Stayed away from markets most of the week with a few forays into longer standing opportunities and listing of January 2022 options in US. Did benefit from the big spike in cryptocurrency prices following the China blockchain announcements.

Portfolio News

Market Rally

Earnings seasons has driven US stocks to record highs

I have been saying all along is that the data is not as bad as people fear. The earnings momentum has been helped by positive news from China trade discussions.

When Donald Trump is arguing about where the deal should be signed, it is a good sign there will be a deal.

Bought

Apache Corporation (APA): Oil Producer. Stock assigned on sold put at $23.50.

Alphabet Inc (GOOGL): US Technology. Earnings disappointed the market but the talking heads saw this as a buying opportunity with price rejecting a top 3 times - next time has a chance for a break in the same way the market has done.

AT&T Inc (T): US Telecom. Talking heads discussion about how the market is not yet valuing the media potential that AT&T has obtained with the acquisition of Time Warner. Taking a long view with newly listed January 2022 options bought a 40/47 bull call spread. With a $1.71 net premium this offers maximum profit potential of 309% if price moves 22% from trade day $38.49 closing price

Let's look at the chart which shows the bought call (40) and 100% profit as blue rays and the sold call (47) as a red ray with the expiry date the dotted green line on the right margin.

The pink arrow comes from the last trade which I closed out a little while ago. Price is certainly on a steep trajectory which matches the move out of the 2015 consolidation. The trade idea is that the fundamentals of the business have indeed changed a lot and price can continue upward momentum in the next 26 months. The encouraging part is 100% profit line is at the level of the 2016 and 2017 highs.

Wells Fargo & Company (WFC): US Bank. Talking heads discussion about the potential the new CEO has for fixing the bank's problems. Taking a long view with newly listed January 2022 options bought a 52.5/60 bull call spread. With a $2.60 net premium this offers maximum profit potential of 188% if price moves 16% from trade day $51.63 closing price

Let's look at the chart which shows the bought call (52.5) and 100% profit as blue rays and the sold call (60) as a red ray with the expiry date the dotted green line on the right margin.

100% profit is below the 2018 highs which is about when the mis-selling scandal broke. The maximum profit line is just above those highs but well below the late 2017 highs. Next chart compares Wells Fargo to its closest competitor, Bank of America (BAC - red line). Price does not even have to make up half the gap in 26 months to make the maximum profit.

Soybean Futures (SOYB): Soybean Futures. Added one new contract on a 4 hour reversal.

Sold

Burlington Stores, Inc (BURL): US Retail. Needed to free up cash to fund Alphabet purchase. Took profits for 9.3% profit since July 2019. Original idea was a Jim Cramer idea and he still holds this in the Action Alerts Plus portfolio.

Eurostoxx50 Index (ESTX50): Closed out in-the-money call contracts in one portfolio: December 2020 strike 3400 (11% loss since May 2014) and December 2022 strike 3300 (6% loss since August 2014). Basically run out of patience in Europe and using the strongish price run to exit. I still hold out-the-money call options, some with longer to expiry (2024)

Centrus Energy Corp (LEU): Uranium. Uranium stocks began to move with not much catalyst news, other than a renewal of interest in nuclear weapons given the cancellation of Russia nuclear deal. Happy to exit for 56% profit since July 2018.

Expiring Options

Apache Corporation (APA): Oil Producer. Strike 23.5 sold put option went to assignment.

Income Trades

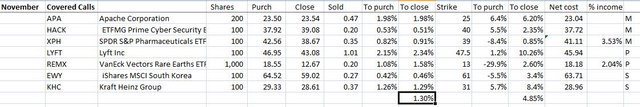

7 covered calls witten in the week with average premium of 1.3% and average coverage ratio of 4.85%. This ratio is lower than normal as trades were set up week before and market prices have advanced. I have reported the closing price from the close before the trade was made. One of these trades has been hit by a big spike in price after Kraft Heinz (KHC) produced solid earnings. Lesson: pay closer attention to price moves on a daily basis and pull preset trades if prices advance strongly.

Cryptocurency

Bitcoin (BTCUSD): Price range for the week was $2,957 (40% of the open). All the price action happened after the China announcement on blockchain technologies

A big week for cryptocurrency with China announcements on blockchain driving big demand. 4 trades closed for $150.19 (1.6%), $908.39 (10.6%), $810.62 (9.3%), $757.76 (10.0%) per contract profits. Currently remain exposed to 3.7 BTC contracts with 2 new trades opened in the week on 4 hour reversals

Ethereum (ETHUSD): Price range for the week was $39 (24% of the open). Price moved with the China announcement but not as strongly as Bitcoin and then drifted back to support at $177 (green line)

2 trades closed for $5.25 (2.9%) and $12.68 (7.8%) per contract profits. Currently remain exposed to 63 ETH contracts with 2 new trades opened in the week on 4 hour reversals

Ripple (XRPUSD): Price range for the week was $0.03987 (14% of the open). Price spiked with Bitcoin to make a higher high and then drifted back below the $0.30 level into no mans land above $0.27735 support.

One trade closed for $0.0105 (3.6%) per contract profits. Currently remain exposed to 150 XRP contracts with no new trades opened

CryptoBots

Profit Trailer Bot Three closed trades on LTC, KNC, OMG (1.42% profit) in 4 weeks bringing the position on the account to 9.90% profit (was 9.84%) (not accounting for open trades).

Dollar Cost Average (DCA) list stands at 7 coins with KNC rejoining the list.

PT Defender continues defending 10 coins. Defence was completed on ZRX and ADA but I kept them on the whitelist to allow trading.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

US Dollar (AUDUSD): Sold US Dollars in pension portfolio to fund upcoming pension payments. AUD has been under pressure for some months now but did have 4 up days with the Federal Reserve cutting US rates.

Outsourced MAM account Actions to Wealth closed out 11 trades for 0.49% profits for the week. 5 trades open (0.1% positive)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

October 26-November 1, 2019

I like your call on Google, as I agree as well. I notice your spreads are +5 points, what's your rationale, more profit potential???

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I assume you mean spreads on my covered calls. I use a variety of spreads. 5% for stocks that are currently profitable and 7.5% for tech stocks (as they are more volatile). 10% for stocks that are not profitable - if a stock is going to move 10% in a month, I will exit even if I am exiting at a loss. Leveraged stocks I use 20% - example I use SQQQ as a hedging trade, or something like DRV or TMV.

I have just learned this over time - gives me a good success rate on getting buyers at reasonable premiums and not getting exercised or assigned. Basic principle = the higher the volatility the higher the spread.

My investing coach used to do covered calls differently. He would buy stock for the calls and write one strike out-the-money always. I just found this resulted in too many exercises or assignments though the returns were generally better.

last point - I mostly only write the current month (sometimes I will go out 6 weeks to next month).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, @carrinm!

You just got a 0.39% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit