Markets are looking for direction. For me, an exit from US Retail and profits on TV streaming and network giant, Cisco. Brexit bumbles may have turned the corner and I am buying back into Germany.

Portfolio News

Market Rally

US markets are moving without much conviction for a couple of days

The headlines tell it all. We all thought the Fed and China were in the realm of the more certain or maybe only less uncertain. Investors are waiting on the trade discussions - idiotic press conference with Donald Trump arguing with his team about what a memorandum of understanding is did not help. Lighthizer now uses the term trade agreement. Jerome Powell undid last week's work in front of Congress, this time about the pace of unwinding of the Fed's balance sheet. Investors got worried that the Fed may be playing to the market's tune too much = exactly what they cheered them doing last week. And then there is company specific news from Home Depot (HD). It reminded investors that the US housing market is not doing that well.

Brexit Bumbles

Big market move of the day came from the Brexit news - plan C

Theresa May presented a timetable of votes to UK Parliament

- March 12 - vote on the revised deal - not passed then

- March 13 - vote on a no deal exit - not passed then

- March 14 - Vote on a delay to Brexit

It seems the EU are prepared to run with quite a long delay. I must say I would be voting the last two votes the other way around. Vote for the delay and then worry about NO DEAL later. Market impact was instant with British Pound jumping 1.2% from open to close against US Dollar

Air France KLM

Dutch government announces a 13% stake in Air France KLM to match that held by French Government.

Share price jumps 5.4% on the day and takes Air France ahead (YTD) of its main European rivals, Lufthansa (LHA.DE - orange line) and British Airways (IAG.MC - blue line). Note: Used Madrid listing for British Airways = all in Euros

I am holding the stock in one portfolio and a 9.6/14 bull call spread. The option contract passes 100% profit and I have doubts that it can go much further given European growth challenges.

Other Stuff: The Affiliate Oracle

Spent most of weekend and Monday preparing for launch of a new Affiliate Marketing product from my friend, Adam Payne. Hence two days updates in one. See the review video here

Adam is a good trainer and his materials will get you upand going and focused in affiliate marketing. Grab your copy here https://mymark.mx/Oracle

Bought

iShares MSCI Germany ETF (EWG): Germany Index. Talking heads are beginning to talk about the possibilities of a China trade deal re-igniting growth. One of the big beneficiaries could be Germany whose shares have not recovered as much year to date as US or China.

The chart plots Germany (EWG - black bars) against S&P500 (red line) and Vanguard Europe ETF (VGK - blue line) over the last 12 months. Germany has lagged off the lows - if that growth does come back Germany will close the gap faster than Europe. Dividend yield is 2.77%

Sold

Westinghouse Air Brake Technologies (WAB): US Industrials. Received stock as part of a spin off from General Electric - fractional shares sold.

SPDR S&P Retail ETF (XRT): US Retail. Shares bought when everyone thought US Retail was dead. Watched a segment of CNBC Options Action on the weekend - they charted the relative performance of XRT with S&P500 - the technicals do not look good and many of the retailers reporting this week. Time to bank a profit and exit for 12% profit since July 2017.

Also closed out a January 2020 44/55 bull call spread for 2.5% loss since December 2017. Overall profits on the options series since July 2017 was 119%.

Roku, Inc (ROKU): TV Streaming. Got that earnings call right and closed out March 2019 strike 52 call options for 209% profit since Thursday. I left in place the strike 50 puts (red ray) and I will let them run to expiry. The updated chart shows that this may have been an impatient exit as there is plenty of upside - I am wary of a selloff in the next two weeks to expiry but I am happy to buy the stock back at $50 if it drops that far.

Cisco Systems, Inc (CSCO): US technology. Share price has closed above $50 for a few days closing at $51.18, I closed out January 2020 40/50 bull call spread as it has passed maximum profit for 213% profit since December 2017. I remain exposed short to March expiry strike 48 put options - happy to buy back at $48 if price drops that far.

The updated chart shows price passing the maximum profit line (red ray) and holding there. I remain exposed in another portfolio with January 2020 strike 45 call options (pink rays). Price trajectory, which is steeper than the pink price scenario, indicates that those could well make 100% profit.

Expiring Futures

Corn Futures (CORN): Corm price has been very volatile through the China trade discussions and through the poor US winter weather. Futures expiry crept up on me when I was not paying attention. I had added two new contracts in the week before expiry = not clever.

4 contracts rolled up automatically locking in average loss per contract of $9.57 (2.5%). The last day of trading looks weird. I bought a contract on last day at $375 - it was closed out at $365 and rolled up at $376 which is way out the normal spread. Weird and disappointing to give away $480 through not paying attention.

Income Trades

The Kraft Heinz Company (KHC): US Packaged Food. Sold March 2019 strike 40 calls for 1.43% premium (1.43% to purchase price). Closing price $34.95 (new trade). Price needs to move another 14.4% to reach the sold strike (new trade). Should price pass the sold strike I book a 14% capital gain. I bought this stock after the selloff. Selloff drove a spike in implied volatility and here was a bonus 1.43% for the taking.

Cryptocurency

Bitcoin (BTCUSD): Price range for the two days was $129 (3.4% of the low). Pump and dump over, price made two inside bars in a row just above the short term support line (new blue ray).

It would be nice to see this as a foundation for the next consolidation in a narrower band than last time (purple channel)

Ethereum (ETHUSD): Price range for the two days was $10 (7.6% of the low). Price also made two inside bars firmly off the longer term support line at $132. This level comes from way back in July 2017.

CryptoBots

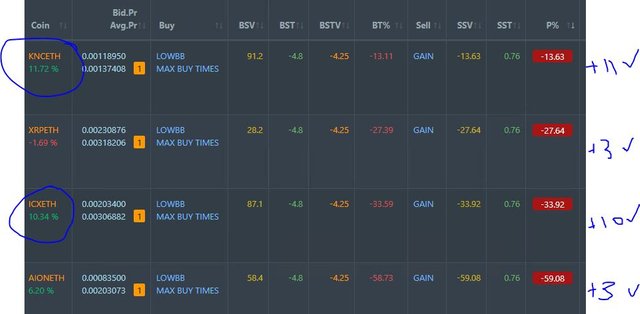

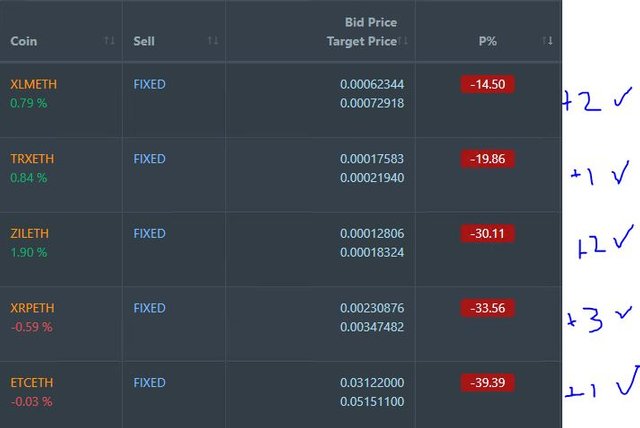

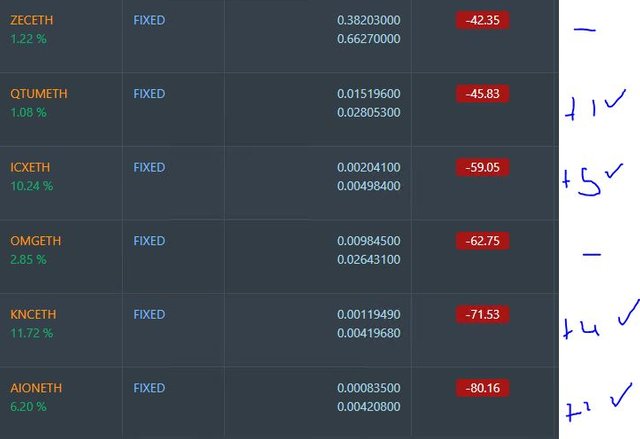

Profit Trailer Bot Three closed trades (2.26% profit) bringing the position on the account to 5.97% profit (was 5.89%) (not accounting for open trades). Leaving EOS on the whitelist looks like a smart move.

Dollar Cost Average (DCA) list remains at 4 coins with some nice steps up.

Pending list remains at 11 coins with 9 coins improving, 2 coins trading flat and 0 worse.

PT Defender continues defending 11 coins. No change.

New Trading Bot Trading out using Crypto Prophecy. No closed trades. Two news DCA trades on FUEL and VET.

FUEL trade looks like a bit of a late trade but the chart has gone upwards sloping in the narrow part of the Bollinger Bands.

VET trade was showing the signal crossover (lower window) and a swing back up on the current bar.

Currency Trades

Outsourced MAM account Actions to Wealth closed out 6 trades for $1 loss for the day. Disappointing to see a trader trading GBPJPY in the middle of the Brexit Bumbles with all 3 losing trades out of 6 on GBP.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work. AirFrance logo is in the public domain

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

February 25-26, 2019

US Rally needs a break as too much better news seems to be priced in given the rebound and could lead to sharp sell offs if not met. Feels like walking around eggshells!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Let's get Vietnam past us and month end. The undercurrent is for a break higher. Exactly the time to be cautious.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit