US markets shrug off the fear for one day. My trade action releases funds for a Plan B Internet Marketing business venture to isolate future earnings from market conditions. Profits in Russia, US Technology, Cloud Computing, Natural Gas and losses on Coal

Portfolio News

Market Selloff

US markets started Monday as if the Armageddon news over the weekend was the new mantra

Markets like to push to test levels - it pushed S&P 500 to 2600 to see if there were sellers there. There were none and the market rebounded to end positive for the day

The market is focused now on two factors - slowing economic growth and China. The speech by Jay Powell last week has taken the heat out of the Federal Reserve risk.

The big drag in my portfolios remains Europe. Theresa May delays the Brexit vote in UK Parliament. French yellow vests protests tear down the streets of Paris, which cannot be good for French GDP. Italy drops off the headlines but it is still there as a factor.

OPEC do find some agreement to cut oil production.

The key for me is Saudi Oil Minister admits that they may have been slow to react to changing market conditions. My read is we will see a more active management process that will work to market conditions rather than scheduled OPEC meetings.

https://oilprice.com/Energy/Crude-Oil/Analysts-Output-Cuts-To-Balance-Oil-Markets-In-2019.html

Bought

Qualcomm (QCOM): US Semiconductors. There are more twists in the Qualcomm China story than twirls in Salvador Dali moustache.

A China Court rules that Apple may not sell a range of older iPhones in China because they infringe a Qualcomm patent. Not too long ago a China court refused to support Qualcomm bid for NXP. Apple can continue selling the newer phones. One of the talking heads thought that this ruling would accelerate Apple agreeing a settlement with Qualcomm on the patent dispute and this would be good for Qualcomm share price - he put a $70 target on the stock. With a closing price of $57.24, this feels worthy of a small nibble

Sold

United States Natural Gas Fund (UNG): Closed a January 2019 7/13 bull call spread for 42% profit since April 2017. Units were subject to a 1 for 4 split some time ago making the spread a 28/52 spread. These sorts of corporate actions change the liquidity dynamics for options that are still working on the old prices, mostly because investors do not understand them at face value. Normally I close out options subject to corporate actions. This one I waited for the price to recover. Natural gas prices are strongly seasonal and with the early cold weather, the price has moved strongly. Closing price was $36.52 which is well shy of the sold call strike. I did book profits on both bought and sold legs. I remain exposed to the stock.

Plan B Business

Following are four sales in one account to raise cash for some business ventures I am pursuing. The weeks of a selloff are not the best time to be making sales. I squeezed out 3 at profits, smaller than I could have achieved a few weeks back, and one loser, which I should really have sold a long time ago.

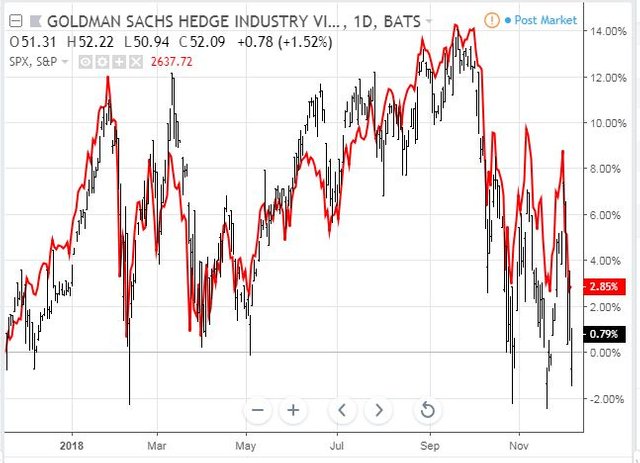

Goldman Sachs Hedge Industry VIP ETF (GVIP): US Technology. This ETF is based on Section 13 filings by hedge funds. It was outperforming the S&P 500 because of a mix of technology and other growth stocks. I closed out for 0.7% profit since November 2017. The comparative chart shows that the fund (black bars) tracked the S&P 500 (red line) quite closely with a few points where it did open up a 4% points gap.

Notable also is it sold off harder than S&P 500 in the selloffs which started in October - and ended just over 2% lower. (See TIB140 for the original rationale)

VanEck Vectors Russia ETF (RSX): Russia Index. 2% profit since August 2017. Original thesis was to invest in Russia as its market valuation was low relative to the rest of the world. It is also a big oil play. A comparative chart shows that the fund (black bars) outperformed the S&P 500 (red line) by more than 5% points until April 2018 and then dropped back finishing 4% points below.

It did however outperform Europe (orange line - SPDR Eurostoxx 50 ETF (FEU)) almost all the way. (See TIB127 for the original rationale)

Workday Inc (WDAY): Cloud Computing. 20% blended profit since September/October 2018. Workday price surged after announcing earnings. I had nibbled a few times at this to bring down entry price. (See TIB294 for the original rationale on cloud computing)

Van Eck Vectors Coal ETF (KOL): US Coal. 28% loss since August 2014. This investment is a classic example of the challenges of trading breaks. Price had been trending down solidly for a few years and had formed a bottoming formation and then broke up. Trade entry idea came from my investing coach. Price failed to hold the break and continued to make an all time low in late 2016.

Normally I would have been looking to average down with the Donald Trump election-led recovery from the 2016 Election. I did not.

Expiring Options

SPDR S&P Retail ETF (XRT): US Retail. The test trade on price moves through the Thanksgiving failed. Two sell offs, one just before Thanksgiving and one just after wipes out any chance of history playing a repeat. The test cost me the price of a dinner.

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend plus a day was $423 (13% of the low). The weekend started with steady selling with a new recent low around the $3200 level. Price did try to push back over the short term resistance level of $3600 but has not been able to hold that level.

Ethereum (ETHUSD): Price range for the weekend plus a day was $17 (21% of the low). Price tested a new recent low of $80 and worked back to the $100 resistance level and also could not hold there. A "no mans land" period between $80 and $100 would not surprise.

CryptoBots

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - DASH (-74%), ETH (-75%), ZEC (-69%), AE (-37%), LTC (-58%), BTS (-67%), ICX (-87%), ADA (-78%), PPT (-86%), DGD (-88%), GAS (-89%), SNT (-69%), STRAT (-78%), NEO (-87%), ETC (-68%), QTUM (-82%), BTG (-72%), XMR (-53%), OMG (-76%).

Coins moved in a tight band of 1 or 2 points. GAS (-89%) remains the worst coin. AE (-37%), ETC (-68%) improved a level with AE the biggest mover up.

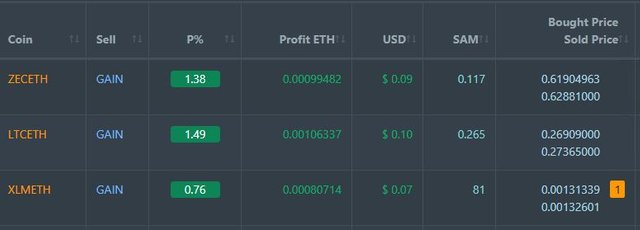

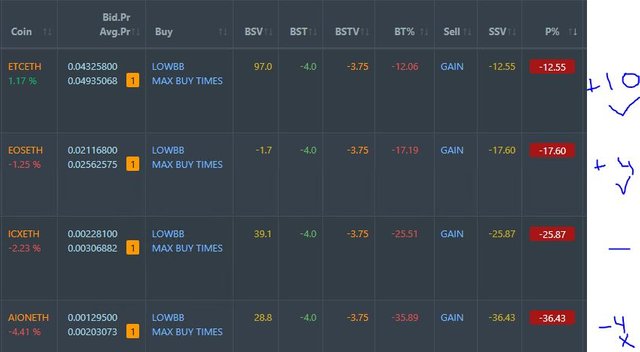

Profit Trailer Bot Three closed trades (1.21% profit) bringing the position on the account to 4.83% profit (was 4.78%) (not accounting for open trades).

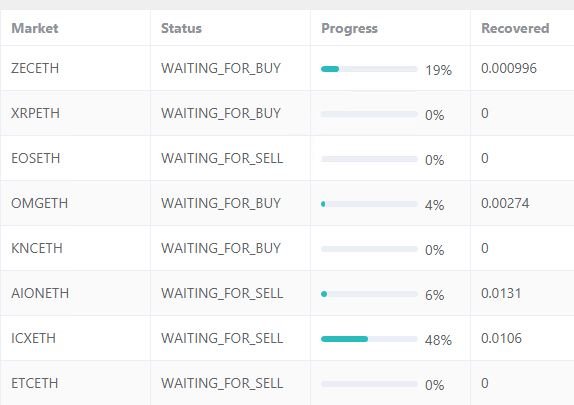

Dollar Cost Average (DCA) list stays at 4 coins with ETC biggest improver. I have been active in moving coins to PT defender when they reach 5% down (ZEC and XRP)

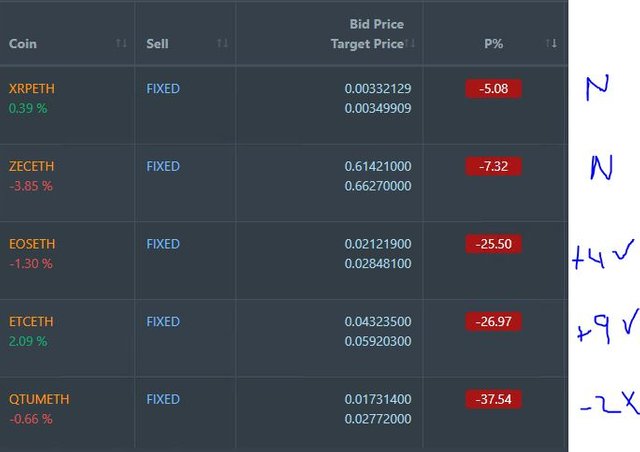

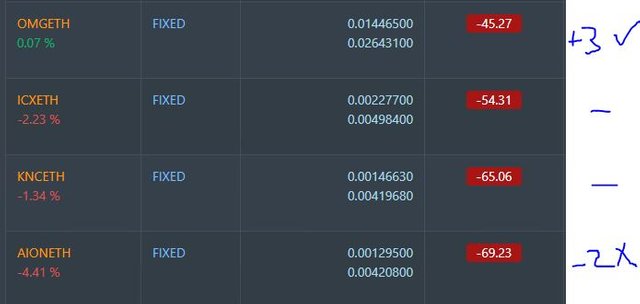

Pending list grows to 9 coins with ZEC and XRP added. ZEC has completed one round of defence. 2 coins new, 3 coins improving, 2 coins trading flat and 2 worse.

PT Defender now defending 8 coins.

New Trading Bot Trading out using Crypto Prophecy. No closed trades.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 2.6% (lower than prior 3.4%).

Outsourced MAM account Actions to Wealth closed out 4 trades for 0.10% losses for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and OilPrice.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

December 9-10, 2018

Will be interesting to see how the markets react as they start to add the opinions of earnings coming in the new year and how they position themselves as year end shifts occur in the industry.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We will see cycles of data winning and fear winning. The next data points are the Fed meeting and the ECB meeting. I have a feeling the ECB will be the problematic one. Draghi has said he would be reducing purchases but the data is starting to look a bit soft for him to act. He is not the bravest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How do you manage all your trades? How do you digest all this information...truly amazing?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I update prices every day - I go through a process of looking at winners and losers. I do that at least once during the evening too when markets are open. I watch enough markets TV to get a feel for what is happening every day - twice a day when I eat and once in the evenings before Europe opens. I am looking for big patterns and shifts.

That flow of data keeps me on top of what is moving. Writing up the journal helps a lot. Running things on a calendar works too - covered calls; options expiry, published announcements (I read them all)

For the rest I rely on remembering things.

Lately I have been opening small positions - market has not felt comfortable for big positions. That means I have a lot to track. My pension portfolio updates over 300 positions every day and another 30/40 or so European options positions which I update once a week. I am beginning to miss things = too much to track.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit