Market themes begin to move my way. There is a lot more gold in the Pilbara. Marijuana has markets in a tizzy. Amazon takes the lead in wages. Raising the profit profile on new dog, General Electric. Crypto is poised to strike

Portfolio News

Market Jitters - Tariff Tantrum Canada trade deal changes the psyche of investors.

US-Canada pulled off top line agreement on a new trade deal at the weekend (though it still has to pass Congress). This has led to some key changes in the investing theses that have been running since the China trade war erupted with rotations out of small caps stocks and India back to large caps especially industrials. That drives the Dow Jones Industrial index to all time highs. The India profile is worsening with rising Brent crude oil prices pushing import inflation.

Jay Powell was talking again this week about the Federal Reserve view on the economy.

Having doused the fire a little last week on the state of the economy he poured more fuel on this week. The economy is going very strongly and he can see a time when the Federal Reserve goes past accommodating through neutral (now) to tightening. He did not say that last week. The result was a spike in yields and a steepening of the yield curve. The ADP jobs data tells its own story - do not be surprised to see a robust number for non farm payrolls this Friday

Oil prices are moving.

Ignore the headlines. Despite an increase in US oil stockpiles oil prices rose. The pressure coming from Iran sanctions is working through to Brent crude prices. The headline writers seem a bit confused.

Cannabis Carnival The American talking heads are in a tizzy about marijuana stocks

They kind of want to get engaged but they feel they should not. It is not making for rational thinking about the sector. Pepsico announces they have no specific plans about marijuana and Tilray share price slumps 16%. It then ended the day up 13%. They then announced a capital raising after market close to fund the next level of developments. Share price was penalised 6%. This is no surprise to me given that building markets needs new capital - it is just like investing in a gold or cobalt or lithium exploration company. Get used to it. Jim Cramer has talked quite a bit about how big the capital requirements are going to be. He did mention again in the pre-market discussion his market size estimate of $500 billion. This is 3 times more than other estimates and fits with my thinking - i.e., a lot bigger than people think.

Bought

Harvest One Cannabis Inc (HVT.V): Canadian Marijuana. Harvest One price sagged a little on the Pepsico story. I added another small parcel to two of my portfolios. Nice to see a 7% jump between open price and close price for the day.

General Electric Company (GE): US Industrials. The talking heads remain very divided over the future prospects of GE. They are all in agreement that Larry Culp will make a good CEO and that he will make changes. They are mostly convinced that we have not yet seen the bottom for price, especially given its sensitivity to the China trade war. I noted in TIB305 that I could improve the profit potential of the January 2021 12/20 bull call spread by selling a put option at a price below the current price.

What does this mean. I am giving someone the right to sell GE shares to me if price drops below the strike price before expiry in 27 months from now. Given that the talking heads cannot agree on a bottom price I picked a price that is 2 strikes below the current price ($8). Price has to drop more than 30% from current levels, having already dropped 50% in 2018, to reach that. I am going to guess that if the option gets assigned at $8 there will be no more sellers left (unless GE goes bankrupt).

I sold January 2021 strike 8 put options for a premium of $0.50. This reduces my net premium from $2.14 to $1.64 implying a maximum profit potential of 387%, a step up from 273% with the sold put in place.

Kairos Minerals (KAI.AX): Australian Zinc/Gold/Lithium Exploration. Two announcements came in about the Pilbara gold assay results for adjacent gold tenements. One for Kairos Minerals

One for De Grey Mining (DEG.AX). Details of both sets shows that gold finding is considerable.

One share price has hardly budged (black bars down 20% in 18 months) and the other has surged 287% (orange line).

I added to my holdings in the laggard. From the announcement, I can see that Kairos gold estimate on the new data is half of De Grey. Its price has a chance to close half the gap. I am not sure what the real differences are. One team is totally focused on gold (De Grey). The other team is pursuing multiple opportunities. That is probably the difference.

Sold

SPDR® S&P Retail ETF (XRT): US Retail. Amazon announced that they were increasing the minimum wage for its employees. I watched a snippet of Jeff Bezos interview that he was moving Amazon to lead the industry on wages - and not be a follower. This move cannot be good for US retailers who will be forced to follow suit which will drive up cots. Add also that we are beginning to see wage inflation beginning the waken from its slumbers. I decided to take profits and sold my stock holding for 21% profit since July 2017.

This is what I wrote in TIB113 at the time of setting up the trade

If the data is right, this sector is not totally dead, it could well come back to life for a nice run

It is rewarding to see a contrarian trade taken when the talking heads were writing off the US retail sector deliver a 20% return. I remain exposed to XRT through a bull call spread in one of my portfolios and to a few individual retail stocks

Shorts

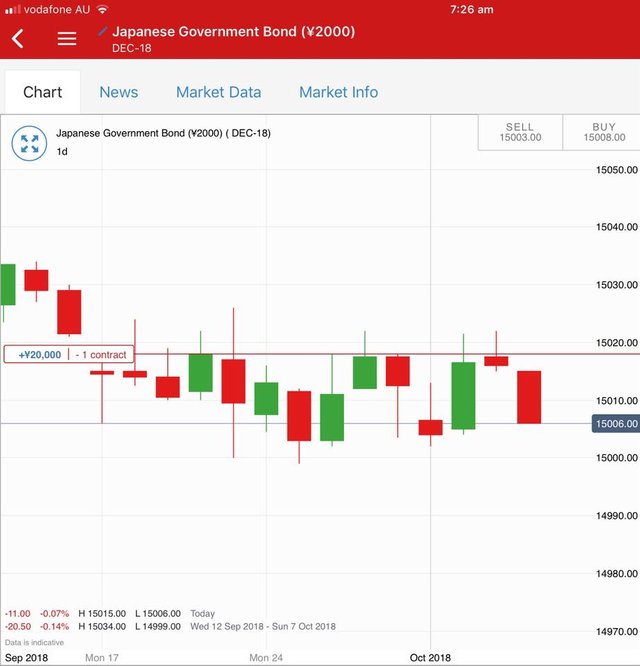

Interest rates are moving. A quick update on charts for 3 of my holding areas - prices heading lower across all 3 markets (i.e., rates rising)

Eurodollar

Euribor

Japan 10 Year Governemnt Bonds

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $114 (1.8% of the high) Price made a long tailed low test bar exactly on the support line on a quiet day. With the benefit of a few more hours trading into this day, we can see it was a higher low.

The next test is to see if price can now make a higher high on the journey back above $6750.

Ethereum (ETHUSD): Price range for the day was $9 (4% of the high). Price drifted lower on a quiet day in "no mans land". It has been quite some weeks since we have seen daily volatility below 10%

CryptoBots

Outsourced Bot No closed trades. (221 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-67%), ZEC (-64%), DASH (-63%), LTC (-47%), BTS (-46%), ICX (-78%), ADA (-69%), PPT (-80%), DGD (-82%), GAS (-83%), SNT (-59%), STRAT (-73%), NEO (-79%), ETC (-52%), QTUM (-78%), BTG (-72%), XMR (-36%), OMG (-67%).

Coins moved in a tight band of 1 or 2 points, mostly down. XMR dropped 3. GAS (-83%) is solo as the worst coin.

Profit Trailer Bot Update tomorrow

New Trading Bot Trading out using Crypto Prophecy. Trades closed last week on XEM (1.79%) and AION (1.77%) following Bollinger Band entry and Crypto Prophecy confirmation. Trade on DGD remains open.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 40.2% (higher than prior day's 28.8%). This account is now trading in negative margin. I have been remiss in changing this account over to a professional account after changes in European Union leverage rules. I now run the risk of the account closing out to recover margin. Changes are in to the broker

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and Gold Exploration companies. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

October 3, 2018

I have also been surprised about the resilience from the XRT given the perceived weakness in the sector which has not been seen. I would be interested to see if this would be the catalyst for weakness which could also be an opportunity to also sell some Real estate players linkes to the sector. I cannot even count how many vacant mal stores I see when shopping around.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Last time I looked at the shopping mall REIT’s, they had all taken a smack. I did hear Jim Cramer talking about the bounce in Simon Property Group. Might be worth checking for a reverse. The other one on my radar is Rodamco which bought Westfield. This makes it the largest mall operator in the world.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Markets are not looking great crypto is testing the patience level of many investors

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The patient investor will wait quietly for crypto to move ahead. When volatility goes down, I grow even more patient

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice sharing my friend

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit