It did not turn ugly. Markets went up across the globe. Trade action is a sneaky play on cannabis and an impatient exit in mining services. Japan has a big up day after Monday's holiday.

Portfolio News

Market Jitters - Tariff Tantrum It was not ugly. It was happy.

I was wrong. Markets had priced in the tariffs that were announced and they moved firmly higher. I think people had a step back and said the data is still solid and they kept buying. There was news flow that helped. Wall Street salaries and staffing have now passed the levels they were at before the last crash. The key news flow was that the China retaliation was less than people feared - many of the tariffs announced were less than 10 percent and were certainly nowhere near the craziness of 25%.

The key headline for me was around yields.

The 10 year surged past 3% with a 7 basis points rise for the first time since May - and the market did not crater. This tells me that investors are focused on the data and not the fear. Now there was a small headline that seemed to skip by the talking heads. China did increase their sales of US Treasuries. That is why yields rose - there was a big seller in the markets who has been quiet for a while. The next Treasury auction could be a key touchstone.

What is the dilemma all about? Is it fear or is data driving markets is the dilemma. You decide.

https://www.bloomberg.com/view/articles/2018-09-18/3-treasury-yields-give-bond-traders-a-dilemma

Now there was one wrinkle in tariffs in my portfolios. Fastest growing stock for the day was Sunpower (SPWR) who manufacture solar panels and have been hit with tariffs. They won an exclusion for the panels they manufacture in Mexico and ship to US - stock went up 14% for the day

Cannabis Carnival The carnival continues with Tilray (TLRY) jumping 29% on news they can import cannabis to US for medicinal trials.

I watched one of the talking heads answering questions. His puritanic background gave him great difficulty in even saying the word POT. Get over it, mate - there is plenty of benefit from cannabis through the CBD compounds without going anywhere near the THC. Jim Cramer interviewed the CEO of Tilray - "cannabis could be great hedge for alcohol and drug companies". Jim Cramer coins the phrase "reefer rally". Some rally.

In a later segment, he did place some caution on the table as to the amount of capital that will be required to make this work. Speculation continues on the size of the industry. Current estimates are $150 billion and growing to $500 billion if the US legalizes at the Federal level. My instinct says it is bigger by an order of magnitude.

Bought

Johnson & Johnson (JNJ): US Pharmaceuticals. This was a trade idea from Jim Cramer who was looking to load up after price came up from the pullback. He liked the long pipeline of products. What I liked is that they have been something of a leader in the development of marijuana development in Canada. I did not study the charts - I just bought a small parcel of stock. The chart compares JNJ (black bars) with the S&P500 using the SPDR ETF (SPY - orange line).

JNJ had been tracking the SPY quite well until the start of 2018 and then pulled back really hard. It has recovered from the lows and there is quite a gap now to make up. It would have been great to catch the bounce. The good news is that I did because I bought the SPDR Pharmaceutical ETF on July 2 which is exactly when JNJ turned. JNJ is close to 5% of that ETF. See TIB257 for the discussion on US Health Care and Pharma.

Sold

MacMahon Holdings (MAH.AX): Mining Services. IN TIB167, I was looking for an uptick in performance coming into earnings and a linkage to improving commodity prices. This just did not happen especially with copper prices under pressure over the last few months. The research house pulled the trigger and exited some time ago at their entry point. I held on and squeezed out 12.5% profit since January 2018 which was more than enough to carry CFD financing costs.

For completeness I updated the chart comparing MacMahon to two Australian mining companies (RIO and BHP). The expectation was for MAH to close some of the gap to the mining companies.

Well the gap did close as MAH is now 4 percentage points better than it was and the mining companies are now both worse than they were. Of note is the way price has been diverging since MAH started running up. This tells me that the trade may have been an impatient exit. I could well reconsider this as a stock trade (i.e., not a CFD trade) especially seeing the big rebound in copper prices over the last few sessions.

Income Trades

When I set up the covered call trades for the month, I leave the trades open. There is some risk in this as price might spike. I got hit on one of those as Japan share prices surged after the market was closed on Monday and took the Japan ETF prices along. There is still some leeway on this ETF to the strike price and there are only 3 market days to go till expiry. I am happy to exit the stock at these levels if it passes the sold strike. I am plenty invested in Japan in other ways.

iShares Japan (EWJ): Japan Index. Sold September 2018 strike 60 calls for 0.31% premium (0.45% to purchase price). Closing price $58.15 (new trade). Price needs to move another 3.2% to reach the sold strike (new trade). Should price pass the sold strike I book a 51% capital gain.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $164 (2.6% of the low). After the big down move on Monday, markets took a day off and produced a quiet inside bar with the close higher than the day before.

The next move is key with a break higher or lower likely to make a higher high or a lower low. The momentum indicators are suggesting higher. I look at the chart going back to the June lows and I see 3 higher lows after the July bounce and pullback. The buyers are lined up right there.

Ethereum (ETHUSD): Price range for the day was $21 (10.8% of the low). Price did the same thing as Bitcoin - inside bar though the close was quite a bit higher up the bar. The encouraging part is price did close above the resistance line.

The next move is key too as a higher high will take price through the new downtrend line I have drawn in and will cement $200 as a support level. The chart does have a very different feel - it just shows steepening downtrends.

You might wonder why I compute the % price move to high some days and to low other days. I compute things in the direction price is moving.

CryptoBots

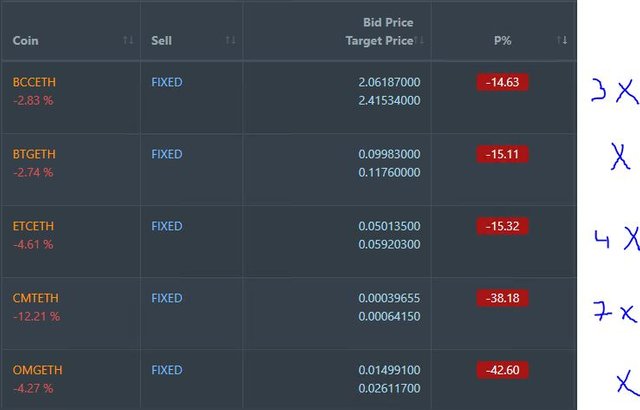

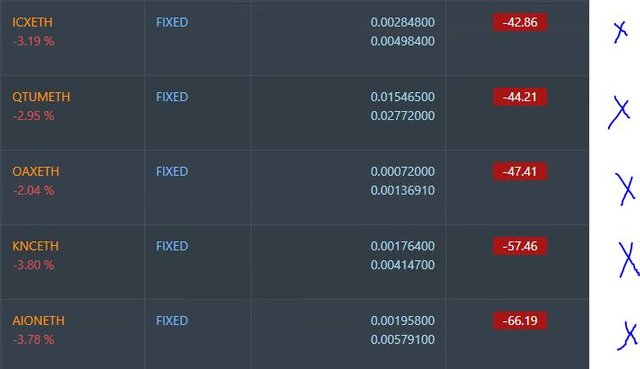

Outsourced Bot No closed trades. (221 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-68%), ZEC (-66%), DASH (-59%), LTC (-49%), BTS (-43%), ICX (-80%), ADA (-73%), PPT (-81%), DGD (-83%), GAS (-84%), SNT (-62%), STRAT (-76%), NEO (-80%), ETC (-53%), QTUM (-80%), BTG (-72%), XMR (-35%), OMG (-69%).

All coins moved 1 or 2 points better. DASH (-59%) and LTC (-49%) improved a level. GAS (-84%) shifted back to sole last place.

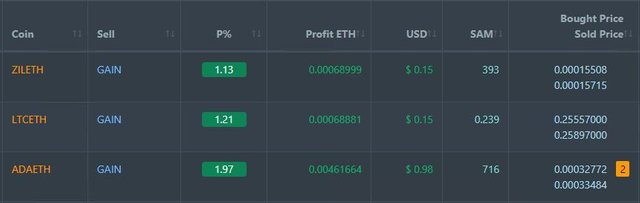

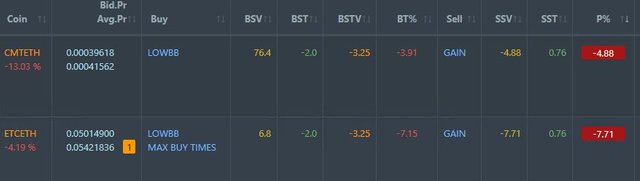

Profit Trailer Bot Three closed trades (1.44% profit) bringing the position on the account to 2.68% profit (was 2.57%) (not accounting for open trades). ADA trade closed with 2 levels of DCA and a good trail above the 0.76% trigger for exit.

Dollar Cost Average (DCA) list stayed at two coins with ADA moving off into profit and CMT coming on.

Pending list remains at 10 coins with all coins worse. CMT was the worst after a pump and dump drove price in two days. Too bad the PT Defender trade started on the dump day. Lesson learned when one see a pump like that is to take the coin off the whitelist until the dump is over.

PT Defender continues defending 6 coins and is now waiting for defence trades on ICX, CMT and ETC to sell.

New Trading Bot Trading out using Crypto Prophecy. No trades today with positons open on DGD, SNT and TRX.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 19.9% (lower than prior day's 20.2%).

Outsourced MAM account Actions to Wealth closed out 1 trade for 0.49% loss for the day. They have one open trade.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

September 18, 2018

JNJ has such a large portfolio of products so they would fair well no matter what the economic figures look like. Would be interesting to see the Pharma group start bidding wars for these Cannabis plays... would just add to the valuations!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My guess is we will see the pharma groups split into two camps.

And we all know how well prepared they are to do 2. They do it all the time to protect pricing and dangerous products all in the name of public health and science.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i do not understand much in commerce, but big companies are getting better and better. JNJ is good choice.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for commenting. Keep reading my posts and you will learn. I share it all - good and bad. What makes you think JNJ is a good choice?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @carrinm! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit