Markets bounce with a patient Federal Reserve. Trade action is profit taking in Japan and Pharma. Europe Muddles is beginning to get on my nerves - Brexit and now German Banking.

Portfolio News

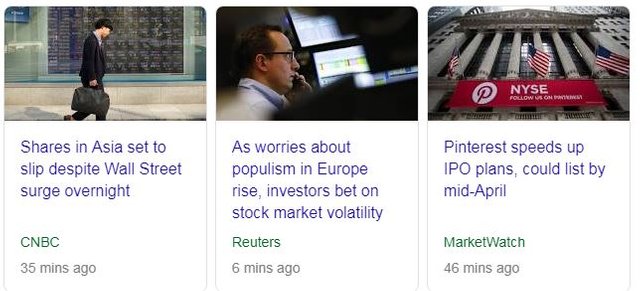

Market Rally

US markets took a day to absorb the Federal Reserve news and bounced led by technology stocks (especially semiconductors). My portfolios like that

Interesting to watch how headlines change - this is for the last hour - feels like a different world

Treasury yields slide especially at the long end of the curve.

The yield search is on again - not good for the few yield shorts I still have in play and for financial stocks (especially banks)

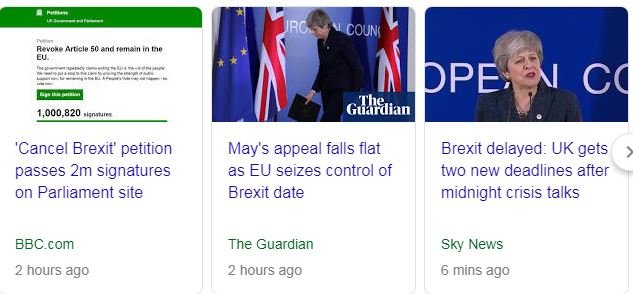

Brexit Bumbles

The farce continues with UK basically losing control of the exit dates with Theresa May unable to convince EU that no-deal is off the table.

The EU plays the hard game and takes control of the dates

- March 29 is now gone as a key date (maybe)

- UK Parliament rejects the deal before March 29, the new exit date will be April 12

- UK Parliament accepts the deal before March 29, the new exit date will be May 22

- UK can get a longer timeline if they can indicate a way forward and commit to European Parliament elections (scheduled for May 23 to 29)

Says Donald Tusk

What this means in practice is that, until that date, all options will remain open, and the cliff-edge date will be delayed. The UK government will still have a choice of a deal, no-deal, a long extension or revoking article 50

Cannabis Carnival

Curaleaf (CURLF and CURN.CN) share price pops 30% on the news that CVS will distribute their CBD oil products.

I watched an interview with CEO, Joe Lusardi - too bad that this one slipped under my radar screen. They have a well established footprint in 10 US States. Here is a video link from Bloomberg Canada the day before the CVS announcement.

German Banking

I watched the Commerzbank (CBK.DE -3.36%) and Deutsche Bank (DBK.DE - 4.10%) share prices tumble

What is going on? German language press release from European Central Bank rings warning bells about "too big to fail" was what I found

A new banking giant resulting from a merger must have extra capital and a legal structure that allows authorities to wind it down if it fails, the European Central Bank's top watchdog said on Thursday.

This is just a classic Europe Muddles type of reaction from an overly bureaucratic monolith that the European Union and European Central Bank have become. The harsh reality is there is a very big chance that Deutsche Bank is on its death bed already and this happened on your watch. What were you doing then? Now that they reach for the desperate measures handbag, you want to make it even more likely to fail.

Sold

Wisdom Tree Japan Small Caps ETF (DFJ): Japan Small Caps. I have had a take profit target in this portfolio for some time - that was hit overnight for a 34% profit since February 2016.

Amgen Inc (AMGN): US Pharmaceuticals. 1% blended profit since November 2018. I did average entry price down - best profit was 3.8% from February 2019. Initial trade idea came from Jim Cramer. He reduced exposure in the Action Plus portfolio last week citing concerns about the upcoming court ruling

We attributed the recent pressure to the imminent Amgen vs. Sandoz Enbrel intellectual property court ruling, which puts Amgen's top selling drug of 2018 ($5.01 billion in sales vs. $23.7 billion at the company level) into future biosimilar risk.

Income Trades

CVS Health Corporation (CVS): US Healthcare. Sold March 2019 strike 59.5 calls for 0.20% premium (0.20% to purchase price). Closing price $56.15 (lower than last month). Price needs to move another 6.0% to reach the sold strike (easier than last month). Should price pass the sold strike I book an 8% capital gain.

Premium might seem low - this was for March 29 expiry = finger trouble early in the morning.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $136 (3.4% of the high). Price did test the resistance level a little higher than the prior day and rejected it making a bearish engulfing bar. At a key level like this, this invariably is followed by a reversal.

Price did close in the middle of the bar = potential for a move either way.

Ethereum (ETHUSD): Price range for the day was $8 (5.8% of the high). Price was not convincing and dropped back to the support level around $132. This could be a good base for a move ahead to test up to $160 (after the weekend perhaps)

CryptoBots

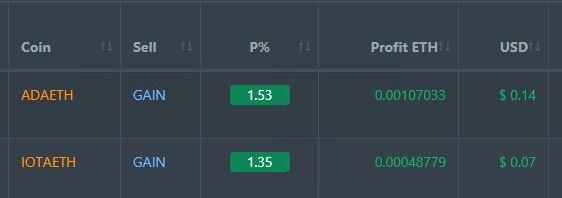

Profit Trailer Bot Two closed trades (1.44% profit) bringing the position on the account to 6.97% profit (was 6.94%) (not accounting for open trades).

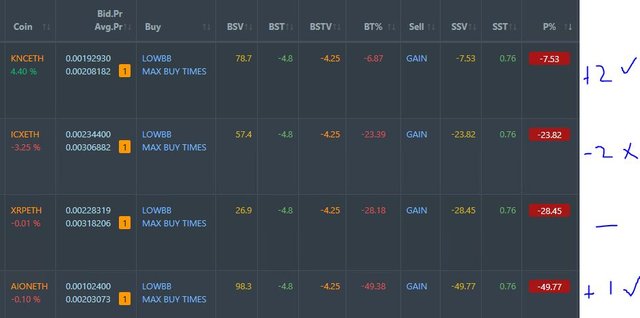

Dollar Cost Average (DCA) list remains at 4 coins - KNC keeps bouncing. Itching to see this one off this list

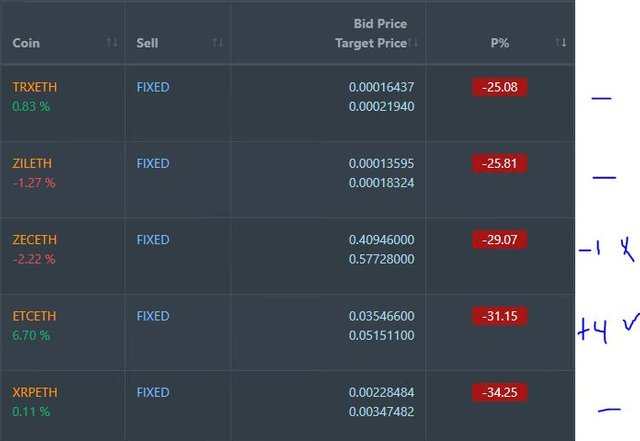

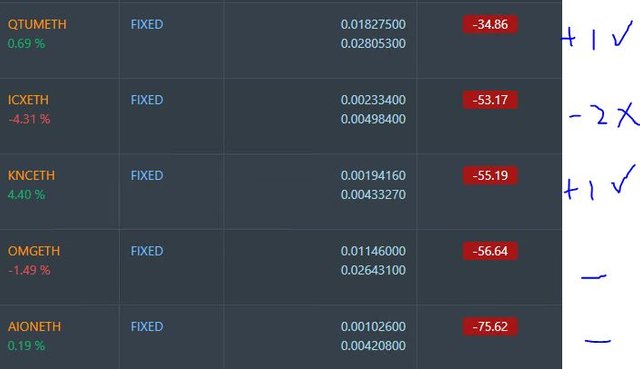

Pending list remains at 10 coins with 3 coins improving, 5 coins trading flat and 2 worse.

PT Defender continues defending 10 coins. No change.

New Trading Bot Trading out using Crypto Prophecy. No closed trades.

Currency Trades

Outsourced MAM account Actions to Wealth closed out 1 trade on USDCHF for 0.43% profits for the day. 3 trades open on USDCHF and USDJPY (0.34% positive). Surprised to see one trade closed on USDCHF and the other not and both buy and sell trades open on USDJPY at the same time.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

March 21, 2019

Volatility seems like it will start to pop again as the quarter closes and economic data and earnings demonstrate where this is all headed. Will be interesting to see how the market deals with it!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear carrinm:

We are SteemBet, the next generation STEEM based gaming platform. We are honored to invite you to join our first fantastic dice game, which is just the beginning of SteemBet game series. Our dividend system has now launched. The prize pool has already accumulated 2,000 STEEM and more than 60 players have participated in staking mining token SBT. A huge reward of 40,000 STEEM is awaiting! Join us NOW with other 500 STEEM users to loot HUGE dividend reward!!

SteemBet Team

Official Website

https://steem-bet.com

Discord Server

https://discord.gg/95cBN3W

Telegram Group

https://t.me/steembet

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit