Was my birthday yesterday and I stayed away from trading screens mostly. Profits in Brazil and Silver added to the celebration. Trump raises the heat on Powell.

Portfolio News

Market Rally

US markets keep heading up but bond yields are sagging.

I wrote last week that one of these markets is wrong.

Either, bonds have overreacted with a down view or stock markets have overreacted with an up view.

This has played through to this week even after the Fed did nothing other than change some words. I will borrow the summary from the Jim Cramer piece (first headline)

Normally I’d be telling you to buy stocks left and right with the Fed about to cut interest rates, and I still think it makes sense to be bullish. However, with the president on the warpath, you need to be more cautious, because even if the trade war is justified, the longer it goes on ... the worse it is for our economy. I expect the president will keep hectoring him, and hectoring him, and hectoring, because Trump needs — desperately needs — to raise tariffs all over the place and needs desperately to have lower rates so the economy doesn’t fail before the election.

That last sentence is key. Trump will do absolutely anything and everything to keep stock markets rising ahead of the election. Given he cannot rely on getting stuff past Congress to spend money, do not be surprised to see the tariff blunderbuss becoming the weapon of choice.

Yields slide with 10 year dropping below 2.0% for the first time since Trump got elected

One of the talking heads was talking this morning about seeing yields as low as the post GFC low of 1.34%. That feels a bit extreme to me but it is now less than 3 rate cuts away. The whole move flowed right across the world with Japan and Germany hitting long time lows. My Euribor trade improved for a while and then went back to that 100.50 level again this morning.

Sold

VanEck Vectors Brazil Small-Cap ETF (BRF): Brazil Index. Had set a profit target at 52 week high which was hit for 11% profit since October 2018.

Income Trades

Commerzbank AG (CBK.DE): German Bank. Sold July 2019 strike 6.8 calls for 1.31% premium (1.04% to purchase price). Closing price €6.11 (lower than last month). Price needs to move another 11.3% to reach the sold strike (easier than last month). Should price pass the sold strike I book a 11% capital loss. Income to date amounts to 53.3% of purchase cost = making more income from this model of trade than capital growth or dividends.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $289 (3.2% of the low). Price makes an inside bar and moves up and away from support at $8891 maybe coiling up for a run at $9954.

I did add one new trade on a 4 hour reversal - now holding 3.5 BTC long.

Ethereum (ETHUSD): Price range for the day was $7 (2.7% of the low). Price also makes an inside bar on a quiet day. This also looks like a coiling up waiting to break through $277 which has been a strong level since it was first tested on May 16.

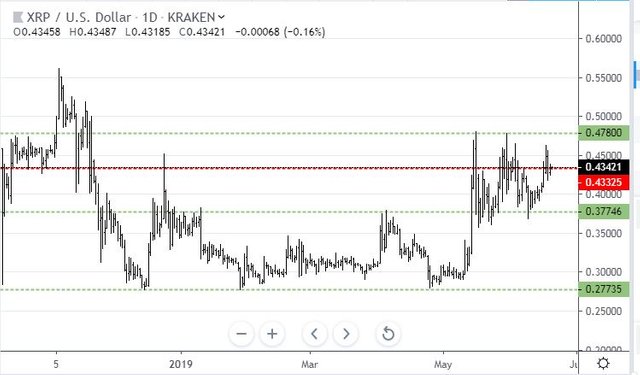

Ripple (XRPUSD): Starting today to report Ripple prices. First chart starts with levels only - this is the way I start.

3 levels from weekly (always green dotted lines). They show a solid bottom and solid resistance to the range (top and bottom lines). Current price action has been basing off a solid support level (middle green line) and price is currently centred on a daily level (dotted red line). Price needs to consolidate around this level before it tackles the big resistance above.

CryptoBots

Profit Trailer Bot Two closed trades (2.60% profit) bringing the position on the account to 8.85% profit (was 8.81%) (not accounting for open trades).

PT Defender continues defending 11 coins. I have left XMR on the whitelist.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Silver (XAGUSD): Forex trade hit take profit target for 2.13% profit. This makes up for the two losses last week.

Outsourced MAM account Actions to Wealth closed out 5 trades on USDCHF, XAGUSD, GBPUSD, AUDUSD for 0.05% profits for the day. They did escape a bad loss on their short silver trade. Trades open on EURUSD and USDCHF (0.12% positive) - both short USD which is a good place to be after the Fed meeting.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Fed logo is in the public domain. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

June 19, 2019

Hi, @carrinm!

You just got a 0.38% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit