Delayed in posting Thursday trade action - mostly written but not posted. Trade action is bottom fishing in US retail and rolling up profits in network equipment and European insurance. Insurance in Europe has been the quiet achiever. Markets were in the watch G20 mood. More about that next post.

Portfolio News

Market Rally

US markets continue to tread water ahead of the G20

Lots of mixed messages coming from Japan - truce; no truce; no pre-conditions ; pre-conditions. Bond markets seem to be a little more clear - yields fall again but hold above 2%.

Bought

Kohls Corporation (KSS): US Retail. Jim Cramer thinks the market is not giving credit to Kohls for the Amazon deal they are implementing. He added this to his Action Plus portfolio to average down. I did the same across all my portfolios. Consumers are still spending. Trade deal will help. I did also write a covered call immediately in one portfolio for just on 1% premium.

Sold

Cisco Systems, Inc (CSCO): Network Equipment. Rolled up January 2020 strike 45 call options to strike 57.5 on a 2 for 1 ratio (i.e., bought 2 contracts for each one held). Really wanted to go out further in time but there was only strike available at 60. Locks in 188% profit since June 2018 and 6% of strike premium felt reasonable especially given this was a free trade. Let's look at the chart which shows the bought call (57.5) and 100% profit as blue rays with the expiry date the dotted green line on the right margin.

The arrows show the cycles price has followed from the 2016 lows. Superimposing the green arrow from the recent lows shows this trade will not get to 100% profit (adjusted for profits to date). The trade will need a repeat of the last cycle to make 100% before expiry - should really have rolled out to 2021 as well. I will review this especially when January 2022 options come out in September.

Allianz SE (ALV.DE): Europe Insurance. Rolled up and out December 2020 strike 200 call option to December 2021 strike 220. Locks in 9.5% profit since November 2017. Have been sitting on a pending order to sell this option entirely at 52 week high - changed my view to get more time and win some delta. New premium was 6.2% of strike. Let's look at the chart which shows the new trade as pink rays working to the green dotted line expiry.

The blue arrows come from previous charts - price is following that trajectory. Complete that and this trade will reach 100% profit (not adjusted for prior profits - this is a totally free trade). The December 2020 strike 240 calls should go in-the-money. I had held off rolling up these 200 strike calls as I was waiting for strike 220 to be offered (not 240 again).

Wheat Futures (WEAT). Price hit trailing stop loss for $9.10 (1.7%) per contract profit in 3 days.

Income Trades

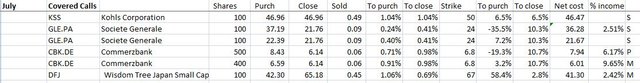

5 covered calls written today at an average of 0.75% - key is most have 10% price range to sold strikes

WisdomTree Japan Small Cap Dividend Fund (DFJ) options chain shows my trade as the only contract open for the month. A brave buyer who believes Japan stocks can go up more than around 5% from here.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $3055 (23% of the high). Parabolic price moves need times of respite. This was the day with price retreating from resistance at $13076 and dropping below the level below to settle around a short term level around $11250.

Ethereum (ETHUSD): Price range for the day was $69 (20% of the high). The heady heights at resistance just below $350 were too much and price plummeted to test back to the familiar zone around $277. The buyers have moved up to there.

I did add one new contract while price was working its way down on a 1 hour reversal around the $300 mark

CryptoBots

Profit Trailer Bot No closed trades

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 2 trades on GBPUSD for 0.43% losses for the day. Trades open on USDJPY (0.02% positive). I must say I am getting tired of the outsourcer trading on GBPUSD - almost every trade for the last 3 or 4 months has been a losing trade. This is the price of outsourcing. Time to write to the manager.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

June 27, 2019

Great addition on ETH as it seems to becoming alive as of late as it tries to catch up to bitcoin. Fundamentally stronger than most, it has a number of catalysts for it over the next year!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a trading play though I do mine ETH for the long haul. I do not even look at mining results.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, @carrinm!

You just got a 0.38% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit