Markets stepped back. Retailer numbers are looking good. I am rotating a few positions and banking a tidy profit to fund it. Going against the grain in semiconductors and a specific cannabis stock

Portfolio News

Market Jitters

The love affair ended and US stocks snapped back especially dragged down by a sagging oil price.

The Federal Reserve left rates unchanged and reminded everyone they plan on being data dependent. What is clear is that Jay Powell, as Chairman, is not swayed by market moves in the same way his predecessors were. That is not the data he depends on - inflation and employment are his data guides.

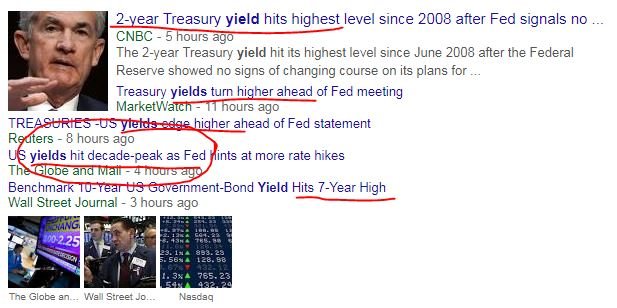

Treasury yields went back to their upward move following the way short term rates had been hinting.

The key headline is we now see decade highs for some of the yields (2 year) - i.e., back to before the 2008 global financial crisis. The 10 year also hit a 7 year high. That brings back the flattening word.

Earnings News

A few portfolio companies reported earnings. This one really made me feel good because I bought the stock again the day before and wrote about in TIB317.

It is the bathroom business of L Brands (LB) that drove the numbers rather than the intimate apparel business. Maybe I should have made puns about business no longer down the gurgler.

Disney (DIS) also jumped in after hours markets after reporting its earnings. I watched the interview with CEO, Bob Iger. I was impressed with his vision to compete with streaming services, especially Netflix, and with the way his plan is clearly mapped out in concrete steps in a planned way. What we will not really know is what the plan is going to cost and how the financing structures could affect results as rates continue their rise. That is the risk in the business.

Bought

Harvest One Cannabis Inc (HVT.V): Canadian Marijuana. Marijuana stocks have been on a roller coaster ride through legalization and the resignation of US Attorney General, Jeff Sessions. Harvest One has been drifting along and down rather than bouncing up and down. I averaged down my entry price in two of my portfolios. I still have less than a standard portion size. I am currently a long way from applying standard portion sizes as I am in a nibbling frame of mind. The market does not feel right to make $25,000 investments right now

Amgen Inc (AMGN): Jim Cramer has been talking about Amgen a lot and holds it in his Actions Plus portfolio. He talked today about two of their drugs, one which has applications for migraines and one for cholesterol. These are delivering good results for users - and usage could grow dramatically once customers find out and Amgen gets the marketing engine going. I nibbled a small holding. I am very wary of investing in pharma as they are so affected by the mood and bureaucracy of regulators. That has cost me a lot of opportunity in the last run though it has also allowed peace of mind and investing is a lot about peace of mind.

Five Below, Inc (FIVE): US Retail. Five Below operates as a speciality value retailer in the United States. The business model is to focus on high demand buzz products and a teen audience. Basically they keep moving their product focus to appeal to what is in vogue. This has its risks if they get something wrong but it also brings volume and margin. They are in the process of expanding from regional (625 stores in North East) to national (2,500 stores) with a big store rollout program in the works.

Idea from Jim Cramer. I liked the bounce in the chart and the connection to the consumer coming into the holiday season. Stepping back the buy:sell chart against the Retail Sector using the equal-weighted iShares Retail ETF (XRT), shows that FIVE has outperformed the sector since late 2017.

The chart gives no clues as to what comes next - too bad I did not see this one earlier is all I can say. Buy:Sell Chart [Means: Buy the first named stock and sell the second named stock. If the chart goes up the first named stock is outperforming. If the chart goes down the second named stock is outperforming]

Now to financials: these margins are impressive for a retail business. For context, I have written in Kohls (KSS) numbers alongside. Why pick Kohl's - because I just sold them. It looks like a nice switch. And the big bonus, Five has a very low debt to equity ratio with no long term debt. That will change as they fund the store rollout program.

Advanced Micro Devices, Inc (AMD): US Semiconductors. The talking heads were discussing a short term options trade on AMD. Implied volatility was too high and I wanted to look at bull call spreads. In this particular portfolio, I am not permitted to hold short positions unless I also hold the stock. I did not have enough shares to write a matching call contract so I rounded up my holding so I have a round number of shares to sell contracts. I also saw a report which highlighted that AMD has higher margins than 85 of all chip stocks. Reason enough to own them if one has a long enough view on growth opportunities. It also suggests to me I should research the other 15% and invest in them.

Sold

Walgreens Boots Alliance, Inc (WBA): US Pharma Retail. Price has held over $80 for a few days closing at $82.44. I closed out a January 2020 65/80 bull call spread as it has reached maximum profit potential. Booked 183% profit since August 2018 which is a little higher than I modelled in TIB269. I remain exposed to the stock and to a January 2019 77.5 strike call option which is now in-the-money but not yet past breakeven. A quick update on the charts is in order - the closed contracts are the fluoro green and red rays.

Price is clearly on the pink arrow scenario which has smashed through the sold call well ahead of expiry. I remain on track to get to breakeven on the January 2019 77.5 strike call option (the blue rays).

Kohls Corporation (KSS): US Retail. 7.8% profit since August 2018. I have had a profit target on Kohls ever since Jim Cramer indicated that he was trimming his position. I put the target on the 52 week high and that was hit. This may have been an impatient exit as my holding was very small and there is still upside for Kohls especially with their Amazon joint venture. I will watch and see if I can get back at a lower level. I will put up a chart to show how price has broken past the selloff and made a new high.

There is a message in this chart especially as we work towards the holidays. There is a lot of consumer power walking US streets right now - no matter what the media tries to tell you. L Brands (LB) tells me that too.

Income Trades

One more covered call hit as prices of cycbersecurity stocks climbed, especially FireEye (FEYE)

ETFMG Prime Cyber Security ETF (HACK): Cybersecurity. Sold November 2018 strike 38 calls for 0.91% premium (1.21% to purchase price). Closing price $37.36 (lower than last time - September). Price needs to move another 1.7% to reach the sold strike (tighter than last month). Should price pass the sold strike I book a 31% capital gain. Income to date amounts to 2.1% of purchase cost.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $123 (1.9% of the high). Traders like to talk about false breaks when price makes a move and then gives up. Bitcoin gave up on one of those yesterday as it rejected the heady heights above $6500 and retreated back to "no mans" land to the next round number ($6400)

We really need to see price hold this level if we are to see another push to stay above $6500.

Ethereum (ETHUSD): Price range for the day was $9 (4% of the high). I wondered in TIB317 if price would respect a short term support level (the brown ray). It did not and pushed below it and settled on its round number ($210) which is a little above the highs of the last consolidation area. For me, this feels more convincing than what Bitcoin did = just a feeling.

CryptoBots

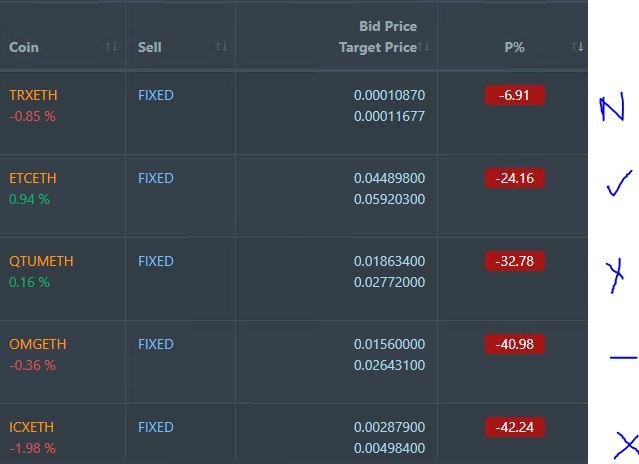

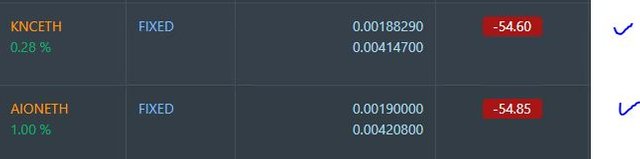

Outsourced Bot No closed trades. (221 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-68%), ZEC (-60%), DASH (-66%), LTC (-51%), BTS (-53%), ICX (-79%), ADA (-70%), PPT (-80%), DGD (-80%), GAS (-84%), SNT (-58%), STRAT (-72%), NEO (-81%), ETC (-58%), QTUM (-76%), BTG (-72%), XMR (-38%), OMG (-68%).

Coins moved in a tight band of 1 or 2 points, mostly down. GAS (-84%) remains the worst coin. PPT (-80%), ADA (-70%), and LTC (-51%) all dropped a level

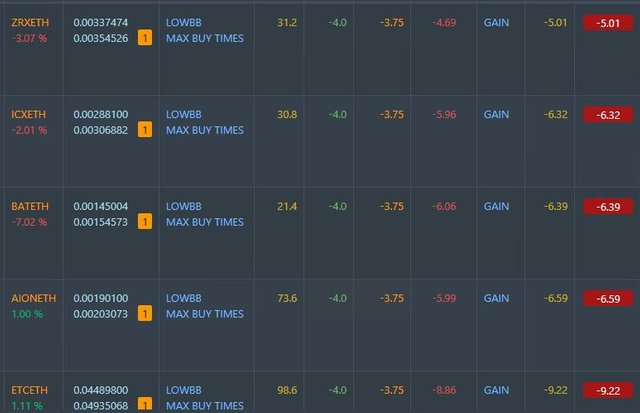

Profit Trailer Bot Two closed trades (1.47% profit) bringing the position on the account to 4.24% profit (was 4.19%) (not accounting for open trades). ZEC trade not shown as it was a PT Defender close

There are 5 coins on the Dollar Cost Average (DCA) list with BAT coming in. That look like a pump and dump to me.

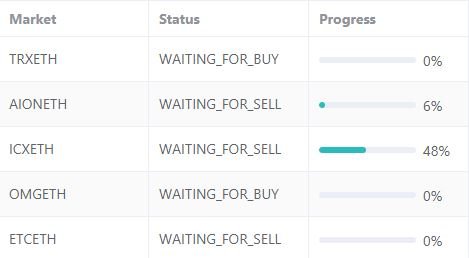

Pending list remains at 7 coins with TRX replacing ZEC and 3 coins improving, 1 coins trading flat and 3 worse.

PT Defender is defending 5 coins with TRX replacing BCC, now completed.

New Trading Bot Trading out using Crypto Prophecy. ZIL (1.84% profit) and ELF (1.84% profit) trades closed out. This leaves trades open on TRX, PIVX and NXS. No new trades for the day

Currency Trades

Forex Robot closed 6 trades (0.19% profit) and is trading at a negative equity level of 0.78% (lower than prior day's 0.49%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

November 8, 2018

Its been a while since you discuss China specific stocks; have they come into attractive valuations as they have been punished more than other markets? Year end portfolio adjustments will soon been in the news as well so tax selling can impacting some positions as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

China is a long game. I bought China Small Caps last week. I am holding Ping An Insurance and China Agricultural Bank. I am also holding IShares China Ashares ETF and I have hedging puts on China Large Caps. I do think there is opportunity in China but one has to pick specific stocks to protect from the rebalancing and the fear selling.

China small caps buy was an expcetion to this as I doubt many mainstream investors in US will have bought it. They buy FXI or ASHR. BUT if one really has a long view that goes past the next recession, buy when the technicals say the bottom has been cleared and there are few sellers left.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit