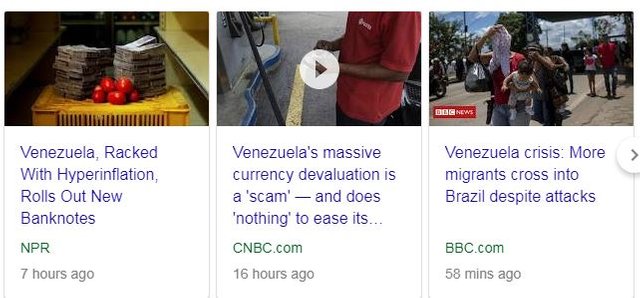

Venezuela knocks off 5 zeroes on its banknotes. Trump rants about currencies and rates. Profits on Nordstrom are a bit impatient. Covered call writing begins for a new month. Crypto surrenders the upward momentum.

Portfolio News

Market Jitters - US Dollar Tantrum Markets continue to diverge with US markets reaching for new highs and emerging markets selling off further

Interest rates fall [Edit: not rose] all over the world again - from US Treasuries to Eurodollar to Euribor to Japanese government Bonds. With earnings season largely over, attention is switching to the upcoming Jackson Hole meeting of central bankers.

Donald Trump made use of the lull to attack the Federal Reserve Chairman (too eager to raise rates) and China and the European Union (manipulating currencies). Weird really as the Chinese currency actually strengthened when the PBOC took action last week. If they wanted to manipulate the currency weaker they would - big time. His grasp of this level of economic and market interaction is, quite frankly, pathetic. Central banks are independent for a reason - to stop politicians from meddling. Look at Turkey and Argentina and Venezuela and Zimbabwe for examples. It always ends in tears.

Sold

Nordstrom Inc (JWN): US Retail. Price passed through the sold strike on the short term 52.5/60 bull call spread I bought ahead of earnings last week. Here is Friday's news snippet again from TIB283

As this is the point of maximum profit potential, I closed out trades in both portfolios for a net 122% profit. This was an impatient close as I did not want to run the risk of price dropping below $60. How do I know it was impatient? Options prices move differently when in-the-money compared to out-the-money (called Delta). The further a contract goes in-the-money, delta starts to disappear and converges to zero. If I look at the two legs of this spread the 52.5 bought leg went up 195% while the sold 60 leg went up 559%. That means that the sold leg is still carrying delta above zero. The patient trader would have waited a few days and paid less to buy back the sold leg.

Income Trades

A new covered calls month begins. A quick reminder on my process for writing covered calls.

- Select stocks I am happy to sell if I get exercised.

- Calculate 5% move up in price from previous day close

- Choose a one month out call option closest to 5% move up in price.

- Place a bid between bid and ask. Ideally one should aim for a premium of about 1% to make this worthwhile - I do not check but I did average 1.55% last month with a few technology stocks added in to the mix.

Slow start to the month thus far with 11 trades made at 0.88% to closing prices from Friday. New trade on SPDR Retail ETF (XRT). This stock has performed well and I am happy to let the market take me out 5% higher than here.

The table shows purchase price and closing price, the premium received and the % relative to close and to purchase price. The strike is shown and the important columns after that are the amount price has to move to reach the strike price - you will see they are all around 5% with a few more than that. The net cost column is updated each month to show purchase price less accumulated premium received - the percentage column at the end shows what contribution income has made compared to purchase price.

Trading costs are a factor to consider. US marklets are a lot cheaper than European markets though DTB has dropped rates to €1.1 per contract for options listed in Germany

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $299 (4.5% of the high). The sellers won the day and pushed price away from the resistance area at $6500. Train tracks off a resistance level is a good reversal signal - do not be surprised to see price head down to support around $6000.

Ethereum (ETHUSD): Price range for the day was $36 (11.8% of the high). Price action looks similar to BTC but different. Price pushed down to the support level around $275 and closed below and made the lowest low in six days. I felt price was poised to break up yesterday BUT I chose not to act. This is a down trending market - do not go long yet I told myself. This will be a key battleground to hold this level and momentum is not bullish.

What is clear is that Bitcoin has the most favoured status - its volatility was half of ETH.

CryptoBots

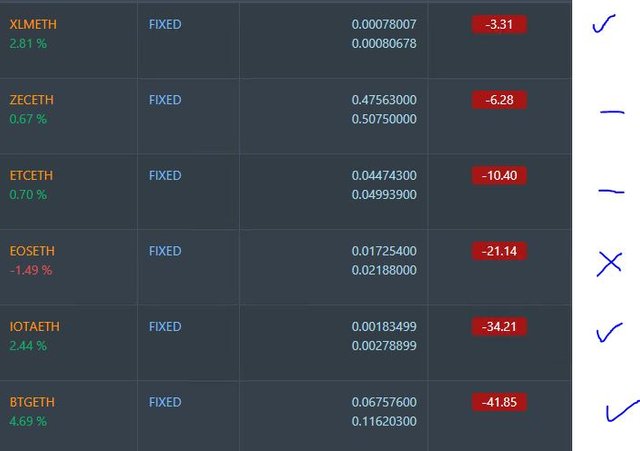

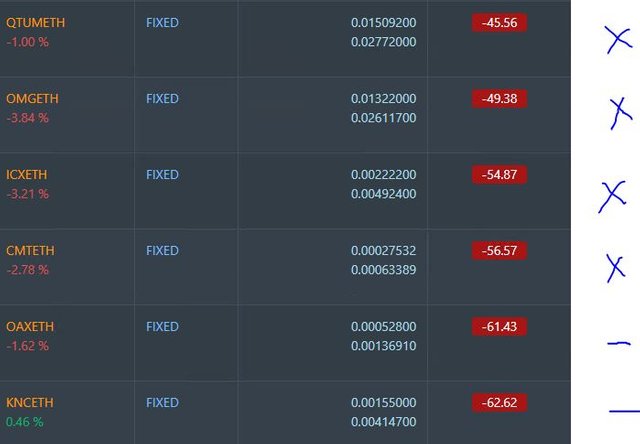

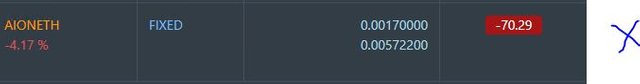

Outsourced Bot No closed trades. (213 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-58%), ZEC (-61%), DASH (-69%), LTC (-49%), BTS (-49%), ICX (-79%), ADA (-64%), PPT (-72%), DGD (-74%), GAS (-84%), SNT (-57%), STRAT (-75%), NEO (-79%), ETC (-45%), QTUM (-75%), BTG (-74%), XMR (-46%), OMG (-64%).

All coins traded worse with ZEC (-61%), and PPT (-72%) going to the next level down. OMG (-64%) dropped 4 points. GAS (-84%) remains the worst.

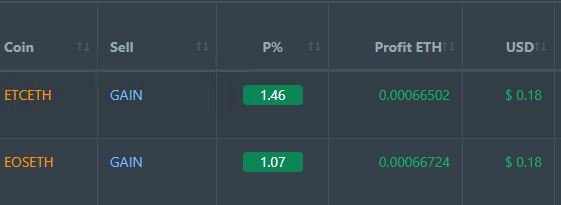

Profit Trailer Bot Two closed trades (1.27% profit) bringing the position on the account to 1.38% profit (was 1.35%) (not accounting for open trades). The encouraging part was both trades were PT Defender trades

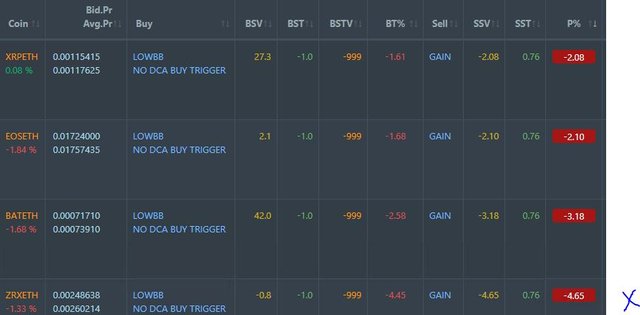

There are four coins on the Dollar Cost Average (DCA) list with XRP, EOS and BAT joining. The EOS trade is a PT Defender trade. XRP is popping on and off as it is close to the 2% cutoff.

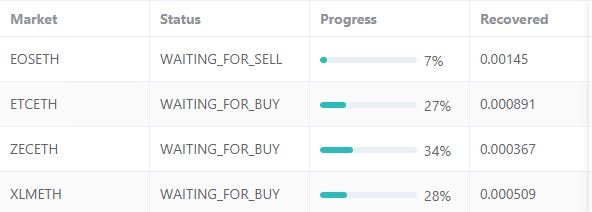

PT Defender is working on 4 coins and has made recoveries on all of them, with the first win on ETC.

Pending list remains at 13 coins with 3 coins improving, 4 coins trading flat and 6 worse.

New Trading Bot No longer reporting. I am trading this account out. Entered one trade on RDNBTC based on lower Bollinger Band signal - trade is looking unhappy - low volume coin on Binance.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 8.2% (lower than prior day's 9.6%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work. Venezuela flag By Denelson83 [Public domain], from Wikimedia Commons

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

August 20, 2018

an inspiring and useful article,i really support your works sir @carrinm

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very informative, thank you for sharing information about currency marketing, have a nice day, friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I’m also tempted with Ethereum here but the reality is no real reason to buy yet. Technicals looks aweful and the fact that the major development for scaling solutions were pushed back to 2019 is disappointing. Lastly, given the pricing and regulatory environment, I see the ICO market drying up quickly.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ehtereum is a long haul play. I am invested because I am using it as the base currency for my bot trading. And I am investing based on Ethereum that I have mined and am mining.

I have no doubt that someone will find a better platform model to do smart contracts without the dictatorship implicit in the way Ethereum is now.

ICO world is diverging - inside US and outside US. US Regulators will never get it. A good consulting business to be in right now - ICO Treasury Management - how to keep your money after doing the ICO.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @carrinm! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

SteemitBoard and the Veterans on Steemit - The First Community Badge.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit