Trump wades into interest rates. Financials take the brunt of that. Profit taking in Europe, Taiwan and Oil. Bottom fishing in UK stocks after collecting British Pounds and in marijuana and US uranium. More action in pharma retail and interest rates and Ethereum.

Portfolio News

Market Jitters - Tariff Tantrum Markets started the day a little tentative and then they got nervous.

What drove the nerves is always hard to discern. Donald Trump talked again about tariffs on cars from Europe. He also had a swipe at the Federal Reserve hiking interest rates (5 since he started as President). The White House later poured water on that commentary to put out the fire. Maybe it was the proposal to change the way foreign investments into the US are vetted and reviewed. Maybe not.

https://www.wsj.com/articles/trade-tensions-weigh-on-global-shares-1531987594

Two charts tell me that the trade war is a problem. The Chinese currency moved weaker 1000 pips in 3 days

Copper price hit a 1 year low. This is always a bellwether for sagging economies, though one can argue it is currently simply reflecting a strong US Dollar. We will need to see the copper inventory numbers from China to know.

https://www.cnbc.com/2018/07/19/copper-hits-1-year-low-approaches-bear-market-on-trade-concerns.html

Bought

Earthport plc (EPO.L): Global Payments. Earthport provides payments solutions for cross-border payments. I bought stock in August 2017 based on a break up in price off support and the potential for a disruptive technology win. The spike in price did not hold and price collapsed and has had two chances at bouncing off the new lows (the pink line).

The 2nd bounce coincides with the appointment of a new CEO, Amanda Mesler, who joined from Microsoft. Maybe this time as I averaged down my entry price based on the new break up in price. See TIB122 for the intial discussion.

https://www.earthport.com/news-insights/insights-blog/limitless-potential/

GAME Digital plc (GMD.L): UK Entertainment. GAME Digital plc operates as a retailer of video games in the United Kingdom and Spain. I bought stock in November 2017 based on a break up in price through resistance. There is a pattern on UK stocks - failed break ups. Price has since fallen back to a support level (the pink line) and is tracking along sideways.

Earnings announced in March 2018 show that the business is making progress in the re-positioning of the business through its BELONG centres and solid growth in Spain and in eSports and Events. It looks like patience will be key. The Spain news is encouraging as Spain has lowest growth rate in the major European economies. I averaged down my entry price with a small additional parcel of shares. See TIB149 for the intiail discussion.

http://www.gamedigitalplc.com/media-centre/press-releases/pr-2018/27-mar-2018

Kingfisher plc (KGF.L): Europe Home Improvement. I ran my normal screens on United Kingdom stocks after selling the Europe ETF (noted below). Kingfisher emerged on a Price to Sales screen with a ratio below 1 and making a new one month high. The chart is quite choppy but it does show an attempt to break back up off the lows tested in 2014, 2017 and early 2108.

Price has passed the lows reached after the Brexit vote. The risk in the trade is the state of the UK economy with the Brexit uncertainty. Kingfisher does operate stores under various brand names right across Europe in addition to UK which mitigates some of that risk and hedges some of the Pound exposure. There is a 10% opportunity if price reaches the 2018 highs and 20% if it reaches 2017 highs. Dividend yield is 3.7%

iShares Global Clean Energy ETF (ICLN): US Energy. I invested part of the proceeds of the sale of oil pipeline operator, Enable (ENBL) in this renewable energy ETF. It contains a mix of technology suppliers and electricity utilities. It is a long term investment on the renewable side of the ETF. See TIB208 for the initial discussion. The trade averages down my entry price.

Walgreens Boots Alliance, Inc (WBA): Pharmacy Retail. I indicated in TIB267 that I would look at bull call spreads to add to my stock position. I bought January 2020 65/80 bull call spread. [Means: Bought strike 65 call options and sold strike 80 call options with the same expiry]. Net premium was $5.47 implying a maximum profit potential of 174% if price reaches $80 on or before expiry. How does that look on the charts? The chart is getting full as it includes the January 2019 options trade too.

The new trade is shown as green fluoro rays with bought strike (65), breakeven and sold call (80 - red ray) and the new expiry on the right margin. If we get the green arrow price scenario I modelled in TIB267, the trade will make breakeven. We will need two moves like that to get to maximum profit. The pink arrow models the 2014 run - get one of those and this trade wins comfortably and there is even a chance that the January 2019 strike 77.5 call option will get to breakeven.

Aphria Inc (APH.TO): Medicinal Marijuana. Marijuana stocks are very volatile. I averaged down my entry price on this Canadian producer only to see price drop even further after my purchase. I remain convinced that medicinal marijuana in licensed geographies is the smart way to invest in marijuana.

Centrus Energy Corp (LEU): US Uranium. Centrus supplies nuclear fuel and services for the nuclear power industry. I have been invested in uranium for some time looking to capture each break up in price. This has been a sorry story of failed breaks. The latest one looks the same as shown in the chart for Global X Uranium ETF (URA).

Something needs to change in the industry dynamic for this to work. There are things happening. India and China are building a number of new power stations. A disgruntled Iran may switch on its uranium enrichment program. Japan's timing on switching nuclear power back fully is uncertain. A few producers have mothballed mines (e.g., Paladin Energy - PDN.AX - has done both its mines). The threat of tariffs imposed on uranium might help US producers. I averaged down my entry price on this US producer. The chart tells its own story - it runs from the time Centrus was created out of the bankruptcy of USEC Inc. Price has had two goes at breaking up. This now looks like a bust. Can it get any lower?

Sold

iShares MSCI Europe UCITS ETF (IMEU.L): Europe Index. 30% profit since April 2016. Shares listed in London. In that time British Pound has depreciated against the Euro by 13% which means Europe went up only 17% in that time as 13% came from forex translation.

iShares Taiwan ETF (EWT): Taiwan Index. Emerging market shares have taken a tumble in 2018 since the tariff tantrum began and since US interest rates rose strongly. Taiwan has been a strong performer especially on the back of its semiconductor industry. This is under threat from tariffs. I decided to take profits and reduce a portion of my holdings. I booked a 18% profit since August 2016.

Shell Midstream Partners, L.P (SHLX): US Midstream Oil. Consistent with my policy of reducing company specific risk in midstream oil, I closed out this holding for a 10% profit since May 2018. A more patient investor would have waited for the oil price to recover a bit more of its recent losses.

Shorts

Eurodollar 3 Month Interest Rate Futures (GEZ): I was reviewing my holdings in this futures contracts and noticed that my previous shorts had been on a smaller contract size. I added a new short contract at the bigger contract size = more leverage. It is disappointing to see a correctly predicted price movement produce a return in the handful of dollars.

Expiring Options

KeyCorp (KEY): US Regional Bank. Price was holding above 20 strike on the expiring options and looking like it could reach next strike 21 (closing price $20.63). I rolled up to the August 2018 strike 21 call options. Net premium was -$0.18 per contract - i.e., a return of premium. Net loss to date is 21% of initial premium paid. Breakeven for the new contract plus accumulated net premium is $21.495. Price needs to reach $22 to make 100% profit. The next Federal Reserve meeting is July 31/August 1. The chart shows the new contract (short blue rays) and the old contract (pink rays).

Price is above the old 20 strike call and is at about breakeven. The pink arrow price scenario started out right but stalled. A more likely price scenario from here is the green arrow which comes from a prior stalling. A move like that will get the trade to 100% profit before expiry.

Of note is the longer dated option contracts at the top of the chart look to be some way out of reach. Price will need to do a whole lot more for those to win.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $292 (3.9% of the high). Price made an inside bar and operated all day above the support line.

Ethereum (ETHUSD): Price range for the day was $20 (4.1% of the high). Train tracks are often a reversal signal. This was the case today with price making a lower low and heading down from the resistance level. Do not be surprised to see price hold this level and have another go at making a higher high. The low price volatility for the day looks like the coiling of a spring.

In my IG Markets account, I added another contract (5 ETH) on a reversal on a 4 hour chart. That was the spring coiling.

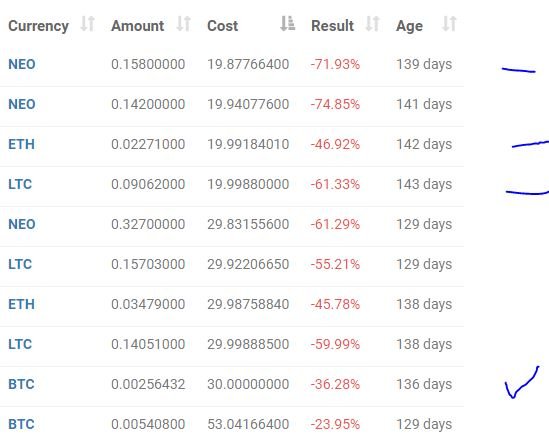

CryptoBots

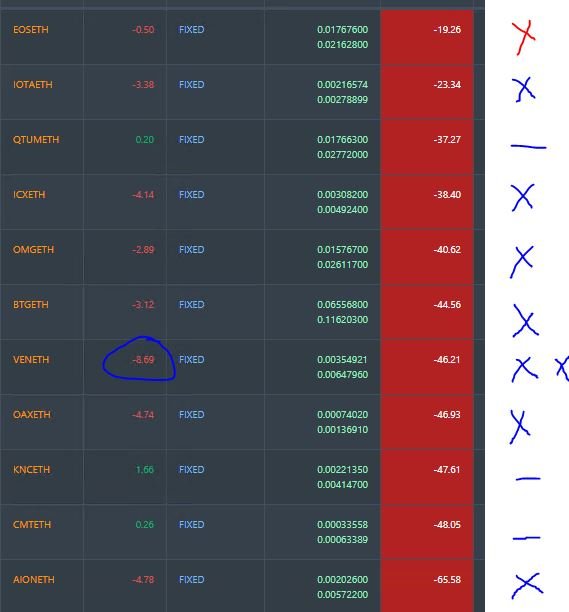

Outsourced Bot No closed trades. (213 closed trades). Problem children went down to 17 coins with BTS (-8%) leaving the list again. (>10% down) - ETH, ZEC (-50%), DASH (-53%), LTC, ICX (-59%), ADA (-40%), PPT (-64%), DGD (-59%),GAS (-69%), SNT, STRAT (-55%), NEO (-64%), ETC, QTUM (-57%), BTG (-64%), XMR, OMG.

It looked like a day for all coins to give up a few points. GAS was heading to the next level down (-69%) and remains the worst

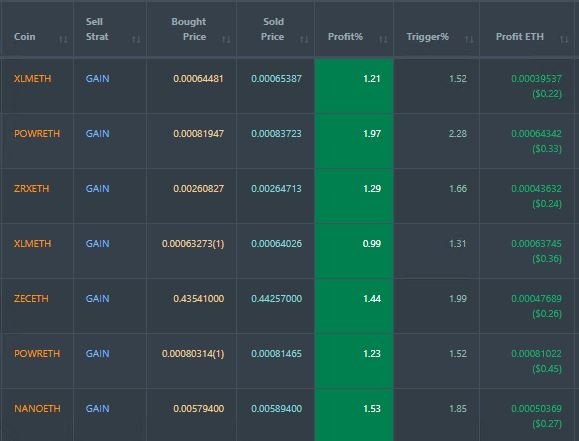

Profit Trailer Bot Seven closed trades (1.38% profit) bringing the position on the account to 0.68% profit (was 0.61%) (not accounting for open trades). POWR and XLM came from one level of DCA.

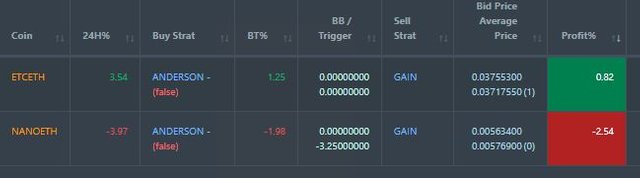

Dollar Cost Average (DCA) list remained at 2 coins with NANO joining ETC. ETC looks like it is getting ready to exit to profit.

Pending list remains at 11 coins with 3 coins trading flat and 8 worse. Worst coin of the day was VEN.

New Trading Bot Positions improved marginally to -49.9% (was -50.2%).

Only BTC improved more than a point. The other coins traded flat.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 3.2% (no change).

Outsourced MAM account Actions to Wealth closed out 1 trade for 0.18% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

July 19, 2018

If Trump does not do that maybe this will not be a burden, I just hope the best for you. Hopefully success is always on your side. Greetings from my little fish :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@carrinm you were flagged by a worthless gang of trolls, so, I gave you an upvote to counteract it! Enjoy!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Appreciated

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you think Uranium makes a come back in the future? Do you like any home improvement stock like LOWES and HD in the US at all?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Uranium is a bottom fishing game. If you do not have any, take a punt in a small way and see what comes. Focus on a producer that can switch back on production easily. Best idea from US is Cameco - CCJ. I will checking it out again this week.

Not looked at home improvement in US. Normally one sees stock like this go well with economic growth. The correlation to study is with Homebuilders - XHB. They signal pressure from rising rates really well. I will not be surprised to see Lowes and HD track them strongly in this environment. I will study tomorrow.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I invested in CCJ many, many years ago, thinking the spot price of Uranium was going to move a lot higher, but it didn't. I have it on my to do list to look at XHB and compare it to the stock market and interest rates going back 10 yrs. Thus, we can compare analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Quick chart of CCJ. It has certainly bottomed out and retesting the support level. The key part of the chart is the comparison with the Global X Uranium ETF (URA - orange line). CCJ is showing it wants to break up compared with the industry. Why? Cameco are in a position to enter production as soon as uranium price moves.

Options are pricey which means that one would need to do a bull call spread. Maybe the patient move is to wait until 2021 options are listed in a few months.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the analysis, I will keep CCJ on my radar. Although as natural gas is suppressed, but if oil gets to $100, could be a nice opportunity to go long, but I like your bull call spread idea better.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

a very good work, thank for sharing @carrinm

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank for sharing this post sir..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

WAG a great play as getting added to the Dow should help give it a base when market rally. They have built some solid earnings over the last 2-3 years as well by integrating well their acquisitions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Addition to DJIA was a bonus. The key thesis is that over the next 18 months while economy grows, people will need pharmacy stuff and it will take Amazon that long to get up to full speed. I do not think investors are fully considering the flow of earnings from international business. For example, Boots has a massive growing footprint in Thailand.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

a tremendous investment @carrinm

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice work! Great result, @Carrinm

Thanks for the advice and recommendations.

Excellent statistics and graphics.

I wish you new achievements and success!

Prosperity and good luck in all your endeavors!

With respect, @Singa

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

an amazing investment and perhaps worth following and emulated ... best regards @carrinm

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit