Markets move up with oil prices. Treasury yields stay quiet ahead of the Federal Reserve meeting. Trading action is focused on the April covered calls with a few new trades included.

Portfolio News

Market Rally

Higher oil prices push markets across the world higher.

The article about the baby boomers is of interest . What it does not say is the role the media has played in keeping people scared the whole length of this bull run.

https://seekingalpha.com/article/4249543-2-greatest-bull-markets-u-s-history-boomers-broke

Treasury yields continue to hold at low levels

The talking heads are mixed as to what is next - a slide below 2.60% for the 10 year or a rise back to the 2.75 range. Nobody is talking 3%. The headlines say it all - 3 headlines and 2 views - higher and/or holding. Talk of recession is pushing out in time especially with European data looking less soft than it was last quarter and strong emerging markets. The whole game seems to have gone back to talk about increasing stimulus now.

Boeing

FAA begins to back pedal on the Boeing 737 Max-8 grounding and more concerning certification

The Seattle Times article is worth reading as it explains the technologies, the implications for certification and the difference this technology actually was for Boeing. Its philosophy has always been to keep the control of the aircraft in the pilot's hands - not what Airbus does and new for Max-8.

Cannabis Carnival

Tilray (TLRY) announced earnings after market close which disappointed but after hours markets pushed the stock up.

Bigger news was Harvest One (HVT.V) agreeing a supply distribution of its Saltipharm range with Shopppers Drug Mart. Price jumped 25% - nice move in my portfolios. I have been banging on about this one for a while now.

https://smallcappower.com/market-mover/canadian-cannabis-stock-harvest-1/

German Banking

Deutsche Bank (DBK.DE) formalizes merger discussions with rival Commerzbank (CBK.DE)

The bank admits that its turnaround plan is not working and merger seems to be the only answer. Reality is the German government has made the turnaround impossible as it will not support job cuts. Faced with harsh reality, they have had to cave in. The real culprit is too loose monetary policies from the European Central Bank. Banks cannot make profits in a negative interest rate market especially without massive job cuts - simple as that.

Bought

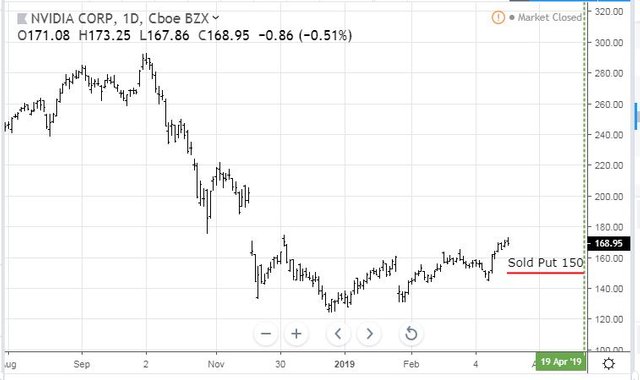

Nvidia Corporation (NVDA): US Semiconductors. Jim Cramer added Nvidia back to the Action Plus portfolio on the back of its capabilities in AI and autonomous vehicles. I had planned to sell in-the-money puts as a way to position my portfolios for a lower entry point. I sold April 2016 strike 150 put options against a closing price of $169.81. I will explore adding a position or possibly a longer term bull call spread.

A quick look at the chart. Price has broken off the lows and is about to close the gap down from earnings before last. Looks like good headroom for a move back to the highs (especially now the hype about cryptocurrency mining is out of picture)

Sold

Sodexo S.A. (SW.PA): Europe Food Services. 10.6% profit since July 2018. I thought I had sold this in all my portfolios - did the final exit overnight.

Shorts

Euribor 3 Month Interest Rate Futures (I): Europe Interest Rates. March 2019 100.125 strike put options expired worthless. Closing rate was 100.30. When I bought that put in April 2017, the contract was at-the-money. Nobody could have imagined that rates would go even more negative than half a rate hike to nearly 2 rate hikes negative.

Income Trades

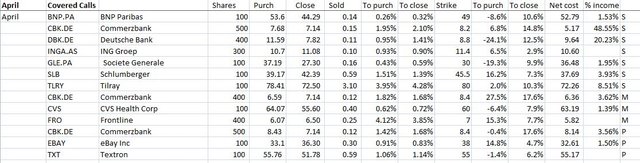

The covered call writing programme begins with a few new stocks that have come back into profit added. I also added a few more that I am happy to hold but that are not profitable.

A reminder on the process for writing covered calls.

- Select stocks I am happy to sell if I get exercised.

- Calculate 5% move up in price from previous day close (10% for stock not in profit and tech stocks)

- Choose a one month out call option closest to 5% move up in price.

- Place a bid between bid and ask. Ideally one should aim for a premium of about 1% to make this worthwhile

I widened the range of the calls for Deutsche Bank and Commerzbank well above 10% to account for the merger discussions. New positions also in Frontline (FRO - oil shipping) which has come into profits and Textron (TXT - Defence contractor) and ING Group (INGA/AS) added to the portfolio this last month. Tilray (TLRY) has a wide range too as it is much more volatile than other stocks.

The table shows purchase price and closing price, the premium received and the % relative to close and to purchase price. The strike is shown and the important columns after that are the amount price has to move to reach the strike price - you will see they are all around 5% with a few more than that. The net cost column is updated each month to show purchase price less accumulated premium received - the percentage column at the end shows what contribution income has made compared to purchase price. New trades do not have that calculation

Cryptocurency

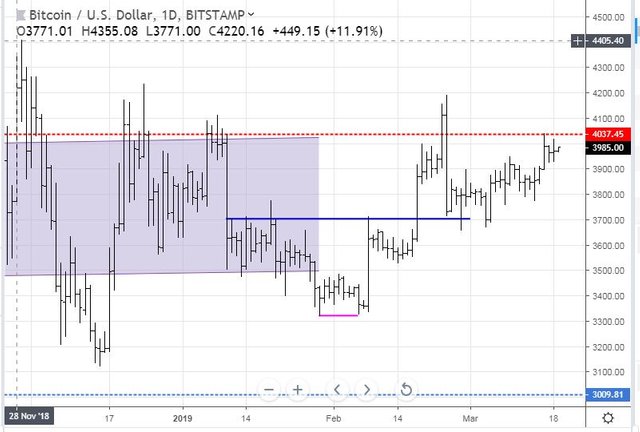

Bitcoin (BTCUSD): Price range for the day was $87 (2.2% of the high). Price pushed again to test above $4000. It is itching to have a go at breaking resistance at $4037.

Ethereum (ETHUSD): Price range for the day was $6 (4.3% of the high). Price makes an engulfing bar with close below the halfway mark = more bearish than bullish.

CryptoBots

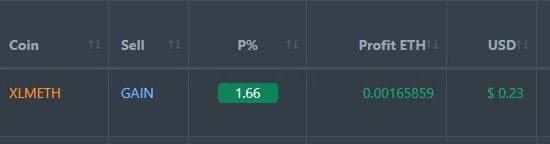

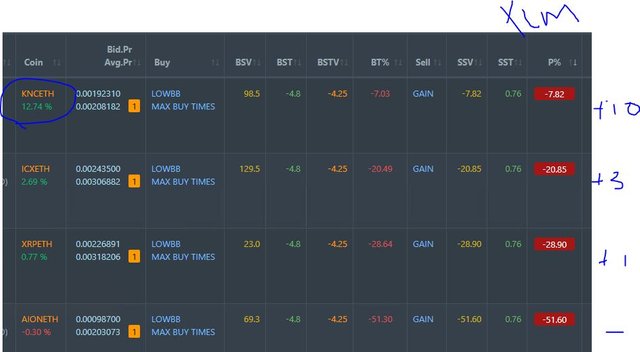

Profit Trailer Bot One closed trade (1.66% profit) bringing the position on the account to 6.90% profit (was 6.87%) (not accounting for open trades).

Dollar Cost Average (DCA) list drops to 4 coins with XLM moving off and onto profit after one level of DCA.

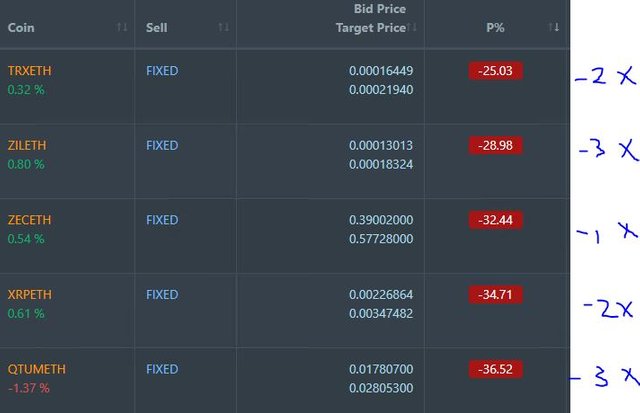

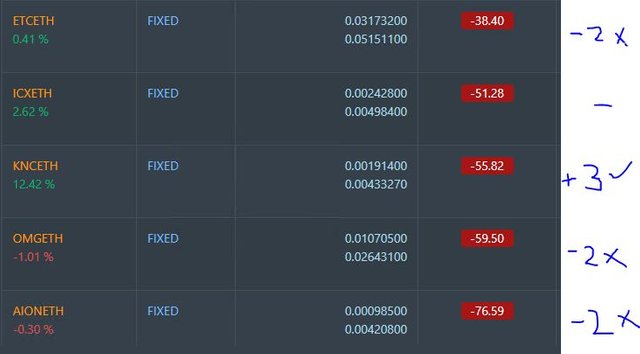

Pending list remains at 10 coins with 1 coin improving, 1 coin trading flat and 8 worse. Note: this relates to 2 days back (not 1 as in DCA)

PT Defender continues defending 10 coins. No change.

New Trading Bot Trading out using Crypto Prophecy. No closed trades.

Currency Trades

Outsourced MAM account No closed trades. Two trades open short on AUDNZD (0.79% negative equity)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

March 18, 2019

Relevant article on the media as despite not being a boomer, I have always had a hedged portfolio which has had an opportunity costs. I try to do my own homework but analysts are often just as bad as the media and impact sentiment.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The last paragraph does say not to listen to the media BUT not for the reasons I keep going on about. One of my coaches always used to ask “how are they positioned?”

He also used to say that diversification is the enemy of great returns. Lean the way the market leans. He is a young man and has time to recover. That is why I lean a part the way the market leans - not all the way

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great advice! I have often found myself on the contrarian side only to get fatigued into waiting for the turn. Thanks for sharing!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit