US markets ignore Brexit and focus on US data. Trade action is all around expiring options - profits in Brazil and looking for more time in Russia and US telecoms.

Portfolio News

Market Rally

US Markets shake off the Monday blues and move ahead on the back of Netflix price increases

Markets are a lot easier to follow when they focus in on data as earnings season gears up.

I did catch the edge of the speech by Mario Draghi, who absolutely epitomizes Europe Muddles.

I just find that he waffles around a point and never says what he really thinks and what is driving his thinking. He tells us the European economy is slowing but is not heading to recession. Then he says this

A significant amount of monetary-policy stimulus is still needed to support the further buildup of domestic price pressures and headline inflation.

Well, well. The use of that word significant is a big deal for a European Central Bank that has started to reduce its monetary support just last month. The whole sentence is confusing. The whole message is just muddled - make up your own mind.

Brexit Bumbles

Brexit vote goes against the UK government in a record defeat

A quick look at what US markets made of all of that noise.

Most investors did not think this would pass. They had it worked out. Markets are not giving clues about which direction it is going to head.

says Bob Pisani of CNBC - I lost the video link

I did watch a Bloomberg interview with Danny Blanchflower, a Dartmouth professor and former Bank of England governor. His views were clear. If you do stupid things, the market will straighten you out was one gem. The more telling part of the conversation was his advice to the UK government. You failed because you tried to bullshit the EU (my words). Get real was his advice. Watch the interview.

I was watching currency markets ahead of the vote. I am short the Swiss Franc in a spot position and I have put options short the Euro. They certainly spiked - in my favour - before the vote. So I let them ride.

Let's look at a few charts to see if Danny Blanchflower is right about markets straightening stupid things out. First chart is a one hour chart of the British Pound against the US Dollar.

It certainly fell over during the day but then recovered as the sellers covered their shorts. I know in my own case that the GBPAUD ended up in exactly the same place as my trade from the day before when I sold pounds. The next chart goes back in time to include Brexit referendum day.

Markets certainly expressed their view of the Brexit decision in June 2016. Before and after swing from stable state to stable state was 13% down in June 2016 and then 18% by October 2016. The June lows are pretty well where markets have placed the British Pound again. The markets set the level and decided that all the things that were done in the next two were years were exactly what Danny said = stupid and a waste of time.

Get real and work on what is best for Britain. Two years of time completely wasted says the markets.

What is next for Britain Bumbles. The opposition filed a vote of no confidence. The government will probably win that and hold off the risk of another general election. More importantly, the government has only 3 days to present an alternative to Parliament which means they will have to work across the house to shape something that has a chance of passing.

After that there are a range of possibilities - it is almost certain that the EU will extend the deadline beyond the 73 days left to run. Rather than cover them all here read the options here - I will stay focused in on the next 3 days and the chances that Theresa May does get real.

https://theconversation.com/brexit-what-are-theresa-mays-options-for-a-plan-b-109749

Bought

QBE Insurance (QBE.AX): Australian/US Insurance. I was checking one of my accounts and found I had received a small parcel of shares as part of a dividend purchase plan after I had sold the stock holding. The parcel is too small to sell and cover trading costs. So I bought a parcel of shares to round up to a marketable parcel. Chart certainly looks like a textbook bounce off a long held support level

Expiring Options

Petróleo Brasileiro S.A (PBR): Brazil Oil Producer. Closed 2 contracts on strike 12 call options for 31% profit since December 2016. I remain exposed through the stock and a 12/20 bull call spread expiring this week. I will sell the bought calls before expiry as I do not wish to take delivery of the stock. As I am holding the stock, I can let the sold calls run to expiry. Once these sold calls are cleared, I will be able to add Petrobras to covered call writing.

A quick update on the chart which shows the 12 strike calls bought in December 2016.

There are some options investing lessons in here.

- Time is important - this trade has ridden out two full cycles (high to high to high) and is in its third

- Initial entry (start of the blue ray) looks like a momentum trade (though it is only the third wave up from the lows)

- There may have been an exit opportunity when price did not reach the highs after the truck strike correction completed.

There is another factor lurking in this chart. The price correction started with the drop in the oil price and yet price has been rising. The chart overlays a US oil producer ETF (XOP- orange line) which shows a divergence in performance. Petrobras earns in dollars but pays its bills in Brazilian currency - this trade is also a short Brazilian Real trade

VanEck Vectors Russia ETF (RSX): Russia Index. I am holding 19/25 bull call spread against a closing price of $20.05. Unlike Petrobras, the trade is currently not profitable with breakeven at $20.76. I closed out the strike 19 calls and rolled to February 2019 strike 20 calls recovering $0.48 of the premium. This pushes breakeven to $21.28. I will leave the sold calls (25) to run to expiry

Quick update on the chart of the expiring trade.

Price did run to the blue arrow scenario but did not make the maximum profit potential (and then the oil price fell over. Russia is an oil play). The pink ray is the new breakeven point and the expiry date has moved out one month. That level is within the highs seen in the last 6 weeks.

Income Trades

Sprint Corporation (S): US Telecom. Bought back the calls sold at too low a strike price for a $0.04 net premium loss (23%). Over the last 4 weeks price has been well ahead of the 6 strike and pulled back to $6.11. I am comfortable holding the stock and will write covered calls next month again to recover the loss.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $153 (4.1% of the high). Price could not really decide what to do - so it did nothing and formed an inside bar.

Well that is what it looks like on a daily chart. On a one hour chart, we do see steady drift sideways and down and then a collapse late in the day.

Ethereum (ETHUSD): Price range for the day was $14 (10.8% of the high). Price too made an inside bar. The good news is it did hold above the prior day low which I wrote about yesterday. Do that again and price could have a run at clearing resistance at $132. Otherwise do not be surprised to see a visit to $112 (yellow ray) or $100

CryptoBots

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - DASH (-74%), ETH (-68%), ZEC (-72%), AE (-38%), LTC (-49%), BTS (-68%), ICX (-87%), ADA (-70%), PPT (-86%), DGD (-86%), GAS (-89%), SNT (-62%), STRAT (-67%), NEO (-84%), ETC (-67%), QTUM (-77%), BTG (-72%), XMR (-54%), OMG (-78%).

Coins moved in a tight band of 1 or 2 points, mostly down. Only two risers: AE rose 6 and STRAT 4. GAS (-89%) drifts lower and remains the worst coin. AE (-38%) and STRAT (-67%) rose a level.

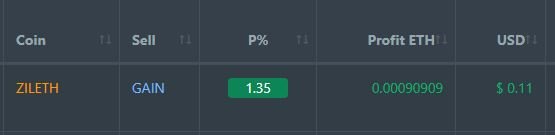

Profit Trailer Bot One closed trade (1.35% profit) bringing the position on the account to 5.36% profit (was 5.34%) (not accounting for open trades).

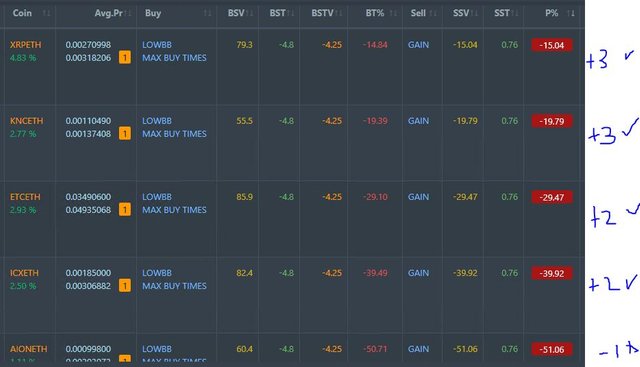

Dollar Cost Average (DCA) list remains at 5 coins with 4 coins improving and one lower

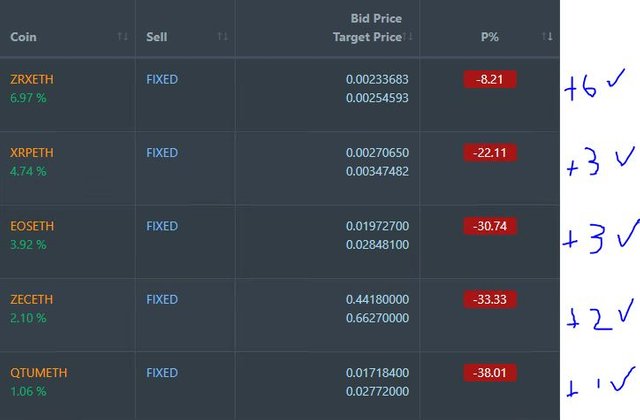

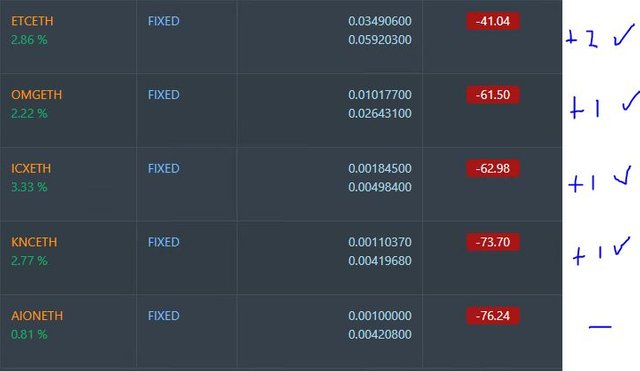

Pending list remains at 10 coins with 9 coins improving, 1 coin trading flat and none worse.

PT Defender continues defending 9 coins. No change.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

January 15, 2019

Insurance has been a tough sector given rhe volatility of results due to catastrophic event exposures like those that are modeled like Hurricanes and especially those that are not like the wildfires. While it could lead to pricing power, margin is compressed in the short term.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interestingly the insurance stocks have been the ones holding up in the selloff in my portfolios. Specifically interesting is the performance of Swiss Re and Munich Re who carry a massive slice of the world's reinsurance risk. They are holding up - which means the catastrophe numbers are priced in and/or they have been able to jack up premiums well enough.

Even more surprising is how my Italian insurance stocks (other than Generali) are still positive.

QBE is a general insurer and is well diversified across geographies. What I like is they are an Australian Dollar hedge as a large slice of income is in US Dollar.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The longer Brexit goes on, the more likely England isn't leaving the EU.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That may be the game the politicians are trying to play, especially on the EU side. They do not want UK to leave but they are playing a hard game to make leaving expensive.

My gut tells me that a 2nd referendum will remove the doubt. 52% of Britons who voted want to be out. Next time they will be more assertive.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @carrinm! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit