US Markets edge higher closing in again on the all time highs. This is a time for rotation trades and hedging trades. I am taking profits on a hedge and a growth story. I am hedging. I am rotating in Japan.

Portfolio News

Market Flip Flop

I don't know about market flip flop but the headlines certainly have a flip flop. In one there is optimism on trade and on the other not.

Maybe the next set of headlines helps. Ooops not.

One thing that is clear is Donald Trump does like to play a game of just saying stuff as he thinks about it. There is not a clear step-by-step game plan of communication though there may well be a clear game plan. Just hard for us to see what it is from the words.

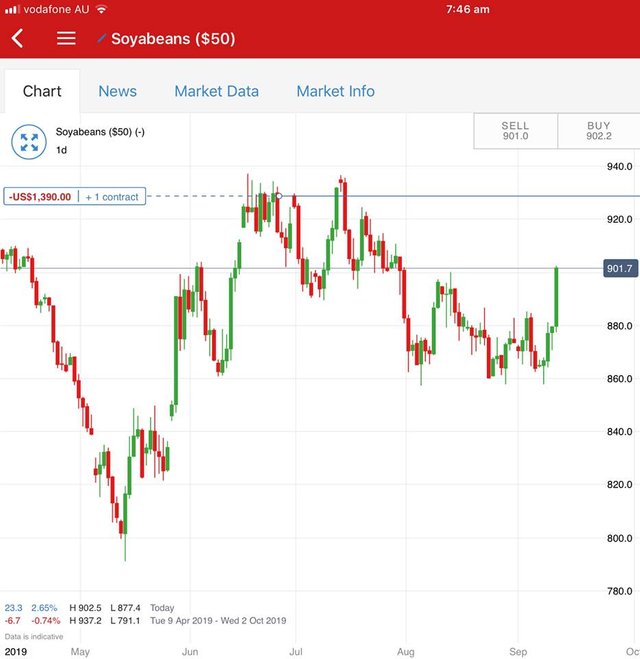

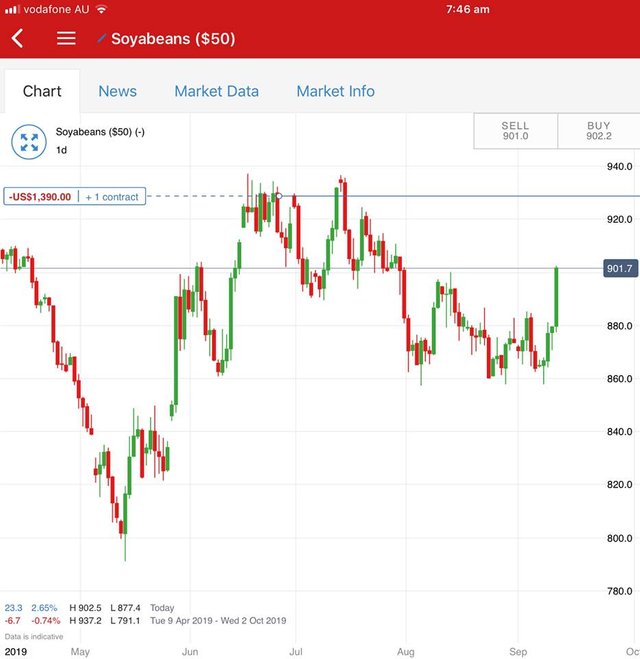

Maybe a chart to help tell us what might be actually happening - that is a 4.6% price move in 4 days. More about what it is below.

Europe Muddles

I chose to avoid listening to Mario Draghi's speech as he announced the next round of monetary stimulus. I find him very dull and dovish to the extreme.

Rather focus on the Euribor chart this morning = you can see when Draghi started talking. Market was clearly expecting a bigger drop in rates than the 10 basis points announced. We have not seen this level on this chart for some time.

Note: this is a price chart. It falls when rates rise - that is a 12 basis points move.

What I do know is Mario Draghi never did get to raise interest rates in the summer of 2019 and he certainly could not get the rabbit out of the hat.

Bought

Made some rotation trades in Japan taking profits in one counter and deploying proceeds into business with a more inward Japan focus

Arigatou Services Company (3177.T): Japan Speciality Retail - mostly 2nd hand goods and fast food restaurants.

Nichimo Co., Ltd (8091.T): Japan Packaged Food - mostly fish products.

ANA Holdings Inc (9202.T): Japan Airline and Hotels. Focus for this top up is expected revenue flows from upcoming Rugby World Cup - starting next Friday, September 20 and 2020 Olympics in Tokyo.

Sold

Mitsui & Co., Ltd (8031.T): Japan Trading. 20% profit since November 2016. As the Japanese Yen exposure is hedged I will not measure the Yen move since purchase

iShares Silver Trust (SLV): Silver. Closed January 2020 strike 15.5 call options for 129% profit since July 2109. Price closed at $16.92 which is just out-the-money for the December 2019 17/20 bull call spread I bought last week in this portfolio. I continue to hold the stock. See TIB468 for the discussion on the trade set up for the replacement.

National Oilwell Varco Inc (NOV): Oil Services. Assigned on a covered call (early exercise) for a 57% blended loss since November 2013 and November 2017. Oil services has been one of the sectors that has been targeted in the value rotation - prices had been hammered on low oil prices and growing bankruptcies in the oil patch till now.

VanEck Vectors Semiconductor ETF (SMH): Semiconductors. With price closing at $121.97, the January 2021 103/120/90 call spread risk reversal hit its profit target. I closed out the entire trade rather than closing just the call spread. Overall profit in the trade was 47% on the call spread and 51% on buying back the sold put - basically made $1,000 for no cash down. An overall net profit percentage does not compute as the net premium was negative (i.e., I got paid). Updated chart shows price testing above the sold call (120) for the second time.

My take profit target went on with the first touch 6 to 8 weeks ago.

Soybean Futures (SOYB): Soybeans. Big spike in soybean futures on back of US-China trade discussions.

Takes out two profit targets for $9 (1.03%) and $17 (1.93%) per contract profit.

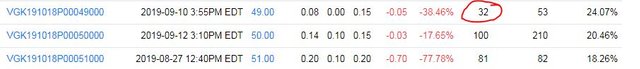

Shorts

Vanguard FTSE Europe Index Fund ETF (VGK): Europe Index. Added the next cycle of hedging trades. I put them on early as implied volatility is drifting lower (even though I have existing trades on with September expiry). Bought October 2019 51/49 put ratio spread. With net premium of $0.045, this did not quite get to cash neutral that I like to get for ratio spreads.

With opening price of $54.05, the bought leg covers a 6% drop in price and the sold leg a 10% drop. Let's look at the chart which shows the bought put (51) as a red ray and the sold put (49) as a blue ray with the expiry date the dotted green line on the right margin

I have modelled one of the price drops after the last long consolidation period. This hedging trade is designed to cover a drop like that (and no more). I have not put a maximum profit percentage on it - looks a bit crazy BUT is dependent on how options pricing moves in the event of a drop below the sold level (49) - it could go bezerk.

Of note is the options chains show that I was alone on the sold leg of this trade (32 contracts across 2 portfolios). Risk in the trade is I am exposed to 1 covered put and one naked put at $49 - i.e., I could be forced to buy the stock at $49.

Income Trades

One covered call exercised early by the buyer.

National Oilwell Varco Inc (NOV): Oil Services. Assigned. I write covered calls on stocks I am happy to exit. For those that are not currently profitable I increase the cover. For this trade I provided 7.3% - price was up 29% when the exercise was made. Not much one can do about that - buy back or let it run to assignment or in this case early exercise.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $438 (4.4% of the low). Price pushes up from support and could well be starting a new cycle higher.

Ethereum (ETHUSD): Price range for the day was $6 (3.4% of the low). A quiet day just working around the $177 support level and holding above.

Ripple (XRPUSD): Price range for the day was $0.00624 (2.4% of the high). Price did not want to push up to $0.26 preferring to test lower towards $0.25

CryptoBots

Profit Trailer Bot No closed trades

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Australian Dollars I have some big payments to make. Sold Euros and US Dollars in one portfolio to generate required funds.

Outsourced MAM account Actions to Wealth closed out 4 trades on EURUSD and AUDNZD for 0.68% losses for the day. Trades open on EURUSD long (0.03% negative). I must say I would not have been trading EUR long on the day Draghi was announcing a new program.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

September 12, 2019

I see the communication to markets having less effect so it probably leaves space for larger move when action actually takes place; both to the up and down sides.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That seems to be partly what happened in Europe. ECB always prepares the market - this time the market read too much into the preparation words and got caught short.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, @carrinm!

You just got a 0.44% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit