Markets are jittery and globalist anti-business agenda does not help. Yields keep falling - makes for some profits and scaling in for an opportunity for more - short on yields this time.

Portfolio News

Market Rally

DoJ and FTC take aim at big tech and market slides again.

I watched the pre-open and market open. Things were looking fine for a while and then the tech stock slide erupted when the regulator moves became real.

What is going on in US is beginning to baffle me even more. Supposedly the President is anti-regulation and pro-market. Just as markets are beginning to show the pressure from the pro-tariff stance he has taken, the regulators (Federal Trade Commission and Department of Justice) take aim at the big tech companies saying it is time to investigate. Maybe this is the only hope the Democrats have of getting to win the next election. Trash the market by letting loose the lackeys in the globalist leaning government agencies. Maybe it is to do with when the mouse is away with Donald Trump on 3 day state visit to UK. Maybe it is part of a globalist agenda anti big business or maybe anti disruptor business. That is another topic altogether. Tweets next to sour my mind.

Yields continue to slide.

I watched a key interview with Sol Sri-Kumar on CNBC talking about his thoughts on yields. The interview is important as he has changed his view and bond people do not often do that. I will summarise the key factors for you BUT do watch the video (ignore the interruptions from the interviewer - he lives in an old world)

Had previously forecast yields would not go over 3% to 4% but go down to 2%. His view is it would hit 2% before it got to 4%. His view is now a 1 handle is possible based on two factors

- Economic growth was a sugar high as a result of tax cuts. Bond market said growth rates were transitory.

- Inflation has just not just got to the 2%

These are the drivers of yield for bond markets - low growth and low inflation equals low yields. Big question is why inflation is staying low despite 3% economic growth and low unemployment?

- Ageing population do not consume as much

- Immigration of younger people is reducing

- Quantitative easing over 10 years has impoverished wage earners in favour of equity holders = not good for consumption

But now there is something else going on? The trade war - very difficult for China or US to back off. Mexican tariffs destroys continuity in policy = end of USMCA. This is changing the growth dynamic as it makes it hard for busienss to plan and operate.

https://www.cnbc.com/video/2019/06/03/why-this-strategist-changed-his-forecast-from-2018.html

This accords with what Jim Cramer said yesterday.

...I believe that the President's become very mercurial, very arbitrary, and very capricious. The Mexican tariff proved that

Takeover Action

Infineon bids for Cypress Semiconductor (CY) at $23.75 cash.

There will be one very camper out of this transaction = the person who sold me 1 strike 17 call option with June expiry. They just made over 5000% return. I did see if I could get a lowball bid to buy it back taken by someone not paying attention. Everyone was paying attention. I console myself in that I will make a profit in the trade when the stock is assigned and I did have an odd number of shares - so I have a small parcel that I can sell at the big profit implied in the deal. Pending order is out there waiting.

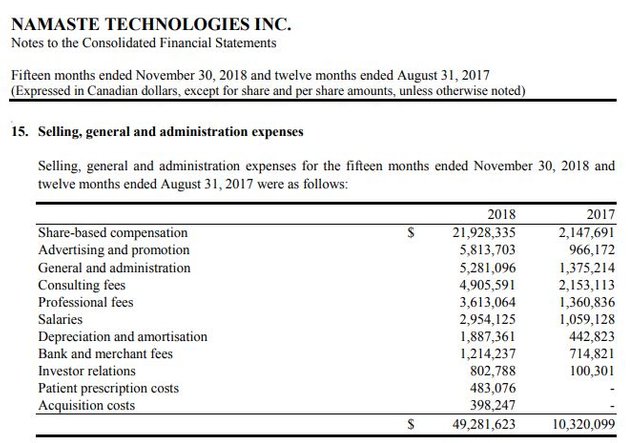

Cannabis Carnival

Namaste Technologies (N.V) issued a press release saying they had filed 2018 annual report after a delay. Change of auditors was one trick and they pulled another trick and changed the year end to make year to year comparisons hard (15 months to November 2018 vs 12 months to August 2017). They made no press release about the content - I had to go read after seeing stock drop 18% for the day. The Profit & Loss Statement has some disturbing numbers on the cost lines with revenues more than doubling but costs going up fourfold (stripping out impairments).

- Share based compensation took a big jump. Just under half of this was not cash based. Some of this has to do with share issues related to acquisitions. How much relates to the now sacked CEO is not divulged.

- Advertising and marketing expense rose strongly but so did revenue

- Big spending on consultants and advisors. This will go away once the troubles are past.

Balance sheet looks solid enough provided these share based compensation cost levels are a one-off

German Banking

Deutsche Bank (DBK.DE) share price drops below €6 for the first time since 2007. Ouch!!

Bought

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. I watched a review of a CNBC Options Actions team trade idea on Treasuries made last month. The idea was that this ETF had tested a level enough times and was a chance to go higher. The trade idea they floated was a straddle. In TIB417, I wrote that I was gong to lean in a direction

In another I decided to go with the directional bias (up) and bought August 2019 Strike 126 call options. Price had already passed through the 125 strike.

Well I got that right.

The new trade idea was to explore going short to trade the pull back to the breakout line. A few of the team were of the mind to stay long though they can all see a pullback coming. What they were all clear on was if one was holding the calls, sell them. I listened hard and I watched the mood of the market and decided to take the profits and double down with a bit more time. I sold the August 2019 strike 126 call options and rolled up 2 for 1 to September 2019 strike 132 call options. At trade time price was below $132. This locks in 209% profit in 3 weeks on the 126 calls and puts a little cash in the bank even after buying 2 contracts for each 1 I was holding.

Quick update on the chart which shows the new trade with its 100% profit mark as pink rays with the expiry line moved one month further across.

Price clearly ran more than the Elliot wave (green zigzag) that I modelled last time. This type of move brings into play a curve running from the 2015 lows (left hand pink zigzag). Get a repeat of that move and price will get close to breakeven and could reach the 100% profit level but not before expiry. The next move from the Federal Reserve is key. Trade management will be important too if the pullback does begin to happen in early August.

Note: Breakeven takes into account credit received even after 2 for 1 roll up. Trade idea in video below

https://www.cnbc.com/video/2019/05/31/the-man-who-predicted-the-bond-bombshell-now-sees-this.html?

Sold

The Home Depot, Inc. (HD): US Home Improvement Retail. CNBC Options Action team reviewed their earlier trade idea to go short Home Depot a little while back. I had chosen not to go short then but did close out a stock holding in one portfolio. I chose to close out my remaining position in another portfolio for 3.5% profit since March 2019. There will be plenty of time to get back on this stock when markets stabilise again.

Income Trades

Implied volatility looked good on this contract - took a swing without the normal leeway as I am tired of waiting for steel tariffs to do anything good for US steel industry. That game is not working out the way Trump wanted. Of course price then moves a big slice of what it has to move to reach the sold strike closing on Monday at $35.87.

VanEck Vectors Steel ETF (SLX): US Steel. Sold June 2019 strike 36 calls for 1.99% premium (1.67% to purchase price). Closing price $35.12 (new trade). Price needs to move another 2.5% to reach the sold strike (new trade). Should price pass the sold strike I book a 14% capital loss.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $696 (8% of the high). Price just did not have momentum to test of the resistance at $8891 and found heaps of sellers all the way through the $8400 level it had been vaguely respecting. Follow on action today has seen price push even lower through $8000.

Added two new contracts on reversals on one hour charts, one set up as a pending order.

Ethereum (ETHUSD): Price range for the day was $24 (9% of the high). This chart looks similar with price drifting away from the test of $277 and then collapsing to lows seen a few days ago (the new pink ray)

Added one new contract on reversal on one hour charts with a pending order not yet triggered.

CryptoBots

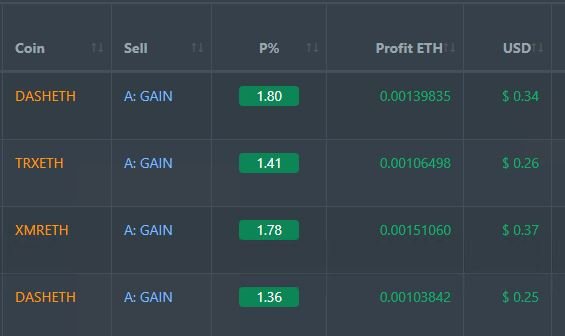

Profit Trailer Bot Four closed trades (1.59% profit) bringing the position on the account to 8.58% profit (was 8.50%) (not accounting for open trades).

PT Defender continues defending 11 coins.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

New Zealand Dollar (NZDUSD): Trade short NZD stopped out for 1% loss. Two losing trades in a row reminds me why I stopped forex trading = not good psychology match. US markets situation has weakened the US Dollar. We see today when Reserve Bank of Australia cuts Australian interest rates for first time in 21 months = no move in AUD.

Outsourced MAM account Actions to Wealth closed out 3 trades on AUDNZD for 0.31% losses for the day. Trades lost both long and short. Trades open on AUDCAD and EURUSD (0.01% positive). Short AUD trades are losing.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

June 3, 2019

It looks like liquidity is starting to dry as well as the market heads into the summer which may help volatility keeps its bid. It has been interesting watching from the sidelines and seeing how much I have saved by staying away; I would have mostly been long since earnings were not bad for the S&P 500.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, @carrinm!

You just got a 0.39% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @carrinm! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Comments were hidden due to low ratings.