Time to bail out of short interest rates in US and add another bow to the marijuana trade. A bit of a rant about Europe.

Portfolio News

Market Rally

US Markets continued to rise on the back of solid earnings and a rising oil price.

What the market was really about was the Federal Reserve changing tack. Commentators are split as to whether they chickened out or whether they made the right change. They still have a massive balance sheet to unwind - time might be running out. The China - US trade discussions continue with the China delegation scheduled to meet with Donald Trump. He will reiterate what he said publicly today - "no deal, the tariffs go to 25% on March 1".

US Steel results mirror what is happening across steel and aluminium in the US. The tariffs were designed to protect US suppliers - they did not work as they impacted customer demand more.

Europe Muddles

This headline caught my eye.

Someone may have come onto my view of Mario Draghi - muddler in chief. Or is he?

Last week, Draghi had to acknowledge that the risks to the currency union’s economy had shifted to the downside.

Maybe the problem is not Draghi but European politicians. They have been brow beaten by the stronger economies (France and Germany) to keep a lid on fiscal policy. That has left everyone relying on Draghi to pull the rabbit out of the "monetary hat"

The euro zone needs to rely less on monetary policy and more on other sources of growth. Fiscal policy should be used much more smartly.

Italy continues its muddling ways and heads into recession - brow beaten indeed.

EU negotiators play hard ball on Brexit negotiations and raise the risk of pushing the UK into recession and making a further massive dent in financial services profitability - already reeling under negative interest rates. Maybe they do not understand or they do not care as long as Germany and France are OK

And a chart to end the rant - Euribor December 2020 interest rates reach for the lowest rate since they were listed = a negative 10 basis points rate in just under two years from now. Note: this is a price chart - price rises when rates fall.

Cannabis Carnival

Aphria (APHA.TO) stock jumped over C$11 today as Green Growth indicated they would be open to increasing their bid.

Price reached the level of their early hostile offer and well ahead of the formal offer. I am holding on as I am sure this will produce a bidding war when a new bidder comes along

Bought

Namaste Technologies Inc (N.V): Canadian Marijuana. My news headline search yesterday unearthed this stock. Namaste heralds itself as the most comprehensive online marketplace for cannabis product and accessories in the world. The article was about their shift to being more than an accessories retailer to a supplier of product. What I like is they have been focused on the value added side of the industry and are operating in countries where use is legalized.

The price chart has features I like. Price has been knocked back from hype highs, has broken the downtrend and is now retesting off a support level

Biggest risk in the trade is that they try to expand too wide and run out of cash.

My view on the sector has been to spread my investments - this is just such a move. How does it compare to other Canadian stocks? The next chart compares it to a selection.

Namaste (black bars) has outperformed Aphria (APHA.TO - red line), Harvest One (HVT.V - orange line) and Aurora Cannabis (ACB.TO - green line) and lags behind Canopy Growth (WEED.TO - yellow line)

Note: I did squeeze the chart in to start once Namaste had started to get share price traction in late 2017. All stocks are listed in Canada = all in Canadian Dollars.

Shorts

Eurodollar 3 Month Interest Rates Futures (GEZ): US Interest Rates. Federal Reserve action this week has reduced the expectations for the number of rate hikes. 10 year yield dropped 5 basis points to 2.63% - looks like two rate hikes less. Closed two short December 2020 futures contracts for 35 basis points profit since June 2017

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $82 (2.4% of the low). Price did make a move up to get closer to the resistance level at $3500 - this is a little encouraging.

Ethereum (ETHUSD): Price range for the day was $6 (6% of the low). price edged higher to test the short term resistance at $112 (yellow ray) mirroring Bitcoin move but a bit stronger.

CryptoBots

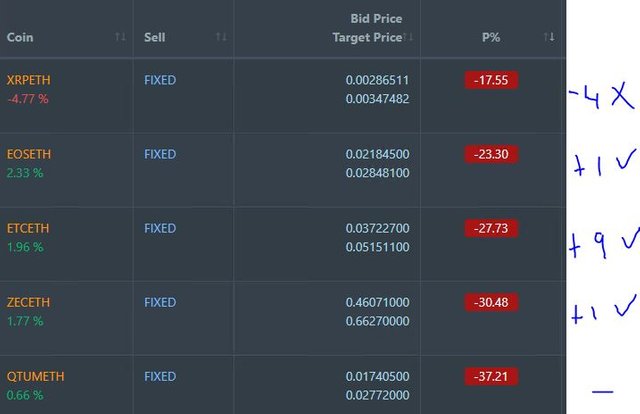

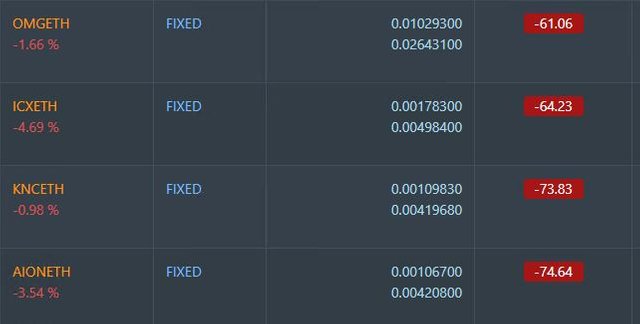

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - DASH (-74%), ETH (-70%), ZEC (-73%), AE (-41%), LTC (-45%), BTS (-66%), ICX (-88%), ADA (-72%), PPT (-87%), DGD (-86%), GAS (-89%), SNT (-62%), STRAT (-74%), NEO (-85%), ETC (-68%), QTUM (-78%), BTG (-72%), XMR (-54%), OMG (-80%).

Coins moved in a tight band of 1 or 2 points, mostly down. GAS (-89%) remains the worst coin. ETH (-70%) and OMG (-80%) dropped a level

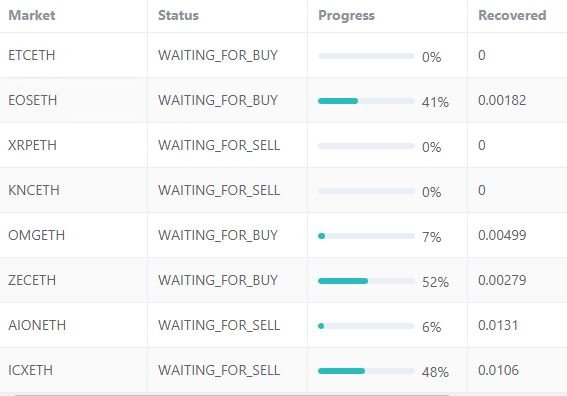

Profit Trailer Bot No closed trades.

Dollar Cost Average (DCA) list remains at 5 coins with ZIL moving on and ETC coming off. ETC trade was restructured in PT Defender after the defence was cancelled at exchange level.

Pending list remains at 9 coins with 3 coins improving, 2 coins trading flat and 4 worse. ETC pending trade was changed after being fixed in PT Defender with a new average price.

PT Defender continues defending 8 coins. I fixed the ETC trade.

New Trading Bot Trading out using Crypto Prophecy. No closed trades. Added a DCA trade on FUEL based on the RSI Stochastic indicator reversing in oversold territory

Currency Trades

Outsourced MAM account Actions to Wealth closed out 1 trade for 0.06% profits for the day. All trades closed

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and Bloomberg.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

January 31, 2019

Heading to UK/ Europe in April what are your thoughts on the AUD vs GBP / EUR ? Do you think we should covert some cash now or hold off?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My view is AUD will continue to slide against USD especially as global growth slows. Anybody's guess as to what EUR and GBP will do as it hinges on what comes out of Brexit. Europe growth story is looking a bit measly. EURGBP has been in a 5% band for 18 months. GBPAUD is above the Brexit lows - that suggests to me to buy your Pounds now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your insight. Yes it will be interesting to be in the UK a few days after Brexit. Not looking forward to the customs line.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am going in late June - time to cycle end to end. I do not have the line problem.

Methinks EU will postpone the date

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The Euro experiments continues to demonstrate how difficult monetary policy is to execute with the lack of fiscal policy to support it. Tool will remain limited as global growth slows.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit