Markets sell off ahead of the George Bush mourning day closing. More bottom fishing in the cannabis rout and US Retail and profit taking in Europe to fund the purchases.

Portfolio News

Market Selloff - Tariff Tantrum

Well that was a one-day fizzer with markets going back to fear mode.

I sometimes wonder what goes on in people's heads. The market seemed to magically think all was resolved following the weekend truce on US-China trade. Leave it for one day and no detailed schedule of agreements comes out on Tuesday and by the way the truce only begins on January 1 and not on Monday and China does not mention the auto deal - wham - market sells off.

A lot of what happened in US markets had to do with the fact that the market will be closed on Wednesday for the George W Bush day of mourning. There was a lot of technical selling as indices approached the magical cross over point on their 100 day moving averages. Nobody wants to be exposed to the market in case something nutty gets said on Wednesday while markets are closed. Maybe it is not the people? It is the machines. And we did get nutty on Tuesday with Donald Trump reminding China that he is a tariff man - so much for a truce.

The Treasury yields did invert on the 2 to 10 year spread.

The bond market was saying on Monday that growth is an important issue. The stock market was being carried away in the trade euphoria. That flowed through to markets on Tuesday. Yes, growth will slow and earnings will come down - the part the market does not know is by how much, so they assume the worst until earnings season comes along. The machines certainly do not know.

Cannabis Carnival

Aphria rebutted claims made in the short selling attack by Quintessential Capital in a press release outlining the various production facilities, licences and other prospects that were acquired in Colombia, Argentina and Jamaica. They did not address the specific claims made about insider activity - that will find its way to the courts, I suspect.

As a vote of confidence in the company, CEO Vic Neufeld and other members of the executive team bought $3.1 million of the company's shares on public markets on Monday.

https://www.cbc.ca/news/business/aphria-short-seller-1.4931565

The rout continued in Tuesday markets with stock dropping another 21% in Toronto trading (after 29% the day before)

My experience on the cannabis craze has been to diversify investments and nibble in small parcels. I am invested across 3 stocks and will look to add one more in coming weeks to spread the risk further. I have had two other investments fail on ASX listed investments - they have reverted to their mining roots (International Goldfields (IGS.AX) and Capital Mining (CMY.AX)) and could well disappear.

Bought

Aphria Inc (APHA.TO): Canadian Marijuana. I had put in a pending order at prior day close at C$7.60. My order was filled at C$6.40 as price gapped down on reopening (I am trading in Toronto). Disappointing to see price drop another $0.41 from there - but then this is the nature of bottom fishing. The risk in the trade is if the LATAM deal allegations are right, the problem may be endemic and other deals are also flawed. The scale of the LATAM deals are small (6.6% dilution) - the current Germany deal is much more important, for example.

Harvest One Cannabis Inc (HVT.V): Canadian Marijuana. The cannabis rout pushed all cannabis stocks lower and hit a low ball pending order I had on Harvest One in one of my portfolios.

Kohls Corporation (KSS): US Retail. I nibbled back into Kohls in the selloff last week. I added another small parcel in the selloff this week. See TIB285 for the rationale on Kohls, which is making the transition to digital better than many retailers.

Sold

Comstage DJ EuroSTOXX 50 ETF (CBSX5E.SW): I needed to raise cash to fund my cannabis purchases in one portfolio. I closed out these index holdings for 31% gain since December 2012. This gain only tells part of the story. This stock is listed in Switzerland in Swiss Francs. Since the stock was bought the Australian Dollar has dropped 31% and the British Pound has dropped 15%.

I mention those currencies as this portfolio is managed for beneficiaries who will receive proceeds in Australian Dollars and British Pounds with the funds starting in the portfolio in Swiss Francs.

Shorts

Euribor 3 Month Interest Rate Futures (IZ): Pending order to go short Euribor rates was not hit overnight as rates continue to slip lower - now implying an interest rate of 0.05% in December 2020 - 5 basis points only = crazy.

Note: This is a price chart. Price rises when rates fall.

Do not expect any help from European Central Bank this Christmas. Europe are beyond helping say the markets

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $303 (8.1% of the low). Price pushed past prior day's low and worked its way back to the $4000 resistance level and failed to hold there. We need to see price move and hold past that $4000 level to feel any conviction about a move upwards

Ethereum (ETHUSD): Price range for the day was $7 (6.7% of the low). Price action was quiet with lower volatility than Bitcoin and also not making a lower low - i.e., an inside bar day. Price is compressing into a triangle - when it breaks it will break hard.

CryptoBots

Binance Small Balances Small balances on BAT and two new Bitcoin Cash coins (SV and ABC) sold and converted to BNB - used to pay trading costs.

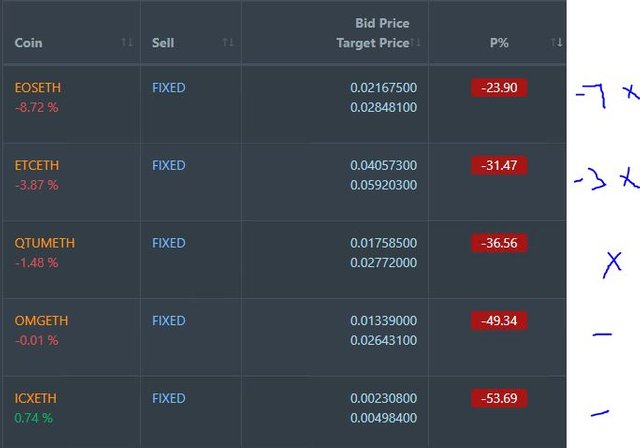

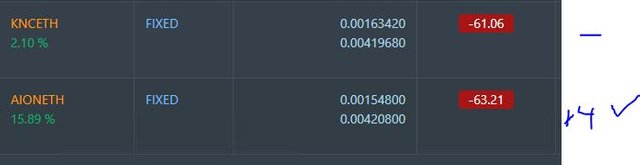

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - DASH (-71%), ETH (-73%), ZEC (-64%), AE (-28%), LTC (-53%), BTS (-63%), ICX (-86%), ADA (-76%), PPT (-84%), DGD (-87%), GAS (-88%), SNT (-66%), STRAT (-74%), NEO (-86%), ETC (-68%), QTUM (-80%), BTG (-72%), XMR (-47%), OMG (-76%).

Coins moved in a wider band of 1 to 3 points, mostly down. AE dropped 3 and STRAT rose 3. GAS (-88%) remains the worst coin and DGD (-87%) is creeping up on it.

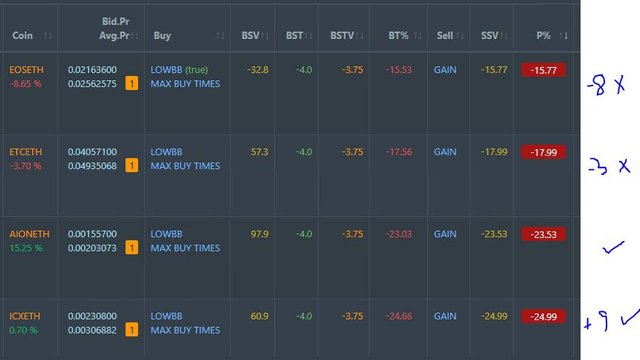

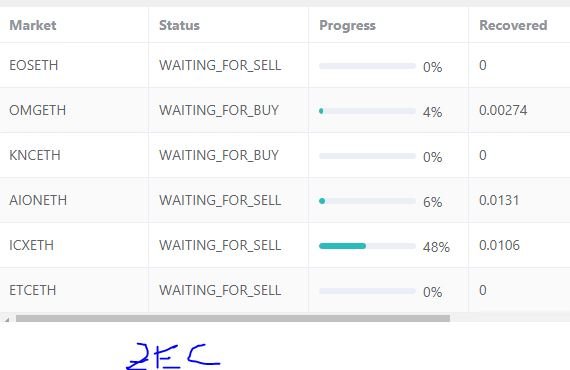

Profit Trailer Bot One closed PT Defender trade (1.20% profit) bringing the position on the account to 4.78% profit (was 4.77%) (not accounting for open trades).

Dollar Cost Average (DCA) list remains at 4 coins with EOS dropping 8 points and ICX gaining 9

Pending list drops to 7 coins with ZEC closing for profit and 1 coin improving, 3 coins trading flat and 3 worse.

PT Defender is now defending 6 coins with ZEC defence complete. ZEC remains a whitelist coin

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 3.7% (higher than prior day's 3.4%).

Outsourced MAM account Actions to Wealth closed out 3 trades for 0.31% losses for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

December 4, 2018

Cannabis related stock have the prospects of having a good run given the recent declines and the pending impactful laws in the US that could clarify the Federal government’s stance on the industry.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @carrinm! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit