Trump uses UN to lambast China and Iran. Democrats start an impeachment inquiry. Bitcoin gets smashed in a margin squeeze. US trade team at loggerheads with the President. Feels like a messy sort of day - time to buy more gold and go bottom fish in agriculture.

Portfolio News

Market Flip Flop

US Market opened a little up and then Donald Trump started talking at the United Nations

I was aghast as I listened to what Trump was saying - a massive attack on China. I stopped watching by the time he got to Iran. I sometimes wonder what goes through his head. This sounded like one of his political rally speeches rather than a presentation to the United Nations General Assembly. Wrong place for this message. That said, he did say what he has been saying all the time.

I also watched the clip where Steve Mnuchin, Treasury Secretary, communicated the China trade delegation story to a somewhat surprised Donald Trump - "we told them not to go to the farms". I cannot see Mnuchin holding his job for long. Nobody likes being surprised in public like that, especially not Donald Trump.

Market was a little queasy about Europe data mostly affecting yields which drop the most in one day in a month.

Nancy Pelosi takes the gamble to start an impeachment inquiry.

That is not going to help markets when they open overnight. That said, economic conditions are a lot more sound than the last time impeachments began of Nixon and Clinton.

Britain Bumbles

UK Supreme Court rules that prorogation of Parliament was unlawful

All 11 Justices agree with the decision - there is no going back as this is the highest court. Boris Johnson says he will not resign and he will deliver Brexit by October 31. We shall see.

Bought

Archer-Daniels-Midland Company (ADM): US Agriculture. Been watching the price chart over the last few weeks as the China trade discussions have ebbed and flowed and especially with the bounce in soybean prices.

Was looking like it has made a bottom and will move if the trade talks progress. The chart shows price breaking the weekly downtrend line and retesting back to the trend line. Bought a parcel of stock with its dividend yield of 3.47%. I also looked at options chains for call spreads and/or risk reversals. With a solid bottom below $36, I felt safe selling puts at that level. Bought January 2020 41/45/36 call spread risk reversal for a net premium of $0.56. This offers maximum profit potential of 614% if price moves 11% from opening price of $40.40. First move was 1.16% down to close at $39.93.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

Let's look at the chart which shows the bought call (41) and 200% profit as blue rays and the sold call (45) as a red ray and the sold put (36) as a dotted red ray with the expiry date the dotted green line on the right margin

What I like is the 200% profit level is in line with the last high and the maximum profit is in line with the high before that. Also like the steepness of the price trajectory which gives me some comfort that the trade can win before expiry in 4 months. I picked the closer in expiry as I wanted to keep trade size small.

Yamana Gold Inc. (AUY): Gold Mining. Looking to bolster gold mining options trades in one portfolio. Implied volatility on options is high (over 50%) but I do like the small trade size. Having had success in another portfolio on a calendar spread last month, I thought I would test it out again. Bought an October/November 2019 strike 4 calendar call spread (i.e., sold October strike 4 call options and bought November strike 4 call options) for a net premium of $0.10 (2.5% of strike). Let's look at a chart. I have ringed the focus zone in red - working to the flouro green and fluoro pink expiry lines. The red ray is the level of calendar spread (4)

Basically what I want is price to stay below $4 until October expiry and then to climb over $4 before November expiry. This is a 12% buffer from the closing price of $3.63.

[Means: Calendar Call Spread: Enter a long and short call option at the same strike price with differnet expiries]

Shorts

Euribor 3 Month Interest Rate Futures: Europe Interest Rates. With the collapse in Bitcoin price, my IG Markets account hit margin limits overnight. They closed 4 contracts for average of 112 basis points loss = an average loss of €5,606 per contract (ouch!!).

This is the first time I have had positions closed. They sent 3 emails, no SMS and no phone call. I would not have heard the phone anyway. They close positions that are the most unprofitable in sequence. I would have done things differently especially as I withdrew A$10,000 from the account last week - I have cash available to ride out Bitcoin bumps. And these contracts have until December 2020 to run = time to be right. No point crying over spilt milk.

Income Trades

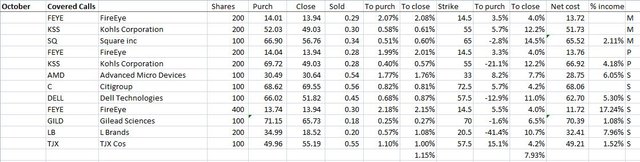

12 covered calls written at an average premium of 1.15% to prior closing prices and 7.9% coverage ratio, which is line with what I target.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $1784 (18% of the high). Price was drifting lower - I had to adjust pending order lower on the 4 hourly chart once. Massive drop in price following margin calls on Bitmex exchange (a leverage exchange) with price pushing below long time support at $8400 and closing above.

Impact in my margin account was ugly. I had 4 BTC worth of contracts multiplied by the $1784 drop = double the amount of margin space I had available = into negative margin at 5.44 am my time. I was asleep with no time to react. IG closed one trade for $5,630.46 (40%) per contract loss.

Pending order that was still open at midnight did trigger (labelled GTC)

.

.

I added in a new contract this morning off the spike lows.

Ethereum (ETHUSD): Price range for the day was $50 (25% of the high). No escape here with price pushing through the important $177 support level and closing below but trading now above the last two cycle lows .

Ripple (XRPUSD): Price range for the day was $0.06694 (24% of the high). No escape here with price dropping past the consolidation range lows and taking out the previous lower low, which it is now trading above.

CryptoBots

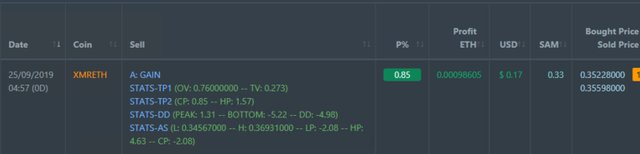

Profit Trailer Bot One closed trade (0.85% profit) bringing the position on the account to 9.76% profit (was 9.74%) (not accounting for open trades).

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account No closed trades.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

September 24, 2019

Hi, @carrinm!

You just got a 0.37% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit