Markets rebound on China news and yields slide right across the world. Trade action is completing the purchases in Japan - this time in Japan consumer areas. Added in one more long on Ethereum

Portfolio News

Market Rebound

Markets moved up strongly as the tariffs story moved down the road.

Treasury yields softened with the key 10 year Treasuries yield dropping below 3%

The fear mongerers are out in the headlines calling this an inversion. A detailed read of the article showing in the headlines shows that the spread that dropped below 0 was between the 3 and 5 year and not a more normal comparison between a short term (say 2 years) and a long term (say 10 or even 20 years). There is no doubt the markets are pricing in at least one fewer rate hike in 2019 than they did before Jay Powell's Financial Stability speech last week.

https://www.bloomberg.com/opinion/articles/2018-12-03/u-s-yield-curve-just-inverted-that-s-huge

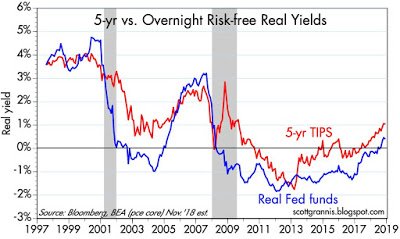

Time to step back and look at the big picture in a new briefing from Scott Grannis. His key chart is to compare 5 year TIPS (inflation protected bonds) and real Fed Funds Rate. This chart is still positively sloped

His preferred spread to look for inversions is between 2 and 10 years. What I like is he always comes back to the same charts and lets the charts tell the story rather than finding data that supports a story. Read the blog post - it is detailed and you will benefit from joining his newsletter to get the posts by email.

http://scottgrannis.blogspot.com/2018/11/the-yield-curve-is-not-forecasting.html

Europe did follow the market relief rally even though Brexit and Italy remain uncertain.

Interest rates in Europe are becoming even more uncomfortable with the short term rate projected for December 2020 dropping to 0.08%, a level not seen since August 2015

I did dig into this article by Gunnar Hökmark MEP, Group of the European People’s Party (Christian Democrats), Belgium. This is what he said about banks

Fourth, banks need to be as stable as possible. They are the core of financial markets, necessary for payments, saving, investment making, liquidity making and financing investments. In Europe, they are financing the dominating part of small and medium-sized companies. We must ensure that they are not overburdened, unable to finance necessary investments, which would lead to financial instability when companies fail to grow.

https://www.openaccessgovernment.org/financial-markets-europe-avoid-crisis/55259/

To my mind those interest rates are going to be the straw that breaks the banks backs - they cannot make any money with rates like that. How then can they be stable?

Cannabis Carnival

Cannabis producer Aphria (APHA and APHA.TO) drops 30% after short seller calls acquisitions 'worthless'

Ouch! Got to love it when a short seller slams a stock, he is selling short, at a Short Selling conference. This feels as illegal to me as Front Running. The story does highlight what I have been saying all along about the cannabis sector. Diversify your investments and nibble in small parcels. As the 3rd largest producer in Canada, I could well be nibbling a little further at a much lower entry price. I look forward to seeing the data that Aphria management comes up with about their Latin American investments. They have clearly not shared enough otherwise the market would have eaten the short seller's lunch

https://www.cbc.ca/news/business/aphria-stock-short-seller-1.4929951

Bought

Arigatou Services Company, Ltd (3177.T): Japan Retail. Arigatou operates in consumer areas of used goods, fast food and DVD rentals - so well geared to the consumer. Revenues are growing but margins are tight. The chart shows price breaking up after a period of consolidation from the lows.

Price target of 35% is below the early 2018 highs. Debt to assets is around 30%. Dividend yield is 3.7% which is high by Japan standards.

Nichimo Company, Ltd (8091.T): Japan Food. Nichimo operates as a vertically integrated producer in the fishing sector covering fishing gear, processed fish and fish processing equipment. Revenues are growing but margins are tight. The chart shows price breaking up through the weekly downtrend.

Late 2017 highs represent a 25% growth target. Debt to assets is around 50%. Dividend yield is 2.7%

Shorts

Euribor 3 Month Interest Rate Futures (IZ): I put on a pending order to go short one more contract looking for a reversal from the current highs. That order was not hit in overnight trade as prices continue to edge higher. I will be reviewing this trade closely as I want to keep a good margin buffer in my IG Markets account.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $368 (8.9% of the high). Price dropped below the $4000 support level into the "no mans land" above the short term range it traded in last week ($3600). We would need to see it hold the low and break back above $4000 to have any confidence.

Ethereum (ETHUSD): Price range for the day was $10 (8.7% of the high). Price gave up trying to go higher and dropped lower in its "no mans land" but holding above $100. This is a bothersome "no mans land" as it is 30% from bottom to top.

I did add one more trade (2 ETH) on a 4 hour reversal. The trade looked tidy at entry - just got messy after.

CryptoBots

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - ETH (-73%), ZEC (-65%), DASH (-71%), AE (-25%), LTC (-52%), BTS (-63%), ICX (-86%), ADA (-75%), PPT (-84%), DGD (-86%), GAS (-88%), SNT (-65%), STRAT (-77%), NEO (-86%), ETC (-67%), QTUM (-80%), BTG (-72%), XMR (-48%), OMG (-76%).

Coins moved in a tight band of 1 or 2 points, mostly down. GAS (-88%) remains the worst coin.

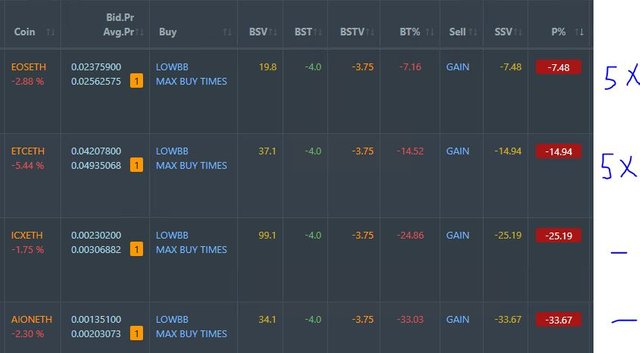

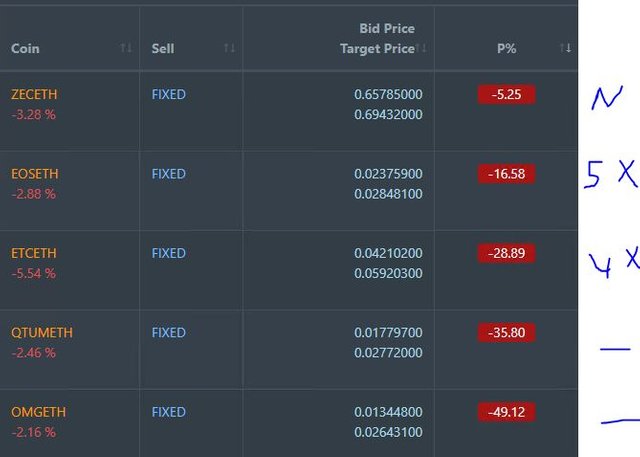

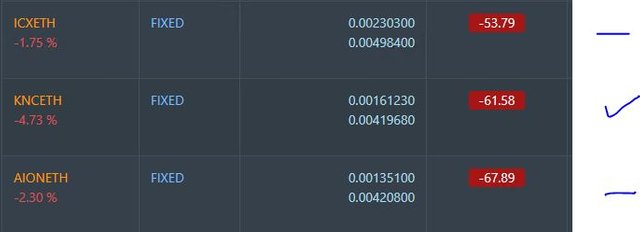

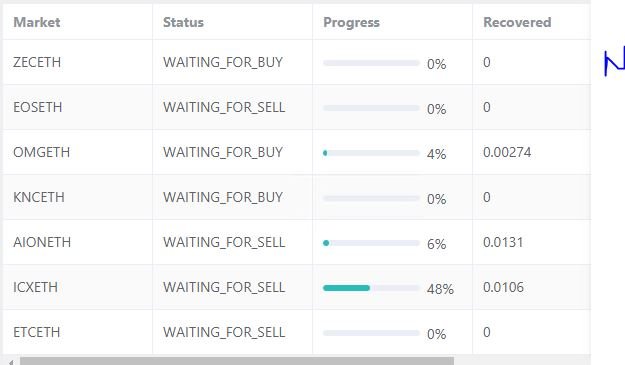

Profit Trailer Bot No closed trades.

Dollar Cost Average (DCA) list remains at 4 coins all completing one level of DCA. I did channel ZEC to PT Defender at -5% before it could do a DCA level. PT defender will manage that process.

Pending list increases to 8 coins with ZEC added and only 1 coin improving, 4 coins trading flat and 2 worse.

PT Defender is now defending 7 coins with ZEC added to the list.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 3.4% (lower than prior day's 3.7%).

Outsourced MAM account Actions to Wealth closed out 4 trades for 0.49% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Scott Grannis image is credited below. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

December 3, 2018

I am starting to think we may come out of this with only a mild slowdown globally but I remain concerned about the levels and debt and the size of central balance balance sheets as rates increase. How will these debt services be repaid if costs increase while GDP cannot grow enough to generate tax revenue to pay. While currencies just drop like a rock to compensate? That is the black swan I am concerned about as I look beyond 2019...

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree. Timelines feel like 18 to 30 months for US.

I think Europe will be the black swan. Black swans are always things we have not seen before. The Fed is moving in the right way to get in shape for the next recession. Europe is not - they are in a dither - rates still negative and ECB only now reducing their bond purchases. Maybe it will change when Draghi retires.

Looking to US there are concerns about student debt and auto loans. But we have seen the sub-prime before. people know how to deal with that. Tighten the rules and last resort, bail out the lenders before they collapse. Emerging market debt is a concern but not large in the grand scheme - we have already forgotten about Greece, and Argentina and Malaysia and Turkey.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @carrinm! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit