Markets open in balance and then slide into the red as Federal Reserve fed fears add to Iran and China trade fears. A few cherry picks in stocks in biotech, frontier markets and buying back US media. A few covered calls and a primer on naked put income trades. Agriculture and Bitcoin makes for a few winners

Portfolio News

Market Rally

Edgy markets go into day two with grumbles of fear building

The market is looking for certainty ahead of G20 and possible meeting between Trump and Xi. Consumer confidence numbers disappoint - no surprise given the job the media does. Sabre rattling on Iran does not help. Words like "obliteration" do not help. And then Federal Reserve Governor John Bullard is a little more cautious than he usually is. Markets did not like that change of tone (tune even) from him. Oil prices do tick up a bit on stockpile data. This stockpile stuff moves prices much more than it should given the data comes out weekly.

Again the bond markets is pointing softer with 10 year again below 2%.

Crypto Craze

Bitcoin pushes to another new high - topping $12,000 (just)

The talking heads are back on the topic. Safe haven. Alternate to gold. Looks good in low yield world. Asset class of its own. Currency. Facebook. China capital controls. Latest thought is the 2020 halving when BTC mining rewards are halved for each block mined. This has been seen in the past to push price ahead of the curve - even though the halving is over a year away.

https://www.cnbc.com/2019/06/25/bitcoin-how-the-halvening-is-boosting-the-cryptocurrencys-price.html

Bought

Biogen Inc (BIIB): US Biotechnology. Big takeover news of the day with AbbVie taking over Allergan had the CNBC Fast Money team talking biotechnology again.

The general view was the sector was in the too hard basket and had not been doing much over the last 18 months. I am not a great fan of pharma and biotech as they face massive regulatory risk. There was a discussion about Biogen - plus points were modest valuation, good management team and a pipleline covering key areas like MS and ALS. I bought a small parcel in the after hours market.

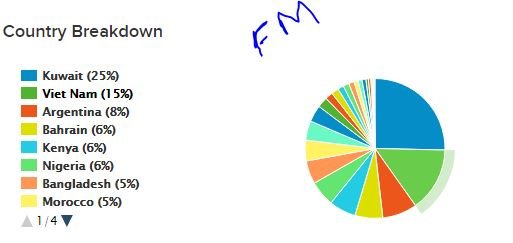

iShares MSCI Frontier 100 ETF (FM): Frontier Markets. Real Vision trade idea highlighting the way Frontier Markets have not followed the developed markets down in the last selloff. A quick look at a buy:sell chart shows Frontier Markets beginning to outperform in the October selloff and again in the last two months.

Buy:Sell Chart [Means: Buy the first named stock and sell the second named stock. If the chart goes up the first named stock is outperforming. If the chart goes down the second named stock is outperforming]

Enough evidence for me to buy a small parcel of stock. What are frontier markets is a good question. They are the markets below emerging markets - e.g., Kuwait, Vietnam, Argentina. The trade feels a bit strange given I sold out of Middle East last week and I am holding Vietnam and Nigeria and Africa specifically. I will dig in a little more in the coming days.

The buy:sell chart for Emerging Markets ETF (EEM) is similar though it has not turned over as strongly and the ETF is dominated by holdings in China. The analyst really liked Argentina but felt that the valuations had already moved too far to specifically buy Argentina ETF (ARGT)

Viacom Inc (VIAB): US Media. Replaced the stock assigned in covered call expiry at $30.42 = a little lower than the assignment price.

Sold

Agricultural commodity prices continued to move up.

Soybean Futures (SOYB): Trailed stop losses during the day. One contract closed on stop loss for $4.30 (0.47%) per contract profit. I replaced the contract as price had forward momentum. Backward look shows that trailing stop losses might have been the right idea and staying away after exit. Price is back where I started these trades.

Wheat Futures (WEAT): Trailed stop losses during the day. One contract closed for $10.90 (2.06%) per contract profit. I replaced the contract as price kept moving forward. Profit target set above range highs (top line). That trade looked solid for a while - not right now.

Now there is another headline idea I saw - cotton is facing challenges too with all the rains in USA. This chart looks a little sick. If the cotton planters cannot plant that chart has to break up. I will watch this for a few days

Income Trades

2 new covered call trades written

FireEye (FEYE): Cybersecurity. Sold July 2019 strike 16 calls for 0.75% premium (0.80% to purchase price). Closing price $14.61 (lower than last month). Price needs to move another 9.5% to reach the sold strike (tighter than last month). Should price pass the sold strike I book a 16% capital gain. Income to date amounts to 11.3% of purchase cost.

3D Systems Corporation (DDD): 3D Printing. Sold July 2019 strike 10 calls for 1.01% premium (0.71% to purchase price). Closing price $8.95 (new trade). Price needs to move another 11.7% to reach the sold strike (new trade). Should price pass the sold strike I book a 20% capital loss.

4 new naked put trades written. Concept here is to pick stock that one would be happy to buy at a low entry price and sell a put option at that price.

Honeywell International Inc (HON): US Industrials. Sold August 2019 strike 155 puts for 0.49% premium. Closing price $174.61 (higher than last trade). Price needs to drop 12.7% to reach the sold strike (same as last trade but at higher strike).

One chart to show the trade idea - chart shows the series of sold puts as red rays with expiry for the current trade the dotted green line on the right margin.

The sold puts are each below or close to a reversal. The red arrows measure normal size sell off - there are a few of that size. The current trade will stay safe in one of those. A selloff like the one from October 2018 and without a bounce back will take price below the sold put. The concept is one would be happy to buy the stock below that level and look for the bounce.

Cisco Systems, Inc (CSCO): Network Equipment. Sold August 2019 strike 50 puts for 0.63% premium. Closing price $57.18 (higher than last trade). Price needs to drop 15.2% to reach the sold strike (easier than last trade).

McDonald's Corporation (MCD): Fast Food. Sold August 2019 strike 175 puts for 0.15% premium. Closing price $203.92 (higher than last trade). Price needs to drop 16.7% to reach the sold strike (easier than last trade).

Roku, Inc (ROKU): TV Streaming. Sold July 2019 strike 85 puts for 1.25% premium. Closing price $100.03 (new trade). Price needs to drop 17.7% to reach the sold strike (new trade).

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $796 (7% of the low). Price smashes its way ahead to touch through the level above and to get close to $12,000 not seen since early 2018 on the journey down.

One contract closed for $668.57 (6.26%) per contract profit. Replaced with a new contract on a 1 hour reversal a little lower than the previous exit (blue dot). I trailed stop loss on this contract and have target set at the entry price of one of my remaining contracts from the journey down.

Ethereum (ETHUSD): Price range for the day was $12 (4% of the low). Price holds above support at $301 and squeezes up to level of the previous high and inches ahead in today's trade.

Ripple (XRPUSD): Price barely squeaks out past prior day high and then settles back to the middle of the day's range - just not ready to party yet.

CryptoBots

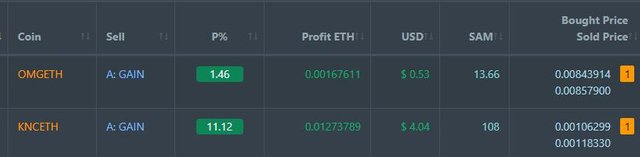

Profit Trailer Bot Two closed trades (6.29% profit) bringing the position on the account to 9.10% profit (was 8.85%) (not accounting for open trades).

Both trades came from DCA list and demonstrate that altcoins are starting to get traction a few days after Bitcoin started its strong rise from June 18

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 2 trades on EURUSD and GBPUSD for 0.23% profits for the day. Once again losing trade on GBP - while Brexit stuff flows I do not trade GBP at all. No open trades

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

June 25, 2019

Amazing to see bitcoin dominating all others in the asset class despite more maturity in comparison to last year. I imagine that others will soon follow as some seek to diversify their gains.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is always a lag. BTC then ETH then the rest. The pullback in BTC and ETH is normally the sign that funds are being switched. Not seeing it yet - XRP chart in next post shows that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice detailed post! Frontier markets intrigue me for a long term investment, and I've never thought about naked put sales like that, they still scare me honestly but I like your idea.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. I am always scouting ideas that are a little less correlated.

Naked puts are a well used income strategy. The books tell you they are best used in sideways markets (like covered calls). I have had great success using them on good names in the rising market - just pick a level you would be happy to buy at 15 to 20% below the market and sit and wait.

The important part is to manage the risk - I only have 4 trades open across my portfolios. I do have enough leeway and margin open to buy all 4 if I have to on a black swan day. Mostly I would just buy the put back and rethink.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, @carrinm!

You just got a 0.41% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit