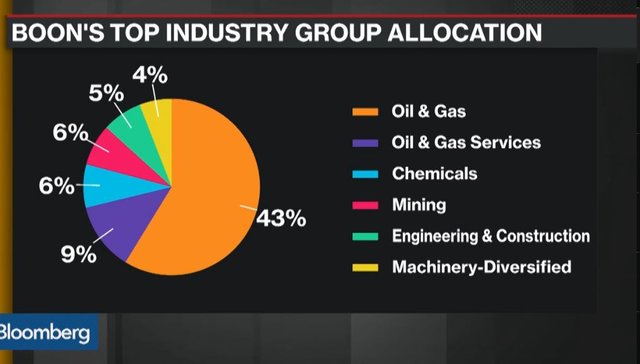

NYSE Pickens Oil Response ETF (BOON). US Energy. I watched an interview with Toby Loftin, of BP Capital Fund Advisors talking about a new Oil industry ETF. He talked about the changing dynamics of the energy and oil industry and that there was no index that measured performance in this changing landscape.

Until now, no indices or passive strategies in the marketplace appropriately reflected today’s energy landscape. Nor did they allow for investors to thoughtfully track and invest across the entire energy value chain in a way that captures the opportunities associated with these fundamental changes

http://tboonetf.com/whitepaper

That grabbed my attention because I have been cherry picking my way across the oil sector, from pipelines to oil drillers to geophysics to fraccing technology to MLPs in the search for opportunity. Here was a way to invest across the width of the opportunity in a sector and reduce individual stock risk. The top 10 holdings line up with quite a lot of what I hold - top of the list was my most recent addition Chesapeake Energy (CHK) up 38% since I bought on May 11.

Another differentiating concept is the ETF invests in industries that are invested in energy usage either as users (like Alcoa or Southern Copper) or energy producers (like GE). A chart from the Bloomberg interview shows that about a quarter of the ETF is invested in energy users (the top left quadrant).

The ETF is equally weighted with rebalancing done quarterly - Chesapeake and Transocean are at the top of the list with the strong price moves this last two weeks. The top 15 gives flavour of holdings as it includes midstream producers, integrated producers and oil services. I have ticked off what I am holding. Of the 82 stocks in the ETF, I am holding 11 equating to 14.06%.

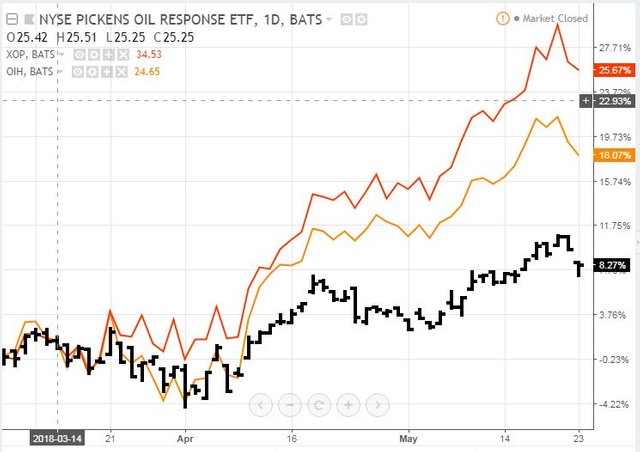

It is early days for the fund. Since its launch it is lagging the main oil industry ETF (XOP - red line)) and the Oil Services ETF (OIH - orange line)).

Looking at the weights of the bottom 15 stocks, I can see that this is because the energy users are being a drag. This formulation is designed to reduce the Sharpe Ratio - i.e., it reduces the risk spread. I will monitor performance and assess if this is a better way to hold the 11 energy related stocks that I currently hold.

Northfield Bancorp, Inc. (Staten Island, NY) (NFBK): US Regional Bank. Congress passed the rollback of the Frank-Dodd legislation that was put in place after the GFC to regulate the banking industry. This was particularly onerous on small banks. I went into the banking screens to find small banks that could do with a hand up. I liked this chart which shows price breaking a short term downtrend and making a new high. Price gets back to the 2016 highs is a 25% jump.

What the chart does not do is show that price is dramaticaly higher than the GFC lows. There is no data before 2008.

3D Systems Corporation (DDD): 3D Printing. I thought I had placed a larger order when I opened my position in 3D Systems last week. That finger trouble was rewarded with a price pullback which gave me a chance to increase my position size at a slightly lower price. My position is still small and I will look to scaling in as price confirms direction. See TIB232 for the rationale.

Shorts

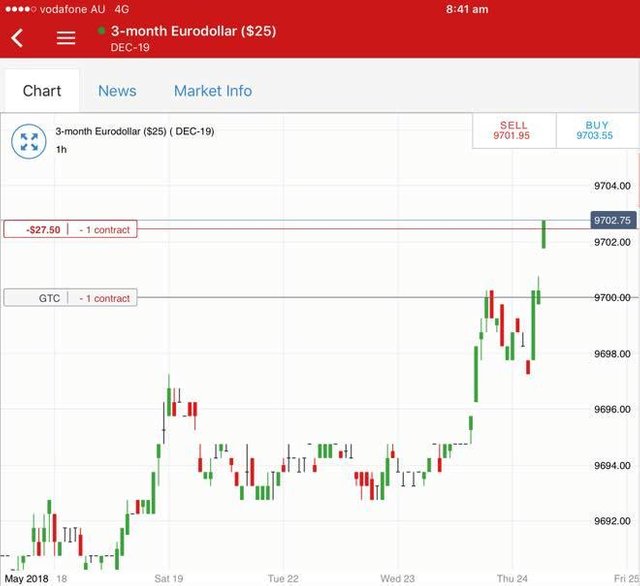

Eurodollar 3 Month Interest Rates (GEZ): Federal Reserve released the mintues of their last meeting and indicated that they would allow inflation to overshoot the 2% target and that they would continue the policy of gradual rate increases. This is exactly what they said in their statement last week BUT the market decided the written words were more powerful than the spoken words and moved to thinking only 2 more rate hikes this year and not 3. Futures prices spiked in US and in Europe (Japan too but that is separate).

I have put in a pending order short 1 contract looking for a reversal (labeled GTC). I will monitor that during the day and move the entry point higher if needed. Once the reversal is confirmed I will scale in the trade.

Income Trades

No bids taken up overnight.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $597 (7.4% of the high). While volatility was back to the average level the day did not feel like that. Price simply went down below the support level at the bottom of no man's land.

I have drawn the support line where there are the most touches on the daily chart. There is a line of argument that would suggest support at the bottom of the reversal before the last break down to lows (the green ray) as this does coincide with a weekly bar. Weekly bars are less critical in continuous markets as there is no chance of price gapping when markets reopen.

It is hard to tell what drove this price drop. The commentary is that volumes are low. There is unconfirmed talk of India levying goods and services tax on crypto trades. There is talk of more raids in China on unlawful ICOs and pyramid schemes.

I was encouraged to see a CNBC Fast Money announcement from a friend and former colleague Asiff Hirji, COO of Coinbase about the moves they are making to get custody solutions working for institutional clients in US and buying the Paradex Bulletin Board and opening it to international clients. We need the volume to get better Bitcoin price discovery.

Watch the announcment here

For me, I decided to test the falling knives as I could see hezitaiton on the shorter time frames indicating there were buyers around the $7500 level. I added a half position on my IG markets account.

The testing question for me is whether I close out my short spread position on the September futures at Bitmex, which is nicely in profit.

Ethereum (ETHUSD): I played the falling kinves game on Ethereum too as the hezitaiton looked more pronounced.

DO NOT COPY THIS AT HOME. It is high risk trading that needs lot of account margin.

CryptoBots

Outsourced Bot No closed trades on this account (205 closed trades). Problem children was unchanged (>10% down) - (15 coins) - ETH, ZEC, DASH (-41%), BTS, ICX, ADA, PPT, DGD, GAS (-50%), STRAT, NEO (-48%), ETC (-44%), QTUM, BTG (-47%), XMR.

GAS is now the worst at -50%. There are clearly problems in the NEO/GAS world. 5 coins in the -40% club.

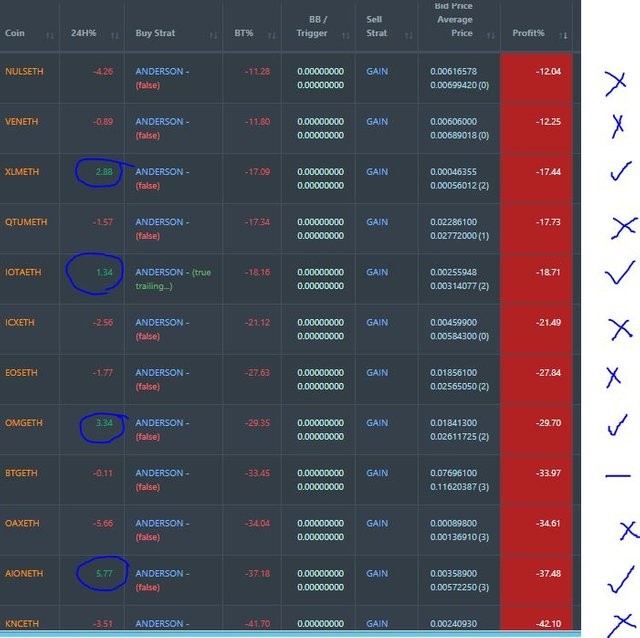

Profit Trailer Bot No closed trades. Dollar Cost Average (DCA) list was unchanged at 12 coins with 4 coins improving, one coin trading flat and 7 worse.

Days like this are good for shaking out likely survivors - XLM, IOTA, OMG, AION went up on a day when ETH and BTC were smashed. Only one coin now worse than 40% down (KNC).

With this massive correction in ETH and BTC prices, this is the day to change the strategy for this bot. I will isolate these coins and manage them manually towards breakeven and start a whitelist based list using a stop loss strategy.

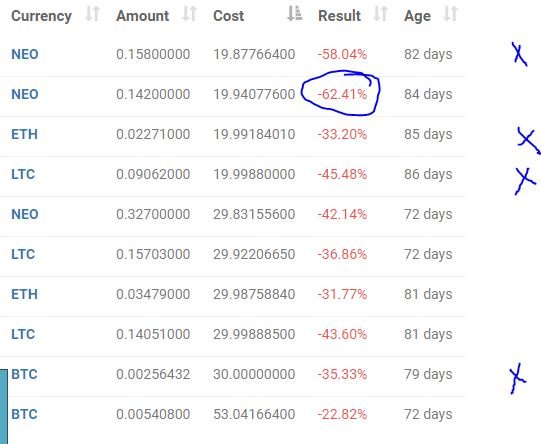

New Trading Bot Positions dropped another 3 points to -38.5% (was -35.1%).

This was a day of least worse - LTC wins that loser tag.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 16.3% (higher than prior day's 14.6%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. BOON images come from Bloomberg TV and etfdb.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

May 23, 2018

Thank you very much for the information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you for sharing information @carrinm

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

postingan anda sangat luar biasa, terimakasih atas informasinya. Salam steemian dari Aceh, jika tidak keberatan kunjungi blog saya @aminnullah

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. The community support from Aceh is great

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are welcome

greetings from our steemit community JOPA SC ( @jopa-sc)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hopefully today your investment goes smoothly.thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very helpful information, we are very helpful with your posts like this, amazingly, success continues @carrinm

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit