Spent most of October travelling including a big bicycle ride. Will report trades by portfolio in pieces - this report for my pension portfolio.

I am switching my time allocations and will report only once a week with only one or two trades explained in detail. I will still report all my trading and investing activity

What was I doing on the bicycle? I finished a circumnavigation of Australia with a ride from Rockhampton to Gold Coast (labelled 2019 on this map) for Kids Cancer.

Bought

Novartis AG (NOVN.SW): Swiss Pharmaceuticals. Averaged down entry price on Jim Cramer idea.

Dell Technologies Inc (DELL): US Technology. Stock assigned on naked put on October expiry at $52.50. Latest price = $52.89. Too bad that Jim Cramer has since taken this off his watchlist - will ride this out writing covered calls.

FireEye (FEYE): Cybersecurity. Stock assigned on naked put on October expiry at $14.50 - price has since moved ahead. Latest price = $15.84.

United Health Group (UNH): US Healthcare. Averaged down entry price on Jim Cramer idea.

Sold

iShares Taiwan Index (EWT): Taiwan Index. Sold odd lot for 18% profit since August 2016.

Surgutneftegas ADR (SGGD.L): Russian Gas. Hit 52 week high profit target for 23% blended profit since March, May, December 2017.

The TJX Cos (TJX): US Retail. 15% profit since August 2019. Assigned on covered call.

ENGIE SA (ENGI.PA): French Utility. 35% profit since April 2018. Hit a profit target on in-the-money call options. Am still exposed in one out-the-money call option.

Income Trades

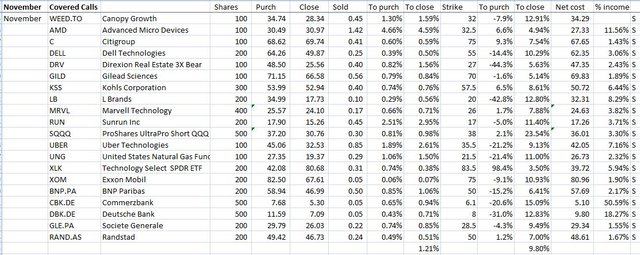

Of 16 covered calls written, 15 expired in my favour and one was assigned (TJX). Naked puts on DELL and AUY also expired in my favour. Wrote another 19 covered calls at average premium of 1.21% with average cover of 9.8%. Implied volatility is climbing higher. Here is the table of the covered calls written in this portfolio.

Key columns are To Close columns with an average posted below - average premium and average coverage.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. Map comes from Google Earth Pro - my actual routes shown.

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charity: I ride for Kids Cancer. Donate at https://mymark.mx/KidsCancerRide. If you want to send STEEM, send it with an appropriate memo and I will send the cash.

October 2-25, 2019

Very nice, we only come this way once, so enjoy the outdoors and save travels.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed. I did.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit