The Federal Reserve did what the market wanted and the market hated it anyway. I turn my attention to a blindspot - time to hedge in Europe. But I am staying steadfast on Europe rates

Portfolio News

Market Selloff

Markets continued their selloff despite the Federal Reserve softening its stance on 2019 hikes a little

The market is a bundle of nerves. For example, it has known for weeks about the potential for a US Government shutdown - suddenly that is the headline. The Federal Reserve did soften its stance and talked of two hikes for 2019 instead of three. The selloff took Nasdaq down further and my hedging trade has reached maximum profit . I will close this out overnight and assess a new hedge.

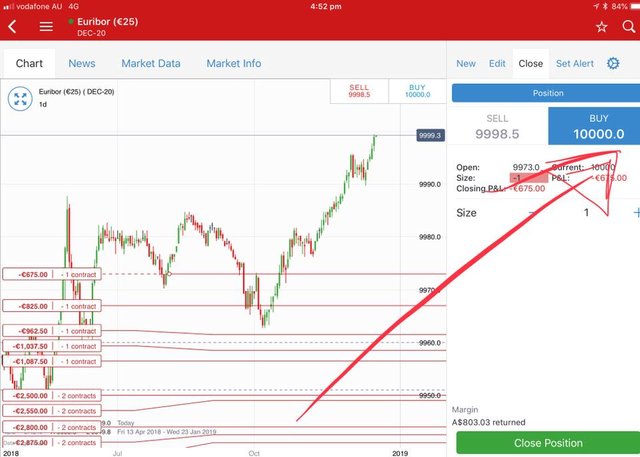

I have been watching interest rates closely especially as they are driving margin calls in my IG Markets account. Eurodollar rates have been signalling for about two weeks now that the pace of rate hikes needed to slow with price dropping a full 25 basis points in the last 10 days = one rate hike less. Europe rates have moved even more

What is behind this?

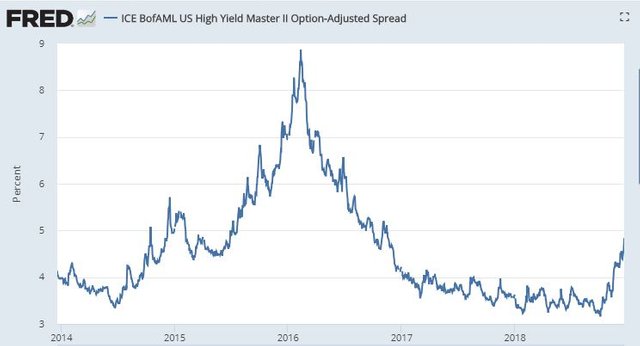

It has been a while since I shared the US Risk Index chart of spreads against high yield debt. It certainly has broken out of the low range it has been in though it has a long way to go to reach the 2016 highs. I am going to guess that this move has been driven by the falling oil price putting pressure on highly leveraged US shale oil operators.

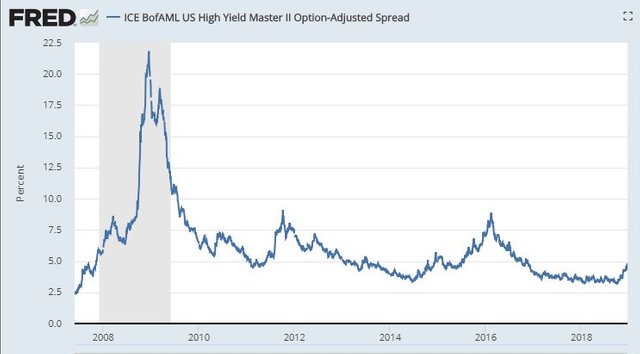

The Risk Index chart is a measure of credit markets views - it is certainly tightening BUT it is a long way from what we saw in 2007 or even in the 2015 flash crash. Here is the longer view.

https://fred.stlouisfed.org/series/BAMLH0A0HYM2?cid=32297

This headline caught my eye

What is becoming clear is the Federal Reserve can push too far. It did step one rate hike back from that. The article says the bigger problem is in Europe

slightest external shock will push Italy over the edge at this point.

There are big problems in European debt markets with spreads rocketing compounded with European Central Bank (ECB) reducing its bond purchases (they are allowed to buy corporate debt). This next chart shows December 2020 Euribor prices which are factoring in zero interest rates two years from now.

What seems clear to me is ECB has made two cardinal mistakes.

- They continued easing long after they should have stopped.

- They started tightening last week into the teeth of a gale.

Sold

MacMahon Holdings (MAH.AX): Australian Mining Services. Trade hit its stop loss for a 15% loss since October 2018. The selloff takes no prisoners. The original idea came from my research house. I closed out the initial trade for a profit (they closed for a loss) and then re-entered. Overall my combined trades lost 2.8%.

Shorts

Vanguard FTSE Europe ETF (VGK): Europe Index. I have been putting hedge trades using put spreads on US indices for some weeks now. This has been something of a blind spot because I have large exposures to Europe - maybe I should have put hedges on there too. Well today I took action and bought put spreads on this US listed Europe ETF. With a closing price of $48.45 I bought a March 2019 48/44 bear put spread (as far out in time as one can go). With a net premium of $1.06 maximum profit potential is 279% if price drops 10.1% to reach the sold strike.

Let's look at the chart which shows the bought put (48) and breakeven as red rays and the sold put (44) as a blue ray with the expiry date the dotted green line on the right margin.

Price has to reach the Q3 2017 lows to make 100% and maximum profit is above the 2017 low.

Bear Put Spread [Means: Bought strike 48 put options and sold strike 44 put options with the same expiry. A put option is the right to sell a stock at the set strike price]

Eurodollar 3 Month Interest Rate Futures (GEZ): US Interest Rates. With the Federal Reserve changing its assesment for 2019 rate hikes, I closed out the two open short contracts on Eurodollar for 9 and 16 basis points losses respectively.

Euribor 3 Month Interest Rate Futures (IZ): Europe Interest Rates. I find it hard to believe that European interest rates will remain at zero for the next two years unless Europe heads into a deep recession and the ECB start massive money printing again (which is totally possible). I added one more short contract when price hit that zero interest rate

Note: this is a price chart. 100 is zero interest rate (shown as 10000 on this platform). Price rises when rates fall.

Cryptocurency

Bitcoin (BTCUSD): Price range for the two days was $530 (14.5% of the low). Price tried to reject the $4000 level in Wednesday trading but pushed its way through on Thursday to test and close above the resistance level at $4037 (that level is from September 2017).

Ethereum (ETHUSD): Price range for the two days was $19 (19% of the low). Price pushed away from the support level and tested back before advancing well into the middle of "no mans land".

Do not be surprised to see price test back somewhere towards $100 again. We would need to see that as a higher low to have any confidence about trying to break through the next level at $132.

CryptoBots

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - DASH (-69%), ETH (-73%), ZEC (-70%), AE (-43%), LTC (-53%), BTS (-68%), ICX (-86%), ADA (-76%), PPT (-85%), DGD (-87%), GAS (-89%), SNT (-69%), STRAT (-58%), NEO (-87%), ETC (-68%), QTUM (-78%), BTG (-72%), XMR (-51%), OMG (-74%).

Coins moved in a band of 1 to 3 points, mostly up. GAS (-89%) remains the worst coin. DASH (-69%) improved one level and STRAT (-58%) improved two with its launch on Microsoft Azure marketplace. Stratis develops blockchain applications for the .NET framework which is part of Microsoft.

https://cointelegraph.com/press-releases/stratis-now-available-in-the-microsoft-azure-marketplace

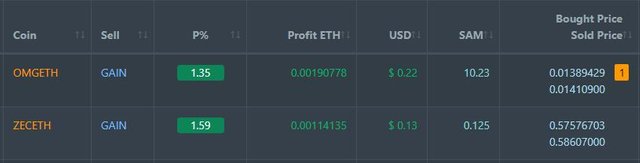

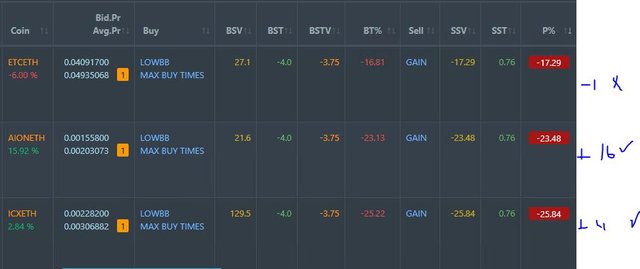

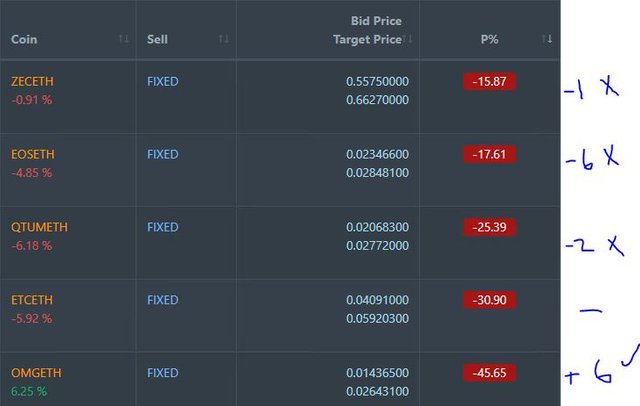

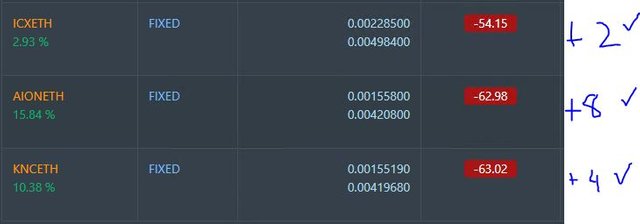

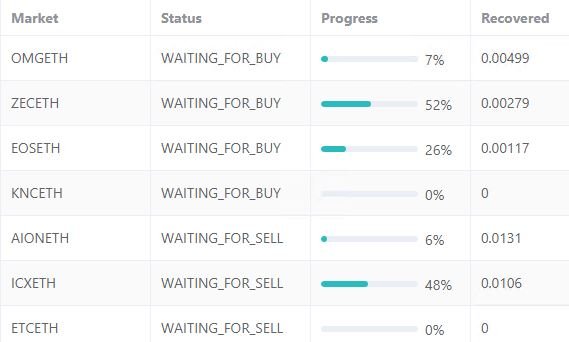

Profit Trailer Bot Two closed trades (1.47% profit) bringing the position on the account to 4.99% profit (was 4.94%) (not accounting for open trades).

Dollar Cost Average (DCA) list drops to 3 coins with OMG moving off and onto profit after one level of DCA. I did move XRP to PT Defender duties (it had come onto this list overnight)

Pending list remains at 8 coins with 4 coins improving, 1 coin trading flat and 3 worse. XRP will join this list.

PT Defender continues defending 7 coins and completed one defence trade on OMG. I will add XRP to defence duties.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Forex Robot closed 4 trades (0.13% profit) and is trading at a negative equity level of 1.9% (lower than prior 3.1%). Swap cost is now 33% of the floating loss.

Outsourced MAM account Actions to Wealth closed out 12 trades for 0.43% profits for the two days. All open trades were closed at profits.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Risk Index chart comes from St Louis Federal Reserve. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

December 19-20, 2018

The next catalyst will be earnings coming up in a few weeks so it will be interesting to see how traders position themselves on preparation for the reports. Many may be headed to the sidelines for now which is leading for more exaggerated movements in price action these days.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit