Markets are nervous as tariffs rumble. An up day does give scope for some shuffling around in technology areas especially cloud computing.

Portfolio News

Market Rally

US markets wanted to go up but ended mixed after a down day the day before.

I watched the market open to a sea of green across the S&P500. It seems that the markets took hope from the speech from Federal Reserve chair - that patient word again. When I looked at portfolio action at the end of the day it was somewhat mixed with two portfolios positive and one negative. Those FANG words are in the headlines again.

There is no doubt Mexico is weighing on the markets

Is there hope or is it time to panic? I do know from past tariff announcements that it takes some time before analysts work out the numbers and what the implications are likely to be. Until they do, the talking heads just spout the latest opinion and fear. This next one is a beaut (my paraphrasing):

The softer than expected ADP job numbers for May are because business owners are not prepared to make hiring decisions given the uncertainty on Mexico tariffs.

Give me a break. The tariffs were announced in the last week of the month.

That said, I do agree that uncertainty is bad for job creation. China is offering enough of that.

Yields continue to drop especially at the short end.

Part of the mixed performance in the markets was in banking stocks which were bid up earlier in the week. Falling yields are normally bad for banks as they earn on net interest margin. This week is a little different as the curve is steepening with short term yields dropping harder than long term. A steepening curve is less bad for banks as they borrow short and lend long.

Europe Muddles

The sorry saga of Europe Muddles continues

In one breath, the European Commission threatens action over Italy's rising public debt. On the other side, Mario Draghi is promising that there will be easing available. The biggest flaw of the European Union model is governments are not able to use fiscal measures to drive economic growth and monetary measures are controlled by a bureaucrat in Berlin. Maybe he should just print the money and use it to bail out Italy. No wonder the short term interest rates chart looks like this - about half a rate cut (12 basis points) since the last high at the end of April.

Note: this is a price chart - yields fall when price rises AND it is a 4 hour chart - you can see when Draghi talked last night = when price jumped out of the zone at 10035 to top 10037. Anything above 10000 is a negative yield.

The next big flaw in the whole story is quantitative easing relies on the banks as the transmission mechanism as they have more money to lend BUT banks cannot make any money at negative interest rates.

https://www.cnbc.com/2019/06/05/europe-markets-look-to-trade-news-economy-and-politics.html

Bought

Kohls Corporation (KSS): US Retail. Kohls price was rocked by the last earnings announcements and is ignoring the potential that flows from the Amazon venture it is working on. Jim Cramer added more of this to his Actions Plus portfolio citing also the change in store allocation in some key segments - e.g., Active. I averaged down entry price in two portfolios.

LAM Research Corporation (LRCX): US Semiconductors. Jim Cramer idea to add this wafer fabrication stock back to the portfolios given the way price has been pushed below his entry price. As I will be taken out of Cypress Semiconductor (CY) by the Infineon takeover, I switched horses in advance.

Microsoft Corporation (MSFT): US Technology. Watched Jim Cramer daily rundown for Action Plus members responding to a question about Microsoft. Cheap at these prices were his words. It is a part of his Action Plus portfolio BUT I was not holding any directly. I added a parcel to two portfolios. One chart to highlight the thesis: Microsoft (black bars) versus Alphabet (GOOGL - purple line) for the last 12 months

Focusing in on the last selloff, Microsoft has dropped only 8 points while Alphabet has dropped 20 points. Normally this would lean me to invest in the laggard. This time it is the leader as there will be no antitrust investigation on Microsoft just yet. That old horse has been flogged before not that long ago.

Dell Technologies Inc (DELL): US Technology. Added new position in one portfolio. I am holding it in another. The trade idea is this feels like a cheap way to invest in VMWare (VMW), of which Dell owns 80%, after the recent selloff in Dell price. Disappointing to see price fall further in the day's trading. Quick update on the comparison between Dell (black bars) and VMWare (red line) for 2019. Dell was only relisted in late 2018.

The recent drop in Dell price has opened up a 10% gap making it an 8% cheaper way to buy VMWare, provided of course that the rest of Dell's business is not worse than their earnings guidance suggested.

Corn Futures Added one new trade.

Trading is all about setting up trading rules for entry and exit and sticking to them. Investing is about validating a theme and making an entry when the theme is in place. This trade was an impatient one - there is a theme and that is probably what drove my trade as I listened to the talking heads talking about the rain on the plains. "The corn should be ankle height by the 4th of July" says one. "Not even planted says another."

The trading rule says wait for the reversal to be confirmed. I did not as you can see. Now my trade is underwater with the reversal not established. This has become an investment.

Sold

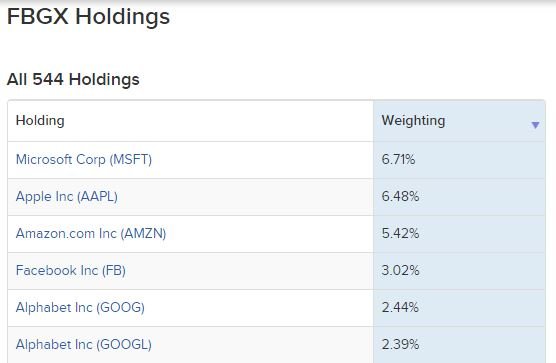

UBS AG FI Enhanced Large Cap Growth ETN (FBGX): US Growth Index. This ETF holds large cap growth stocks (544 holdings). Its top 6 holdings are dominated by FAANG stocks (nearly 20%). Facebook and Alphabet are facing regulatory scrutiny. Apple is under the pump with China exposure. I switched holding in this to get away from the FANG pressure points and focus on Microsoft. 8% profit since November 2018.

Naked Puts

Weekly update on naked puts highlighting safety margins at trade time and now and sorted into expiry order.

- I took action on Boeing (BA) to buy back the put and sell a lower strike (345). At report time this was also underwater (now not). I will watch this every day as I do not want to buy 100 shares just yet.

- I also took action on iShares South Africa (EZA) and bought back 51 strike and sold 47 strikes, which are currently safe.

- Added in Las Vegas Sands (LVS) which I had missed. Bad one to miss. This has been trading comfortably above 60 for all the weeks since opening the trade - now not.

- Nvidia (NVDA) is caught up in the China story. I am figuring we will have answers before January 2021.

- Ensco (ESV) is ugly but exposure is small. It just has to stay afloat (bad pun for an offshore oil driller)

- Safest trade is ROKU at 50% safe - even more this week with price topping $100 = too bad I do not own the stock.

Cryptocurency

Bitcoin (BTCUSD): Price range for the two days was $671 (8% of the high). Price tested below the support level at $7761 finding some buyers there and makes an inside bar on the second day.

Ethereum (ETHUSD): Price range for the two days was $18 (7% of the high). Price tested down to the new support line (pink ray) on Tuesday and makes an inside bar the next day. There appear to be buyers around that $238 level.

CryptoBots

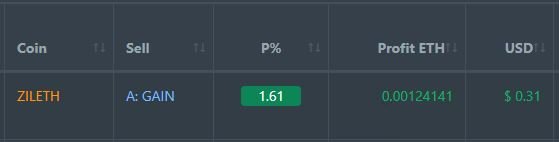

Profit Trailer Bot One closed trade (1.61% profit) bringing the position on the account to 8.61% profit (was 8.58%) (not accounting for open trades).

I spent the afternoon working through profit calculations for the ZEC trades closed out using PT Defender. Profits reported by Profit Trailer do not match what is actually going on. Profit Trailer reports profits for a closed trade based on the price it used to buy the last holding.

What PT Defender does to trade away a bad trade is to buy a holding and then sell a little more than that holding and steadily whittles away at the bad holding (i.e., using profitable trades to recover small amounts of the loss from the bad trade). The trade by trade profit calculation does not reflect this properly. I will progressively work through the results and adjust the spreadsheet that I use. I will use LIFO accounting to reflect what PT Defender does. Good news from a tax point of view in Australia we can choose any method we prefer.

PT Defender now defending 12 coins with EOS added.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 4 trades on EURUSD and AUDNZD for 0.45% profits for the two days. Trades open on AUDCAD, EURGBP, EURUSD, XAUUSD (0.5% positive). Must say I am not enjoying seeing trades open both ways on a currency.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. ETF mix image is credited below the image. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

Tracking: I used data from CoinTracking.info for the ZEC profit calcs. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

June 5, 2019

Hi, @carrinm!

You just got a 0.45% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great perspectives once again! I still feel that it can go either way but incredible to see how the rhetoric is so polarizing as we are celebrating the economy one day only to dump its future the next!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit