Bitcoin bounds ahead. Options expiry time is somewhat uncomfortable in semiconductors, oil drilling and shipping. Markets are cheered by the Fed and earnings. I am buying US Retail again in a contrarian mood. Brexit blues on the Pound makes a winning European banks trade look bad. The trade exit was bad too.

Portfolio News

Market Jitters Markets liked Jay Powell testimony and earnings - data wins.

The main take away from Jerome Powell, Federal Reserve Chairman, was that he was comfortable that US growth was on track and that the Fed were still on track for gradual pace of rate hikes. This was totally in line with what the last statement said. I watched a bit of the testimony and thought he did skirt around the flattening yield curve subject. A more financial savvy Congress membership would have been digging into that topic a little harder than they did. Earnings were a little mixed but they did point to a solid quarter of growth. The best part of the day's trading was that the market did not panic on the big sell off in Netflix (NFLX) before market open on its modest growth projections.

The Putin-Trump summit took a twist when Donald Trump said he misspoke and moved to stand behind US Intelligence services. Markets were not fussed either way.

Rubies

News in my portfolios is that Mustang Resources (MUS.AX) has agreed to merge its ruby interests with Toronto listed Fura Gems (FURA.V)

This brings scale to the ruby business for Mustang and allows it to focus on its Mozambique graphite and vanadium resources. I had always viewed these interests as the bonus part of the investment - now it is the focus. Focus always helps. There is no doubt that Mustang is sitting on a massive ruby opportunity at its Montepuez facility. What has also been clear is that the management team has not done as good a job at selling rubies compared to finding them and getting them out of the ground. Maybe the new team at Fura can do it better. The tough part as a Mustang shareholder - the deal is in stock and not in cash. Some cash would be good to fund the graphite development.

http://www.mustangresources.com.au/irm/PDF/2789_0/MustangAgreesRubyAssetMergerwithFuraGemsInc

Europe Steel Thyssenkrupp (TKA.DE) share price popped overnight. I have been watching this since they announced they would be merging via joint venture with India's Tata Steel. Price had not moved much on that news. Maybe it was absorbing the US steel tariffs hit at the same time.

The merger economics require a significant number of job losses (say 4,000). Activist shareholders believe there can be more. This has put a lot of pressure on management and the Supervisory Board. German business and German law do not do job cuts easily or well. The CEO and the Supervisory Board chairman both quit - maybe the change can happen now. It has to, to compete with China and to cope with US tariffs.

https://www.dw.com/en/thyssenkrupp-in-turmoil-over-future-plans/a-44711579

Bought

Walgreens Boots Alliance, Inc (WBA): US Retail. I bought Walgreens in June 2017 (see TIB104) on the back of a talking heads conversation about the potential for Walgreens to close the Price Earnings gap it has to the rest of the Consumer Staples sector (15 vs 22). Well the talking heads were at it again saying it could not get any worse than it is. Let's see what the updated chart says.

My option trade is showing and was opened at the bottom of the right hand blue arrow. The trade headed in the right direction for a while and then fell over. It had one go at testing the support level it had been trading along (dotted green line) and fell over again. The collapse coincided with the integration of 1932 Rite-Aid stores it did acquire in the curtailed Rite-Aid merger. That should have improved performance somewhat. The problem was Amazon acquired online pharmacy PillPack in June and the market said Walgreens could not compete effectively with Amazon.

Since this Amazon news broke, Walgreens share price has bounced and showed signs of recovery. The fact remains that Walgreens does have the largest retail pharmacy footprint and it will take Amazon some time to scale PillPack up. As I already hold an options contract I bought the stock. This will also allow me to buy a new options contract using a bull call spread. I have borrowed one of the price scenarios and placed it at the current price zone (fluoro green arrow). A price move like that will get price back to the resistance level (dotted green line) for a 16% price advance.

Sold

DB XTrackers Stoxx 600 Banks (XS7R.L): Europe Banks. I was looking to raise some cash in one portfolio. My aim was to sell off some of the Europe index holdings - sold this one in error. Late in front of the PC and I did not check the ticker to make sure it was Europe and not Europe Banks. Too bad - I did book 6.9% blended profit from September 2013 and August 2014. This is serious under-performance compared with other markets and needed more time.

The chart tells the story about the trade - made some progress and sold at the wrong time - should have waited for the recovery once European interest rates rise.

This stock is listed in London in British Pounds, so there is a foreign exchange effect to consider. As it happens I had Pounds in the account when I bought the stock (both times). Normally I would leave funds in Pounds and run investments totally in pounds and spend pounds when I travel to visit my family. Interactive Brokers restructured the way Australian accounts operate when they reviewed their Australian licensing and now they translate foreign currency back to reference currency on day of trade (in this account US Dollars). This locks in 22% and 26% forex losses for the two stock parcels - this is the price of Brexit.

Expiring Options

July expiry is Friday July 20. Time to review and take action on a few positions - run to expiry, take delivery, sell or roll out for more time.

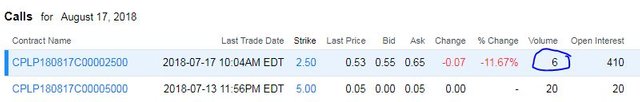

Capital Product Partners L.P (CPLP): Shipping. This trade is in-the-money and has been rolled up a few times. In one of my portfolios, I do not have enough cash to take delivery of the stock. Current strike price is 2.5 and next strike is $5 with a closing price of $3.06. I decided to roll out one month for the same strike price (price is unlikely to reach the next strike price ($5) in 4 weeks). The additional premium to add another month ranged between $0.03 and $0.07 = a small price to pay to get some more time. Given that I have done this a few times, the amount price has to move to recover the premiums paid is growing.

The chart will tell us if this was a smart move compared to just closing out and saving the residual premium.

I have extended the ray for the bought call (2.5 - the pink ray). I have drawn in the modified breakevens and 100% profit lines (the pink rays) to show the accumulated premium (now $1.53). I have moved the price scenario to the current price zone. That tells me that price has a small chance of reaching breakeven but will not reach 100% profit by the August expiry. I was better off taking the loss and looking elsewhere. I will explore doing that if oil price improves a bit - 2/3 of CPLP is oil shipping.

The options chains also tell me that nobody else is thinking the way I do - now I know why!!

Qualcomm (QCOM): US Semiconductors. Price is not showing signs of passing the 60 strike by Friday, closing at $58.91. The saga on the Chinese regulatory approval for the acquisition of NXP Semiconductors (NXP) just keeps getting dragged out with the next milestone date set for July 26 - i.e., after options expiry this Friday. I chose to roll out to August strike 62.5 call options (higher strike and one more month) and locked in 94% loss. Additional premium was $0.70 to add to the $1.76 already paid. Let's look at a chart which shows the new trade as pink rays with the bought call (62.5), breakeven and 100% profit. Expiry is the dotted red vertical line (August 20).

While price has pulled back in the middle of its current run, I think there is a chance that it can complete the pink arrow price scenario if the NXP deal gets approved before expiry. This will offer a 100% profit potential.

Note: the revised calculation does not include the benefit from the sold puts that expired last month ($0.29 reduction in the breakeven).

Transocean (RIG): Offshore Oil Driller. I had put on a short term trade with a 12 strike call option and rolled up last month to a 14 strike. That trade had been looking really solid until the recent pullback in oil prices dragged offshore oil drillers lower. I decided to roll out one month more with the same strike price (14). I paid an additional $0.24 premium to add to the initial $0.50 paid. I have updated the chart by extending the green rays to the next expiry date.

Price has not moved up as steeply as previous price scenarios but I have left one in (pink arrow). If price does repeat that move, the trade will now make a profit of 305% (was 500%). We are going to need to see a solid move in the oil price back above $70 a barrel.

I did manage to sell more July expiring options than I was holding. As price is unlikely to pass $14 before expiry, I will let that one run and collect the premium.

EDIT: My coach always says to ask when you roll a trade, would you invest in this if it was a new idea? I am happy that there is a chance of the trades winning given the premium paid. They may not recover the rolled up premiums profitably was my challenge I accepted

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $811 (12.2% of the low). Buyers grabbed hold of the Blackrock news and drove price higher. SBI Holdings (8473.TK) in Japan also announced the opening of their new crypto exchange in Japan after jumping through all the regulatory hurdles.

See TIB195 for a discusison of my holding in SBI.

Ethereum (ETHUSD): Price range for the day was $48 (10.3% of the low). Price made its way to the upper resistance level and is testing it for a break up. Volatility was lower than Bitcoin.

CryptoBots

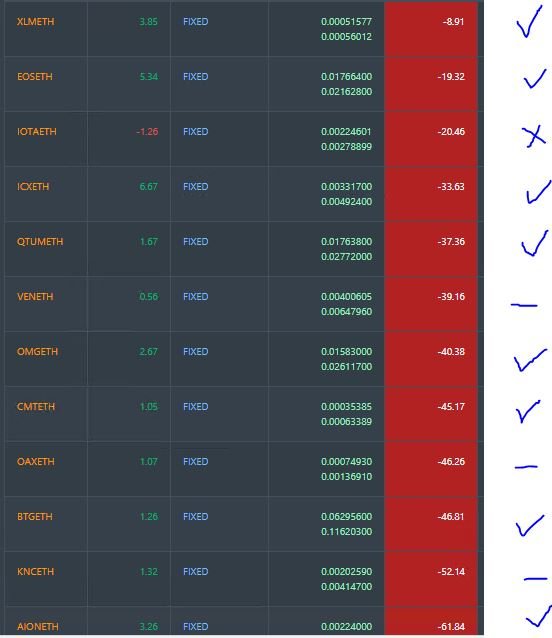

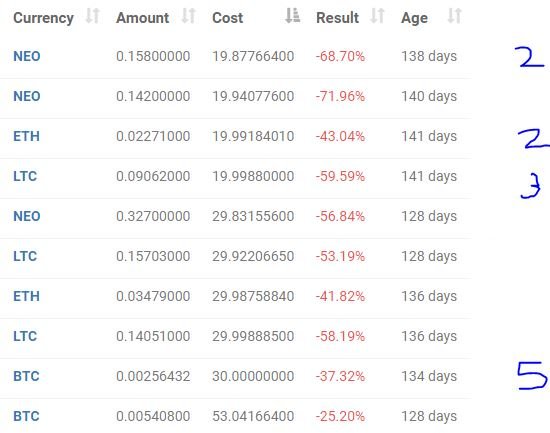

Outsourced Bot No closed trades. (213 closed trades). Problem children was unchanged at 17 coins. (>10% down) - ETH, ZEC (-44%), DASH (-52%), LTC, ICX (-51%), ADA (-41%), PPT (-61%), DGD (-54%), GAS (-65%), SNT, STRAT (-50%), NEO (-60%), ETC, QTUM (-53%), BTG (-62%), XMR, OMG.

STRAT improved 4 points and NEO went back to the 60% down club. GAS (-65%) remains the worst.

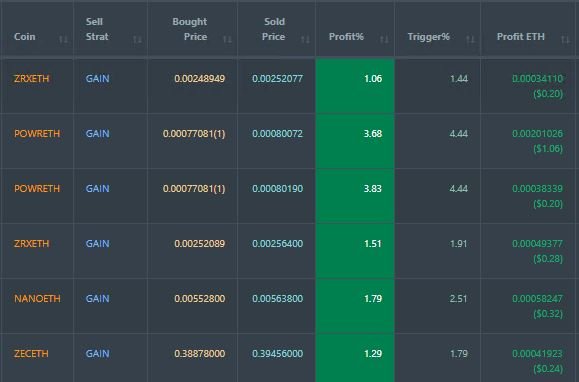

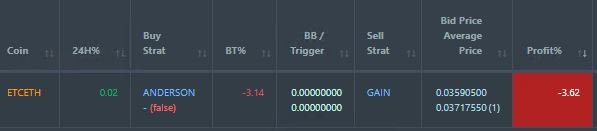

Profit Trailer Bot Six closed trades (2.19% profit) bringing the position on the account to 0.52% profit (was 0.41%) (not accounting for open trades).

Encouraging to see new additons to the whitelist (ZRX and POWR) make winning debuts. I added ZRX during the day following a Real Vision trade idea. ZRX is building a decentralized exchange model for which ZRX will be the access token. POWR is a token used for electricity trading and is developed in Australia. Encouraging also to see POWR do one level of DCA twice and win. I was concerned that it was in the middle of a pump when I added it and was waiting for the dump.

ETC remains the only coin on the Dollar Cost Average (DCA) list with one level of DCA

Pending list remains at 12 coins with 8 coins improving, 3 coins trading flat and 1 worse (IOTA). XLM continues to move higher - no dump yet.

New Trading Bot Positions improved 3 points again to -48.1% (was -51.8%). Good to see the 50% down average broken. Still a long way to go.

BTC improved 5 points with all coins improving.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 3.2% (lower than prior day's 3.4%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

July 17, 2018

Fed Powell was so avoiding the yield curve issue as he knowa that the Fed has limited tools to steepen the curve without impacting the economy and sectors that the administration wants to protect. He seems to have congress blinded by the positive impact of tax cuts which is only short term.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly. Easy to answer the question by saying that Congress is providing the tools - keep the deficit growing and the long end of the curve will need higher yields to cover the perception of risk from the growing deficit.

I heard the Twist word again. Too bad the balance sheet is shrinking.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A very precise decision, when one month later @ carrinm.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@carrinm A very useful content which had lot of information and great knowledge sir.. Thanks for sharing great knowledge and to guide us..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit