More tariffs. Market Jitters become trembles and a correction in China. Back on the short Eurodollar horse and new covered calls in Dutch/US Insurance.

Portfolio News

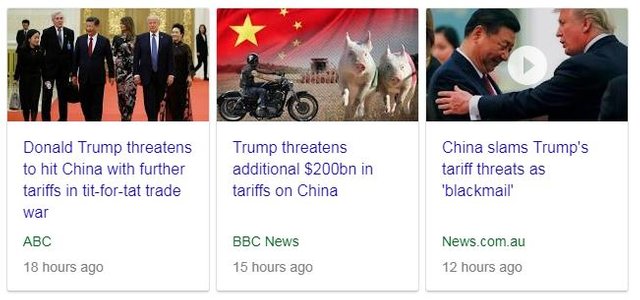

Market Jitters - Tariff Tantrum Talk was of another $100 billion in China trade targeted for tariffs. WRONG

The man knows no bounds in the game of negotiation. Is it a game of bluff or is it bullying? Add the $200 billion to the $50 billion to the solar and washing machines and steel, we are pretty close to the whole deficit of trade between US and China. A size related rescaling of the US-China deficit amounts to $344 billion. It feels like a game of bluff because US only exports $115 billion to China. China can only retaliate with tariffs on that amount of trade. Of course, they can retaliate a lot harder by withdrawing market access to US businesses and/or reducing support for North Korea sanctions and/or stop buying US treasuries and/or depreciate the Yuan.

There are more subtle ways too as the China bureaucracy can grind work into forever ever land for anything to do with US business operating in China or seeking access.

https://www.wsj.com/articles/how-china-can-retaliate-beyond-tariffs-1529428031

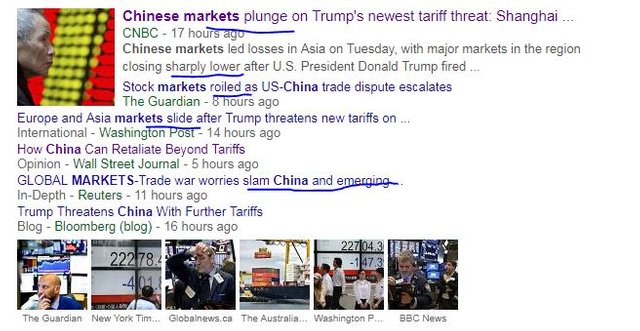

Markets took it on the chin right across the globe

Most spectacular was in China markets with the indices down 3 to 6% on the day and 1 in 4 stocks hitting the circuit breakers which kick in when a stock drops more than 10%. Agriculture took a beating too especially Soy Beans - China is the largest market for US sourced soy beans.

It was not all doom and gloom. The market will start working out who the potential winners are in a trade war situation. The idea of the tariffs is to level the playing field to protect and then stimulate local production. The market started its work and pushed the Russell 2000 index to a new all time high. One answer is small cap American business.

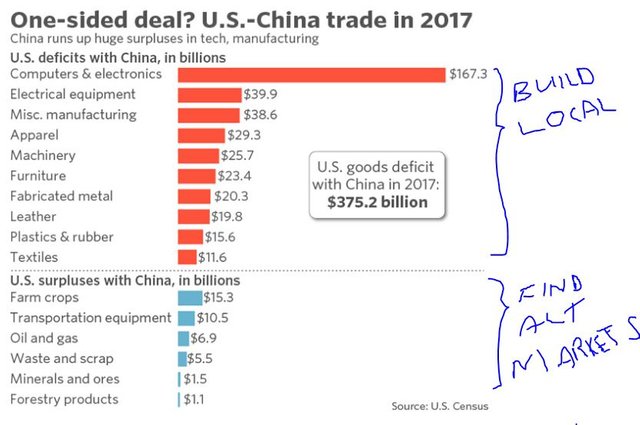

Data will be the way to win on this trade arena. Here is a chart of the deficits and surpluses by sector

The first step is to work on the deficits map and identify which local business can step in to replace trade on the top of the chart. Second step is to calibrate the chances for providers in the bottom half of the chart to find alternate markets. If they can find new markets, well and good. If they cannot, they become candidates for shorting - agriculture might be the best call for shorts. One has to asses the chances that China can find alternate sources of supply too. Then one has to gauge the chances of a compromise or backing down. Donald Trump is very dependent on farmer votes and mid-term elections are not far off. I am guessing we will see some backing down when it comes to agriculture.

Oil price went wobbly again ahead of the OPEC meeting

Iran Oil Minister was vocal about opposing any production increase making it difficult for OPEC to make any decision. The markets reacted by pushing oil prices down. Does this mean that they are beginning to smell a chance that OPEC members will start working outside the current agreement - i.e., start pumping more oil anyway? Meeting has not started yet and the speculation is rife - leaking like an oil well.

World Cup The Google search for Russia is all about the World Cup.

No surprise there as Russia won again and effectively wiped out the chances for Africa Cup holders, Egypt. Most worrying though is the risk of running out of beer. My Russian investments do depend on a steady flow of beer for the tourists - very few drink vodka is my guess.

What a novel concept. Soccer fans in the sweltering Russian summer heat want to drink beer, not vodka. Just an amazing realization to come to.

https://sportsnaut.com/2018/06/draft-problem-russia-running-out-of-beer-at-the-world-cup/

A little further down the headline list is this one.

Wilbur Ross denies insider trading on shorting a Russian stock. How many Americans are invested directly in Russia is a good question, let alone have enough information to know what stocks to short?

Meanwhile on the sporting fields, Australian headlines have gone past the Optus streaming issue to what really matters

Who are the frauds and what is the Polish goalkeeper up to in the shock defeat by Senegal? The frauds are not identified - maybe it is the players who dive.

This image was posted on reddit - it is a limited run novelty product - both stores selling it have disappeared. Hard to know who owns the image.

https://www.reddit.com/r/funny/comments/7qfrtz/realistic_foosball/

As for the goalkeeper, the problem seems more to do with the 4th official letting a player on the field during the run of play. Normally they wait for a break in play. As for results, Japan and Russia and Senegal win.

Shorts

Eurodollar 3 Month Interest rate Futures (GEZ). I watched the price chart drift upwards and then stablizie. Margin in my IG Markets account was holding steady with a steady BTC and ETH price. So I added one new short contract at 97.0095 to replace one of the contracts I closed off the day before.

I do not know that this has the best scope for asymmetric returns (compared to Euribor or Japan Government Bonds) but I do know there is less risk of central bank muddling or fumbling on the trade. The chart shows a tidy trade entry on the reversal on a 4 hour chart

The good news is the Euribor chart is showing signs of slowing the upwards trajectory - also a 4 hour chart.

Income Trades

A down day for markets meant than no US trades hit their bids. I did get hit on one European trade - a new trade on Aegon NV - the Dutch/American Insurer.

Aegon NV (AGN.AS): Sold July 2018 strike 5.6 calls for 1.88% premium (2.35% to purchase price). Closing price €5.32 (new trade). Price needs to move another 5.3% to reach the sold strike (new trade). Should price pass the sold strike I book a 32% capital gain.

Cryptocurency

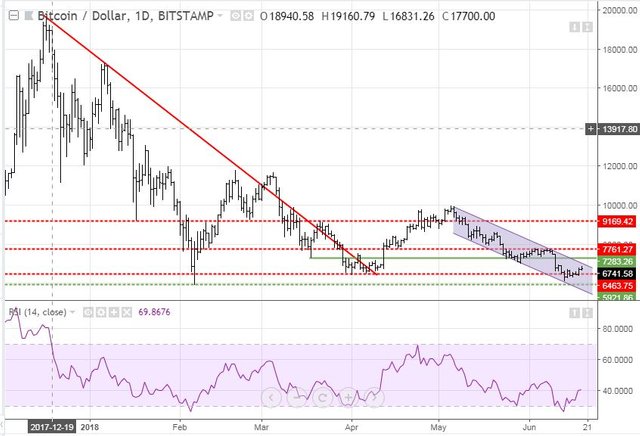

Bitcoin (BTCUSD): Price range for the day was $181 (2.6% of the high) for the quietest day we have seen in recent times and is inching towards the top of the channel. Every small move up like this is good news for margin in my IG Markets account.

Ethereum (ETHUSD) Price range for the day was $34 (6.2% of the high) and poked its nose above the top of the channel (but did not close above).

CryptoBots

Outsourced Bot No closed trades on this account (212 closed trades). Problem children was unchanged (>10% down) - (18 coins) - ETH, ZEC (-44%), DASH (-48%), BTS, LTC, ICX, ADA, PPT (-55%), DGD (-46%), GAS (-58%), SNT, STRAT (-47%), NEO (-56%), ETC, QTUM, BTG (-56%), XMR, OMG.

I did tweak one robot and it opened one new trade on LTC. Worst performer is now GAS but not a lot to split between NEO, GAS, BTG and PPT.

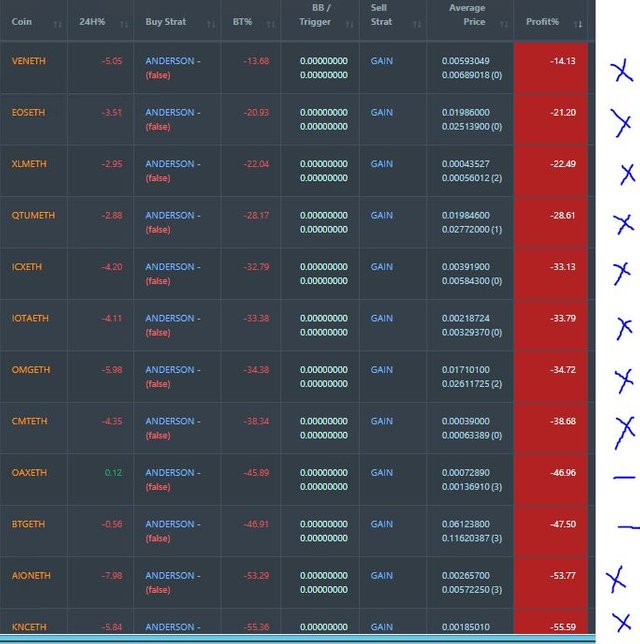

Profit Trailer Bot No closed trades. Dollar Cost Average (DCA) list was unchanged at 12 coins with 2 coins trading flat and 10 worse. VEN did not continue its upward moves. This type of day is quite normal when ETH has a quiet day - everything else drifts down.

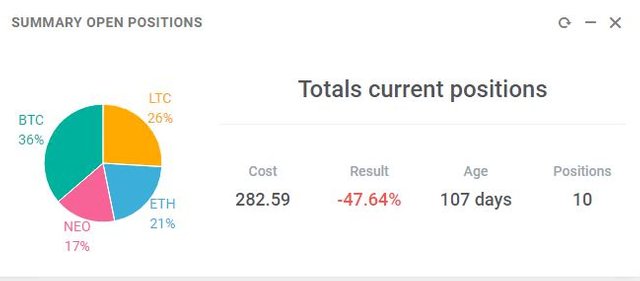

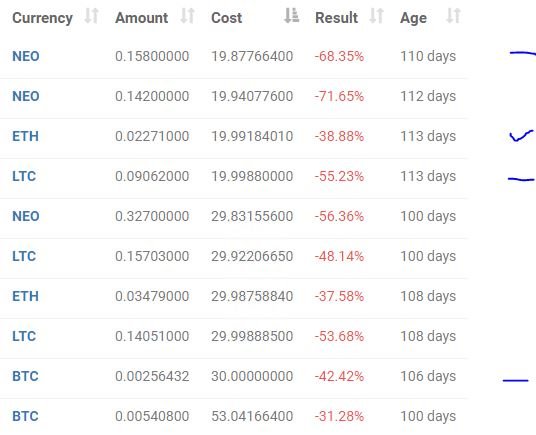

New Trading Bot Positions improved 1 point to -47.6% (was -48.5%).

ETH mproved 3 points and the other 3 coins traded flat.

Currency Trades

Forex Robot closed 4 trades (0.16% profit) and is trading at a negative equity level of 1.8% (higher than prior day's 1.5%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Other images are credited below the images. Chart images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

June 19, 2018

Upvoted ($0.13) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very useful information @ carrinm, sometimes world oil influence not only from opec meetings but from inter-state warfare.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I look for things that are changing to drive my investing thinking. Inter-state warfare is currently the same as it has been for a while. OPEC meeting is a change. Supply bottlenecks in US are a change. Iran sanctions are a change. Demand growth from growing economies is a change. Tariffs will flow through to a change as the flow of goods slows or changes direction.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Will taarif flow to change as the flow of goods slows down or changes direction? Is this a gap?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

First thing businesses will try to do is find alternate markets. For buyers this could mean buying locally or buying from a country supplier who is exempted. Example, China has already started buying soy beans from Brazil and not US. For sellers they look to find new customers in new countries.

Second thing is businesses look to see if they can pass on the higher prices to their customers. If they can, they continue buying and the customer pays. The customer then has to work out what they do with less money - stop buying that product or some other product or borrow more money.

If customers cannot take the higher prices, the business has to decide if they can absorb the higher cost. If they can, the trade continues but profits go down and the knock on goes to shareholders as reduced dividends or to other cost categories which get reduced.

Ultimately the end result is a reduction of demand somewhere in the supply chains and economic growth suffers. Already we are seeing estimates for 0.5% reduction in China GDP growth, as an example.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your explanation, this is very professional. Allow me to share this with everyone.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Results from @smartmarket promotion

Before:

After:

Say 20 votes and $0.75 net after 2 SBD spent (at $1.25: 1 SBD)

Positive returns but no new followers. Time to scale up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit