US Markets are looking a little toppy say all the talking heads. Time to look to the short side ahead of this week's earnings. Continuing the process of unwinding US Dollar strength trades but not giving up on Europe interest rates just yet.

Portfolio News

Market Rally

US markets continue to move ahead driven this time by technology stocks.

The changed tune from the Federal Reserve has had a major impact on sentiment. Now the markets have only to look to China - more stimulus from there and a trade deal and the bulls will keep running. They might have to wait until after the Chinese New Year holiday ends.

Cannabis Carnival

The carnival continues with Aphria passing through C$14, now well ahead of the bid offer from Green Growth. Part of that price move may just reflect sector moves for the day as the Green Growth offer is a stock offer which will also move up with the sector.

The big question then becomes when to sell? The whole industry is in a state of flux and there is a lot of misinformation going around. Example: a short selling attack on Aphria based on information pertaining to their LATAM operations led to an announcement that CEO and company co-founder would both step down from executive positions (Jan 11). They are still working and have not been replaced yet and their profile information is still on the website.

https://windsorstar.com/news/local-news/aphria-ceo-and-company-co-founder-to-step-down

My thought is there is a bidding war going to break out - might just wait for that. But then this comes along.

Namaste Technologies (N.V) fires its CEO on securities fraud allegations.

It seems that CEO, Sean Dillinger, may have transacted some self dealing transactions as the business has been buying stuff all around the world. The press release says the company will conduct a strategic review including selling.

The murky business in the two cases not surprisingly has a common thread - a short seller in both cases breaks some dodgy deals news.

I might well be taking some of the profits from one and adding to my small parcel in the other.

Shorts

A few trade ideas from CNBC Options Action for the week's earnings announcements. I followed them up because the week before they made a really good trade on Amazon - which I did not pursue.

Chipotle Mexican Grill, Inc (CMG): US Fast Food. Stock has moved ahead strongly year to date (+42%) since the December selloff and is trading at around 50 times earnings. Bought March 2019 500/450 bear put spread with a view to price correcting through earnings. With a net premium of $9.28 maximum profit potential is 438% if price drops 27% on earnings. This may seem a bit far fetched but there have been stocks that have dropped as much on poor earnings.

A quick look at the chart which shows the bought put (500) as a red ray and the sold put (450) as a blue ray with the expiry date the dotted green line on the right margin.

It also shows that price has risen 42% since the selloff. The maximum profit line is just beyond half of what price has risen - disappointing earnings could readily push price back to that halfway mark. Maybe a better put to sell would have been 475 strike.

Expedia Group, Inc (EXPE): Travel. 50% of Expedia revenues are outside the US which makes them more exposed to slowing global growth and a stronger US Dollar. Bought March 2019 120/95 bear put spread with a net premium of $4.57 offering maximum profit potential is 447% if price drops 30% on earnings.

A quick look at the chart which shows the bought put (120) and 100% profit as red rays and the sold put (95) as a blue ray with the expiry date the dotted green line on the right margin.

There have been two bad earnings surprises in the last 2 years, each big enough to take this trade to maximum profit (the blue arrows). That said, the last 3 earnings reports have seen the stock rise. (Earnings marked E)

Alphabet Inc (GOOGL): Global Search. Technical set up is starting to deteriorate with price breaking the long run uptrend and forming a head and shoulders formation. The right shoulder has not reversed yet - time will tell.

View is there is more risk than reward similar to what we have already seen in Amazon or Facebook or Microsoft. The talking heads were not expecting a sharp move on earnings - a modest move in line with past moves. So the trade setup is a calendar put spread, selling a Feb 2019 1100 put option and buying an April 2019 1100 put.

What we are looking for is price to hold above $1100 on earnings until expiry on Feb 15 (which it did in after hours trading dropping from $1141 to $1107) and then drift lower into April expiry. If it works out that way the April puts are bought with a nice discount - a net $19.12 (1.7% of close) vs $31.37 (2.7% of close). That 1100 level before February 15 is key - drops below that and one has to buy the stock or buy back the sold put. The longer term view is to be open to the downside below 1100

https://www.cnbc.com/video/2019/02/01/alphabet-is-about-to-report-earnings-heres-what-to-expect.html

Euribor 3 Month Interest Rate Futures (IZ): Europe Interest Rates. I have been watching the price chart move strongly upwards. I entered another short contract on a price reversal on a daily chart.

Cryptocurency

Bitcoin (BTCUSD): Price range for the 4 days was $121 (3.6% of the low). Price traded stubbornly below the bottom of the short term trading range, not once sticking its head into the range.

All I can see is a desire to move lower

Ethereum (ETHUSD): Price range for the 4 days was $8 (7.8% of the low). Price did push up towards the short term resistance level (yellow ray) but chose to stay shy of it.

CryptoBots

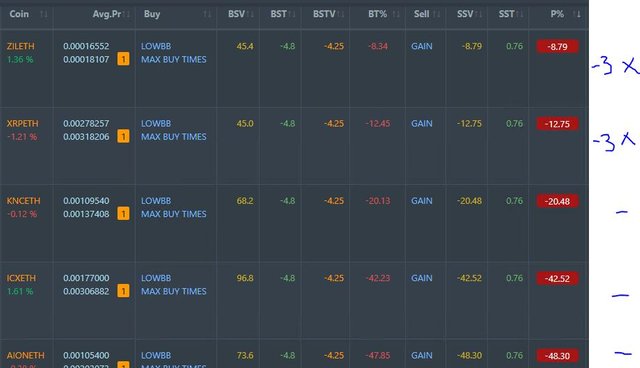

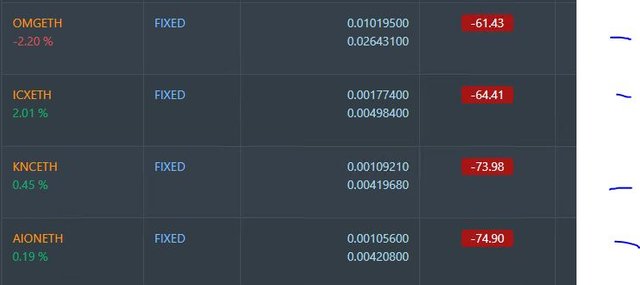

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - DASH (-74%), ETH (-70%), ZEC (-73%), AE (-41%), LTC (-42%), BTS (-66%), ICX (-88%), ADA (-72%), PPT (-87%), DGD (-86%), GAS (-89%), SNT (-62%), STRAT (-74%), NEO (-85%), ETC (-69%), QTUM (-78%), BTG (-72%), XMR (-54%), OMG (-80%).

Coins moved in a tight band of 1 or 2 points, mostly down. LTC rose 3. GAS (-89%) remains the worst coin.

The one year membership has come to an end. I will not be renewing and I will not be promoting this. Lessons: Bot requires 15 coins. My whitelist trading does not extend to 15 coins (it has less than 10). One has to trade with stop losses to cover big price corrections. I got caught out. Plan of action: close down the bots and consolidate the coins into whitelist coins.

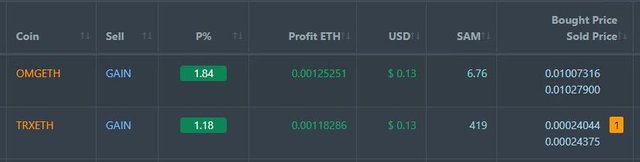

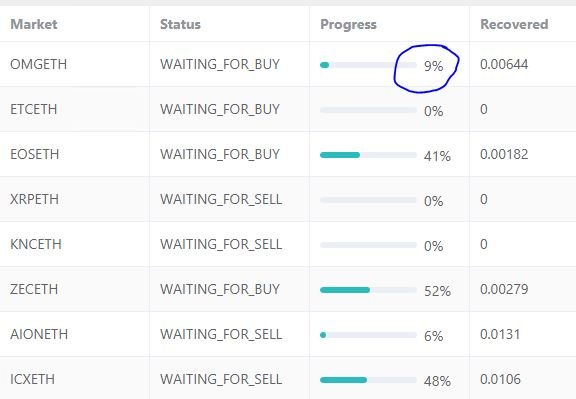

Profit Trailer Bot Two closed trades (1.51% profit) bringing the position on the account to 5.64% profit (was 5.59%) (not accounting for open trades).

Dollar Cost Average (DCA) list remains at 5 coins with 2 coins trading worse and 3 flat.

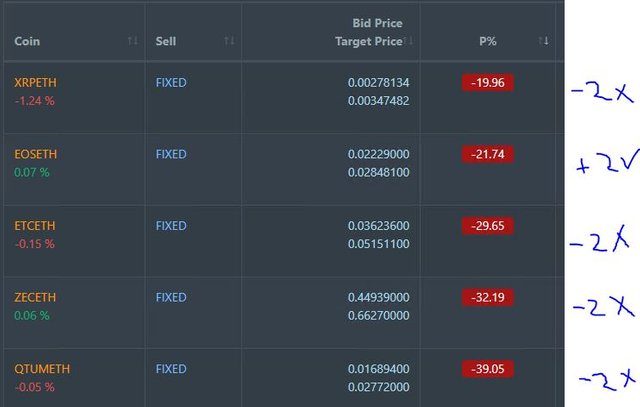

Pending list remains at 9 coins with 1 coin improving, 4 coins trading flat and 4 worse.

PT Defender continues defending 8 coins. It did complete one defence sale on OMG.

Now that the Outsourced Bot has reached the end of its life, I am going to restructure all the bot trading to get back to basic principles.

- Trade a whitelist of about 8 to 10 coins only

- Run a 7.5% stop loss strategy

- Run one level of DCA.

To do this I will close all open positions that are not whitelist coins and/or are below 7.5% down = start with a clean slate.

New Trading Bot Trading out using Crypto Prophecy. DCA trade on FUEL closed (1.86% profit). Trades remain open on FUEL, SC, VET, XLM. These too will be consolidated.

Currency Trades

Swiss Franc (USDCHF): I have been holding a spot Swiss Franc position since options expiry in early January. During the week I elected to put a stop loss and take profit on the trade because my Swiss Franc stock holdings are smaller than the spot position. The trade hit the take profit target yielding a 0.08% profit (1.9% on the spot position itself)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

February 1-4, 2019

My concern is the inconsistency of the Fee and the data. They came in particularly dovish last week despite probably already knowing the 300k print on employment so why the mismatch, right? What data points are they seeing in actuals that leads to concern? Unless they are pricing in the risks like the ongoing trade war, why reverse course so sudden; it make me feel like they are the ones being lead with a collar.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Jerome Powell is a man of markets. This is his collar.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Correction: EXPE trade was April 2019 expiry (not March)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit