Markets step ahead to record highs on GDP data. Europe may not be as bad as people feared. I add to some banking options there. Ford surprises - and I add a small stock position => Electric Vans. Profits in Japan go to emerging markets. And corn futures rollover hurts - maybe got the bottom this time.

Portfolio News

Market Rally

GDP numbers gave the US markets a boost to overcome a nervous Thursday to get to record highs.

Market moves were broad based with only energy dragging as oil price dropped a little on Trump tweets to OPEC. Europe markets are also heading upwards as the gloom dissipates.

The headlines are pointing to old man Europe as becoming of interest for US investors too. The articles also talk about emerging markets - not just China. I do worry about trade war shifting focus when China deal is done.

https://etfdb.com/news/2019/04/26/etf-investors-should-look-beyond-us-markets/

Interest rate markets are comfortable - growth is moving along well enough but not too strongly to keep the Federal Reserve at bay.

Now the talking heads did spend the weekend digging into the GDP numbers - some of the growth went into building inventories ahead of the China tariff changes. This will be worked off and GDP numbers will soften again, they say. Consumer spending and business investing will be the key

The Walt Disney Company (DIS): Disney earnings pushed prices to add to the Disney+ streaming momentum.

Pretty sure a successful weekend with The Avengers movie breaking records will help no end. Jim Cramer did take profits. I am holding on as my percentage holding of my portfolio is less than his.

https://www.dw.com/en/disneys-avengers-endgame-breaks-global-movie-box-office-record/a-48516067

German Banking

Deutsche Bank (DBK.DE) and Commerzbank (CBK.DE) call off merger talks.

This first paragraph says it all

Pssst! Anybody want to buy a German bank? Two for sale, cheap at the price. All offers considered. Contact O Scholz, finance ministry, Berlin. No time-wasters.

The heart of the problem is highlighted in the article

- Too many cost cuts needed

- Not competitive in a competitive marketplace

- Over layered management hierarchies (that are not any good anyway). I know. I worked in German banking long enough 20 years ago.

And to end the article

Deutsche Bank is supposedly too big to fail. It is also too big to succeed.

Portfolio holdings do need a resolution and a plan - maybe two takeovers coming from outside. I am going to guess Commerzbank will get taken

Tesla (TSLA): Electric Vehicles. Tesla price continues to fall after earnings

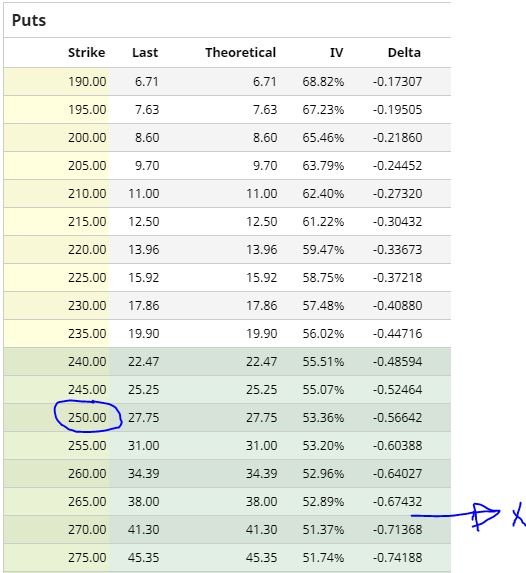

This takes price on June 250 put options past breakeven. The trade management question arises: when to exit or roll down? CNBC Options Action team suggested that one should roll or exit when delta gets to 70%. Of course, one can leave the trade in place and decide whether to be assigned or not at expiry - a short 2 months away.

Where to find Delta data? My broker, Interactive Brokers does provide it on the Trader Workstation. I found it also on Barchart.com - create a free account and log in. The table shows options chains for June expiry puts.

70% delta applies to 270 strike put options - which suggests to me price needs to drop another $15 or $20 from the current $235.14 close.

https://www.barchart.com/stocks/quotes/TSLA/volatility-greeks?expiration=2019-06-21

Bought

ING Groep N.V. (INGA.AS): Dutch Bank. Price has worked its way off the December lows quite strongly. I averaged down a December 2021 strike 14 call option. Quick update on the chart which shows the original trade as blue rays with the revised 100% profit target shown as a pink ray

Price is matching the price scenario I modelled at the time of the original trade, turning at the predicted point. Go back to 2018 highs and this trade will be close to 200% profit. This trade is a bit further out-the- money than I typically go. It would be good if there were 13 strike call options. Next step is to look to selling a call around those highs to improve the profit profile further (or look to 2022 expiries).

iShares MSCI Malaysia ETF (EWM): Malaysia Index. Deployed proceeds from Japan sale to average down entry price (10% lower). Talking heads have been suggesting that emerging markets are not as scary as they thought a few short weeks ago.

Ford Motor Company (F): US Automotive. Ford announced good earnings on the back of strong performance in truck segment. Jim Cramer was talking about the way the management have been set free to transform the business by the Ford family.

What had caught my eye was the $500 million investment Ford made in Rivian, an electric-vehicle startup, to leapfrog its electric vehicle business. For Rivian, this investment is a big deal as they can leverage Ford's manufacturing skills as they design and build their US manufacturing facility.

https://qz.com/1603505/for-500-million-rivian-will-teach-ford-how-to-make-electric-pickup-trucks/

Ford has strong cash flows, something which Tesla lacks. Good move by Rivian. Dividend yield for Ford is 6.83% - can they hold it?

Sold

iShares Japan ETF (EWJ): Japan Index. Small holding left over after a covered call assignment some time ago closed out for 39% profit since April 2011. Proceeds deployed in Emerging Markets.

Tidewater was Gulfmark Offshore (TDW) Next partial fill (49 warrants) for 64% profit since December 2017 on December 24 Strike 100 call warrants. A long way to go to clear 1800 warrants selling this few at a time. Broker is winning nicely.

Expiring Futures

Corn May Corn futures rolled over for $26 per contract loss (6.9% loss). That caught me by surprise to see May futures roll over in April. My corn trade idea is a long term trade - the current futures contract is not the best vehicle. I get a bit locked in with automatic rollover. The continuous futures chart does show that this rollover could well have happened at the right part of the price curve. - I really do need a China trade deal closing.

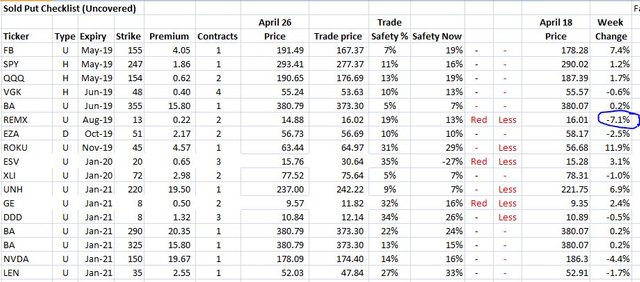

Naked Puts

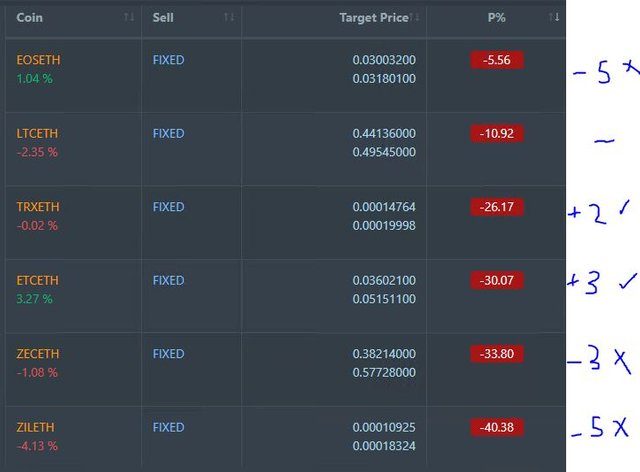

Weekly update on status of uncovered put contracts. The table shows in expiry order the uncovered puts [income trade puts are not here]. Key columns are strike, latest price in the centre and the safety percentages. I have highlighted in RED trades that are within 20% of safety.

REMX has popped onto this list with a 7% drop in price this week. This stock is the Rare Earths/Strategic Metals ETF - the price drop will be because of Lithium price falling. Of the others, Ensco plc (ESV) is small and General Electric (GE) has time to go.

Last week's risk candidate UnitedHealth Group (UNH) has improved somewhat with a 7% improvement in price.

Type of trade column indicates rationale for the trade. U - Up. D - Down. H - Hedge. I will be adding to hedges soon with July expiries on SPY, QQQ, VGK while implied volatility is low.

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $245 (4.6% of the high). Price makes 3 inside bars over the weekend. The last two occasions this has happened price has broken lower. There is strong support lower at $4995 which dates back to August 2017 and respected in the last few weeks.

Ethereum (ETHUSD): Price range for the weekend was $10 (6.7% of the low). Price also makes an inside bar and then tries to push higher. Hard to see this as convincing action in the middle of "no mans land".

CryptoBots

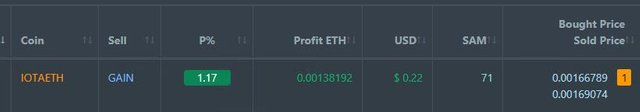

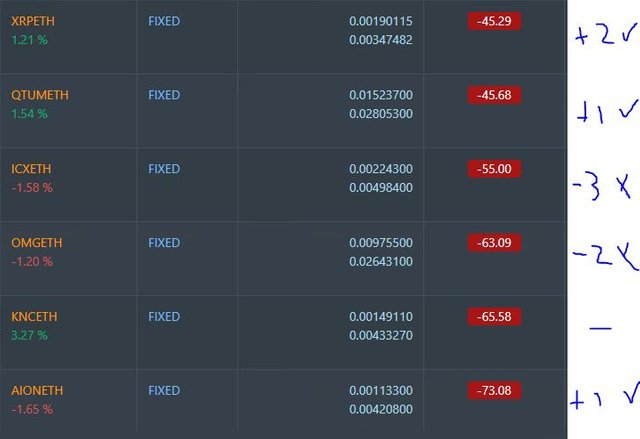

Profit Trailer Bot One closed trade after one level of DCA (1.17% profit) bringing the position on the account to 7.04% profit (was 7.02%) (not accounting for open trades).

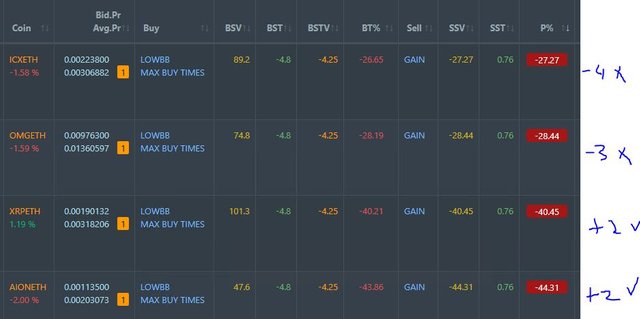

Dollar Cost Average (DCA) list remains at 4 coins with 2 coins up and 2 down.

Pending list remains at 12 coins with 5 coins improving, 2 coins trading flat and 5 worse.

PT Defender continues defending 12 coins. No closed trades.

New Trading Bot Trading out using Crypto Prophecy. No closed trades. Trades open on SC, VET, XLM.

Currency Trades

Outsourced MAM account Actions to Wealth closed out 4 trades on EURUSD and EURAUD for 0.79% losses for the day. Always disappointing to see a trader flip flop on both sides of a trade and lose both ways. This is the hard part of outsourcing trading. Trades open on AUDNZD and USDCHF (0.16% negative)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and Quartz.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

April 26, 2019

Tesla looking unhinged with that price action although competitors looking to get into electric. Probably mostly a game of valuations here.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Been holding above that level each cycle since IPO. When the funding round comes along, it could crack even harder. My instinct is that Elon Musk, like all stage one entrepreneurs, does not have the real focus to make something that dominates a niche. He will fly off in a new direction and the old directions will drift.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit