A busy day shopping looking for relative value. More oil shipping punts and profit taking in TV streaming, 3D printing, midstream oil and US Dollar. Cryptocurrency has a quiet day sitting on hands.

Portfolio News

Market Jitters - Tariff Tantrum I said yesterday that markets were hiding underlying turmoil - same again today.

Underneath the smooth facade of a rising US market and sliding Treasury yields was a major devaluation of the Turkish Lira, another drop in Russian markets, a 50 basis points rise in Philippines interest rates and slides in Brazilian Real and South African Rand. Emerging markets were a casualty in my portfolios with Turkey down 3.9%, Russian Small Caps down 1.4%, Vietnam 0.8%, Philippines 0.6%, and Mexico 2.5%

The Treasury yield headlines do show what is really going on = uncertainty with one day up and the next day down

A key move from China was the conspicuous absence of oil and oil products from its list of tariffs. Oil bounced.

Bought

Nordstrom, Inc (JWN): US Retail. Trade idea came from CNBC Fast Money pitch. For a long time US Retail was not fancied by market analysts. In July 2017 I started investing with a view that Retail was the last under-valued sector in the US Economy and it could pop with strong economic growth. (see TIB113 for that call). That was a good call with SPDR Retail ETF (orange line - XRT) going up 26% compared with the S&P500 (black bars) which did 15%.

Earnings announcements for this quarter that have been made have mostly been very good. Nordstrom is due to release its earnings on August 16. The talking heads liked the guidance information provided last week especially the growth in online sales. Now to the charts.

Norstrom (black bars) has lagged the retail sector (orange line) by 16 percentage points since I bought XRT. It has been trading in a range between $46 and $54 for all of 2018 and has not been able to break out. Since the May 2018 low, price has been making higher lows on each cycle. On the flip side, the MACD momentum indicator is showing divergence, making lower highs while price has been making level highs. The talking heads read was that this was more likely to break up rather than down on the back of strong consumer spending numbers and improving online profile.

I bought a small parcel of stock. I did also look at options chains. January 2020 options looked expensive to me though I feel there is a short term opportunity to trade through earnings. The trade that I took was a October 2018 52.5/60 bull call spread with a net premium of $2.54. This offers a 200% return if price passes $60 on or before expiry. I am looking for a price spike when results are announced next week.

L Brands, Inc (LB): US Apparel Retailer. L Brands is best known for its Victoria's Secret women's intimate apparel and Bath & Body Works brands. I initially bought into L Brands looking for price to break up from its lows. Jim Cramer of CNBC was talking about the stock - worst performer on the S&P500 year to date at 45% down but showing 3% increase in sales year on year for the last quarter. That tells me that the economic growth story is working through to the top line.

Earnings announcemnt is on August 15 - we will see if it is working to the bottom line. I added another small parcel of stock - this is boom or bust time for L Brands.

The chart tells a story of yet another failed break up and retreat to the lows (the lower support line comes all the way from 2012. Part of the makeover challenge is Victoria's Secret has to widen the product range to provide larger sizes

https://creativecommons.org/licenses/by/2.0/ CC BY 2.0 Matthew Simoneau

Rite Aid Corporation (RAD): US Pharma Retailing. Rite Aid announced that the proposed merger with Albertsons would not complete. Share price was smashed by more than 10 percent. Even after the sale of 1,932 stores to Walgreens (WBA), Rite Aid retains a solid enough pharmacy footprint (#3 in US). I am always keen to profit from a price overreaction and on instinct I bought stock and October 2018 strike 1.5 call options.

Rational analysis suggests that Rite Aid may not overcome its problems of low comparable store sales growth, challenges from Amazon's PillPack, and a high debt burden. I will be watching this closely over the coming weeks.

The chart for the last 12 months is pretty messy with the merger interventions playing havoc with any price progression. My options trade needs price to get back to August highs to make 100% profit and halfway to break even. Maybe I will need a knight in shining armour to come along to pick up the pieces.

Koninklijke Ahold Delhaize N.V (AD.AS): Europe/US Supermarkets. Some days one just gets lucky. I sold my December 2019 expiring options the day before Ahold announced results which disappointed markets, principally because of competitive challenges in their US operations. With modest premiums available on 2021 expiry options, I bought December 2021 strike 22 call options with 7.8% premium to strike. I also added a short term option for October 2018 strike 21 (2.5% premium to strike) as I think the market probably overreacted to the results.

Let's look at the chart which shows the long term trade as blue rays and the short term as pink rays. Top line in each trade is the 100% profit level. For the short term all price has to do is get back to where it was last week.

For the long term trade, this looks like a blue sky trade. I have modelled a previous run which followed a sharp pull back. Repeat that and the trade will pass breakeven. What needs to go right is, say, 18 months more of economic growth in Europe and US

Frontline Ltd (FRO): Oil Shipping. I wrote in TIB277 about the changing dynamics in oil shipping following Iran sanctions and China oil products tariffs. News today was that China took oil products off the list = good for oil prices. In one of my other portfolios I averaged down my entry point on this oil shipping stock. The chart shows the steady slide down in prices from the start of 2016 followed by one attempt at a break up and then a retest. My 2nd trade entry is right on that support line (if it holds). I am holding call options in one of my other portfolios with a 7 strike which currently looks like a lost cause.

Sold

3D Systems Corporation (DDD): 3D Printing. As indicated in TIB277, I elected to take profits in 3D after their spectacular results announcement on Wednesday. I closed out two thirds of my holding for a 45% profit since May 2018. Trade idea came from Real Vision. I remain exposed through a small parcel of stock and a January 2020 12/22 bull call spread. Sale price was $17.88.

Centennial Resource Development, Inc (CDEV): US Midstream Oil. Consistent with my policy of reducing company specific risk in midstream oil, I closed out my small holding for a 1% profit since May 2018. The company specific risk in this case is the company's assets primarily focus on the Delaware Basin, a sub-basin of the Permian Basin. The Permian Basin is facing significant transportation bottlenecks which is increasing costs in the short term. I will allocate the proceeds to the Alerian MLP ETF (AMLP) to diversify the risk across multiple holdings.

I did notice that Exxon Mobil (XOM), which has bought large acreage in the Permian, confirmed its commitment to resolving the bottlenecks courtesy of the pipeline it is building with Plains All American Pipeline (PAA)

Invesco DB US Dollar Bullish (UUP): US Dollar. I have had a take profit target set for some time. That was hit overnight for a 2.4% profit since January 2015. The low return for 3 years of holding tells me that this was not the best way to invest for dollar strength. Either a direct currency trade or an interest rate trade would have provided better returns (though with more volatility and higher margin)

Roku, Inc (ROKU): US TV Streaming. Roku announced stellar results which took the market by surprise.

Jim Cramer of CNBC described the conference call as one of the top 10 calls of the year. I opted to take profits on half my holdings for 36% profit since June 2018. This is what I wrote in TIB247 at the time

The trade idea at the first level is to see price get back to the highs with the Russell 2000 inclusion being part of the fuel. That provides a 40% profit potential.

Well I got that right - level one achieved. Thanks to @getonthetrain for the idea. There is a lot more to come as the revenue model is clearly working. Who would think that Roku could outperform Netflix (orange line) in its short listing life? It was level pegging until yesterday and then BOOM!!

Coming back to Jim Cramer. He did not have the trade on and was kicking himself (he could not have been reading this blog). This is what his thoughts are after the blast

https://www.thestreet.com/investing/how-to-rock-a-trade-on-roku-14678609

Sprint Corporation (S): US Telecom. Sold a portion to deal with the trade size error I made in prior day's trade (see TIB277). $6 trading loss thus far. I will change the selling price to recover fully including trading costs. There is some risk in the trade given the regulatory uncertainty facing the T-Mobile acquisition. I will be watching closely

Shorts

Eurodollar 3 Month Interest Rate Futures (GEZ): 30 year US Treasury auction was closed fully with yields a little lower than markets expected. This dragged all yields down. I added another short trade while yields were sliding - i.e., not a reversal. DO NOT copy this style of trading at home. WAIT for reversals.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $437 (7.1% of the low). Price made an inside bar after the horror day the day before. It feels good to see a market take breath like this though one never knows what comes next and there are no clues from volume. Everyone is sitting on their hands

Ethereum (ETHUSD): Price range for the day was $18 (5.1% of the low). ETH had an even quieter day than BTC with volatility appreciably lower than it has been

CryptoBots

Outsourced Bot No closed trades. (213 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-46%), ZEC (-50%), DASH (-62%), LTC, BTS, ICX (-75%), ADA (-53%), PPT (-73%), DGD (-67%), GAS (-80%), SNT (-48%), STRAT (-69%), NEO (-75%), ETC, QTUM (-69%), XMR (-44%), OMG (-55%).

70% down group was reduced by two coins with GAS (-80%) getting worse and STRAT (-69%) getting better by a point each. QTUM (-69%) is creeping into that group.

Profit Trailer Bot This bot runs on a VPS service which means that the service should be continuusly available. It was disappointing to find the service down. A quick trip into the back office to find out that a technician had changed out the wrong disc drive during a hot disk swap - YIKES.

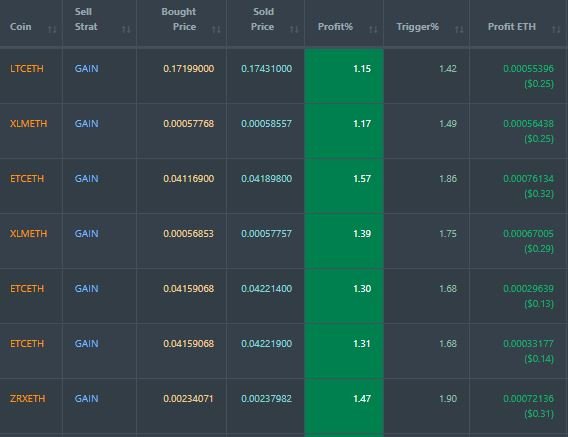

Seven closed trades (1.34% profit) bringing the position on the account to 0.89% profit (was 0.82%) (not accounting for open trades).

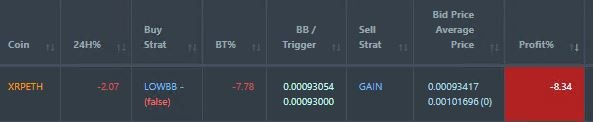

Dollar Cost Average (DCA) list is unchanged with XRP still not making one level of DCA. I suspect there is not enough buyer volume to allow a trade.

Pending list remains at 10 coins with 3 coins improving, 6 coins trading flat and 1 worse (QTUM).

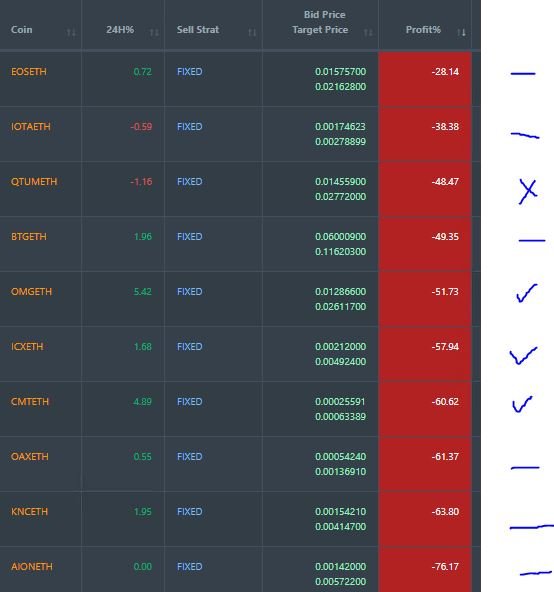

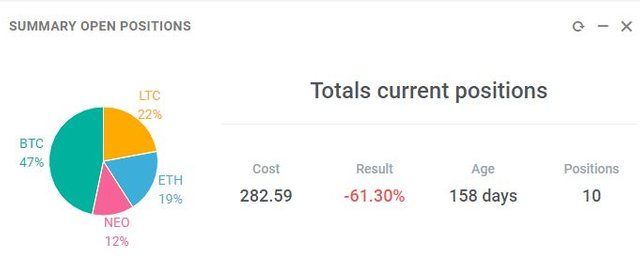

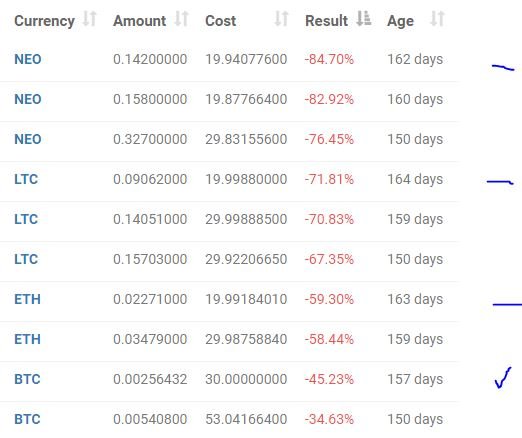

New Trading Bot Positions traded flat at -61.3% (was -61.5%)

BTC improved one point and the other 3 coins traded flat.

Currency Trades

Forex Robot closed 2 trades (0.08% profit) and is trading at a negative equity level of 6.9% (higher than prior day's 5.7%).

Outsourced MAM account Actions to Wealth closed out 1 trade for 0.3% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Victoria's Secret image is credited below the image (found on Flickr). CC rights included the rights to amend the image. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading.

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

August 9, 2018

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing your post@carrinm.

Give me a upvote done sir...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

4 points come to mind

That way we know who we we are talking to

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good post in details thanks .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Only pockets of retail have done good in this Amazon led market. Some of the older department stores seems like dying dinosaurs.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

One cannot argue with 26% growth in the retail sector overall for the year. Yes, there were winners and losers. The reality is the analysts did not read that one right. In fact, they were totally wrong. Welcome to contrarian investing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Another fabulous post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks bro

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

An amazing and useful post I like it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're welcome :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit