Markets like jobs data and then along comes Trump tweetmania on the weekend. Rolling up and out in Europe insurance, banks and oil. Switching horses in US media and adding more lithium. Bitcoin erupts and takes out some profit targets. Profits in corn (for one day only)

Portfolio News

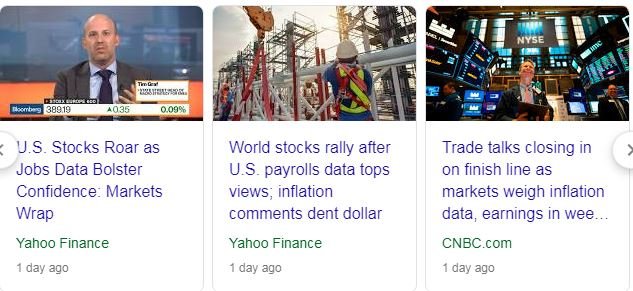

Market Rally

Jobs report spurs markets to new highs

I wrote some months ago that markets were worried about 3 things - the Fed; slowing growth and China. Well on Friday all that seemed to be going along just fine with Steven Mnuchin saying trade talks were progressing. Treasury markets were calm enough.

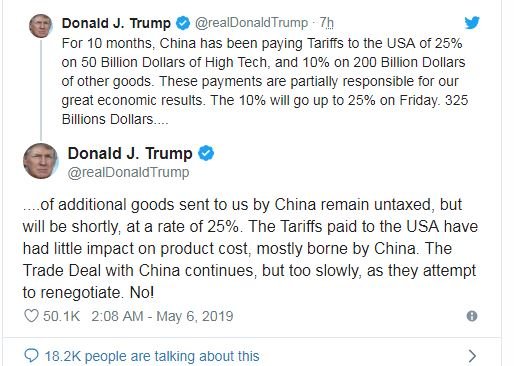

A tweet bombardment on Sunday changes all that

Not only did he threaten to increase tariffs on things already tariffed, he extended the threat to an additional $325 billion of goods = all the China exports to US.

We can only hope that this is part of the normal negotiation process he adopts. After all the Chinese Premier is visiting Washington on Thursday. The futures market is already assuming not and are giving away all of Friday's gains. The man is a loose cannon and bit like a bull in a china shop.

No prizes for guessing what the tweet bombardment did to corn price when futures re-opened after the weekend. All my trades were profitable at the close.

Bought

Sociedad Química y Minera de Chile S.A. (SQM): Lithium. SQM is one of the leading producers of lithium worldwide. I read that they are in the process of setting up a partnership with Kidman Resources (KDR.AX) to build a lithium hydroxide facility in Western Australia. This bought me back to the source and I added some SQM after an absence in my portfolios.

ING Groep N.V. (INGA.AS): Dutch Bank. Used proceeds from AXA sale (below) and averaged down December 2021 strike 14 call option in one portfolio and added a December 2021 strike 12 call option versus closing price of €11.24. The updated chart shows the new strike 12 call as fluoro green rays with the 100% profit line just above €14. Price remains on a winning price trajectory.

Viacom Inc (VIAB): US Media. Switched investment from DISH Pay TV service to average down entry price in one portfolio.

Royal Dutch Shell plc (RDSA.AS): Europe Oil. Rolled up December 2021 strike 28 call options versus closing price of €28.85 to December 2022 strike 30 call options locking in 117% profit since June 2017. The roll up also averages down entry price on that contract. The sold contract was part of a 28/40 bull call spread - that spread is now a 32/40 bull call spread as I was holding 32 strike calls as well. Updated chart shows the revised 100% profit for the strike 30 call options as a dotted pink ray.

Prior charts had shown a possible price scenario (blue arrows). Price did drop to the level indicated by the scenario but it took longer to do that. For the new scenario I have modelled the same types of move with dotted blue arrows. This scenario has three legs - continue to around the 32 level, then pull back for a few months to somewhere around the bottom of the right hand arrow and then move ahead. This will be enough to get to 100% profit by December 2020 (3 and half years from now)

Sold

Afterpay Touch Group Limited (APT.AX): Australian Payments. Took profits out to fund a share purchase plan payment due this week in Gold/Cobalt. 73% blended profit since July 2018 - 63% on portion allocated in September 2018 share purchase plan. Thanks to my son for the investment idea.

SPDR STOXX Europe 50 ETF (FEU): Europe Index. Out of patience with Europe and deployed the proceeds into lithium. 4.7% profit since November 2012.

Diamond Shipping (DSSI): Shipping. 2.5% profit in one portfolio and 15% loss in another since spin off from Capital Product Partners (CPLP) in March 2019. These are small holdings left after the spin off.

AXA SA (CS.PA): French Insurance. Closed December 2020 strike 22 call options versus closing price of €23.07 for 93% profit since March 2018. In another portfolio rolled up December 2021 strike 22 call options to strike 24 locking in 20% blended profit since June 2018. The updated chart shows the new contract as orange rays (strike 24 and 100% profit above)

The back story for the chart explains the complications. I had bought strike December 2020 strike 28 call options looking for price to start a move up after consolidating in 2017. (the red zig zags). AXA announced the acquisition of Bermuda-based insurer XL Group not long after. The market view was that they overpaid and price was smashed down. I felt the market was wrong and bought the December 2020 strike 22 call options (the pink rays). I recently rolled those out in time to 2021 (green rays). The market looks like it was wrong and price appears to be tracking the blue arrow price scenario. The new trade fits in to that with 100% profit where the top of the right hand blue arrow is. The 28 strike calls look like history but there is still time.

DISH Network Corporation (DISH): US Pay TV. In TIB247, I set out the rationale for buying stock in the face of continued TV cord cutting with a possibility of an acquirer coming along to grab the streaming TV subscribers, DISH was building. Close to one year and that has not happened. Closed out for 4.3% profit since June 2018 and rotated into another merger candidate, Viacom. The updated chart shows what might be a lucky escape or an early exit. I left in the markers for the profitable short trade closed some time back.

Corn Futures (CORN): Pending order on one contract filled for $9.25 per contract profit (2.5%) This goes some way to recover losses made in the rollover to July futures last week (and releases margin).

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $483 (9% of the low). Price seldom does what happened on Friday and Saturday = drive ahead to new highs for the 4th and 5th consecutive day without some sort of price catalyst. But we did then get a higher high and a bit of consolidation above the support level of $5547.

The big price move on Friday took out two profit targets for $392.08 and $360.47 per contract profit (7.5% and 7%)

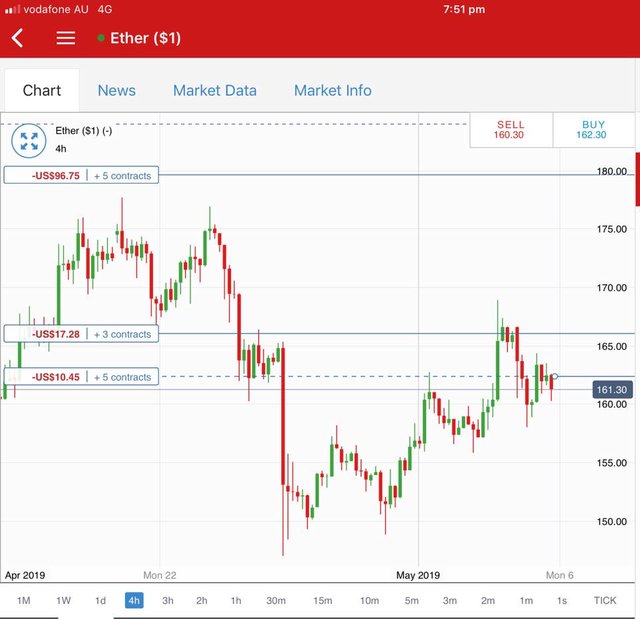

Ethereum (ETHUSD): Price range for the weekend was $12 (7.6% of the open). Price did spike on Friday the same way Bitcoin did but could not follow up and settled back to trade around the short term resistance level of $159 (now a support level)

The big price move on Friday took out profit targets for $12 per contract profit (7.8%). I added one new CFD contract on a 4 hour reversal (might have been a bit impatient)

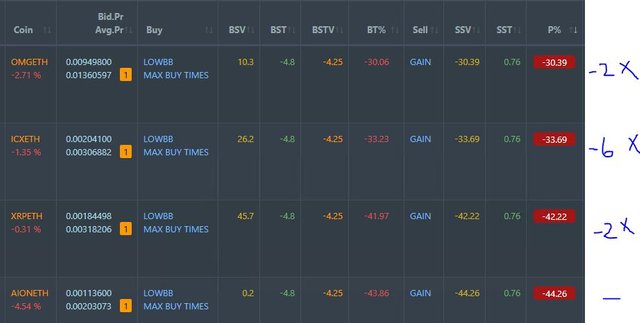

CryptoBots

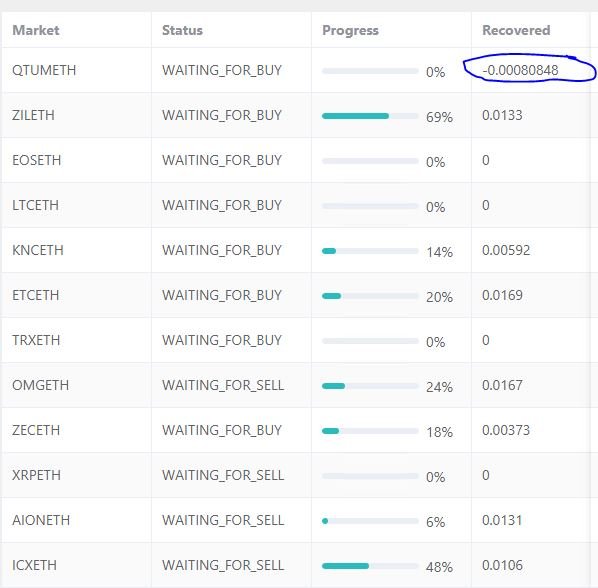

Profit Trailer Bot Three closed trades (1.5% profit) bringing the position on the account to 7.17% profit (was 7.11%) (not accounting for open trades).

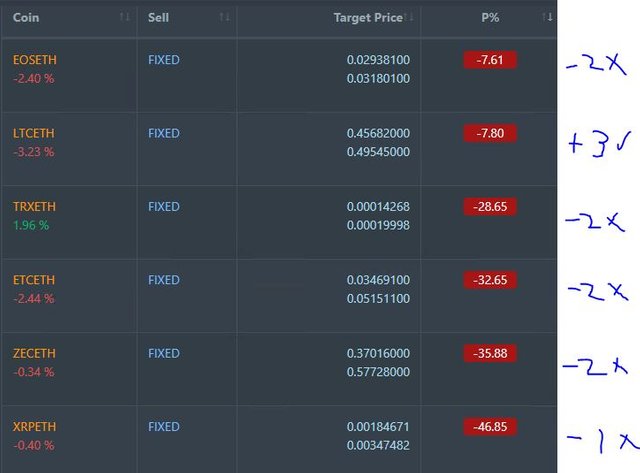

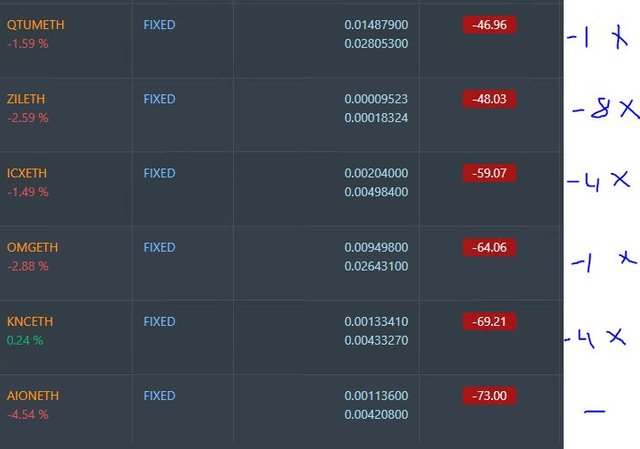

Dollar Cost Average (DCA) list remains at 4 coins with only 1 coin trading flat, the others worse.

Pending list remains at 12 coins with 1 coin improving, 1 coin trading flat and 10 worse. Drops like this are normal when Bitcoin and Ethereum rise hard. Altcoins follow behind more slowly.

PT Defender continues defending 12 coins. One closed trade on QTUM. Something looks weird there as the recovered amount became more negative.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account No closed trades. One open trade on AUDNZD (just negative)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and CNBC. Tweet image comes from Twitter.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Rising price for Bitcoin is a good time to get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

May 3-5, 2019

It will be interesting to see how volatility expands and for how long as this will be a sign for traders to increase hedges given the swift changes in rhetoric being seen.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Timing was not good as I wanted to set up the next hedges - now vol has spiked. Good news is I will be able to claw back some premium. There is still 10 days to run to expiry and a lot can happen.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit