The market selloff drags S&P 500 into correction territory. Yields fall too. Fear abounds. Trade action is testing the lower bounds for oil producers. A maturing fixed interest bond raises questions of what next? IBM scoops up Red Hat for 63% premium.

Portfolio News

Market Selloff

The selloff continues despite good earnings reports in US markets.

It is challenging to pick which headline to believe as to what the drivers are. It is always a combination of effects which become exaggerated when economic growth starts heading to "end of cycle". To my mind there are 3 key things at play here

- End of cycle growth concerns

- China and the wider tariff sitation. Tariffs are going to increase costs especially when US companies start to realign their supply chains

- Rising interest rates and the way the Federal Reserve responds. Short term rate markets suggest that the Fed may be on the right path for now BUT they are concerned that if they keep raising there will be a few rate hikes too many.

My read is the China trade issue is the biggest thing markets should be worrying about. I suspect they are worrying more about the Federal Reserve because they know what happens when the Fed goes too far. They have seen it before in recent times. Nobody remembers the last time we had such a tariff escalation because it was before the Great Depression of the the 1930s.

Interest rates caught a bid and yields fell as investors sought safety

I put each link below - read each article and make your own choices

https://nypost.com/2018/10/27/trump-is-right-the-fed-has-raised-interest-rates-too-fast/

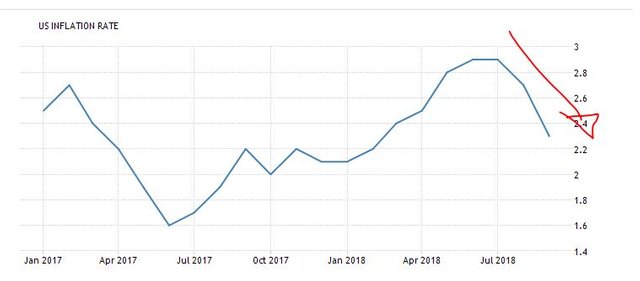

My read: The last US inflation read was softer than markets expected - one could then say that inflation rising is not the problem as a shorter view of the charts suggests it is declining.

However when I look at a longer view chart like the Federal Reserve does, I see a rising curve. You decide for yourself.

https://tradingeconomics.com/united-states/inflation-cpi

Cloud Computing

IBM announced over the weekend that they would buy Red Hat, the UNIX cloud computing software company for $190 a share in an all cash deal.

This is a 63% premium to Friday's closing price. See TIB294 for my discussion on Cloud Computing and my first purchase of Red Hat on this cycle. Added to in TIB308. Always nice to pick a winner before one of the big boys decides it is a winner.

You read about Red Hat here.

Bought

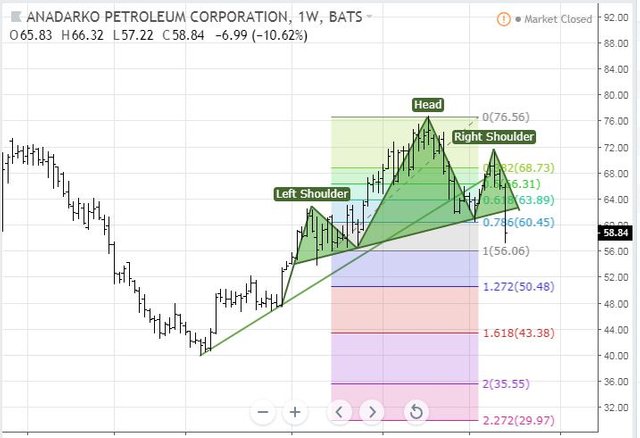

Anadarko Petroleum Corporation (APC): US Oil Producer. Averaged down my entry price in the selloff. I did notice that Jim Cramer did the same in his portfolios. In TIB286, I presented a chart which showed price retracing to test the 0.618 Fibonacci level.

The updated chart shows that it only hesitated there and then went to test the 0.786 level. With the big selloff it is now testing the lows from the last cycle up. The chart has a head and shoulders feel about it though the right shoulder is higher than the left.

Sold

Inter American Development Bank MTN 3.75% 09/10/2018 Fixed interest bonds acquired by prior fund manager reached maturity for 4.2% loss since May 2015. This shows the challenge of buying bonds in a rising interest rate market. That said, the coupon of 3.75% did stay above the Australian inflation rate for the life of the bond.

The real challenge is going to be finding a replacement. Current yield to maturity on Australian bonds is 3.18% on long duration bonds. I might be better placed at buying US Treasuries and run the currency exposure on the Australian Dollar continuing to slide for some time yet.

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $73 (1.1% of the high).

Price stayed within the bands of Friday's price for the whole weekend which was inside the narrow parallel channel it has been in since the Tether rumour bust the week before.

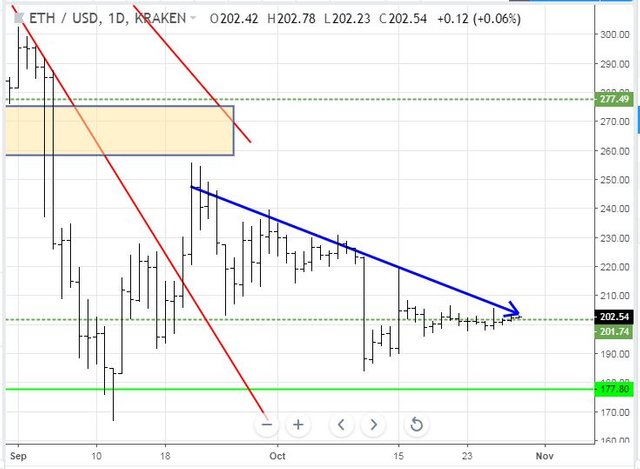

Ethereum (ETHUSD): Price range for the weekend was $7 (3.4% of the high).

Price is itching to break above the $200 level with 4 successive days with higher lows and now testing the underside of the downtrend line I drew last week (the blue arrow).

CryptoBots

Outsourced Bot No closed trades. (221 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-69%), ZEC (-64%), DASH (-67%), LTC (-52%), BTS (-52%), ICX (-78%), ADA (-71%), PPT (-79%), DGD (-81%), GAS (-84%), SNT (-58%), STRAT (-70%), NEO (-81%), ETC (-58%), QTUM (-76%), BTG (-72%), XMR (-40%), OMG (-69%).

Coins moved in a tight band of 1 or 2 points, mostly up. ETH (-69%), PPT (-79%), and SNT (-58%) all improved a level while STRAT (-70%) and XMR (-40%) dropped a level. GAS (-84%) dropped a point and stays last.

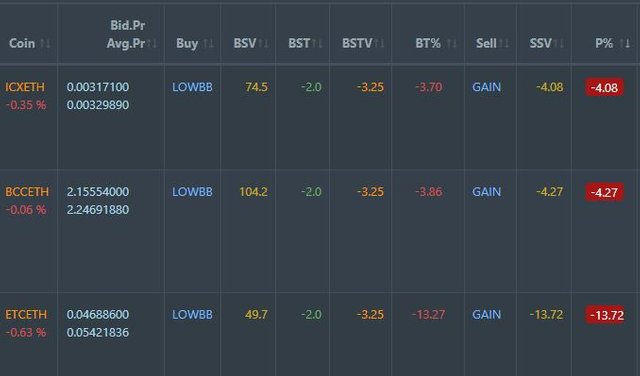

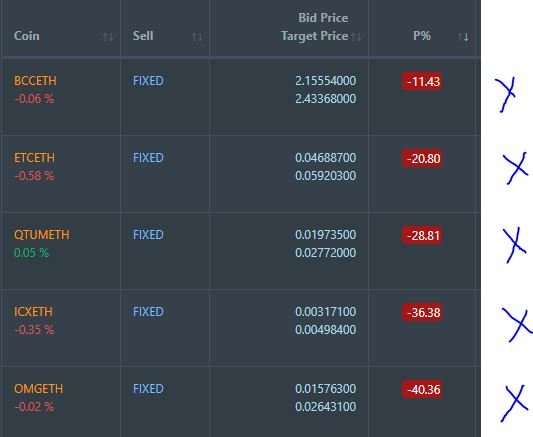

Profit Trailer Bot No closed trades since last report. I did open up the bot for one more trade which was opened on ZEC

There are now three coins on the Dollar Cost Average (DCA) list with BCC joining ICX and ETC. These are all PT Defender trades.

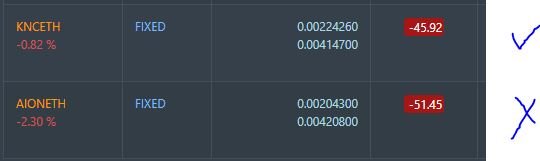

Pending list remains at 7 coins with 1 coin improving a little (KNC) , and 6 a little worse.

PT Defender continues defending 5 coins with no changes in positions.

New Trading Bot Trading out using Crypto Prophecy. Trades closed on NANO (1.31%), TRX (1.65%), XEM (0.87%) and BTS (1.86%) leaving only one trade open on XLM.

One chart showing entry setup on BTS. At the time the target (1530) was above the top Bollinger Bands - it did make it

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 21.4% (lower than prior day's 24.4%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work.

Red Hat image is on the public domain at https://www.deviantart.com/petux7/art/redhat-symbol-205115600

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Prophecy provides a useful tool to identify oversold and overbought coins -https://mymark.mx/CryptoProphecy

October 26, 2018

Great call in the Cloud play! I wonder if this will give a lift to other players like Workday or Salesforce given the correction. I have also been watching the Cannabis plays that has fallen down the list in the media but have also pulled back despite great potential still out there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cannabis plays will separate out in 3 groups

My Red Hat story is a story really of a missed opportunity. I bought it before the dot.com crash first time around - I would have been looking very happy if I had held for the long haul. Coming back to stuff I know was a late move but in time enough, this time

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

we hope that it will soon be stable, keep the spirit of @carrinm, thank you for sharing, I will share your post ...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@carrinm, I don't know that much Technical Details or i can say that i am not an Crypto Analyst but instead i am Crypto Enthusiast and i really want to see the boost and in my opinion nowadays we are watching some effective news and can see positive signs towards Institutional Investors in Crypto Economy and if Bitcoin boosts then others will also drive effectively.

Wishing you an great day and stay blessed. 🙂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit