Selloffs create opportunity. Many emerging markets are growing. Time to buy in and a little rebalancing. Interest rates remain my friend. Ethereum tanks some more - good time for ETH based bot trading to profit.

Portfolio News

Market Jitters US markets wanted to go up right from the opening bell - and they did.

This comment sums up the way the US markets acted

Turkey is not a member of the European Union or the euro zone, so it has less hooks into the European banks, which means less trouble for us

https://www.cnbc.com/2018/08/14/us-markets-investors-shake-off-turkeys-economic-crisis.html

That is the perception. The reality is different with Spain’s BBVA (BBVA.MC), Italy’s UniCredit (UCG.MI), France’s BNP Paribas (BNP.PA), Dutch bank ING (INGA.AS) and Britain’s HSBC (HSBA.L) the most exposed to Turkey. It would be better if Turkey was part of the EU as the European Central Bank (ECB) could bail it out. Turkey will have to depend on its own actions or the IMF for a bailout.

In the event of a Turkey default, we have to hope that the stress tests run by ECB and the Bank of England on the member banks will have tested that type of default. The markets seem to think so (in Europe too)

Donald Trump let a genie out of the bottle with the tariffs on steel and aluminium and the ongoing saga with China.

Turkey responds with tariffs of its own. I did write in TIB279, that I thought that Donald Trump was doing the bully boy thing. I am not alone. I watched this Bloomberg TV interview with Todd Battaglia of Meg Green & Associates.

We have gone from world peacemaker to world disrupter. Trump should have two more red hats made, one for each. Take one off and put on the other.

The main implication he draws is that in a world of disruption one may have to switch from a passive index management model to an active management model = keep shifting things around to navigate around disruptions. Good thought there.

On the interest rates front yields went down and tracked back up - confusing or really the best bellwether of what data is important. More about that in my trades.

Bought

I shared data about Turkey in TIB279 - my view is that this feels like Argentina and Malaysia and Brazil before it. That is, not big enough right now to completely derail the way global economies are growing. The talking heads are divided into two camps - those that are fearful of contagion and those that are looking at the data. I also wrote the other day that one of the talking heads was specific about the criteria to use when one considers investing in emerging markets. I had previously focused on annual GDP growth. He added in two more - current account deficit and labour availability. Turkey adds one more - debt levels.

I went through the data from Trading Economics and made some adjustments. The first table shows annual GDP growth sorted from best downwards. That is a list mostly of emerging markets and frontier markets. Over the last two years I am pretty well invested in all of them to some degree (except Bangladesh and Chile and Israel)

The next table shows quarter on quarter GDP growth. I highlight this because it now includes the United States. The data is telling me that US growth is accelerating and that explains the record breaking earnings season that is playing out right now. (Ignore Venezuela).

My GDP growth candidates are going to come from these lists (now I am invested in quite a few already) and I will dig down a level to look at candidates by region. I am going to re-sort the list by Current Account status from highest surplus and present the top 10.

Next 4 trade candidates come from this list - three buys and one sell. I am already holding Thailand and Taiwan in my portfolios at good size and profitably, which leaves South Korea to add. Netherlands caught my eye with higher GDP growth than other European countries, a jobless rate that has scope to add employment and modest debt levels. I did try to buy call options on Amsterdam Index to add to my holdings but my broker was not allowing the trade for some unknown reason.

iShares MSCI South Korea Capped ETF (EWY): South Korea has been a blind spot based on a belief that its economy is too closely tied to China (I think my coach put that feeling there). I did take a punt in TIB118 on a way out-the-money call option a year ago. That remains a punt. I also added a closer to the money call option in TIB126. That is also under water. This time I added a parcel of stock to one portfolio.

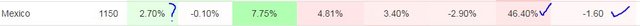

iShares MSCI Mexico Capped ETF (EWW): When I sorted the Americas by current account, Mexico popped into my eye (it is lower than Brazil but higher than the US). I am already holding Mexico in one portfolio and added it to another. A rising oil price should accelerate GDP growth and there is employment scope to grow and debt is modest.

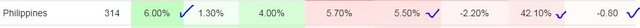

iShares MSCI Philippines ETF (EPHE). Philippines is one of the high growth economies in SE Asia. It has plenty scope for employment growth, debt levels are acceptable and the current account is only marginally in deficit. I added this to one portfolio to average down my entry price. Was it a good trade? I am not convinced this morning.

iShares MSCI Poland ETF USD Acc (IBCJ.DE): Poland was discussed in a Real Vision trade idea last week. The premise of the idea was that Poland was growing faster than Europe and their central bank was more likely to start raising rates than the European Central Bank. The trade idea was to short the Euro against the Polish Zloty. I looked at the options markets and felt that the implied volatility was too high to use options. I am currently short the Euro against the US Dollar using options and was thinking of closing that out and doing a currency trade short EURPLN. Then I saw Poland was in the top 15 GDP growth table. In fact it is the 2nd highest European country after Ireland. There is scope for employment (5.9% jobless) and the debt levels are acceptable (50%) and they run a current account surplus. Instead of trading via currency I decided to buy the Euro listed ETF rather than the US Dollar one. This effectively makes me short the Euro and long the Polish Zloty as well.

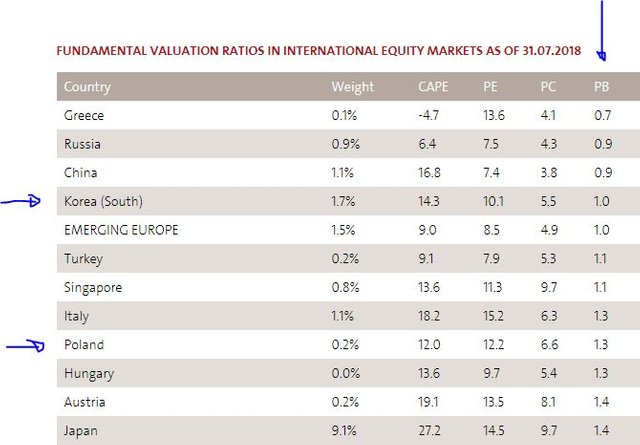

In going back over my journals, I was reminded of a tool I used a lot to choose undervalued markets. I used it for Price to Book Valuation comparisons. The table below is sorted from cheapest. I was encouraged to find Poland and South Korea ranking in this list as in the top 10 cheapest markets. I leave Japan on the list at number 11 for reference as I am invested there strongly.

https://www.starcapital.de/en/research/stock-market-valuation/

SPDR S&P Emerging Markets Small Cap ETF (EWX): I had bought this ETF the last time there was an emerging markets selloff (see TIB244). I averaged down my entry point. The rationale that I applied in June 2018 still applies now.

Alerian MLP ETF (AMLP): US Midstream Oil. Following the sale of an individual midstream oil stock (CDEV) last week, I added to my holding of this ETF. This reduces company specific risk in US midstream oil.

Sold

iShares MSCI Singapore ETF (EWS): The step back analysis of GDP data indicates that Singapore has an uncomfortable debt to GDP ratio and maybe not enough leeway for employment with a lowish jobless rate. I closed my positions for 11% profit since June 2016.

Sprint Corporation (S): US Telecom. Traded out my position size error from last week and recovered trading cost. I retain the original trade size I wanted. I have learned over time that it is best to fix trading errors immediately - this time I was lucky that price did push back above my initial entry within a week.

Shorts

Japan Government Bonds With sliding Bitcoin and Ethereum prices, I received another margin call in my IG Markets account. I closed one JGB short position for 25 basis points profit (0.16%) to release capital for margin. Interestingly, this week Japan interest rates have been less volatile than Europe or US rates.

Eurodollar 3 Month Interest Rate Futures (GEZ): Turkey Turmoils drove investors to safe havens including short term interest rates. My view is that nothing has changed in the short term drivers of the core data that is going to drive the next Federal Reserve rate decision. If anything, the tariffs will start to work through to higher costs and higher inflation. I added one small contract short on August 13.

Looks like I was right with August 14 seeing prices fall and rates rise again.

Cryptocurency

Bitcoin (BTCUSD): Price range for the two days was $664 (10.1% of the high). In two days, price traded between two key levels, $6500 and $6000. It looked for a while that Bitcoin was holding the ascendancy as people deserted Ethereum, but then the floodgates opened. The good news is price did hold the long time support level of $6,000.

I signed up to a new price tracking product, called Crypto Prophecy, to test it out. At the base level what the tool does is identify areas of excessive price movement up or down and uses these as pointers to reverse. It does this for all coins in one control panel. My thinking was to test this out on leading (say top 10) coins only. First test was on BTC against Tether (USDT). The signal was showing excessive price drop and I noted that price was outside the lower Bollinger Band on the one hour chart - I hit the buy button.

I was pleasantly surprised to see price reach the top Bollinger Band, this morning which is where my pending order sits waiting for an exit.

I did the same thing for an Ethereum Classic long relative to Ethereum (ETCETH). It is too soon to declare victory but it might give me another way to model bot trading ideas.

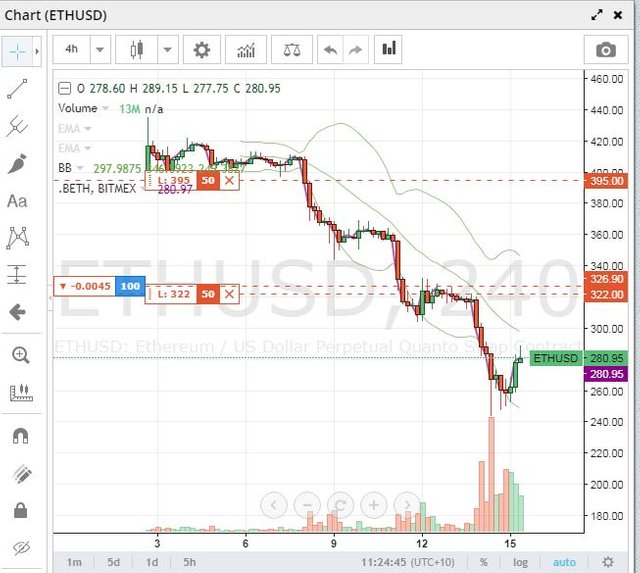

Ethereum (ETHUSD): Price range for the two days was $72 (22.3% of the high). Price headed directly to the bottom of "no mans land" as it likes to do and found support there with twice the volatility of Bitcoin.

There is no doubt that very many of the successful ICO holders of ETH have headed for the exits as discussed in this video.

I added another long position in my Bitmex account on a 4 hour reversal. Take profit is set at the previous highs on that chart.

When I logged out I was presented with a news digest. This article caught my eye about Ether: A Double Digit Shitcoin (I hate that word). 3 questions are raised

Did any funds actually realise any of their outstanding 2016 profits? Can VC-turned-hedge-fund-punters psychologically handle mark-to-market losses? How many token projects actually sold a large or hedged portion of the Ether they raised?

The quick summary is the problem of Ether has to do with ICO's cashing out their ETH; VC funds being caught out in having to mark crypto assets to market; retail investors having exited. The summary for me - SCARED money and NAIVE money. It is a no holds barred read.

https://us3.campaign-archive.com/?u=db45c09bdf20e1866bb32123f&id=1da0bd867e - article archived in a Reddit post.

CryptoBots

Outsourced Bot No closed trades. (213 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-56%), ZEC (-59%), DASH (-68%), LTC (-41%), BTS (-50%), ICX (-81%), ADA (-61%), PPT (-79%), DGD (-76%), GAS (-86%), SNT (-59%), STRAT (-76%), NEO (-80%), ETC (-46%), QTUM (-73%), BTG (-76%), XMR (-48%), OMG (-63%).

This was a horror two days with all coins sliding and the following going down a level: LTC (-41%), BTS (-50%), ADA (-61%), ICX (-81%). GAS (-86%) remains the worst but is joined now by ICX and NEO at 80% or more down

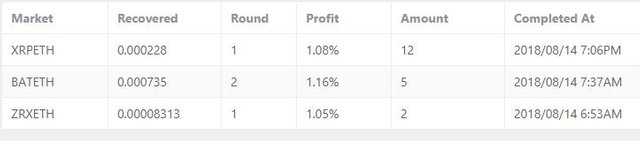

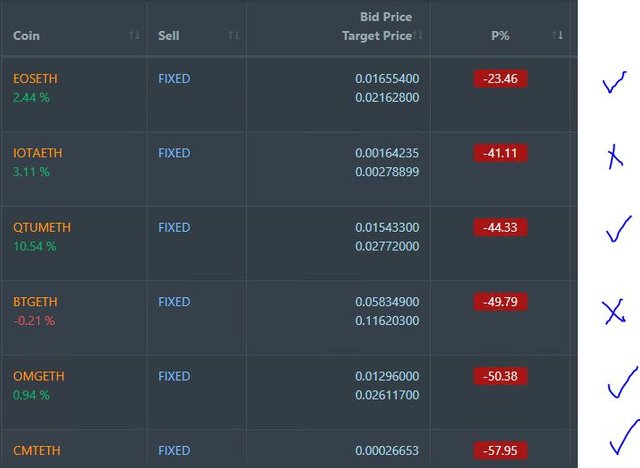

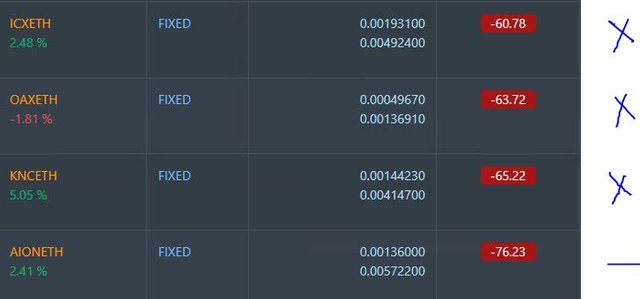

Profit Trailer Bot Fourteen closed trades (1.49% profit) bringing the position on the account to 1.15% profit (was 1.05%) (not accounting for open trades). Highlights of the trading was XRP, BAT and ZRX being defended by PT Defender to get back to profit. Becasue the bot is trading ETH pairs, a big fall in ETH offers profit opportunity.

There is one coin on the Dollar Cost Average (DCA) list with XRP, ZRX and BAT moving off. Great work by PT Defender to clear these

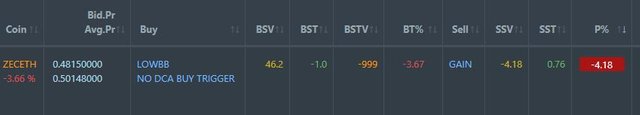

Pending list returns to 10 coins with 4 coins improving, 1 coins trading flat and 5 worse. The next task is to work out how to get PT Defender to tackle these.

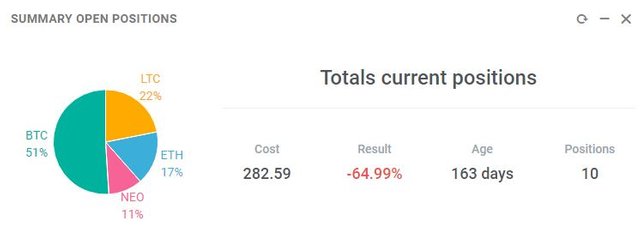

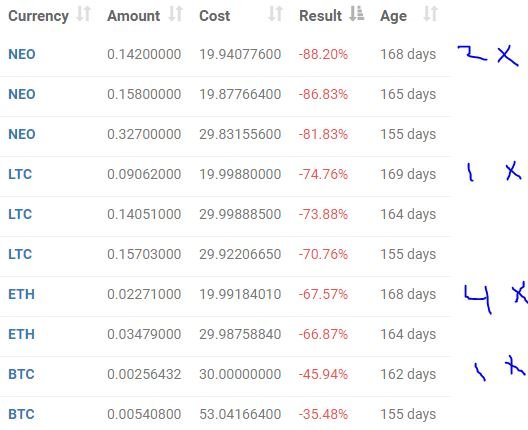

New Trading Bot Positions dropped 2 points to -65% (was -63.5%)

All 4 coins traded worse with ETH by far the worst. NEO is close to 90% down in dollar terms - this looks terminal.

Currency Trades

Forex Robot closed 6 trades (0.23% profit) and is trading at a negative equity level of 12.4% (higher than prior day's 8.8%). Currency markets reacted strongly to the Turkish Lira event and ran to the US Dollar. Robots cannot cope with days like this.

Outsourced MAM account Actions to Wealth closed out 7 trades for 0.07% profits for the two days.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. GDP data comes from TradingEconomics.com. PB chart is credited below it. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. Bitmex is now trading more BTC and ETH value than any other exchange. http://mymark.mx/Bitmex

August 13-14, 2018

Great read! I think your analysis is driving me to be more positive than I currently am. I have been net neutral since 2016 which has limited my returns. While I am still hesitant from a US market perspective, I may look to add some exposure internationally. Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good to hear. The easiest way to limit investing returns is to limit your geography. The 2nd easiest is to limit the instruments you use.

With the range of ETF's available, especially to US investors, there is no excuse really. With the availability of global markets on single platforms there is equally no excuse. I use Interactive Brokers and Saxo Capital Markets and IG Markets = global access across all instruments. Happy to offer a referral link if you need.

Now it is important to understand the forex implications. It is disappointing to see a great foreign return evaporate because of an adverse currency move. Many ETF's are hedged especially at country level - Europe and Japan.

Where to start? This post's table has some clues as to undervalued markets

My instinct would be Europe (VGK or FEU or EZU) and Japan (EWJ or DFJ). Maybe narrow down Europe to Europe Financials (EUFN).

Best resource to compare ETF's is Etfdb.com - they have a compare ETF's tool too. http://etfdb.com/tool/etf-comparison/EZU-VGK/#holdings

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great! Appreciate this! I used IB years ago before they went public and struggled with thr interface for trading so moved to ETrade. Send me the referral links to check them out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pop me an email with your email address and I will send it through to them and they will contact you - bitcoinprofits AT fastmail.net

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So is the mexican peso a buy in your opinion? Also nice trade set up on ETH on the reversal daily hammer candle.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not my place to give advice. I present a weekly chart of USDMXN. Price accelerated away from the lower uptrend line for the 2017 high and then retraced back to a new uptrend line. That line is exactly the same slope as the lower one. Price has made two higher highs and two lower lows.

That tells me to be super cautious of doing anything other than being long USDMXN. What can change this? Changing position from the Federal Reserve on rates - slowing down will weaken the US Dollar. Rapid move up in oil price - strengthen the peso

Note: The question needs to be more precise. You asked: "is the mexican peso a buy?" I answered: I would not buy the Mexican Peso and sell the US Dollar. Same applies to your ETH statement. Assuming ETHUSD: The problem I have with the hammer bar was the bar after was also a long tailed bar facing the other way.

The market is undecided in a volatile way. Now when you look at ETHBTC, the bar after was less volatile (but also undecided). The challenge in the setup is it is a counter trend trade - it might work but it will go horribly wrong if it does not. Seeking confirmation of the reversal would be safer.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for great insight.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very useful market information @ carrinm, thank you very much.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good information @carrinm, I think this is a good time to gain and gain profits in the future, thank you for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hi @carrinm, you share a useful information that decreases crypto market price is a good time to invest, this is a very good idea, I am a new user steemit and happy to meet you, follow me also my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is an advertised post

The author of this post or one of his supporters has used one or more paid services to promote this post. This post's valuation and number of upvotes does not represent human curation. This means this post's valuation does not represent community appreciation and should be viewed as advertised content.

If you are new to these services please be warned that bid voting is a huge gamble with little return on investment if not utilized right and might also lead to a net loss.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Got to love a bot making opinions. This is an investing journal of fully original content. The use of voting bots is part of the testing I do for measuring returns. The results are clearly showing me that returns are indeed positive and range between 5 and 10% of the investment made (every single time I make the posts). I am happy to share the results because I do track them and you will find them posted in the comments in quite a few of the more recent posts. .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 14.78 % upvote from @boomerang.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit