Markets step back from the brink when Trump steps back. I am trading into the recovery in semiconductors at a sector level and at stock level. Some big moves happening in rare earths. Corn breaks 2019 highs and I am in the exits.

Portfolio News

Market Rally

Donald Trump adjusts some of the Huawei existing business rules and stocks rebound

The recovery is led by semiconductor stocks which seemed to overreact in Monday trade. Well I did write that the reaction was not totally rational with all semiconductor stocks hit and not just the ones affected by Huawei. Boeing news on the possibility that the 737 Max 8 problems could have been triggered by birdstrikes pushed Boeing (BA) price up. To my mind this is not that rational either - if the probelm is a physical component that is prone to damage from a birdstrike the fix is harder than fixing software, which can be done remotely.

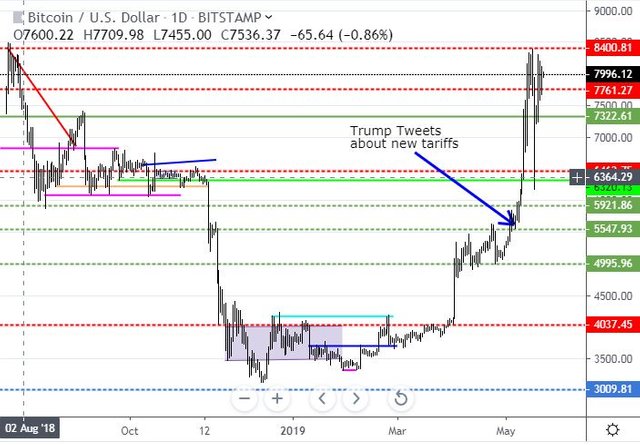

Crypto Craze

Craig Wright, self proclaimed inventor of Bitcoin files copyright protection on the Bitcoin white paper.

Having watched the debacle surrounding the launch of Bitcoin Cash and all the other Bitcoin spinoffs and the infighting with Roger Ver, I doubt this is good news for the Bitcoin price stability. It feels like the ground is being laid for another war similar to the last Bitcoin Cash hardfork.

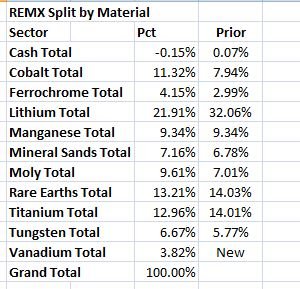

Rare Earths/Strategic Metals

By now you will have grown tired of the molybdenum chart moves. Popping the last few days have been some rare earths stocks.

This one is Arafura Resources Limited (ARU.AX) which popped 35% on the day. Its principal project is the Nolans project, a rare earths-phosphate deposit that supplies neodymium and praseodymium products located in Aileron, Northern Territory, Australia.

Also popping was Lynas Corporation Limited (LYC.AX) up 14% on Tuesday and another 9% in early trade on Wednesday. The VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) was up 5% in US trade. The REMX ETF holds a mix of stocks covering some of the rare earths mined and developed by Lynas and Arafura and holds 6.21% of Lynas

Now there is deal activity underlying these moves with Australia's Lynas and Blue Line plan Texas rare earths facility and Lynas announcing a big expansion in its Malaysia production facility which may solve some of its licensing problems there.

https://sg.news.yahoo.com/2-australias-lynas-lays-345-234127584.html

Coming back to molybdenum, the bad news is General Moly (GMO) price sagged 11% on the day - maybe the short squeeze from last week is over.

Bought

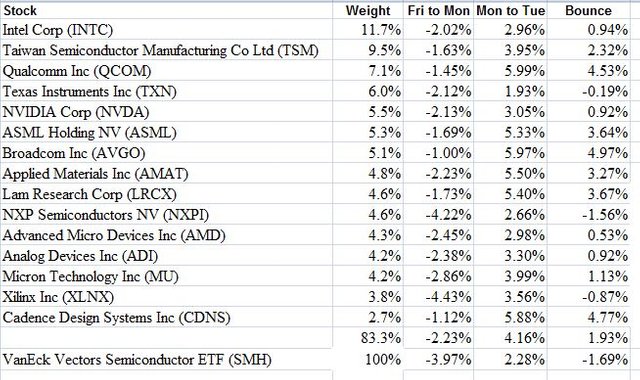

I watched the indiscriminate selling of semiconductors on Monday and watched again as price started to come off the lows on Tuesday. I listen to the talking heads telling me economic data is still solid. If this is true, semiconductors selling off nearly 20% from recent highs and more than 2% in one day is irrational.

VanEck Vectors Semiconductor ETF (SMH): Semiconductors. Rather than try to cherry pick specific semiconductor stocks less affected by China and Huawei, I looked to the sector as a whole. Bought January 2021 103/120/90 call spread risk reversal. Bought January 2021 103/120 bull call spread for net premium of $6.90 offering maximum profit potential of 146% in its own right. Funded the call spread by selling a January 2021 90 strike put option for $8.39 giving a net negative premium of -$1.49 (i.e., I got paid). Risk in the trade is where price drops below $88.51 (i.e., sold put minus net net premium). The chart shows why I picked the levels.

The sold call (120) is where recent highs were. The bought call (103) was one strike out-the-money at trade time. The sold put (90) is below the 2018 trading range lows though not as low as the December 2018 low. The options chains shows that a January 2021 strike 80 put option last traded at $5.55. That would offer an entry point below the December low but would imply a trade with an overall positive net premium of $1.35. That would give the trade a maximum profit potential of 1159% if price passed $120 and give coverage right down to $80. An 85 strike put traded at $6.52 = still cash neutral.

I did step back today and have a look how the top 15 holdings in this ETF fared between Friday and Tuesday. Average fall on Monday was 2.23% and the recovery on Tuesday was 4.16%. Biggest fallers were Xilinx Inc (XLNX) and NXP Semiconductors NV (NXPI) and biggest bounces made by Broadcom Inc (AVGO) and Cadence Design Systems Inc (CDNS). This table tells me that analysts did work out overnight on Monday which stocks were sold off too hard on Monday. What it also tells me is that my instinct was right about the rationality - the sector ETF bounce did lag the top 15 stocks. Time will tell if my instinct to use the ETF was right.

Table shows price move in percentage on Monday and on Tuesday and sums the two columns for Bounce factor [just an indicator - it would be better to compute the relative price move based on prices]

NVIDIA Corporation (NVDA): US Semiconductors. Added another small parcel in one portfolio to average down my entry price and to benefit from the Monday selloff.

Sold

Corn Futures (CORN). I kept trailing stop losses higher as price pushed past 400. I also pushed price targets higher. Stop losses were triggered for $30.25 (8.4%) and $33.25 (9.2%) per contract profit. This closes out all futures contracts though I remain exposed to the ETFS Corn ETF (CORN.L)

Uncovered Puts

The down move in the markets increases my exposure to naked puts.

- Naked put on Facebook (FB) expired safely

- Naked puts on Nasdaq (QQQ) and S&P500 (SPY) also expired safely. I replaced these with July expiries which will apear in next update

- Most concerning remains Boeing (BA) especailly as the close in contract expires in June. Tuesday news about the birdstrike possibility took off some of the pressure

- LYFT remains of some concern with multiple contracts open (but trade size is smaller)

- Biggest faller for the week is oil driller, Ensco (ESV). This is a problematic sector with Weatherford (WFT) filing for bankruptcy last week

Income Trades

Two trades completed. I did adjust European strikes to bring them all down a notch - got no trades.

Viacom, Inc (VIAB): US Media. Sold June 2019 strike 31 calls for 1.05% premium (1.00% to purchase price). Closing price $28.60 (lower than last month). Price needs to move another 8.4% to reach the sold strike (tighter than last month). Should price pass the sold strike I book a 4% capital gain. Income to date amounts to 1.9% of purchase cost.

3D Systems Corporation (DDD): 3D Printing. Sold June 2019 strike 9.5 calls for 1.32% premium (1.77% to purchase price). Closing price $8.49 (lower than last month). Price needs to move another 11.9% to reach the sold strike (easier than last month). Should price pass the sold strike I book a 16% capital loss. Income to date amounts to 6.3% of purchase cost.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $441 (5.4% of the high). Price makes another inside bar after testing down to resistance at $7761 (2nd dotted red line from top)

Ethereum (ETHUSD): Price range for the day was $17 (6.9% of the low). Price ekes out to pass the prior day high but stays firmly in the middle of the range it has been in for a few days.

One contract closed on profit target for $17.15 per contract profit (7%)

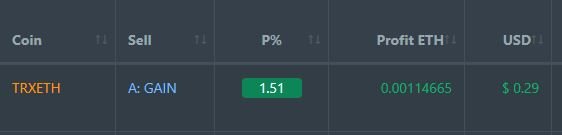

CryptoBots

Profit Trailer Bot One closed trade (1.53% profit) bringing the position on the account to 7.91% profit (was 7.88%) (not accounting for open trades).

Did the work to fix PT Defender - now defending 13 coins. Fix was quite a bit more technical than one would hope and there are still some loose ends on XMR and XRP and ADA. One PT Defender trade completed on TRX

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 3 trades on EURUSD, CADJPY for 0.22% profits for the day. Trades open on GBPNZD, CADJPY (neutral)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

May 21, 2019

I know the “sell in May and go away” was not in your thoughts but with decreased volume coming for the US Summer, it not be a bad idea! I am still enjoying my vacation from the markets although I get the itch to come back every day!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Getting that feeling too. Will be making some reductions soon to release cash and time to enjoy life more

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit